这是我们20201120的报告《

洪灝|展望2021:价值王者归来

》的英文原版。感谢阅读。

-----------------------------------------------

We continue to advocate value investing in 2021.

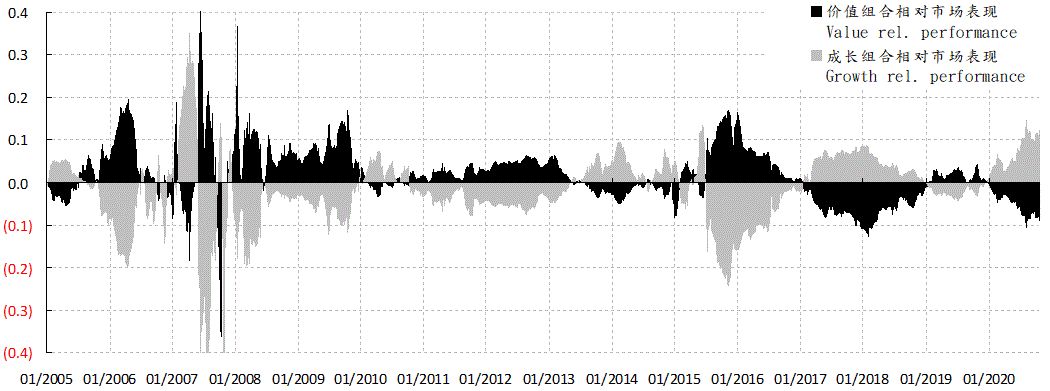

China’s value sectors have started to outperform since our 2H20 outlook report in June. But what on earth is “value”? It is confusing, as value is a relative term defined when compared with growth and price – unlike the GICS sector with an absolute definition about earnings sensitivity to economic cycles. At the current cyclical phase, the value sectors are the long-forgotten traditional and cyclical sectors with low valuation.

Cyclical recovery continues; inflation upside surprise.

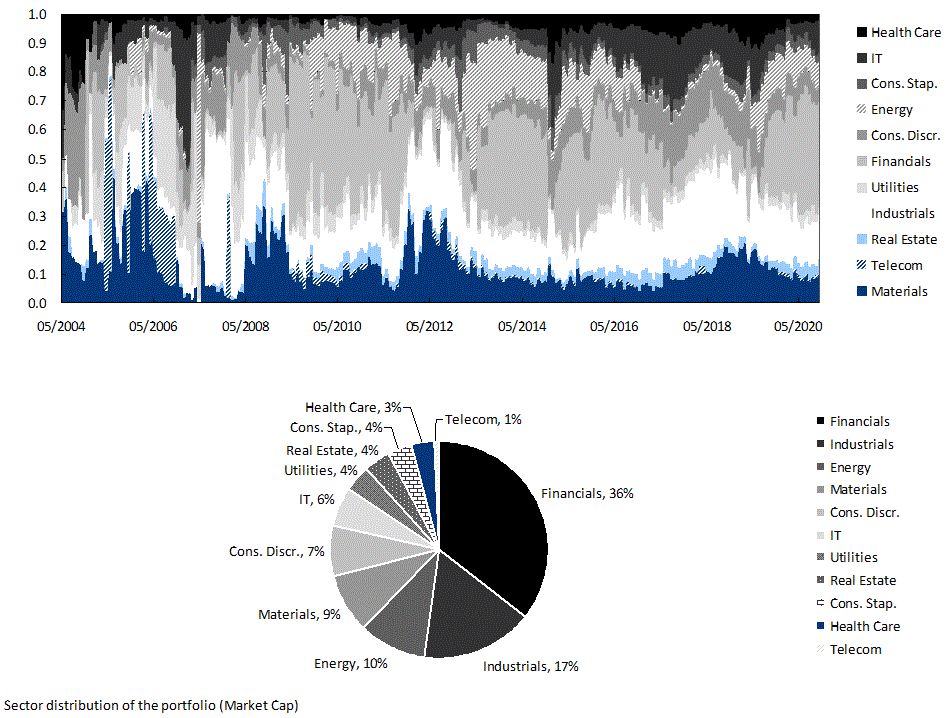

Our proprietary cycle indicator has been heralding a recovery since June. As credit growth continues at a measured pace in tandem with M2, and property investment heals after digesting the “three-red-line” policy, the recovery should continue. Other indicators, such as the copper cycle and gold, as well as the PBoC’s three-year monetary cycle, are all auguring well for the recovery. With demand improving as consumer confidence bounces back from historic lows, inflation pressure will creep up. Our model allocates towards traditional sectors such as financials, industrials, materials, energy and consumer discretionary, and keeps some exposure to IT.

“Valuation Investing” vs. “Value Investing”; industrial modernization within China’s 14th Five-year Plan (FYP).

Companies that create value over the long run may not offer good valuation in the short term. The term “value” has the intangible quality of management, strategy and resources at company’s command. It is different from the consensus understanding of “value investing”, which is more about a quantitative valuation number. The difference between valuation and value is often like Christmas tree and Christmas.

That said, China’s 14th FYP emphasizes industrial modernization and the real economy, as well as how best to share the fruits of economic development among companies big and small, and people rich and poor. The crackdown on online lending and the anti-monopoly guideline for the platform economy are important signposts. The 14th FYP will be conducive to the traditional sectors with low valuation to create value. As such, valuation and value investing have large intersection.

SHCOMP ~2,900 - 3,600; USD entering weak cycle bodes well for China and RMB-denominated assets; HK, EM, gold, commodities and Bitcoin.

The top end of our forecast range implies ~10% upside for SHCOMP, with ~2,900 being the likely bottom. But what is more important is the structural change within a broader market. Besides the cheap traditional and cyclical sectors, SSE50, CSI300 and HSCEI are all inexpensive with the tailwind from a strengthening RMB. Rising real yield concurrent with a cyclical upswing augurs well for these assets – till around end of 1Q20. We will re-examine our trading positions then.

Figure 1: Historical and current sector allocation based on value

Source: Factset, BOCOM Int’l

Figure 2: Value has also substantially underperformed growth in China

Source: Factset, BOCOM Int’l

Figure 3: USD strength in the current cycle has peaked, and it heralds lower secular US growth