What Shows the Best Profit: Close Out the Biggest Loss

The late 1980s have witnessed some of the toughest and most frustrating futures markets in recent memory. Good trading strategy mandates that you should be able to profit with equal facility in both up and down markets. But, during many campaigns, we have experienced markets that have appeared to be moving both up and down nearly simultaneously. Many solid uptrends have been punctuated with violent downside reactions. These price slides briefly abort the uptrend by stopping out speculative long positions. And, after the stops have been “cleaned out,” the market resumes its northerly course. Meanwhile, quite a few bear markets have experienced equally violent rallies. The rally cleans out the speculative protective buy stops, knocking the so-called weak holders out of their profitable short positions. Then the bear market resumes.

在我的记忆里,80年代末的期货市场,交易最困难,成果最令人泄气。优秀的交易策略告诉我们,不管市场是上涨还是下跌,都能得到利润。但是在很多次战役中,我们却感觉同一个市场几乎同时上涨和下跌。不少趋势坚挺的上涨趋势,间歇性出现激烈的回调。短时间内价格快速下滑,不但破坏了上涨趋势,还扫到了投机性多头仓的止损点,让他们出场了。等把做多的仓位洗出去后,市场又恢复上涨趋势。与此同时,不少空头市场也穿插着同样激烈的反弹,反弹到很多空头仓位的止损点,把意志不坚定的持仓者也洗出去了,接着盘面又恢复跌势。

The hot breath of the margin clerk is being felt more frequently than ever before due to the erratic and violent nature of countertrend swings. What should you do when confronted with the familiar windowed envelope that you know is the call for margin? Over the years, I have had countless conversations and correspondence with traders concerning the strategy of dealing with margin calls. In general, they are ambivalent and inconsistent in their response to calls, and seek guidance in terms of a viable, strategic approach.

由于反趋势的洗盘怪异,激烈,催缴保证金的压力老是迫在眉睫。每当接到那熟悉的,开有透明小窗的信封时,你知道是催缴保证金的,你该怎么办?这些年来,我跟其他交易者有过无数次的交谈,也写过不计其数的信,谈的是应付保证金催缴通知书的策略。大体来说,面对保证金催缴通知书时,他们总是犹豫不决,每次做法也不完全相同,但大家都希望能找到一种可行的策略。

There are two types of calls-new business and maintenance. Of the two, maintenance calls are far more common. Exchange regulations require that new business calls be met with new funds, not with liquidation. However, maintenance calls may be met either with deposit of new funds or by reducing positions.

保证金通知书有两种形式——一种是新开户通知书,另一种是催缴保证金通知书。两者之中,当然以催缴保证金通知书最为常见。交易所规定,接到新开户通知书后,要存入资金,不是平仓。但催缴保证金通知书既可以存入新资金,也可以通过减少仓位来应付。

Most traders make the wrong decision when confronted with the inevitable margin call. The options are: Put up new money or reduce positions and, if reducing positions, which one(s) to close out to meet the call. In most circumstances, I do not recommend putting up new funds to meet a maintenance call. The call is a clear signal that the account is underperforming, or at least that some of the positions are underperforming, and there is no logic in trying to defend bad positions with new money. The appropriate tactic is to liquidate some positions to eliminate the margin call and reduce your risk exposure. But, if you close positions to reduce risk, aren’t you also reducing your profit potential and your ability to regain a profitable footing? Reducing positions yet maintaining your profit potential sounds like a hypothetical goal, but how can you actually achieve it? You do it with a basic strategy that is known to successful floor traders but unfortunately not to commission house speculators to any degree.

You close out those positions that show the biggest paper losses when marked to the market, especially if they are antitrending. This clearly reduces your loss exposure by eliminating the positions that are carrying the biggest losses. Yet by holding on to your most successful positions, which are obviously being held on the right side of the trending markets, you have maintained your potential to profit. The odds clearly favor ultimate profits on profitable with-the-trend positions over losing antitrend positions.

当接到保证金催缴单时,大部分交易者都做了错误的决定。一般有两种选择,一是存入新的资金,另一个是减仓。如果选择减仓,那么要减掉哪个仓位呢?大部分情况下,我不建议别人存入一笔新款,满足维持保证金的要求。这种催缴通知书中明显的信号,表示你的账户表现不好,没有道理再拿钱去保卫这样一个不好的仓位。比较适当的战术是平掉一些仓位,免除追缴保证金的要求,并减低所冒的风险。但是如果你为了降低风险而把仓位平掉,这么一来,你的获利潜力和重新获利的立足点也没了呀?一边减低仓位,一边保持获利潜力,听起来好像是可望而不可及的目标,但是我们事实上还是做得到。那么,要怎么做?你要做的事是用成功的营业厅交易者所知道的基本策略,而不要用经纪行投机者采用的那一套。

