中文导读

Facebook在2016年美国总统大选中传播虚假消息以及俄罗斯操纵假账户干预选举,这令Facebook的形势不容乐观。除此之外,Facebook还面临着开支显著增加和政府加强监管所带来的挑战。Facebook若想克服这些困难,无法依靠外力,只能通过自身积极行动来完善核心产品和恢复受损的声誉。

Russian meddling is only one challenge facing the social-networking giant

In its early days Facebook embraced the motto “move fast and break things” to describe its engineers’ strategy of rapid innovation. “Move slowly, and try not to break anything else” seems to be its new creed. In the last year Facebook has contended with several controversies, including charges that it helped spread false news, unwittingly facilitated Russian meddling in the 2016 election and fanned political polarisation . After denials of responsibility and little action, Mark Zuckerberg, its boss, has talked of “fixing” Facebook in 2018. It will be a huge task.

Russia’s alleged manipulation of Facebook users will harm the company. On February 16th special counsel Robert Mueller filed conspiracy and fraud charges against 13 Russians for interfering in America’s 2016 election; Facebook was mentioned no fewer than 35 times as a place where Russian trolls swayed Americans through targeted political advertising and curated posts.

The indictment is also evidence that Facebook was not transparent in reporting the extent of activities that occurred on its platform. Last autumn it said it had determined Russian content reached around 130m Americans, and that Russian trolls had spent a mere $100,000 on ads during the 2016 election. Those figures seem too low. The Russian troll farm described in Mr Mueller’s indictment probably had an annual budget of around $70m and would have spent heavily on Facebook ads and content. American politicians may press the social-media firm for more information and also haul executives before Congress again to give testimony, especially as concerns mount about foreign interference in upcoming elections in 2018 and 2020—big distractions for a firm contending with several other significant challenges.

Controversies around Russian meddling, fake news and hateful speech on social media have not yet dented Facebook’s advertising revenues. But it seems likely that shrill and angry posts on the site, and bad press about social media, are playing a part in chilling usage of the core Facebook platform. Mr Zuckerberg’s approach to fixing it has been to tweak what posts users see, prioritising “meaningful interaction” over “meaningful content”, which has resulted in people seeing more of their friends’ updates and fewer news stories. But that does not go nearly far enough, says John Battelle of NewCo, a digital publisher.

Last month when Facebook reported earnings, it announced a decline in daily active users in America and Canada for the first time and estimated that, globally, users were spending around 50m fewer hours per day on Facebook. Such a drop translates into users worldwide spending around 15% less time on Facebook year over year, reckons Brian Wieser of Pivotal Research Group, an equity-research firm.

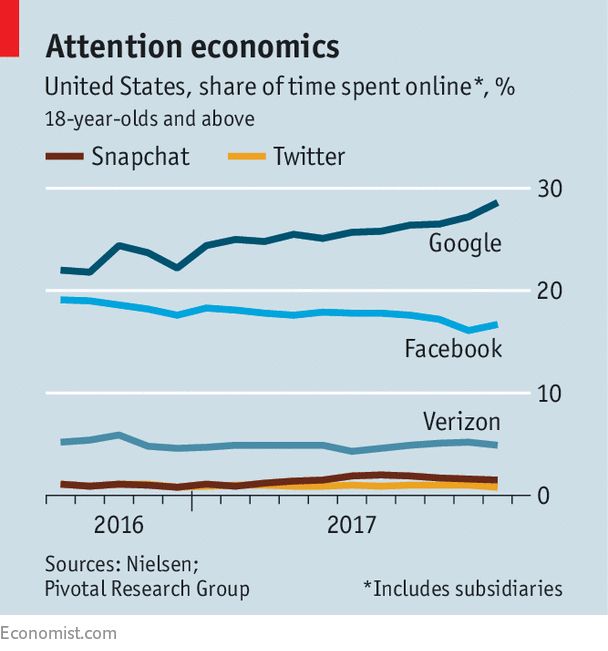

In America, Facebook is steadily losing users under the age of 25 (see chart). Youngsters are spending more time on other apps such as Snapchat, and Facebook-owned photo-sharing app Instagram, where their parents and grandparents are less likely to lurk. While Instagram and the two messaging apps that Facebook owns, Messenger and WhatsApp, help insulate the firm, “core” Facebook still accounts for at least 85% of the firm’s revenue. Americans and Canadians are by far its most valuable audience, with an average revenue per user of $86, four times more than the global average. If users continue to engage less with Facebook’s core network, it could cause advertisers to leave over time.

Yet most analysts and investors are still exuberant about future prospects for Facebook, which with a market value of $521bn is the world’s sixth biggest publicly traded firm. They may be underestimating some of the risks the firm faces. One challenge, which has been highlighted by the Russia controversy, is its sloppiness. For a company whose sales pitch to advertisers is that it offers precision, targeting and transparency superior to traditional media, including television, it is remarkable that it has struggled to track the movement of ad dollars and content on its properties.

Yet most analysts and investors are still exuberant about future prospects for Facebook, which with a market value of $521bn is the world’s sixth biggest publicly traded firm. They may be underestimating some of the risks the firm faces. One challenge, which has been highlighted by the Russia controversy, is its sloppiness. For a company whose sales pitch to advertisers is that it offers precision, targeting and transparency superior to traditional media, including television, it is remarkable that it has struggled to track the movement of ad dollars and content on its properties.

A second challenge is that Facebook’s costs are growing significantly. In 2018 expenses are expected to rise by around half, to $23bn, while gross revenue will grow by about a third, to $54bn, according to BMO Capital Markets, an investment bank. Today Facebook has around 14,000 workers overseeing security, safety, compliance and community operations, twice as many as a year earlier, and that figure is likely to rise as more countries require it to find and remove objectionable content.

Facebook is banking that future growth will come from luring more advertising spending away from television, but this will require investment in video content to the tune of billions of dollars. Meanwhile growth rates for digital advertising are bound to slow. This is particularly true in America, where digital’s share of total ad spending—which today stands at 44%—outstrips the percentage of time people spend on digital versus traditional media.