中文导读

经过多次尝试,中国大陆股票本周三被认可纳入美国摩根士丹利资本国际公司(MSCI)证券交易所股票指数。MSCI将222支中国大企业集团的股票纳入其新兴国家股票指数,占MSCI新兴市场国家股票指数0.73%的份额。虽然份额不高,但这无疑是中国资本市场改革与演进,以及国际投资者与中国市场相互适应、更好互动、互利共赢的重要契机和推进器。有了中国股市的加入,MSCI的全球“版图”也变得更加完整。

Index inclusions will force investors to buy Chinese stocks and bonds.

FROM shoes to shirts and phones to fridges, made-in-China goods have blanketed the globe over the past three decades, entering every country and just about every home. But one kind of Chinese good few abroad dare touch: its financial assets. Outsiders own less than 2% of its shares and bonds, far below the levels of foreign ownership seen in other markets. Capital barriers and financial risks have put investors off. This, however, is changing. The globalisation of China’s capital markets is slowly gathering steam, as symbolised by the inclusion of Chinese stocks and bonds in global indices.

MSCI, a company that designs stockmarket indices, announced on June 20th that it will bring Chinese equities into two of its benchmarks: one that covers emerging markets; and another that follows stocks around the world. To begin, it will include a small number of shares, just 222 of the more than 3,000 listed in China. But its decision matters to asset managers who track their performance against MSCI’s indices or who invest in exchange-traded funds linked to them. They will in effect be forced to allocate capital to China’s stockmarkets, many for the first time. Because MSCI is giving Chinese stocks a limited weighting (0.73% of its emerging-markets index), the resulting cash inflows could add up to only about $10bn next year, equivalent to less than one hour of trading in China’s frenetic markets. Yet the weighting is likely to increase in the coming years.

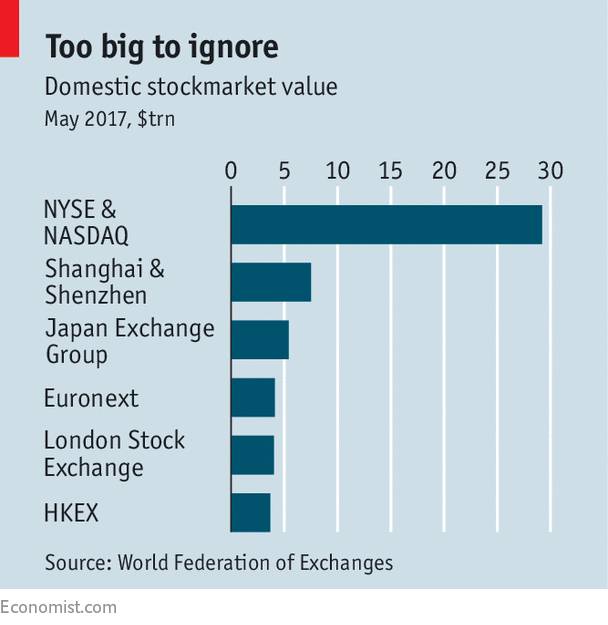

It was a contentious decision, despite China’s size. The country accounts for 15% of global GDP. Its stockmarket, housed in exchanges in Shanghai and Shenzhen, is the world’s second-biggest (see chart). But for each of the past three years MSCI had debated whether to add Chinese shares to its indices, only to back off each time because of restrictions on foreign investors.

Gaining access to China’s markets was—and is—hampered by formidable obstacles. Because of China’s tightly managed capital account, foreigners can only buy shares through a few quota-controlled channels. MSCI concluded that enough had been done to allay such concerns, largely thanks to a scheme that lets foreigners buy mainland stocks in Hong Kong.

Foreign institutions already hold Chinese shares but until now have mainly focused on firms listed in Hong Kong (see article) and America. These overseas Chinese stocks form 28% of the MSCI emerging-markets index. But onshore Chinese stocks are collectively much more valuable. They also encompass a far wider range of companies. The pensions and university endowments that follow MSCI will now own shares in makers of traditional Chinese medicine and distillers of baijiu, a fiery grain liquor—albeit only in tiny amounts invested passively through index trackers.

Chinese fund managers hope that the MSCI seal of approval might also entice active investors. “If you like Chinese food, you should go to China and have the real food. It is so much more diverse and authentic,” says Wang Qi, chief executive of MegaTrust Investment, a Shanghai-based fund manager. But many foreigners still shun the local fare. The stockmarket remains rife with insider trading and price manipulation. Memories of a debacle in 2015, when authorities intervened heavily after a bubble burst, also remain fresh. Chinese regulators are betting that greater participation by international institutions will help bring order.