石油和天然气价格暴跌使石油公司开始认真对待成本上涨的问题,对于他们来说最重要的挑战是如何维持利润。

编者按:石油价格的下滑导致全世界的石油公司都致力于减少生产成本,在本文中,我们首先提出了我们对于石油天然气上游产业的一些看法,我们聚焦于全世界生产成本的变化趋势以及该产业的安全性和可靠性是如何改善的。我们将利用UK

North

Sea的最新分析数据了解这些变化持续的可能性,以及影响他们的主要内部和外部因素。本文由公共或专门的数据和我们对运营商和承包商的高级管理人员的采访总结而来。

经济衰退对石油工业造成的影响:生产成本不断降低

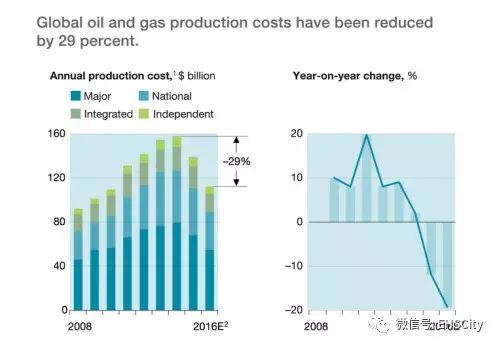

在过去两年半的时间里,石油的价格从每桶100美元下降到每桶低于35美元,最近回涨的趋势使价格回升到每桶50美元。这一变化已经影响到公司的支出方面。我们预计该季度有关石油产业的设备和服务的全球资本支出与2013年比有45%的下滑,我们第一次对全球的生产成本进行了相同的分析,我们审查了37家每天生产近4000万桶石油气的石油气公司的生产成本报告(图1)。

图1 全球石油天然气的生产成本已经下降了29%

图中应注意:1. 数据来源于从2008年起到现在代表着整个产业1/3支出的37家天然气和石油公司的公共报告。2. 由22家公司季度报告估计得到。

总的来说,自2014年以来,生产成本下降了约440亿美元(29%),与过去几年大幅上涨的趋势相反。例如在2008到2014年期间,各经销商的生产成本增加了600亿美元。最近生产成本的下降使得2016年的经营支出降到2010年以来最低的水平。

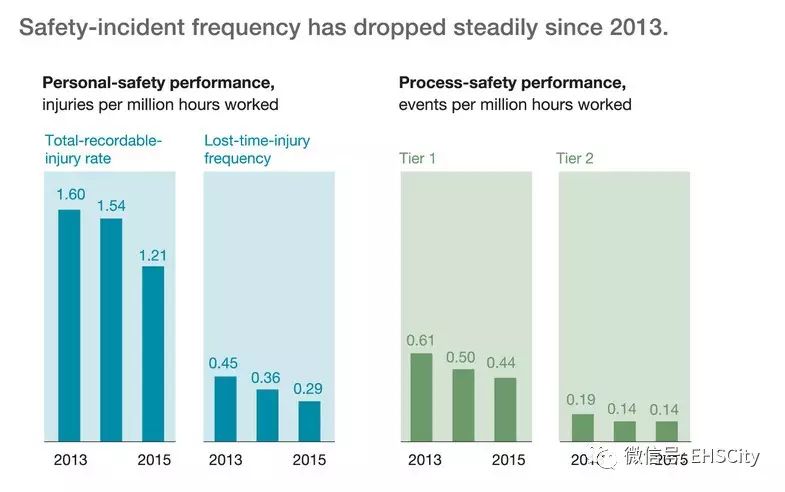

生产成本的下降不是经济衰退的唯一影响,国际石油和天然气生产商协会(IOGP)报告指出,2012至2015年全球安全绩效也有所改善。

图2 自2013年以来,安全事故频率稳步下降。

注:蓝色柱状图上方信息为:人身安全(每工作百万小时受伤人数)、受伤率、失时工伤频率;绿色柱状图上方信息为:工程安全问题(每工作百万小时事故数目)。

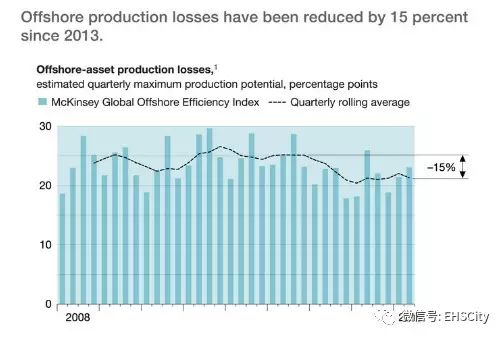

石油产业改善的第三个方面就是生产领域总经营生产的损失,麦肯锡的全球沿海资产效率指数通过对来自墨西哥湾、巴西挪威、英国和泰国的每天生产1000桶石油的400多个海上石油生产设施的生产数据进行分析,总体损失减少了15%。亏损大部分来自没有预料到的石油断供期,而且由于运营商使这些断供的频率和覆盖的范围减少,计划停产的日子减少了25%以上。

图3 自2013年以来,沿海的石油产量降低了15%

图中应注意:1. 通过对来自墨西哥湾、巴西、挪威和英国的400多个海上石油生产商(每天平均总产量为一千万桶)的生产数据进行分析。

生产成本的下降会持续下去吗?

