北京时间4月26日晚,特朗普大张旗鼓地公布了他引以为傲的税改计划,试图兑现自己竞选时的承诺。

那么特朗普的税改计划具体是什么呢?税改力度有多大呢?

下面让我们从特朗普税改的原文件中找找答案,看看商人川普到底想干些什么,又会对整个股市有哪些影响!

The Goals Of Donald J. Trump’s Tax Plan

特朗普税改目标

Too few Americans are working, too many jobs have been shipped overseas, and too many middle class families cannot make ends meet.

越来越少的美国人在工作,越来越多的工作被外包到了海外,并且越来越多美国中产阶级入不敷出。

This tax plan directly meets these challenges with four simple goals:

这个税改计划将以4个主要目标来应对以上挑战:

1、Tax relief for middle class Americans: In order to achieve the American dream, let people keep more money in their pockets and increase after-tax wages.

对美国中产阶级减税

:为了实现美国梦,我们决定让美国人钱包更富裕一些,增加人们的税后工资。

2、Simplify the tax code to reduce the headaches Americans face in preparing their taxes and let everyone keep more of their money.

简化税务系统

,减轻美国人报税时的负担,让美国人更富有。

3、Grow the American economy by discouraging tax inversions, adding a huge number of new jobs, and making America globally competitive again.

通过

阻止税收逆转,增加就业

,让美国企业在全球更有竞争力来增长美国经济。

4、Doesn’t add to our debt and deficit, which are already too large.

不要增加负债和赤字

,我们的负债和赤字已经非常大了。

The Trump Tax Plan Achieves These Goals:

特朗普的税改要实现以下目标:

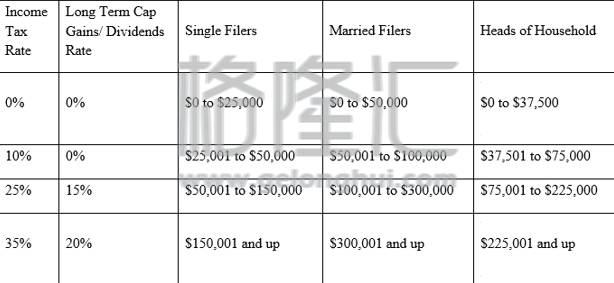

1、If you are single and earn less than $25,000, or married and jointly earn less than $50,000, you will not owe any income tax. That removes nearly 75 million households – over 50% – from the income tax rolls. Those who would otherwise owe income taxes will save an average of nearly $1,000 each.

如果你是单身,同时收入小于2万5千美金,或者结婚和连带收入小于5万美金,你将不会有任何的个人所得税。这将从纳税清册中剔除掉7500万个家庭。对那些依旧要交税的人而言,他们平均每人省下来了1000美金。

2、All other Americans will get a simpler tax code with four brackets – 0%, 10%, 20% and 25% – instead of the current seven. This new tax code eliminates the marriage penalty and the Alternative Minimum Tax (AMT) while providing the lowest tax rate since before World War II.

所有的美国人都将会得到一个简单的纳税编码,有且仅有4个税档:0%,10%,25%,35%,而不是现在税务体系的7个税档。新的税务体系将会取消婚姻惩罚税和代用最低税,同时新的税务体系提供了自二战以来最低的税率。

3、No business of any size, from a Fortune 500 to a mom and pop shop to a freelancer living job to job, will pay more than 15% of their business income in taxes. This lower rate makes tax inversions unnecessary by making America’s tax rate one of the best in the world.

没有任何企业,无论大小,不管是财富五百强企业还是小型杂货店,还是自由作家,所支付的所得税都不会超过15%。如此低的税率将会导致美国的税率是全世界最棒的,这会降低企业税务倒置的现象。

4、No family will have to pay the death tax. You earned and saved that money for your family, not the government. You paid taxes on it when you earned it.

不会再有家庭需要支付遗产税。你赚的并节省下来的钱是你家庭的,而不是政府的。在你赚到钱时,你为它支付税务。

The Trump Tax Plan Is Revenue Neutral .

The Trump tax cuts are fully paid for by:

特朗普减税方案导致的税收下降将会由以下支付:

1、Reducing or eliminating most deductions and loopholes available to the very rich.

