【财联社】(研究员 薛彦文)

12月12日,在恒生指数不断走高的背景下,在港上市的恒安国际,其股价却持续下跌,一度跌幅超过8%,今天上午10时47分,恒安国际突然盘中停牌。

恒安国际股价下跌,主要与做空机构—Bonitas Research,发布的做空报告有关。该研究报告指,自2005年以来,恒安国际捏造了110亿元的净收入,这在其资产负债表上表现为虚假现金,公司已负债累累,该报告认为,恒安的股权最终毫无价值。

恒安国际是港股通标的,当下,其市值高达688亿港元。据港交所披露易显示,截至目前(2018年12月11日),内地投资者通过港股通,持有恒安国际678.6万股股份(约合3.86亿港元),占比为0.55%。

恒安财报真的造假了吗?内地投资者真的将损失惨重吗?

恒安国际成立于1985年,以女性卫生用品起家,主要产品为安乐卫生巾。1996年,公司推出了安儿乐婴儿纸尿裤;1997年,恒安心相印系列产品诞生;1998年,公司在港交所上市;1999年,公司推出安而康成人纸尿裤。目前,公司是中国最大的家庭生活用品企业之一。

据财报,今年上半年,恒安国际总营收为105.53亿元,同比上涨16.25%;净利润为19.46亿,同比上升5.01%。

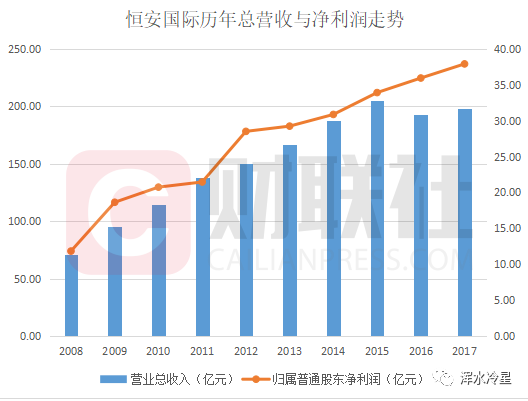

事实上,近十年来,恒安国际业绩持续上涨,公司总营收由2008年的70.56亿,增长到2017年的198.43亿,增幅高达181.22%;同期净利润也由11.83亿,增加到37.94亿,增幅为220.71%。下图为财联社根据财报绘制的恒安国际历年总营收与净利润走势:

不过,Bonitas Research发布的报告认为,恒安国际与关联方进行虚假交易,从而创造出虚幻的交易量、收入和利润;恒安国际的虚假交易,主要体现在,高得令人无法相信的营业利润率这一财务科目上。

该报告称,在一个非常饱和且商品化的行业中,当竞争对手正在努力创造15%的营业利润率时,恒安国际却说其2018年上半年,其卫生巾部门营业利润率为51%。

其实,如此高的毛利率确实令人怀疑。曾在A股申请IPO的重庆百亚,其招股书显示,公司2016年卫生巾毛利率为56.6%,同期,恒安国际该业务的毛利率高达72.6%。

此外,当下,卫生巾市场竞争确实极为激烈。2016年,中国女性卫生用品市场规模为394.9亿,同比下跌0.7%。中信建投在研报中称,女性用品市场规模下跌的主要原因是,由于行业产能过剩,市场竞争加剧,致使2016年女性卫生用品平均出厂价有所下降,由2015年的0.25元/片,下跌到0.24元/片(跌幅为4.16%)。

事实上,不只是营业利润率存在异常,恒安国际还存在手握巨额现金,却频繁融资的现象。

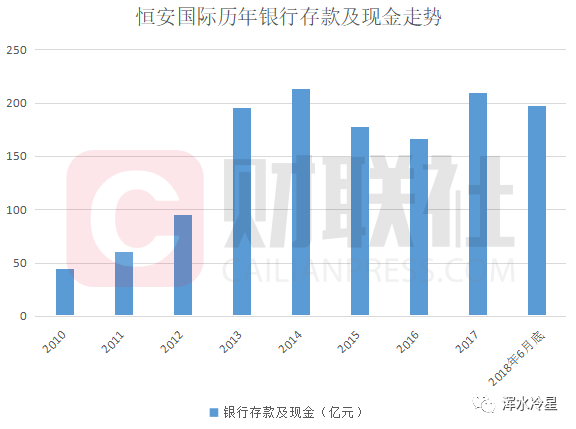

据财报,截至2018年6月底,恒安国际银行存款及现金总额为197.83亿,从财报上看,手握近200亿元的恒安国际,并不缺钱。以下为财联社根据财报绘制的恒安国际历年银行存款及现金走势:(注:2010年—2015年单位为亿港元,2016年—2018年6月底单位为亿人民币)

