航数

| CA DATA

报告称,美国旅游市场份额将至少在2023年持续下降

增长缓慢滞后于强劲的全球趋势;

业界呼吁

美国

品牌

重新授权

根据美国旅行协会发布的最新预测,对前往美国的海外旅行的需求低迷将维持该国落后于全球国际旅行增长的趋势。

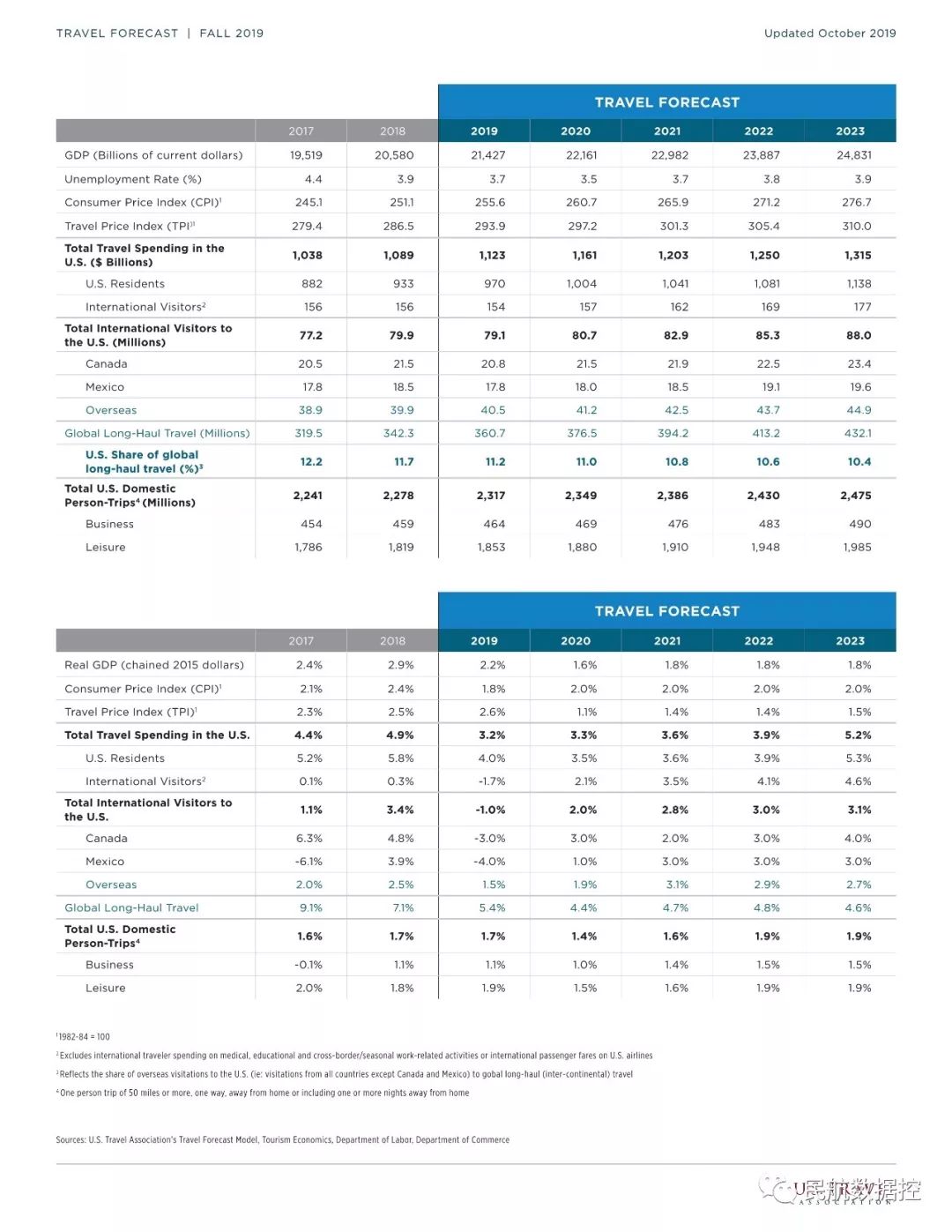

预计到2023年,全球长途旅行的年均增长率为4.8%,而美国的增长速度预计仅为这一数字的一半,即2.4%。

到2023年,这一差距将使美国在长途旅行市场中的份额进一步减少至10.4%,并将继续从2015年的13.7%的高位稳步下滑。

2019-2023年市场份额的下降将意味着美国经济进一步损失780亿美元的游客消费和13万个

美国

就业机会。

由于自2015年高点以来的下滑,到2018年,经济已经损失了590亿美元和12万个工作岗位。

美国旅行协会主席兼首席执行官罗杰·道(Roger Dow)说:“国际入境旅行是美国的第二大出口产品,将其增长速度作为国家优先事项可能会在帮助该国摆脱经济衰退方面起着不同的作用。”

“眼下,该国没有捕捉海外旅行的全部经济潜力,但也有一些交钥匙的政策解决方案,可以帮助解决这一启动与品牌的重新授权国会

美国

旅游推广机构。”

正如本周在《华尔街日报》(Wall Street Journal)上指出的那样,在旅游业的带动下,至关重要的美国服务出口部门在当前的全球经济环境中面临着巨大的阻力。

同样令人担忧的是,通常强劲的国内旅游市场预计将出现疲软增长,美国旅游报告预测,到2020年,该市场将仅增长1.4%,为四年来最低增速。这进一步加剧了人们对经济增长放缓的担忧,并强调了加强经济增长的重要性。国际方面。

在独特的融资模式(无需花费美国纳税人一毛钱)的支持下,Brand

USA

是一项至关重要的计划,可确保美国在国际旅游美元及其产生的经济利益的竞争中保持竞争力,其国际竞争对手依赖强大的纳税人,资助旅游部。

该机构将在明年到期,无需国会立即采取行动。

在过去的六年中,

Brand

USA

的营销工作已使660万游客增加到美国,产生了477亿美元的经济影响,

每年为

美国提供

近52,000

个就业机会。

U.S. Travel Market Share to Continue Decline Through at Least 2023: Report

Slow Growth Lags Strong Global Trend; Industry Calls for Brand USA Reauthorization

Sluggish demand for overseas travel to the U.S. will sustain the trend of the country falling behind international travel growth worldwide, according to the latest forecast released by the U.S. Travel Association.

While global long-haul travel is projected to grow an average of 4.8% annually through 2023, the pace of U.S. growth is projected to be just half of that figure—2.4%.

That gap will further diminish the U.S. share of the total long-haul travel market to 10.4% by 2023—continuing the steady slide from its previous high of 13.7% in 2015.