凡是帐面亏损最大的仓位,都应该平仓,特别是它们与趋势相反时,更应该这么做。亏损最大的仓位既已消除,你的损失风险自然会降低。但是,交易最成功的仓位一定要持有,因为这种仓位显然是处在有趋势市场正确的一边,这么一来,获利潜力保住了。赚钱的顺势仓位,跟亏钱的逆势仓位比起来,前者获利的概率自然比较高。

Regrettably, most speculators choose to close out the profitable positions while holding onto the losing ones. “After all,” they reason, “no one ever goes broke taking a profit.” But no one ever gets rich taking small profits, especially in trending markets with big potential.

The strategy of closing profitable positions and holding onto losing ones is costly, frequently ruinous, and typical of unsuccessful traders. Conversely, one of the hallmarks of successful operators is their ability, coupled with the discipline, to close out losing positions and stick with the winning ones. And, while it may be more ego-satisfying to take profits rather than losses, we are not playing for ego here. We are playing for big plus figures at the bottom line with reasonable risks. In that context, you should be more concerned with an overall profitable operation than in proving yourself right and the market wrong.

很遗憾,大部分投机者都会选择平掉赚钱的仓位,持有亏钱的仓位。他们的理由是:“总之,没有人因为获利而破产。”但是,我们也不要忘记,没有人能够因为一点蝇头小利而致富,尤其是在有庞大获利潜力的趋势市场中。赚取一点蝇头小利就沾沾自喜,未免可悲。

提早平掉赚钱的仓位和持有亏钱的仓位,这个做法,代价太高,结果是毁灭性的,是失败交易者的典型做法。相反的,成功交易者的特点就是他们有能力,也愿严守纪律,把亏钱的仓位给平掉,同时持有赚钱的仓位。而且,虽然获利比亏损更有面子,但是我们要知道,我们不是为了面子而交易。我们之所以交易,为的是在合理的风险中赚大钱。依据这个原则,我们要关心的是整体的获利交易,而不要想方设法去证明自己是对的,市场是错的。

There is a corollary here that professional floor operators use as a proven strategy. I

n any given market or in two related markets, you buy the strongest-acting future and sell the weak-est-acting.

