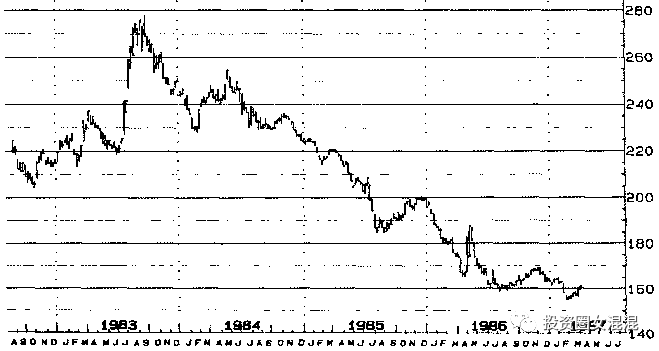

When Fundamental and Technical Analysis Diverge

For

example, in the autumn of 1984, the Chicago grain markets seemed to be

in the process of breaking down from broad sideways trends into plain

old downtrends. All of the good long-term trend-following system had

flipped down, as had most objective chart techniques. This was

confirmed-as if further confirmation was needed - when the CRB Grain

Futures Index broke down through the 230.00 level (see Figure 6-2A).

Yet, the reality of this developing bear trend, so strongly entrenched

that it lasted nearly two more years, was generally obscured by a steady

barrage of bullish stories and articles in the business press: poor

U.S. growing weather and its toll on crops, unprecedented Soviet grain

shortage leading to huge grain purchases in the world market, and

smaller Canadian crops. Such broad-based bullish news! So why were the

grain markets breaking down into a tenacious downtrend that would last

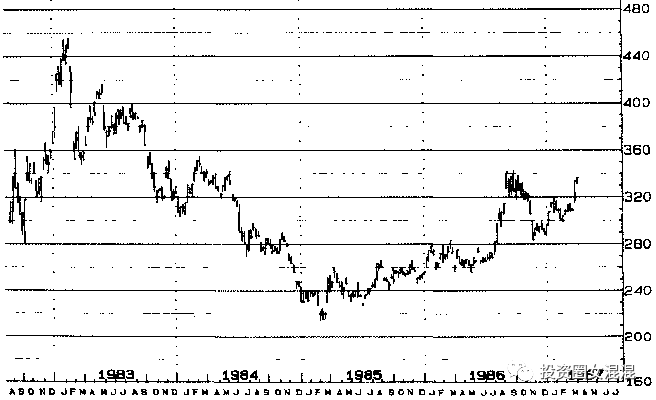

nearly two years? We experience a parallel situation in the metals

market commencing around mid-1984, where so many of the eminent market

projections, economic and political analyses, and brokerage

recommendations had predicted improving prices and had recommended the

long side of markets. Long side indeed! And, here again, the CRB

Precious Metal Index tells the self-same story (Figure 6-2B). Prices

poised on the brink of yet another down-leg-soon to be confirmed in the

market-during the relentless bear trends of the early 80s.

比如说,1984年秋季,芝加哥谷物市场似乎就要突破上下差价颇大的横向盘整区,进入本来就有的下跌趋势。所有表现不错的长期趋势跟踪系统都已显示下跌,客观的图形技术也显示这种情况。如果还需要进一步证实的话,那么商品研究局谷物期货指数跌破230.00也说明了这一点(见图6-2A)。但是,报章杂志上不断有多头题材和报导出现,使得这个成型中的空头趋势(趋势很强,后来持续了约2年)像雾像雨又像风。报导说:美国谷物生长期间,气候很差,不利收成,农作物征税,苏联谷物短缺,不得不在全球市场大肆采购,加拿大收成减少。利好消息到处都有!那么为什么谷物市场会下跌,跌个不停,前后达两年之久呢?1984年开始的金属市场趋势,也有类似的情况。那时候,有很多市场预测、经济和政治分析。经纪公司也插上一脚,全都预测价格会上涨,建议客户做多。真的,他们都叫人家做多!在这里,商品研究局贵重金属指数又说出相同的故事(见图6-2B)。当时,价格就要承继80年代初的空头趋势,再跌一段——马上就要在市场中得到证实。

图6-2A 商品研究局谷物期货指数

【1984

was a year of confusion and ambivalence for the futures trader. The

news and recommendations were almost universally bullish, and

speculators bought into the first quarter rally on the assumption that

prices were starting to head north. In reality, this brief advance was

just a minor pause in the major bear trend that had gripped futures

market since 1983 and would continue through 1985-86. Only the

disciplined and pragmatic technical traders made money-and lots of it-on

the short side of these markets.

1984年对期货交易者而言是让人头昏的一年。新闻报导和投资建议几乎全面偏多。春季价格反弹,投机者以为价格开始上涨,开始买入。其实,短暂的上升趋势只是主要空头市场的喘息期,原来期货市场从1983年便步入空头,并延续到1985——86年。只有守纪律且务实的交易者在期货市场做空才能赚钱,而且是大钱。】

图6-2B 贵金属指数

Digesting

such a steady diet of bullish news couldn’t fail to give one a bullish

bias-but an objective and pragmatic reading of the various technical

factors showed clearly that we were in a bearish, or at best a

sideways-to-down situation. Successful

speculators, with a disciplined and pragmatic approach to their trend

analysis and utilizing a viable trend-following strategy, would have

ignored all that pap and focused instead on a sound technical analysis. By

so doing, they would have either scored some profits on the short side

or, at least, been kept away from the long side and its attendant red

ink.

