12月10日,由腾讯研究院发起并主要支持,北京大学、斯坦福大学、牛津大学共同主办的第五届“北大-牛津-斯坦福互联网法律与公共政策研讨会”在深圳华侨城洲际酒店开幕,本次会议的主题为“创新、包容与秩序——变化中的科技、互联网与法律”。

腾讯研究院院长司晓在第一环节“创新与发展”进行发言,分享了他对平台经济和治理的思考。

以下为司晓发言内容:

谢谢Klausner教授。

非常荣幸今天受邀参加“北大-斯坦福-牛津互联网法律与公共政策研讨会”,并借此机会跟大家分享一下我们对平台经济和治理的一些思考。

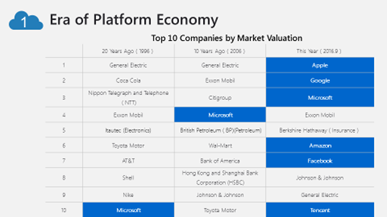

1996年,全球市值排名前十的公司当中,大部分来自制造业和资源采掘行业。十年后的2006年,花旗、美银、汇丰等大银行排在了榜单靠前的位置。二十年后的2016年,苹果、微软、谷歌、腾讯等科技企业占据半壁江山。这些科技企业都有一个共同特点,即他们都是平台型企业。这标志着全球进入了平台经济的时代。

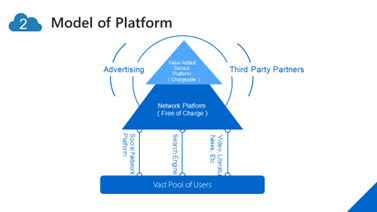

平台经济的商业模式主要由三部分组成。底层是由海量潜在用户构成的巨大蓄水池。第二部分是平台提供的搜索引擎、社交网络、视频网站等基础服务。

这些基础服务如同巨大的抽水机,将潜在用户转变为平台上的活跃用户。

从平台的角度来说,最简单粗暴的盈利模式就是对基本服务收费。譬如谷歌对每个搜索请求收取一分钱,可以很快产生现金流。但这么做可能会导致活跃用户大量流失,重新掉回底层的蓄水池。腾讯曾经尝试对新注册的QQ号码收费,用户每注册一个新的QQ号码需交费一元。结果大量用户开始脱离平台,我们也迅速放弃了这种向基础服务收费的盈利模式。

这一经历教会我们重要的一课,也即

平台经济商业模式最重要的第三部分,双边市场。

通过基础服务转化而来的海量活跃用户构成了平台的一边,另一边则是由用户流量带来的广告变现机会,以及被海量活跃用户吸引而来的第三方增值服务提供商。

平台可以通过广告变现和与第三方服务商利润分成达成可持续的盈利模式。

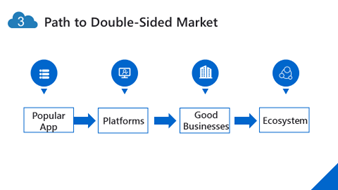

双边市场的形成大致可以分为四个步骤:

第一步,开发一款好用的非常吸引人的互联网产品,提供能够持续快速积累活跃用户的基础服务;

第二步,延伸这款产品的基础功能,扩张用户基础的同时增加用户的粘性;

第三步,随着用户流量增加,广告变现的机会浮现,突破盈利瓶颈;

第四步,互联网平台属性增强,开始吸引第三方增值服务提供者的注意力,像磁石一样吸引双边市场相关方,逐渐演化出基于互联网平台的活跃生态。

腾讯的社交产品平台生态就是沿着这一路径走过来的,其他平台型企业如Facebook、谷歌等,也经历了大致类似的发展过程。

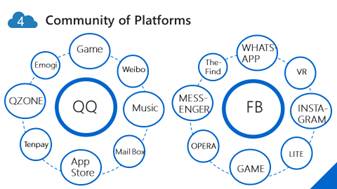

如果靠近观察,我们可以发现,互联网平台的结构日趋复杂,不再是简单的孤立产品,而是由一系列大大小小的平台构成的平台群。这些平台群的结构往往由一个核心平台,和附着在它周围的数个周边平台组合而成。以腾讯的QQ社交平台为例,它以QQ为核心,辅以QQ空间、QQ游戏、QQ音乐等小平台,共同构成一个功能丰富的活跃平台群。再如Facebook,以Facebook为核心,辅以Instagram、Whatsapp和Messenger,形成一个多平台的社群。