运营商通过很多方式减少了支出,具体行为包括通过对组合管理进行投资,重新调整运营模式和组织结构,提高工作效率,并根据当前市场的情况,从材料和服务商处获取更低的成本价。

为了确定石油产业的生产成本能否继续保持目前的水平,我们需要详细了解节省生产成本的渠道,并判断每种渠道是短时的还是长期的。推迟各种活动的节省是短时的,但材料和服务商成本价的降低主要取决于当前石油市场的条件和石油的价格,除去石油需求和各种制度的影响,这种节约有不断维持下去的可能性。

我们还需要了解未来可能导致支出上升的因素。例如,石油价格的上涨带动各种活动频率的上升会影响到运营商和服务公司之间的合作,还会影响到技术上和监管上的支出。

North Sea有关如何降低成本的观点

我们可以通过参考2014年以来在英国北海进行的降低生产成本的工作,深入研究这个问题。英国石油和天然气公司报告说,该行业的运营成本在相同领域从2014年的97亿美元降至2016年的71亿英镑(27%),伴随着生产效率和整个行业安全绩效的提高。

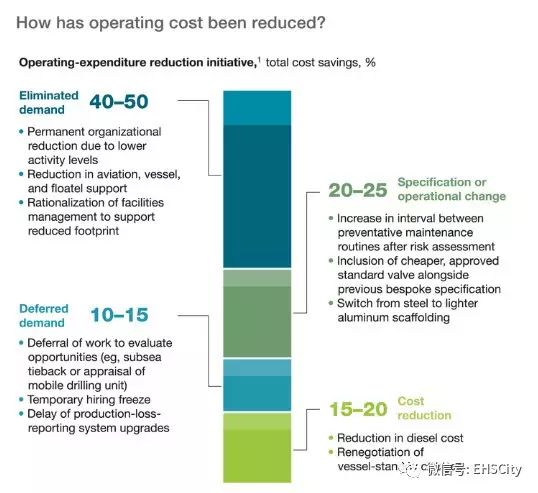

我们的分析显示,超过一半成本的降低来自经营效率的提高,并且免除了不必要的活动。这些削减比暂时延期的活动或和服务、货物商进行谈判的降价有更大的可持续性(图表4)。我们得出结论,即使石油和天然气的价格较高,成本的降低也是可持续的。

图4 运营成本是如何降低的

-

注:基于对英国近海200家在2015-2016年成本减少的公司的分析。

-

深蓝:消除活动——各种活动永久性的停止、船业资助的减少、设施管理合理化使支出减少;

-

浅蓝:推迟活动——推迟各种活动、进行评估(水下回接系统和移动钻井设备评估)、暂时停止招聘、推迟生产损失报告制度的升级;

-

深绿:生产制度和方法的改变——进行风险评估后增加预防性维护频率、使用便宜的标准阀、将钢制脚手架换为铝制;

-

浅绿:降低成本——减少柴油机成本、重新商讨船只等待费;

上表表示了使生产成本降低的四个主要因素:永久性的取消计划的活动、和货物服务供应商协商使价格下调、生产制度或方法的改变、推迟计划的活动。这些因素都有不同程度的可持续性。根据运营商对200多项计划活动的分析,2015年至2016年运营成本节省了4亿多美元,我们估计40%至50%的生产成本降低来自永久消除活动,另外20%至25%来自生产规模和方法的变化。预计这两种类型的影响可以持续2-3年,甚至影响程度不断增加。

剩余生产成本的降低来自与服务商品供应商的谈判,使价格下降(15%至20%),或延迟活动(10%至15%)。这两种因素在很大程度上取决于石油价格和活动水平,因此这些因素造成的成本降低的持续性较低。是否能继续这种影响与市场环境相关,不是运营商可以简单控制的。

我们提到的英国公司提到了两个共同的主题:

效率可能以更大的幅度提高,但这种变化比迄今为止成本的削减更难。许多运营商在2014年第四季度的价格下降之前就已经开始了提高效率的工作。在价格崩溃之前,成本的上涨已经引起了管理层的关注。降低成本的动作(包括通常的识别未来的风险并不断改进活动方案)随着经济衰退而加快步伐和强度。我们所涉及到的公司的工作重点已经转向提高效率,并获得更多的机会。