截至2018年6月底,恒安国际定期一年以上银行存款为18.89亿,定期3个月至一年之内的存款为134.31亿,手握合计153.2亿定期存款。然而,今年上半年,公司只产生了2896.1万元的利息收入,其半年利率仅为0.18%,令人生疑。

更值得关注的是,今年下半年以来,恒安国际频繁发债融资。2018年12月6日,公司发布公告称,其完成了发行10亿元的超短期融资券,票面利率为每年3.9%,为期270天。今年8月底至今,公司已发行了35亿元的超短期融资券。而在今年8月初,恒安刚发行了票面年利率为4.58%,总额为30亿的3年期债券。

账面巨额现金和频繁发债融资,如此矛盾的现象出现,真的合理吗?事实上,在A股上市的康美药业,就因存在同样的情况,已遭到众多投资者的质疑。

不过,从分红的角度来看,恒安国际又似乎表现不错。2006年至今,恒安国际累计进行了13次现金分红,累计分红总额为230.35亿港元,股利支付率超过60%。

然而,Bonitas Research发布做空报告则认为,高额分红是公司大股东掏空公司的手段之一。截至2018年6月底,许连捷持有公司20.1%的股份,施文博持有公司19.41%的股份,两大股东共持有公司39.51%的股权。

做空报告称,恒安国际大股东通过财报造假获得了丰厚的现金红利奖励,大股东至少已经从股息中获得了约78亿人民币的收益。该报告指,只要恒安的内部人员仍然是家庭亲属,恒安的现金和资产将被吸走,债权人和股东的利益将无法得到保障。

以下为做空报告原文(后附翻译):

We are short Hengan because we believe Hengan has fabricated RMB 11 billion of net income since 2005 which has manifested itself as fake cash on its balance sheet. Laden with debt, we assert that Hengan’s equity is ultimately worthless.

Hengan International Group Company Limited (HKEx: 1044) (the “Company” or “Hengan”) is best known for its “Space 7”, “Anerle” and “Anle” branded sanitary napkins (think maxipads) in China. In a very saturated and commoditized industry, Hengan claimed to generate 51% operating margins for its sanitary napkin segment in 1H’18, while its competitors are striving to generate 15% operating margins. Hengan’s reported historical return on assets for its sanitary napkin segment are equally questionable, claiming to achieve a remarkable peak return on sanitary napkin assets of 72% in 2016!

We believe the scheme was orchestrated using a web of inter-company related transactions to artificially inflate profits and conceal fake cash balances. Despite boasting cash and bank balances of RMB 19.8 billion and a working capital balance of RMB 7.6 billion as of June 30, 2018, Hengan has been aggressively raising debt to support its operations. In the five months from August to December 2018, Hengan issued six separate tranches of debt to investors raising a total of RMB 7.5 billion with a majority of the proceeds earmarked for working capital!

Characteristically with frauds, insiders create sham transactions with related parties to create illusory transaction volume, revenues, or profits depending on the fraudster’s desired outcome. Often these sham transactions are only on paper, and the fabricated buying and selling activity appears on the balance sheets of the counterparties as receivables and/or payables. We suspect this is how Hengan insiders have historically concealed dubious activity from auditors.

The scheme’s orchestrators have already been handsomely rewarded with significant cash dividends. Since 2005, Hengan has paid out RMB 18.6 billion in total dividends, which means at least ~RMB 7.8 billion has been pocketed by Hengan insiders from dividends. Our research has uncovered an undisclosed nefarious disposal of a Hengan revenue stream to Hengan’s CEO’s private family business at the bargain basement price of 0.7x 2016 net income! In addition, we found that Hengan’s insiders have undisclosed private businesses that claim to have transacted with Hengan on a Fujian real estate investment, increasing our suspicions that additional undisclosed benefits have been siphoned from Hengan to enrich insiders at the expense of investors.

So how do investors value a public company operated by unscrupulous insiders who use inter-company sham transactions to generate and conceal fabricated profits and cash? We think as long as Hengan’s insiders continue to be family relatives, Hengan’s cash and assets will be siphoned out to benefit insiders at the expense of creditors and shareholders. And if Hengan’s operational control was to change, we suspect the new team would find Hengan’s books to consist of overstated growth rates and profitability coupled with highly overlevered inflated asset valuations.