这样的平台群极具活力,在互联网的细分领域往往占据主要市场份额。但同时,这样的市场结构并不能有效排除竞争,因为平台的相对优势地位持续受到颠覆性创新的威胁。

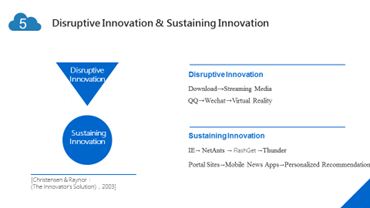

哈佛大学教授Clayton Christensen指出,创新并非生而平等,

大部分创新是渐进式的小的技术进步,也即所谓“维持性创新”;仅有少数创新能够完全打破既有市场结构,成为所谓“颠覆性创新”。

而正是这少数颠覆性创新,对互联网平台竞争产生深刻影响。

举例来讲。上世纪90年代,网络蚂蚁开发出“断点续传”技术,解决了用户在用IE浏览器下载文档时,每遇断网需从头开始下载的痛点。这一技术帮助网络蚂蚁迅速占据下载工具市场超过一半的市场份额。之后网络快车、迅雷等陆续开发出“多线程下载”、“指纹下载”等新技术,短时间内收获大量用户,暂时成为下载工具市场领导者,但下载工具行业本身并没有被颠覆。这些技术也都属于比较典型的“维持型创新”。

近十年,中国互联网由PC端迁移到移动端。随着无线网络连接速度大幅提升和数据传输成本大幅下降,用户倾向于使用流媒体软件在线消费数字内容,而不再把数字内容下载到本地。下载工具软件市场几乎被完全颠覆,被流媒体技术取代。从这个角度来看,流媒体是对传统下载工具软件的“颠覆性创新”。

颠覆性创新,是左右平台经济时代市场竞争的主要力量。

也正因为如此,对于互联网平台来说,无法预知何时何地,在何种环境下会遭遇颠覆性创新,只能保持开放包容,密切关注技术和市场变化,为未来可能的不期而遇做好准备。

这一场景颇似刘慈欣在他获得雨果奖的科幻小说《三体》中描述的“暗黑森林”。在森林中多个文明共存。每个文明都知道在广袤的宇宙中还存在其他先进文明,但每个文明都无法预测何时何地在何种环境下会遭遇其他文明,也无从判断未来可能遭遇的其他文明是敌是友。我们所能做的,就是时刻保持警惕,做好万全准备,随时应对可能出现的突发状况。

以下是我对平台经济发展的三点思考。

第一点思考,平台的本质是连接。

透过双边市场,平台上聚集的海量用户和第三方服务商以极低成本连接起来。信息透明高效在市场主体间传递,大幅降低需求和攻击之间的匹配成本。例如Airbnb,将海量用户的出行需求和闲置房屋资源以极低的成本匹配起来,形成新型的互联网旅游住宿平台,估值一度超过老牌的高端连锁酒店,突显平台经济的本质就是连接。

第二点思考,平台经济赋能于微小的个体。

通过普遍而频密的连接,平台上服务消费者和提供者之间的界限逐渐模糊,被赋能后的消费者正日渐演化为内容创造者和利润中心。2016年,一款名叫“分答”的应用吸引市场注意。分答定位为知识分享平台,注册用户可以向驻在分答的众多明星名人和专家学者提出问题,并付费购买答案。得到答案的用户可以向其他用户转售答案。如果用户碰巧问了一个有趣的问题,甚至可以通过转售获利。上线仅仅两天,分答就吸引了大量用户,打造出知识分享的闭环商业模式。

第三点思考,在对平台经济了解不多的情况下,应该采取包容性的监管政策。

沿用旧的监管思路管理颠覆性新技术往往不成功。19世纪80年代英国议会曾通过一系列机动车管理法。其中一个法案规定汽车在乡间行驶速度不得超过每小时4英里,在城市中这一高限再减半。法案还要求有人执红旗在车前引路,以防可能出现的事故。这一法案也因此被称为红旗法案。

这一荒诞的法案是沿用旧思路管理新技术的经典,我们应该尽量避免重犯类似错误。实际上,颠覆性创新在实践中总会遭遇来自现有体制的不解和抵制。但事后看,它们对促进整个人类社会的福祉有巨大推动作用,而现有体制的抵抗往往适得其反。这是值得各方思考和借鉴的经验。

谢谢大家!

[英文版]

Thank you.

It is my honor to attend this great event again. This is the first time that the conference held outside the university campus. I enjoyed the nice tour to Tencent, Dajiang, and Huawei yesterday, with our distinguished guests. Shenzhen is perfect to host this conference. Not only because our headquarter located here, but also because this is the city at the heart of Chinese internet innovations.

I would like to take this opportunity to share with you my thoughts about innovation and competition in the era of platform economy.

This table shows the changes of the largest company list, ranking by market cap, in the past two decades. In 1996, the top 10 companies were mainly from manufacturing and oilmining sectors. In 2006, large banks like Citi, BOA, and HSBC took the top positions. While now, in 2016, IT companies such as Apple, Google, Facebook,and Tencent occupied more than half of the list. These newly emerged IT giants share one common feature, that they are all so-called internet platforms.