许多人认为有可能在运营商和供应链之间开展新的更多的合作方式。根据“英国石油和天然气2016年经济报告”显示,在英国,供应链利润率从10.3%下降至7.6%,供应链的服务商的收入下降了29%。但与此同时,从2016年四月份开始,OGUK运营商合作指数从5.9增加到了6.7(10分满分),这表明合作方式方面已经有一些进展。

全球生产商受到的影响

简单的来说,世界石油和天然气生产领域未来支出的变化取决于两个因素。第一是能否维持现有生产所需的经济状况和活动水平,和能否获取新的降低服务供应价格的机会。第二是执行活动的成本、市场的价格和产业的效益和效率。

这两个因素在很大程度上取决于石油的价格,因为价格能够决定哪个因素可以提供经济上的影响,从而推动供应链的需求。然而生产成本也受到监管、技术进步、采油厂以及公司自身因素(维持和提高效率、效益的能力)的影响。尽管如此,我们的分析表明,迄今为止,即使石油和天然气的价格较高,至少一半的生产成本可以维持现状。成功的公司通过以新的方式和供应链合作,并利用新技术来改善运营模式、学习如何降低活动成本,从而搭上了经济衰退的顺风车。

How will fluctuations in the oil and gas industry around the world impact

EHS

?

A lot of time and money is spent on trying to predict the

future. There are organizations built around it, millions of dollars

spent on it and alas – as those in the UK and United States experienced

first-hand in the political landscape of 2016 – they don’t always get

it right (if I’m going there, I might as well say they got it downright wrong.)

Companies will pay big bucks for advisors to do what they do best

and advise on what to expect in coming years. If Blockbuster knew that

one day internet streaming of films would become as big as it has, I’m

pretty sure they’d have moved much faster.

Staying ahead of the game is one of the cornerstones of

successful capitalist participants, and one of the biggest players in

the capitalist world is the oil industry: the Organization of the

Petroleum Exporting Countries (OPEC) – nations such as Saudi Arabia,

Iran, Algeria and Qatar – earned over $982 billion in net oil exports

in 2013 alone. That figure doesn’t even include revenues from the

United States, Europe or Far East Asia.

Peak Predictions, Price Continue to Fluctuate

Year-on-year, there are predictions of when the world will run out

of oil. It’s certainly a worry on a planet that massively depends on it

for transport, machinery, heating, lighting and more. (Check out this

timeline of "oil peak" dates that have been called in the past and that

have come and gone without apocalypse).

Now, governments and oil and gas companies are funding research into sustainable alternatives as we continue

down the path of preparation for the day the oil runs out.

Interestingly, what we’ve seen in recent years is so much supply from

OPEC – in a bid to defend their market share against the United States –

that the price of oil fell from $113 per barrel in 2013 to just $32

per barrel in 2016. This came as the industry was still recovering from

the significant drop in 2008; the shock of which was heightened by experts’ claims just months before that oil was about to reach $200 per barrel. They were only around $150/barrel off the mark.

Not surprisingly, this has had major ramifications for oil and gas

companies throughout the world. Globally, over 350,000 workers have

lost their jobs since the dip in 2014. Prices are picking up three

years later, but only after OPEC and Russia agreed to curb production rates as the negative effects of cheap oil reached the economies of member countries. The industry is recovering, but a barrel of oil will still only

set you back $50. We might, in fact, be defying all oil-Armageddon

prognoses to date, and instead be experiencing peak demand long before

peak supply. Whoever would have thunk it?

Profits and the Path to Redemption

Combine subdued production with the oil-and-gas-friendly rhetoric

from the Trump administration, and it’s plausible that the industry

could be on the path to redemption. President Donald Trump has

already, although controversially, signed executive orders on

advancing the Keystone XL and Dakota Access pipelines, and the United

States looks set to be a net exporter of oil by 2050 (again with those

predictions!).

As regulations are cut by the Trump administration, profits will

likely start to climb. So, does more profit potentially mean more

investment in EHS, right? Well, not without the worry that the very

change that leads to increased profits also wipes out the need for EHS

spending: deregulation. The Environmental Protection Agency (EPA) already is anticipating taking a massive hit to its funding.

Are executives committed to EHS morally, and not just because

compliance with existing regulations is mandated? Do you dare predict

what will happen?

What Is the Role of EHS?

With the oil industry rebounding, the hope is that the upturn will

have a positive effect on EHS. Actually, despite thousands of job

losses and cost-cutting, the oil and gas industry remains the biggest

spender on EHS and sustainability software, accounting for $342

million-worth of fees in 2016, or 37 percent of the entire global

market, according to Verdantix. This may come as a surprise when other

studies reveal that only 10 percent of oil and gas companies expect to increase EHS budgets in 2017, while 19 percent of DNV GL survey respondents say cost-cutting in the industry is raising health and safety risk at their organizations.