The 2019-2023 decline in market share would translate to a loss to the U.S. economy of a further $78 billion in visitor spending and 130,000 American jobs. As a result of the decline since the 2015 high, the economy has already lost $59 billion and 120,000 jobs through 2018.

“International inbound travel is the No. 2 U.S. export, and making its pace of growth a national priority could be a difference-maker in helping to keep the country out of a recession,” said U.S. Travel Association President and CEO Roger Dow. “Right now, the country is not capturing the full economic potential of overseas travel, but there are some turnkey policy solutions that could help to address that—starting with congressional reauthorization of the Brand USA tourism marketing organization.”

As noted this week in the Wall Street Journal, the crucial U.S. services export sector—led by travel—faces significant headwinds in the current global economic environment.

Equally worrisome is projected soft growth in the normally strong domestic travel market, which the U.S. Travel report forecasts will increase by just 1.4% in 2020, the slowest pace in four years—further stoking fears of an economic slowdown and underscoring the importance of bolstering the international side.

Supported by a unique funding model that doesn’t cost U.S. taxpayers a dime, Brand USA is crucial program for ensuring the U.S. remains competitive in the race for international tourism dollars and their resulting economic benefits—with its international rivals relying on robust, taxpayer-funded tourism ministries. The agency will expire next year without immediate action by Congress.

Brand USA’s marketing efforts over the past six years have brought 6.6 millionincremental visitors to the U.S., generating $47.7 billion in economic impact and supporting nearly 52,000 American jobs annually.