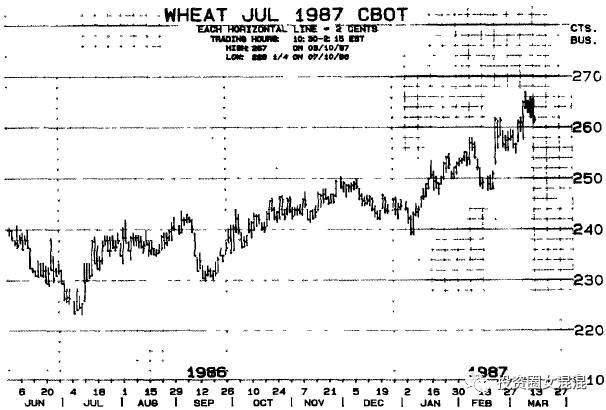

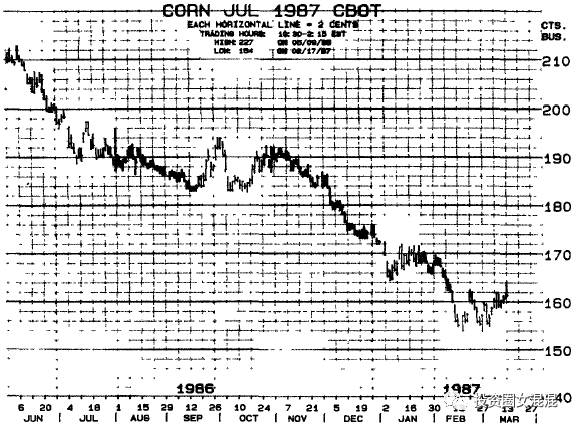

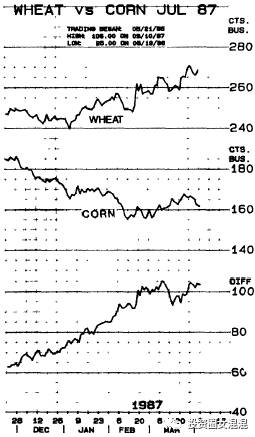

This tends to hedge your bet because, if the market advances, your long leg should outperform your short leg; if the market declines, your short leg should be weaker than the long. And, as an accompanying bonus, you frequently get a reduced margin on the position, or, for the same dollar margin, you can put on a bigger position. As an example, the Chicago corn market has been in a major downtrend from late 1983 to at least early 1987. The wheat market, on the other hand, has been trending generally higher, providing technical or systems traders a succession of quite reliable buy signals. Suppose you got a sell signal in corn and put on a short position in, say, June of 1986. Your margin on each 5,000-bushel contract would probably have been $400. Then let's suppose that you got a good buy signal in wheat in October of the same year and put on some longs. Your margin on each wheat contract would normally be $750. So for each wheat (long) and corn (short) contract, you might expect to have to post $1,150 in margin. Have we got a deal for you! You don’t have to put up $1,150 for the wheat/corn position. You don't even have to put up $750 (the higher of the two legs). In fact, you can put on the position for a measly margin of $500. I don’t approve of trading on such thin margin and would prefer to post the required margin on the greater of the two sides ($750 in this case). But that's still tremendous leverage, and it doesn’t take very much of a math whiz to calculate the profit, either in dollar terms or as a percentage of margin, that was made during this period in the wheat/corn (spread) position (you do it on your calculator-mine only goes out to seven figures). A tough analysis? Perhaps-but not too tough if you had opted to buy the stronger market (the wheat) and sold the weaker (the corn) See Figure 15-1. An alternative means of timing these spread (also called straddle or switch) trades is by using spread charts, such as those published weekly in the CRB Futures Chart Service by Commodity Research Bureau (see Figure 15-2). Here you put on and take off the position as a spread, and you time your trades on the basis of price differences. For example, in the wheat versus corn position shown in the accompanying chart (15-2), the market went from wheat 63 cents over corn to 1.05 over. Assuming you caught just half the 42 cent move, you would have scored a profit of 21 cents, equal to $1,000 (after commission) and over 100 percent profit on your margin.

专业营业厅交易者有一个很好的策略。这个策略是:

在任何一个市场中,或两相关的市场中,做多趋势最强的期货,做空趋势最弱的期货。

这么做可以对冲风险,因为如果市场上涨,你做多的仓位表现一定会比做空的仓位好;如果市场下跌,做空的仓位表现一定会比做多的仓位好。还有附带的好处,如果这么做,需要缴的保证金往往能够降低,或者说,以同样的保证金,你可以持有更大的仓位。举例来说,从1983年年底到1987年年初,芝加哥玉米市场一起处于大空头趋势。相反的,小麦市场趋势是大致上涨,给了技术或系统交易者一连串相当可靠的买入信号。假如你得到了玉米市场的卖出信号,并在1986年6月做了一个空头仓。每5000蒲式耳的一份合约所需的保证金可能是400元。接下来,假如你在同年的10月,在小麦市场得到买入信号,也因此做了一个多头仓。通常每份小麦合约的保证金是750元。所以说,对每一份小麦(做多)和玉米(做空)合约来讲,你可能要缴1150元的保证金。这笔钱吓倒你了吗?其实,对每一个小麦/玉米仓位来说,你根本不必投入1150元,甚至连750元(两个仓位中比较高的一个)也不要。事实上,只要500平均区区之数,你就可以建立仓位。我个人是不太赞成用这么少的保证金,而倾向于交两个交易中比较高的金额(这个例子中是750元)。但是这还是有很大的杠杆作用,这一段期间内,小麦/玉米(跨期)仓位赚了多少钱,不必数学天才也算得出来。利润的表现方式可以是单纯的金额,也可以是所缴保证金的比率(请你自己用计算器算,我的计算器只有7位数)。这是个高难度的分析?也许是吧——但还没有难到不懂得要买入比较强势的市场(小麦),卖出比较弱势的市场吧(玉米)?!请参考图15-1。琢磨这些跨期(或叫做换月)交易时机的另一个方法,是利用所谓的跨期图,如商品研究局每周出版的CRB期货图(见图15-2)。在这里,把仓位看成一种跨期仓位加以建立或取消,进出时机以价格差距为依据。举例来说,在图15-2的小麦对玉米仓位中,小麦高于玉米的价格从63分扩大到1.05。这42分的波动中,假使你只抓住一半,那也有21分的利润,相当于1000元(扣除手续费后)或保证金的100%以上。

图15-1 1987年7月小麦和1987年7月玉米

【You buy the strength (wheat) and sell the weakness (corn). This is the type of situation that many professional operators seek; it has good profit potential, reasonable risk, and low margin. Opportunities like this appear every year-and the trader should be alert to the chance to buy the strength and sell the weakness. For entry timing, you can take signals from whichever technical or trading system you have confidence in and time each leg on the basis of these signals.

