Click '

CHINADAILY

' above to follow us

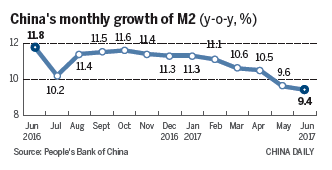

Growth in a broad measurement of China's money supply dropped to a record low in June as regulators worked to reduce leverage in the nation's economy.

The M2 money supply grew 9.4 percent from a year earlier, after a 9.6 percent growth rate in May, which also was a record low, according to data from the People's Bank of China. That is compared with a 12 percent target for the broad money supply for the whole year.

But not too much should be read into the slower growth of money supply because credit grew at a proper level to support economic activities, Ruan Jianhong, head of the Survey and Statistics Department of the central bank, said on Wednesday.

Ruan said the change is a natural result of deleveraging in the financial sector.

The central bank has vowed to contain financial leverage, fending off financial risks involved in key areas such as shadow banking and real estate financing.

The money supply growth change is no surprise, according to Li Chao, chief economist with Beijing-based Huatai Securities. The central bank sent signals to the market of its intention to enhance supervision earlier in May, easing market tensions through injecting liquidity, Li said.

Debt reduction in the financial sector has not impacted economic activities, Ruan said. "The financing demand in the nonfinancial sector has been met properly," Ruan said.

M2 includes cash, liquid accounts and other accounts including savings deposits and some securities. In the nonfinancial sector, M2 increased by 10.2 percent year-on-year in June, which is 0.8 percentage points higher than the overall growth of the M2 supply.

The financial sector has continued to support economic activities, "especially to sectors that have become new growth engines," Ruan said.

There has been considerable growth in medium- to long-term loans issued to sectors that make a high contribution to growth. In the first half of this year, credit issued to the high-tech manufacturing sector grew at a higher rate than the average for manufacturing, according to the central bank.

Supported by the continued advance of new growth drivers, the Chinese economy ended in a strong position in the first half this year.

The economy is not likely to lose its growth momentum in the second half, either, said Gao Huiqing, head of the development research department of the State Information Center.

Gao said it "might be a good idea" to quicken deleveraging a little while stabilizing growth "is not the top task for the government".

"It will be a long-term campaign to defuse the systemic financial risks and it might take years to finish. The pace needs to be controlled properly so that it will not hurt economic growth," he added.

Audio and translation of the story is available on our WeChat mini-app