减少或者取消大多数抵税项,以及消除有些人可以使用的各种税务漏洞。

2、A one-time deemed repatriation of corporate cash held overseas at a significantly discounted 10% tax rate。

美国企业在海外的现金调回本国需要征收10%的税。

3、Reducing or eliminating corporate loopholes that cater to special interests, as well as deductions made unnecessary or redundant by the new lower tax rate on corporations and business income.

减少或消除企业涉及特殊利益的税务漏洞,同时减少企业不必须要的抵税项。

DETAILS OF DONALD J. TRUMP’S TAX PLAN

税改细则

The Trump Tax Plan: A Simpler Tax Code For All Americans

特朗普税改:对美国人而言,更简单的税务体系

When the income tax was first introduced, just one percent of Americans had to pay it. It was never intended as a tax most Americans would pay. The Trump plan eliminates the income tax for over 73 million households.

当所得税首次推行时,整个美国仅有1%的人需要支付它。所得税从来就没有被打算成为大多数美国人都必须支付的东西。特朗普的税改将会取消7300万家庭的所得税。

42 million households that currently file complex forms to determine they don’t owe any income taxes will now file a one page form saving them time, stress, uncertainty and an average of $110 in preparation costs. Over 31 million households get the same simplification and keep on average nearly $1,000 of their hard-earned money.

4200万家庭现在需要填写复杂的税单来决定他们没有偷税漏税,如今他们仅仅只需要填写1页纸的表格即可,这将会给他们节省大量时间,环节压力,同时节省下来平均110美金的报税费用。将会有3100万家庭得到同业的税单简化,新的税务体系将会给这些家庭节省1000美金的辛苦钱。

For those Americans who will still pay the income tax, the tax rates will go from the current seven brackets to four simpler, fairer brackets that eliminate the marriage penalty and the AMT while providing the lowest tax rate since before World War II.

对于那些要支付所得税的人而言,新的税率将会从现在的7类,变为4类。新的税务体系将会取消婚姻惩罚税和代用最低税,同时新的税务体系提供了自二战以来最低的税率。

With this huge reduction in rates, many of the current exemptions and deductions will become unnecessary or redundant. Those within the 10% bracket will keep all or most of their current deductions. Those within the 20% bracket will keep more than half of their current deductions.

如此大规模的减税,将会导致目前大多数的减税或者免税项变得不再重要。对那些在10%税基的人而言,绝大多数的减税项将会得到保留。对那些在20%税基的人而言,将有超过一半的减税项得到保留。

Those within the 25% bracket will keep fewer deductions. Charitable giving and mortgage interest deductions will remain unchanged for all taxpayers.

对那些在25%税基的人而言,减税项将会变得很少。慈善捐赠,抵押房贷这两个抵税项将会对所有纳税人保留。

Simplifying the tax code and cutting every American’s taxes will boost consumer spending, encourage savings and investment, and maximize economic growth.

简化税务体系,降低每个美国人的税,将会刺激消费者消费,增加存款和鼓励投资,最大化经济增速。

Business Tax Reform To Encourage Jobs And Spur Economic Growth

通过企业税率改革来刺激就业,助力经济增长

Too many companies – from great American brands to innovative startups – are leaving America, either directly or through corporate inversions. The Democrats want to outlaw inversions, but that will never work. Companies leaving is not the disease, it is the symptom.

有太多企业,从伟大的美国品牌企业到新成立初创公司,正在离开美国,直接或者间接的参与了税务倒置。民主党希望通过立法来限制税务导致,但是这不会有用的。企业的离去并不是病,而是症状。

Politicians in Washington have let America fall from the best corporate tax rate in the industrialized world in the 1980’s (thanks to Ronald Reagan) to the worst rate in the industrialized world. That is unacceptable. Under the Trump plan, America will compete with the world and win by cutting the corporate tax rate to 15%, taking our rate from one of the worst to one of the best.

华盛顿的政客们把美国在1980年(里根时期)形成的全世界最好的企业税率结构变成了目前工业化世界里最差的企业税务结构。这是不能容忍的。在特朗普的税费方案中。美国将会与世界其他国家直接竞争,并且通过把企业所得税将为15%而最终获胜,把我们从目前全世界最差的企业税率重新变回最好的。

This lower tax rate cannot be for big business alone; it needs to help the small businesses that are the true engine of our economy. Right now, freelancers, sole proprietors, unincorporated small businesses and pass-through entities are taxed at the high personal income tax rates.