听了这些源源不断的利好消息,人们不做多也难,不过,如果客观和务实地研读各种技术因素,我们可以很清楚地看出这个市场走的是空头市场,至少是比较弱的局面。成功的投机者既严守纪律,又用很务实的方法分析趋势,并采用可行的顺势交易策略,对于这些杂音,根本听而不见,而只是一心一意钻研技术分析。这么做,一方面可以因做空而赚到一点钱,另一方面,又可不必因做多而亏钱。

The

frequent divergence between what you read in your charts and system

printouts and what you read in the printed word or hear on TV seems to

provide a near-permanent feeling of ambivalence to most speculators. And

this applies to projections of general conditions as well. Half of our

learned economists keep telling us that, if interest rates advance, we

will have a general bear market in commodity prices because higher

interest rates increase the cost of carrying inventory and encourage

trade firms to reduce and defer purchase of inventories. Also, with

higher interest rates, investors tend to put funds into higher-yielding

credit instruments rather than in risky futures positions. There surely

is logic in that argument. The rub though is that the other half of our

economists tells us that if interest rates decline, we will have a

general bear market because it would signify an overall reduction in

inflation, meaning falling commodity values; and besides, investors

wouldn’t look to buy commodities as an inflation hedge when they see

reduced inflation ahead.

我们在图形或者系统打印出来的报表上面所看到的东西,总是跟我们在报章杂志上所看到或者电视上所听到的分析背道而驰,这就难免会在大部分投机者心里上创造一种似乎永无止尽的矛盾情结。其它事情的预测上,也可以看到同样情况。有一半的所谓博学经济学家一直告诉我们:如果利率上涨,商品期货价格就普遍看跌,因为利率上涨后,持有存货的成本会提高,并促使贸易商减少或推迟采购存货。而且,在利率上涨后,投资者会把资金抽离风险较高的商品期货市场,转入收益较高的信用票据中。这种说法自然合情合理。问题是另一半的经济学家告诉我们:如果利率下跌,商品期货也会进入空头市场,因为这表示整体通货膨胀下降,也就是商品价值下跌;而且,投资者眼见未来通货膨胀趋缓,不会再买商品做为通货膨胀的对冲。

We

find the same type of ambivalence when analyzing currency markets, and

it is difficult for the trader or hedger to operate in currencies on the

basis of fundamental expectation or market events. For example,

following weakness in currencies some time ago, the major New York

business daily noted, “The U.S. dollar surprised traders with a show of

strength yesterday that stemmed, in part, from the detention of a Polish

labor leader.” The D-mark was weak, and that was attributed to the fact

that the German banks are major creditors of Poland.

分析外汇市场时,也有同样的矛盾情结,交易者或避险者很难根据基本面的预期或市场事件去交易外汇。比如说,纽约一份主要财经专业报在美元走软一段时间之后,指出:“昨天美元绽露强势,令交易者大吃一惊。美元转强部分原因起于波兰劳工领袖遭到拘留。”德国马克疲软,原因在于德国银行业者是波兰的主要债权人。

However,

the yen happened to be up that day, so the article deftly labeled its

strength a result of the yen’s isolation from Europe. However, had the

yen declined or the D-mark advanced, you can be sure that appropriately

logical explanations would have been created and disseminated.

但是那一天日元碰巧上涨,那份报纸很有技巧的把日元之所以强势,归因于日元独立于欧洲市场之外。不过,要是实际情况相反,如果日元下跌或者德国马克上涨,你一定也会听到有人创造出合情合理的解释并到处散播。

When

I find myself becoming excessively confused or agitated by a plethora

of such obvious contradictions and contrived after-the-fact news

analyses, my response is to seclude myself for a detailed and pragmatic

examination of my short-and long-term charts as well as my other

technical indicators-seeking order from among the chaos.

Such an interval is always best conducted in some seclusion, away from

interruptions and ringing phones, hovering colleagues, and anxious

glances. There seems to be a nice correlation between the tranquility of

the session and the clarity and quality of the analysis. Where do I go

to get away? I sail off and anchor in some snug and tranquil harbor -

but a beach, a quiet park or backyard, or just a peaceful and deserted

room would do just as well.

那些显然矛盾和事后刻意编造出来自圆其说的新闻分析,把我搞得太迷糊或心烦气躁时,我的反应是找个清静的地方,详细和务实地检查我那些短期和长期图形,以及其它技术指标,目的是要在一片混乱中理出头绪。做这种工作,最好是找僻静之处,不要有人打扰,不要有电话,不要有忙碌的同事走来走去,也不要有人在旁边焦虑地等着。这个环境是不是清静,跟你做出来的分析是不是彻底,品质好不好,有很大关系。到哪里去找这么一个清静的地方?我会驾船出航,抛锚在舒适幽静的港湾——不过,海滩,静谧的公园,或者一处清静,远离他人的房间,也可以把事情做的很好。

相关阅读:

【原文推送】克罗谈投资策略(01)

【原文推送】克罗谈投资策略(02)

【原文推送】克罗谈投资策略(03)

【原文推送】克罗谈投资策略(04)

【原文推送】克罗谈投资策略(05)

【原文推送】克罗谈投资策略(06)

长按图片点击“识别图中二维码”关注本混混的公众平台~

.............................................................................

▋投资圈女混混 版权声明

[版权声明]本文(除标注非投资圈女混混的作者外)系原创稿件,全文及配图所有权利皆为署名为投资圈女混混的原作者所有。非商业用途转载:请标明出处,并保留投资圈女混混公众号信息及署名,必须与本文严格一致,不得修改/替换/增减本文包含的任何文字和图片,不得擅自增加小标题、引语、摘要等。除特别声明和单独授权,本公众号一切内容禁止纸媒,即印刷于纸张之上的一切组织包括但不限于转载、摘编的任何应用和衍生。商务合作转载:请联系投资圈女混混公众号(INVEST_SmallPotato)。本文所提供的报告下载链接,仅限于学习用途,不得用作商业用途,下载后请于24小时内删除,谢谢。