这是我们20190513的报告《

洪

灝:“战争”与和平

》的英文原版。感谢阅读。

在进入英文原文之前,我希望做一些补充说明:

- 我把中文标题改为《

伟大的博弈》

。因为根据已知的信息,我暂时认为谈判是一次短期的博弈。特朗普在美国市场剧烈波动之后,在电视采访中表示他有“很好的解决方案”,并表示“G20会晤会有成果”,感觉”应该能达成协议“。这些补救言辞或暗示了他的软肋。与此同时,中方透露了一些谈判的细节,但表示”不会用人民币汇率作为谈判的武器“,显示了我方诚意。

美国赤字的修复并不能解决双方根本上的不同。更何况,中国的经常性账户盈余与GDP占比已经急剧缩小了。与其说是意识形态的分歧,还不如说是害怕失去霸权。一个被斯诺登、维基解密曝光监听自己公民的国家,却莫须有地指责华为,是虚伪的。短期的协议不改变长期竞争的格局。

- 感谢各位读者在后台的留言。有人指出我的博弈分析不考虑政治和意识形态的差别。然而,我的分析给出了一个思考的框架和博弈的出发点,并过滤了不必要的噪音。同时,即便是考虑了政治和其它因素,也只会大致等比例地改变最后“回报”一栏里的回报数字,但是不改变决策路径。

比如,我方的出口产业链是对方的5倍。这从双方互相的出口额可以看到。这也是为什么,对方发推特称,25%的关税,对方承担4,我方承担21%。其实,只要我们知道,在谈判失意后,我方的短期损失远大于对方,那么在对方亮牌增税后,我方经济利益最大化的、理性的选择就是达成交易。这就是对方strategic commitment战略性地下重注,通过限制己方的选择迫使对方做出有利于己方的选择。

- 对方如此出牌,表面上看不合常理。然而却是这时做博弈的最佳选择,恰恰说明对方是理性的,并迫切地希望达成协议。或者为自己的大选拉票。在有限次重复博弈里,越到最后几轮的博弈,出尔反尔来使自身利益最大化的概率就越大。严重时甚至导致对方在第一轮博弈游戏里就出千。现在跳出来看,的确如此。有报导称,对方在谈判中不断地提高我方需要购买的对方的出口数量。谈判中出现最后出现惊天逆转的情况并不罕见。看一下中美1999年入世的谈判情况,也是充满了悬念的。我们对于达成协议仍然谨慎乐观。当年谈判时,龙永图先生曾说:“我最怕的就是谈判和国家荣辱联系起来。每让一步就是丧权辱国,进一步就是为国增光。实际上,绝不是这么回事“。谈判争的是利,而不是气。

- 毋庸置疑,双方已经进入了长期竞争模式。之前是重量级拳击手对轻量级,对方自然不放在心上。现在是重量级对重量级,对方自然要求比赛规则公平。政治经济方面的讨论,许多热血青年已经洋洋洒洒。我作为一个宏观研究者,就不浪费读者的时间了。如不幸风险情景最终出现,只要我们坚持改革开放、公平正义,就没有什么能够阻挡我们前进的步伐。

以上,于最后一班跨海渡轮上。

----------------------------------------

“If everyone fought for their own convictions, there would be no war.” ― Leo Tolstoy, War and Peace

Let us assume that the trade talks are a repeated and sequential game with finite rounds, ignoring political influences and ideological differences. Each party in this game is to maximize self-economic interest, given the actions of its opponent. This is not a cooperating game, as establishing long-term binding contact appears difficult.

To win in this game, it pays to establish credibility by making a “strategic move”. Such a move is one that “

influences the other person’s choice in a manner favorable to one’s self, by affecting the other person’s expectations of how one’s self will behave. One constrains the partner’s choice by constraining one’s own behavior”

(

Thomas Schelling, The Strategy of Conflict,

1960). It is counter-intuitive to achieve one’s objective by limiting one’s option. But it is the right way to play such a game. And it is exactly what Trump did last Sunday. He has created a fait accompli that has left China with little choice.

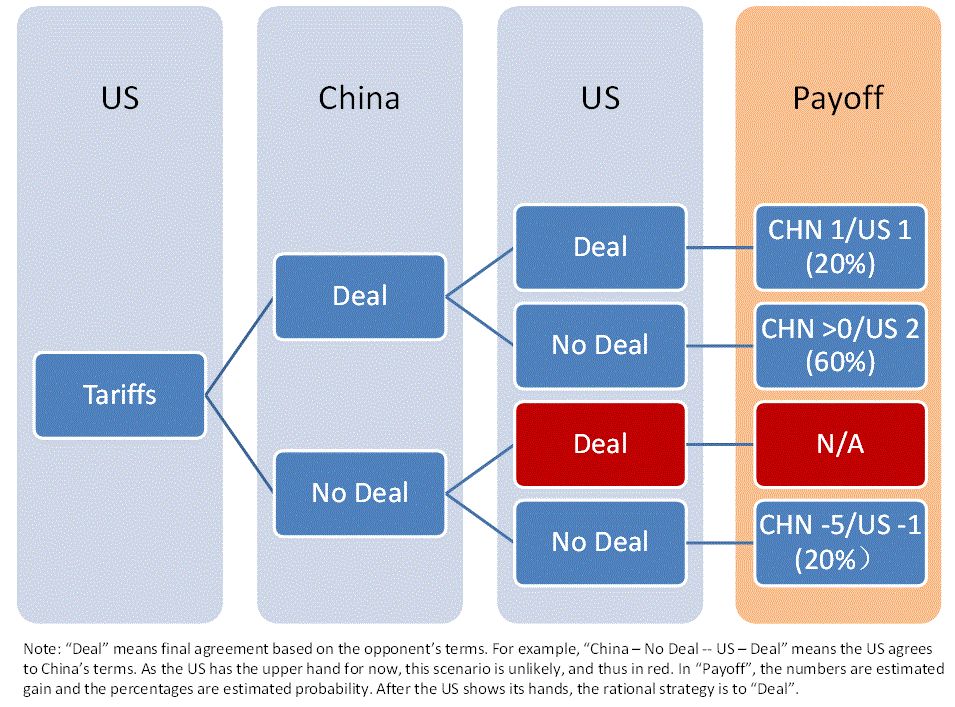

Applying the Stackelberg model for sequential games, it appears on paper China’s rational strategy is to work with the US to reach a deal (

Figure 1

). Essentially, this is a textbook

maximin

strategy to maximize minimum gains in order to avoid catastrophic losses, given the US’s hands. If so, it seems that

in theory

Trump’s negotiation brinkmanship that demonstrates a credible threat can indeed help accomplish a deal.

Figure 1: After the US unilaterally raised tariff towards the final rounds of trade talks, China’s rational choice is to work with the US to reach a deal.

Source: BOCOM Int'l

That sounds plausible on paper. But such analysis has a number of restrictive assumptions: each player is rational being one of them. But it is easy to lose one’s head in a stressful situation. The analysis is also short-term focus and entirely utilitarian, ignoring longer-term impacts such as relocation of industrial supply chain, loss of foreign confidence and potential capital flight. Further, in such a game, the winning strategy for both sides is really to play “

tit-for-tat

” – you scratch my back and I scratch yours. Before the hiccup, both sides did show goodwill in delaying tariffs and compromising during talks to reach an agreement. But now tension starts to escalate.

The constraints outside textbooks are showing in unpalatable technical patterns of risk asset prices. For instance, soybean futures has broken its support level last seen during the worsening trade talks in 2018; the Hang Seng’s long-term support has turned into significant near-term resistance; the RMB is plunging towards its lows (

Figure 2-4