(© Shutterstock)

在每一天的每一分钟,世界各地的人们都在使用180种不同的货币从事买卖和借贷。但其中一种货币的使用频率远远超过其他任何货币,那就是美元。

设在华盛顿(Washington)的卡托研究所(Cato Institute)的货币政策分析人士泰特·莱西(Tate Lacey)说:“全世界的人都把美元视为在动荡时期的一种比较安全的资产。”

美元成为首要国际货币的原因在于其稳定性,以及美国经济一贯富有活力,而且美元长期以来的通货膨胀率一直很低。

正是由于具有这种稳定性,外国政府、公司和个人纷纷购买美国国库证券:它们为较不稳定的货币提供了最安全的投资选择。

根据财政部的数据,近几个月来,全世界的投资者所购买的中期债券(Treasury note)和长期债券(Treasury bond)比过去两年中的任何其他时期都多。

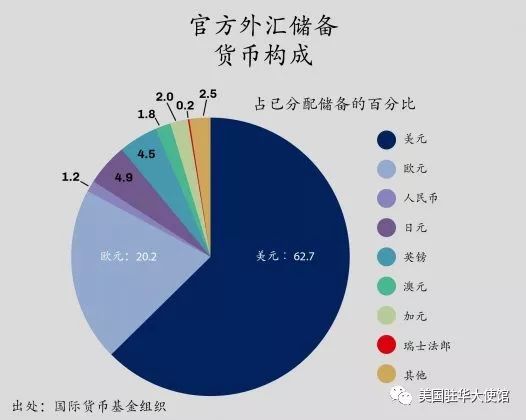

衡量全世界对美元的信心的另一个方式是看一看储备货币。储备货币是指一国中央银行或主要金融机构持有的今后可用于投资及偿还国际债务的大笔货币。各国可持有多种货币作为其储备货币,包括欧元、英镑和人民币等等。

但大多数国家都依赖美元。国际货币基金组织(International Monetary Fund)最新发布的外汇储备货币构成报告显示了美元作为一种储备货币的实力:据该基金统计,美元占全世界货币储备的62.7%。

事实上,尽管美元的占比不断变化,但它在外汇储备中所占的份额从未低于过50%。

莱西表示,国际投资者都在寻找节省资金的稳定方式,特别是在危机时期。他说:“美元能提供这种选择,而能做到这一点的任何其他货币,就算有也是凤毛麟角。”

财政部长史蒂文·姆努钦(Steven Mnuchin)指出,美元的实力“是美国经济的一种体现,也反映出它将继续成为储备货币中的首要货币的事实。”

The world counts on the dollar

Every minute of every day, people around the world are selling, buying, lending and borrowing, using 180 different currencies. But one of those currencies is used far more than any other: the U.S. dollar.

“Folks around the world see the dollar as one of the safer assets during periods of turmoil,” said Tate Lacey, who covers monetary policy at the Cato Institute, a Washington research group.

The dollar is the primary international currency because it’s stable, the U.S. economy is consistently dynamic, and the dollar has had relatively low inflation over time.

That stability is why foreign governments, companies and people buy U.S. Treasury securities: They offer the safest investment destination for less-stable currencies.

In recent months, investors worldwide have bought more Treasury notes and bonds than at any other period in the last two years, according to Treasury Department data.

Another way to understand the confidence the world has in the dollar is to consider reserve currency. Reserve currency is a large quantity of currency that a country’s central bank and major financial institutions hold to be used later for investments and international debt obligations. Countries may hold a number of currencies as part of their reserve currency, including euros, pounds and yuan, among others.

But most depend on the dollar. The International Monetary Fund’s most recent report on the currency composition of foreign exchange reserves showed the dollar’s strength as a reserve currency: The dollar makes up 62.7 percent of the world’s currency reserves, IMF found.

In fact, while the dollar’s share varies, it has never made up less than 50 percent of foreign exchange reserves.

International investors, said Lacey, look for stable ways to save money, especially in times of economic crisis, “and dollars provide that in a way that very few — if any — other currencies do.”

The strength of the dollar, said Secretary of the Treasury Steven Mnuchin, “is a reflection of the U.S. economy and the fact it is and will continue to be the primary currency in terms of the reserve currency.”