Unfortunately, the man who predicted the 2014 crash is predicting

another later in 2017. Whether this is “future babble” or not,

expectations of downturns in the oil and gas industry will have one of

two outcomes for EHS: it either will take a backseat, losing funding

while witnessing decreased morale in the face of redundancies and cuts,

or organizations will maintain its importance in order to avoid worsening an already bad situation.

As the Chinese NOC’s Deputy DG Ye Hua Huang, states, “We all need to be careful about safety all the time – no matter what the oil price is. It can never be compromised.”

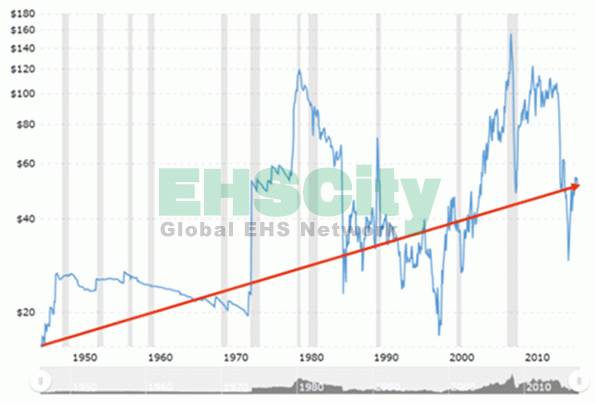

Can We Look Forward by Looking Back?

Are you familiar with the saying, “What goes down, must come up?”

Perhaps not, but you probably do know its evil twin. With every dip the

oil and gas industry has ever experienced, there has come a turning

point (see Figure 1, Crude Oil Prices 70-Year Historical Chart).

The price of oil bounces back, profits gain pace and there’s the onboarding of thousands of workers to support demand. Take the fact that the oil and gas sector not only

still exists but is the third-most-profitable industry in the world as

evidence that challenges have been overcome ever since its emergence

in the early 1900s. As for where we are now, predictions for 2017 vary widely.

I already mentioned that the man behind the 2014 crash prediction is taking a similar stance this year, but this is almost completely in contrast

to the rhetoric of OPEC and Russia (who so far are sticking to

promises to curb oil production until prices stabilize – a wise move).

It is encouraging to note that while prices find a new equilibrium, big

oil and gas companies are funding research into sustainable

alternatives such as the new PREP C20, a “powerful and sophisticated

solution designed to fractionate large amounts of polymer, in

an entirely automatic process.” It might not so much be when the upturn

hits, but when the significant shift starts to take effect.

Up? Down? Whatever happens, we know for sure that the world is not

stagnant. A number of emerging industries are set to effect economies,

workplaces and everyday life on a global scale – oil and gas is an

industry that will more than notice the rise of artificial intelligence

and automation.

The description of PREP C20 says it all: “An entirely

automatic process.” EHS in oil and gas dramatically will change as less

human intervention is required and exposure to human error is reduced.

The laws of exponential growth dictate that the more we discover, the faster we discover. Changes to how the industry goes about its daily business might be about to get a whole lot more disruptive than the fluctuating price of oil has been.

Clue to the Bigger Picture

Unfortunately, I have not landed on that gold mine. I don’t know

what’s going to happen to the price of oil or its effects on EHS, and I

don’t know when my colleague will be replaced with a robot and when I

will be replaced with its robot friend.

Predictions are extremely helpful for planning, and nowhere

is that truer than in the EHS profession: leading indicators and the

availability of ever-more data are helping organizations identify

trends and avoid similar dangerous situations in the future. But as

Niels Bohr, a Nobel Prize-winning physicist said, “It’s hard to make

predictions, especially about the future.”

In the period of fast change that approaches, only businesses that ride the innovation tide likely will succeed and it won’t be easy. The EHS professional

will be instrumental in this era. Expect a heck of a lot of in-game

time on that management of change software, but equipment upgrades

won't be the only change you'll have to manage. Worker

attitudes will vary, workforces will be streamlined, new processes will

be required and you’ll still be arguing the case of EHS investment to

the board. (But maybe they’ll all be computers and will be able to work

it out for themselves that continued EHS encouragement is crucial in any high-risk company’s success. Who knows?)

Then again, that is a prediction. Despite knowing that “it’s hard to make predictions, especially about

the future,” what are your predictions for the coming challenges in

oil and gas? Is speed of change on your agenda as an EHS professional?

Surely, the only thing we know for sure is that nothing is for

sure – and the track record of the price of oil vs. the track record

of expert predictions on the price of oil seems like a good indicator

of that to me.

The overarching challenge for you is making EHS excellence the constant come hell, high water, hostile markets… or complete industry overhaul.