建议你买强(小麦),卖弱(玉米)。这是很多专业交易者寻寻觅觅的状况。这个方法获利潜力不错,风险合理,保证金很低。这种机会每年都会出现——交易者必须提高警觉,时时留意买强卖弱的机会。至于进场时机,可以根据你有信心的技术或交易系统发出的信号,并根据这些信号抓取每一市场建立仓位的时机。】

图15-1续图

图15-2 1987年7月小麦对玉米跨期图

【As an alternative method of timing spread (buy strength versus sell weakness) trades, you can use spread charts. These charts are available for a broad selection of related markets or two different futures in the same market. You can enter and liquidate positions on the basts of price differences. As an example, let’s assume you put on long wheat versus short corn at wheat 70 cents over corn, and the current difference has widened to 1.00 over (you have a 30 cent profit on the position). If you want to stop out if the difference narrowed to, say 90 cents, you would enter the following order. “Buy (quantity) corn and sell (quantity) wheat at 90 cents stop, premium on the wheat.” With this order, you would be locking in your profit at 20 cents, less breakage and commissions.

决定跨期(买强卖弱)交易时机的另一个方法,是利用跨期图。这种图包含很多相关的市场或同一市场两个不同的期货。你只可以依据价格的差距,决定要不要进场,或者要不要平仓。举例来说,在小麦价格超过玉米70分时,做多小麦,同时做空玉米,目前的差价扩大到1.00元(你的仓位已有30分的利润)。如果你决定在差价缩小到90分时止损出场,那么你可以下这样的单子:“在小麦价格超过玉米90分时买入(数量)玉米和卖出(数量)小麦”。有了这么一个单子,你就把利润锁定在20分,没考虑毁损和手续费。】

Yet another aspect of this buy strength, sell weakness strategy can provide extra profits to knowledgeable operators. An important feature of many big bull markets is a price inversion, also called an inverted market, in which nearby futures gain in price relative to distant ones and ultimately sell at premiums to the nearbys. This is due to a tightness - or a perceived tightness - in spot (nearby) supplies. Traders should watch these switch differentials carefully, because an inversion, or even a significant tightening of the normal premiums between futures months, could provide an important confirmation of a developing bull situation. In fact, I generally add another 25 to 50 percent to any long position I may be carrying following such a price inversion, on a closing basis.

这种买强卖弱策略的另一个层面,是能提供聪明的交易者额外的利润。很多大多头市场都有一个重要的特色,那就是价格会倒置,或者叫做倒置市场。在这种市场中,近期期货涨势比远期期货的价格涨势要凶猛,最后近期期货价格竟比远期期货为高。造成这个现象的原因,是现货(近期期货)供给紧俏——或者大家认为紧俏。交易者应该十分小心谨慎地观察这些跨月差价的变化,因为价格倒置,或者各期货月份的正常溢价显著缩小时,很可能就是一个非常重要的信号,确认了多头市场正在酝酿之中。事实上,碰到这种价格(收盘价)倒置现象发生时,如果我手头上有多头仓,通常我会加仓25%到50%。

In addition, professional operators are always on the alert for developing price inversions, and at the first sign of an inversion (on a closing basis), there are spread traders who buy the premium future and sell the discount. Granted, you have to be pretty nimble to play this game because the inversion could unwind at any time. But while it lasts, you can score some good profits with reasonable risks. In summary, it doesn’t matter how you label this strategy-keep the profitable positions and close out the losers, buy the strength and sell the weakness, or go long the premium and short the discount. What is important is that you are aware of it, you identify your strong-weak markets accurately, and you apply this strategy in a consistent and disciplined manner.

此外,专业交易者都会密切注意价格倒置现象有没有成形。一旦有价格倒置的迹象(以收盘价为准),跨期交易者就会买入有溢价的期货,卖出有折价的期货。可以想见,玩这种游戏时,身手必须十分矫健才行,因为价格倒置的现象随时都会恢复正常。但是价格倒置期间,你却可以在合理的风险中得到不错的利润。总而言之,不管你把这种策略取什么名字,必须留下获利的仓位,平掉亏钱的仓位,买强卖弱,做多溢价期货并做空折价期货。最重要的是你要知道这种现象的存在,准确地找出哪个市场强,哪个市场弱,同时必须持之以恒,严守纪律。

相关阅读:

【原文推送】克罗谈投资策略(01)

【原文推送】克罗谈投资策略(02)

【原文推送】克罗谈投资策略(03)

【原文推送】克罗谈投资策略(04)

【原文推送】克罗谈投资策略(05)

【原文推送】克罗谈投资策略(06)

【原文推送】克罗谈投资策略(07)

【原文推送】克罗谈投资策略(08)

【原文推送】克罗谈投资策略(09)

【原文推送】克罗谈投资策略(10)

【原文推送】克罗谈投资策略(11)

【原文推送】克罗谈投资策略(12)

【原文推送】克罗谈投资策略(13)

【原文推送】克罗谈投资策略(14)