Internet platforms often function as double-sided markets. On the one side, millions of users visit the platform everyday for some basic services, such as searching for information,calling a cab, or buying a pair of shoes. On the other side, countless third-party service providers are engaged and sell their services through theplatform.

The business model of internet platforms could be roughly summarized in this graph. At the bottom, the vast pool of potential users is like a deep well. The basic services, given either a search engine, a social network app, or a video-sharing website, turn potential users into active users. That is like pumping water from the deep well onto the platform.

To the platform, perhaps the most convenient way of making profit is to charge a small amount of money for each basic service they provided. Say, if Google charge one cent for every searching request it received. But then the next day, big chance Google will learn that its hard-earned active users are back to the well again. In the early days of Tencent, we hadtried to charge one RMB for every QQ account officially registered. But only found our users were pissed off and left us by hundreds of thousands. By then we learnt the major lesson the hard way: Never ever charge your users for basic services.

Here comes the point when platform companies recognized that they have to become a double sided market to make money. A platform’s job is not directly charging its users, but to polish their services to make sure their users visiting them as often as they can.Vast number of active users will then attract many advertisers and third-party service providers. Therefore, platform companies will enjoy a sustainable revenue from advertising, or from sharing profits made by third-party sales.

The path to become a double-sided market generally has four steps. First, an attractive and easy-to-use productis a must. Second, as this product extends itself and includes more and more functions, a platform emerges. Then, with the volume of active users grows,revenues from advertising and other value-added services grow. At the final stage, the platform serves like a powerful magnet. Players from relevant sectors will show much interest in joining the ecosystem growing around the platform. Tencent has went through this process, so as to our peers including Facebook, Google, Airbnb and many others.

Nowadays, the structure of the platforms gets more and more complicated. If you really look into those platforms, you will find that they are not with a single and unified structure. Rather, they are often a group of platforms grow together like a community, with a clear core and peripherals.

For instance, the early Tencent model had QQ as its core, and Q-Zone, QQ Music, QQ Games as the peripherals. Another example would be Facebook, with Facebook app as the core, and Whatsapp, Instagram, and Messager as the peripherals.

The core continuously draw large volume of visitors from the potential user well,while peripherals generates revenue by providing value-added services. Of course, the sheer size of the visiting volume could be a good source of significant advertising revenues.

The emerging of platform economy reshapes the landscape of competition. In this new world of competition, technological innovation plays a key role.

Professor Christensen from Harvard University famously argued that not all innovations are created equal. Most of them are mild and gradual improvements. A few are mean to disrupt the whole industry. The latter matters the most.

A few examples would help. Back to the 1990s, Chinese internet users had to restart the whole downloading process whenever their IE went down. A small Chinese company fixed this problem with a software patch called NetAnts. NetAnts allows users to pick up from where the downloading process stopped. With this small improvement, NetAnts gained more than half of the Chinese downloading tool market in no time. Nonetheless, the third generation of downloading technologies soon arrived. Flashgets, Xunlei followed NetAnts model, and made some small improvements

like "Multi-thread downloading", “digital fingerprint downloading” . They all gained significant market share from their predecessors. This is what we called the "Sustaining Innovation" .

But when the whole internet went mobile, streaming media totally disrupted the internet-based content downloading business. Fast and cheap connections to the servers driving users from downloading tools to streaming apps. NetAnts, Flashgets, and Xunlei are either switching to streaming or died out. The whole downloading tool industry was disrupted and almost disappeared. Which is a good example of “disruptive innovation”.

As a practitioner, I truly believe that disruptive innovations pose vital threats to platforms. Worse, disruptive innovations are unpredictable by nature. We don’t know when and where, at which corner we will come across this monster. That is why high market concentration does not, and will never block the competition in the internet industry.

This situation is somehow similar to the “dark jungle” described by Liu Cixin, in his award-winning science fiction novel “TheThree-Body Problem”. He won the 2015 Hugo Award by this novel. In dark jungle,Human and other alien civilizations coexist. Everyone knows someone is out there, and will encounter them someday one day. But the jungle is so dark, noone could see others. No one could tell that someone is enemy or friend. The only thing reasonable for us is to keep our gun fully loaded, and pay 100% attention to every sound we heard, and every light we saw.

Taxi, an industry as old as automobile itself, is now facing a wave of disruption driven by car-hailing platforms. Hotel, an industry may be older than many civilizations, is now challenged by a group of house-sharing startups.

Complex in structure, fusion of different organizations, borderless competition, these distinct features of platform economy challenge the current settings of regulatory framework. How should we approach and solve these challenges?

Platform, or double-sided market, is where the service users meet service providers. As internet made information transparent and free, the cost of user-provider match making is now close to zero. Platforms gradually replace formal hierarchies in organizing economic activities.