中文导读

戊戌狗年来临之际,美国驻华大使馆在微博上向中国人民拜年。然而就在一天后,中国股市大幅下跌,愤怒的股民纷纷将矛头指向华尔街,并在大使馆的微博下指责美国。经过政府的积极调控,股市最终在农历新年真正到来前有所好转。有人质疑此次股市的下跌和好转与2015年政府强势干预下的情形相似。但是细究起来,两者却大不相同。

A plunge echoes the crash in 2015, but much has changed

A CHINESE new-year message from the American embassy in Beijing looked innocuous. It welcomed the Year of the Dog on Weibo, a microblog, with photos of the embassy staff’s pooches and a video greeting from the ambassador and his wife, each with a dog in hand. But it soon attracted 10,000 angry responses. The post had become an unlikely lightning rod for public discontent about the stockmarket.

A plunge on February 9th had left Chinese shares down by 10% on the week, their steepest fall in two years. Some punters found solace in blaming the American embassy for the rout, which started on Wall Street. For others it was a matter of convenience, because their real target, the Chinese securities regulator, knew to disable comments on its Weibo account on such a grim day for stocks.

Even so, their protests seem to have been heard. Before the market reopened this week, Chinese officials urged big shareholders to buy stocks to restore confidence. The Shanghai Stock Exchange warned investors against placing large sell orders. And more than 300 companies suspended their shares from trading, to sit out the turbulence. Lo and behold, share prices clawed back a bit of ground in the three days of trading before the new-year holiday, which began on February 15th.

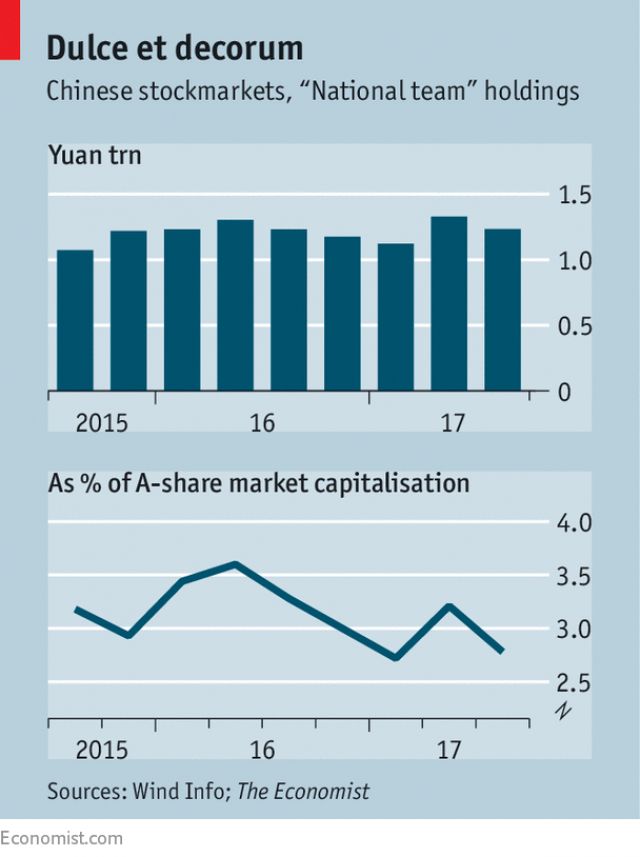

The rebound in China was welcome for global investors, supporting a broader recovery in international markets. But it also carried uncomfortable echoes of the Chinese meltdown of 2015, when the government intervened heavily, going so far as to create a “national team” of investment funds to buy shares. However, looked at more closely, the differences between the two episodes are more striking, and more reassuring, than the similarities.

To start with, valuations in China are far more reasonable today than they were three years ago. ChiNext, a tech board billed as China’s answer to NASDAQ, trades at 42 times the value of company earnings, a touch higher than NASDAQ but well down from its eye-watering 150-times multiple before the 2015 crash. The CSI 300, an index of China’s biggest firms, has a 14-times price-earnings ratio, comparing favourably with the 25-times ratio of the S&P 500, America’s most-watched share index.

The Chinese stockmarket has started to mature. Since its launch in the early 1990s it has often been likened to a casino populated by mom-and-pop investors. But over the past couple of years, institutions have played a bigger role, partly thanks to rapid growth of the asset-management industry. China still has a large army of day traders, as the American embassy can attest, but institutions have led a shift in money from small-cap firms to blue-chip stocks.

A programme that allows investors in China and Hong Kong to trade stocks on each other’s exchanges, subject to strict quotas, has brought the Chinese market closer to global pricing. Later this year China-listed shares will be added to the MSCI emerging-markets index for the first time, another step in opening China to international investors. Regulators in China still meddle more than do their counterparts in advanced economies. But the “national team” that helped rescue equities in 2015 has been whittling down its holdings, and it appeared to stay on the sidelines during the recent sell-off.