这样的降低税率不仅仅针对大型企业,它也同样旨在帮助小型企业—我们经济的发动机。目前,自由职业者,独资企业,和小型企业都是按照最高个人所得税而征税的。

This treatment stifles small businesses. It also stifles tax reform because efforts to reduce loopholes and deductions available to the very rich and special interests end up hitting small businesses and job creators as well. The Trump plan addresses this challenge head on with a new business income tax rate.

这样的税率扼杀了小型企业。它也同时扼杀了税改,因为所有减少有钱人使用的税务漏洞和抵税额的努力,最终都以伤害小型企作为结局。特朗普的税改方案设计了一个新型的企业所得税来解决这个难题。

These lower rates will provide a tremendous stimulus for the economy – significant GDP growth, a huge number of new jobs and an increase in after-tax wages for workers.

降低税率将会大幅度刺激美国的经济—显著的GDP增长,大量新的就业,同时提高税后工资。

The Trump Tax Plan Ends The Unfair Death Tax

特朗普税改将会终结不公平的遗产税

The death tax punishes families for achieving the American dream. Therefore, the Trump plan eliminates the death tax.

遗产税惩罚了那些追求美国梦的家庭。因此,特朗普的税改方案将会取消遗产税。

总结

其实,目前特朗普税改计划就以下6个要点:

1、企业所得税从35%下调为15%;

2、个人所得税从7档下调为4档:0%、10%、25%、35%;

3、废除备选最低税额(AMT)制度;

4、为海外留存的数万亿美金征收一次性税收(10%的税);

5、废除遗产税;

6、取消主要由富人收益的定向税惠措施。

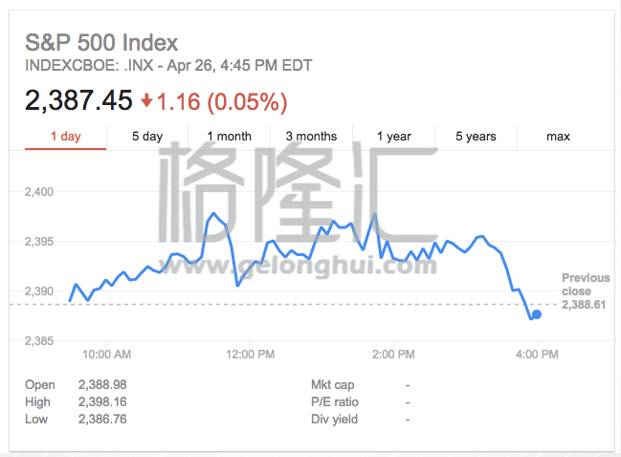

如果川普真的可以把这份减税计划落实,那么对美股而言可谓是破天荒的催化剂。

企业税率下降20%,将会大幅度提高企业的盈利能力,即使保持在现有的估值水平下,美股也有大幅度上涨的空间了。

与此同时,消费者的个人所得税也大幅度降低,从而可能会大幅度刺激美国消费者的消费欲望。

但是根据美国国会税务联合委员会成,基本上税率没下调1%,联邦政府收入将会在10年内减少1000亿美金,所以20%的减税服务可能使美国政府在10年内损失2万亿美金。

对此,美国财务部部长成税改方案将依赖经济增长抵消大规模减税对财政收入的影响。特朗普政府通过税改和放松监管来推动经济增长,实现3%以上的可持续增长的目标。

目前以上只是特朗普税改的大体框架。具体的税改细节要到6月份才会揭晓。

作为投资者,不仅仅要看到税改落实后的利好,还要关注如果税改失败该怎么办。实际上,在上台之初,特朗普一直读希望先废除和取代奥巴马的医改方案,然后着力解决税收问题。

但是出师不利,在3月份的国会众议院投票中,特朗普的医改方案遭到撤回。

因此市场也非常担心如此激进的税改方案能否得到国会通过。

这也就是为什么如此爆炸的消息,美股反而没涨。

目前,对投资者而言,最重要的是等待政策的靴子落地!