Please click the right bottom "

Read more

" or go to the following webpage to participate Asiamoney Brokers Poll 2017:

https://www.euromoney.com/article/b13j49qfcr6jpp/asiamoney-brokers-poll-2017-vote-now

Voting period: 6th July, 2017- 18th August, 2017

-----------------------------

On August 10 1992, not long after the Shenzhen Stock Exchange was set up, IPO subscription fraud was uncovered, as the stock market was roaring and an IPO ticket would mean staggering sums. The mob rioted on streets, and the “8-10” incident had since forever etched in the almanacs of the fledgling Chinese market. The incident also highlighted the urgency to set up a market regulatory body.

Dr. Liu Hongru, China’s first CSRC chairman and a brilliant student of a former Soviet Union Monetary master, gave a speech at the first ever CSRC staff meeting. And he was frank. “We all need to be patient in this job. If stocks plunge,

the crowd below us

would be upset for being stuck in a losing position; if stocks soar,

the leaders above us

would be upset for fear of social harmony; if stocks don’t move at all, someone would be upset and say it is not a free market. In the end, it would be hard to satisfy everyone. Someone somewhere is bound to be upset sometimes.”

Dr. Liu’s opening speech from twenty years ago is prescient, and paints a good picture of the state of the Chinese market today: the Shanghai Composite is stuck and going nowhere. A mysterious force above has swayed the market. It can neither go up nor down too quickly, or sideways - it is a trilemma.

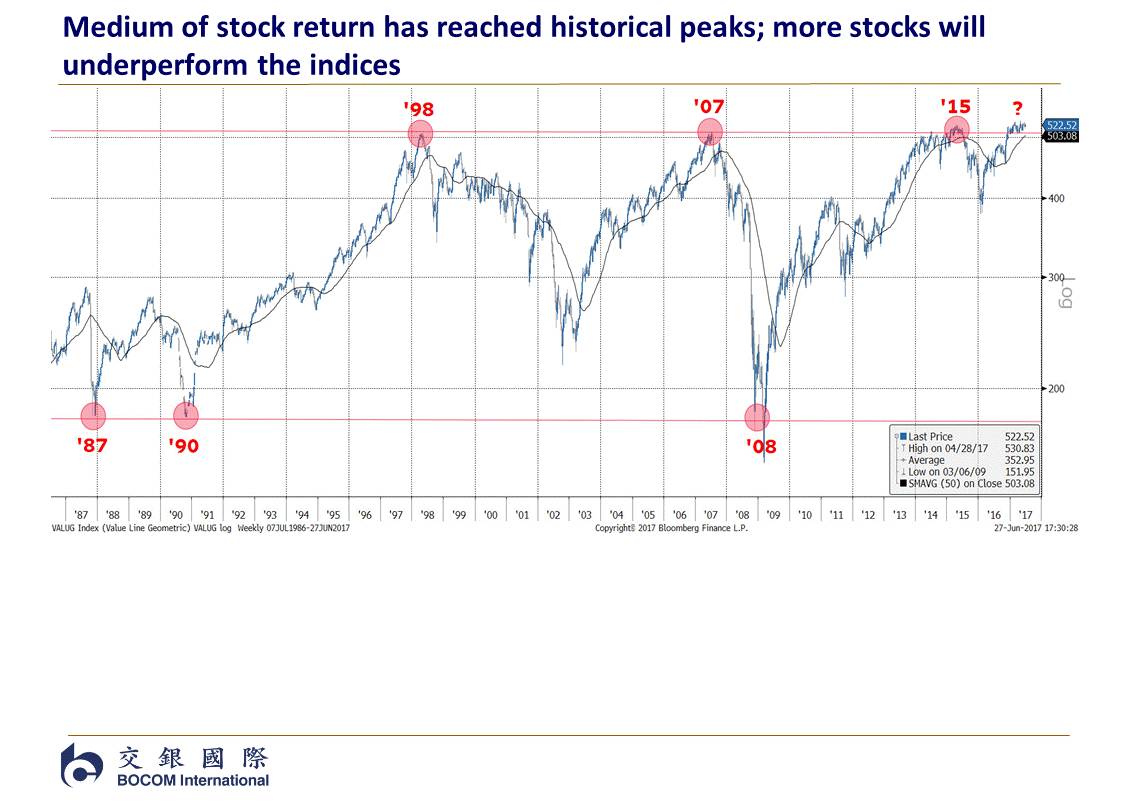

Indeed, not only the Chinese market is in doldrums, the market leadership in overseas markets is narrowing, too. Fewer and fewer stocks seem to be leading the market higher. This phenomenon can be seen by the median return of the overseas market has reached its historical peaks. Surging market volatility tended to ensue, if history is a guide. Russian Default and the collapse of LTCM in 1998, the onset of global financial crisis at the end of 2007 and the burst of the Chinese stock market bubble in mid-2015 and its global contagion all followed the peaking of the market’s median return, for instance (see focus chart below).

In our report titled “

2H2017 Outlook: An Idiot’s Guide to China’s Nifty-Fifty Run

”, we wrote that other market risk indicators, such as the VIX, junk bond spread, implied market risk premium and our proprietary market sentiment indicator were all pointing to heightened market risks ahead. Although the market continues to break new ground, we note that the volume of index put options is several times of that of call options, and buying of VIX calls is rising, too. When market trends are approaching such extremes, it suggests that the market opinions are reaching consensus. As such, value-added investment suggestion now is not to forecast the next market correction, but rather, the market direction after the correction, and how to cope.

Our focus chart above suggests elevated market risks, but also gives hints about the future market direction. The market trajectories after these peaks in market median return and the subsequent market correction were different. In 1998 after the LTCM collapse and Russia Default, the Fed immediately cut interest rate. Meanwhile, the US economy continued to grow. The environment of lower interest rate and stable economic growth was conducive to the US stock market gains, till the NASDAQ bubble burst in March 2000.

After the subprime crisis broke at the end of 2007, global economy sunk into one of the worst post-war recessions. And after the Chinese stock market burst in 2015, the global economy continues to grow, thanks to the collaboration between the global central banks. And the US market continues to make new highs. Obviously, economic growth determines the market direction after correction.

We believe that global economic growth will moderate in the second half, but a recession is unlikely. We note that tightened regulatory oversight in the financial industry in China has taken its toll. Leading indicators such as credit expansion, M2 broad money supply growth and the property inventory cycle have slowed rather rapidly. (Please refer to our report “

A Definite Guide to China’s Economic Cycle

” on 20170324).

Meanwhile, the US return on capital investment, a consistent leading indicator, has resumed its secular down trend, hinting at moderating growth ahead. In Yellen’s testimony yesterday, she suggested disinflation may not be due to some transitory factors, and saw “roughly equal odds that the US economy’s performance will be somewhat stronger or somewhat less strong than we currently project”.

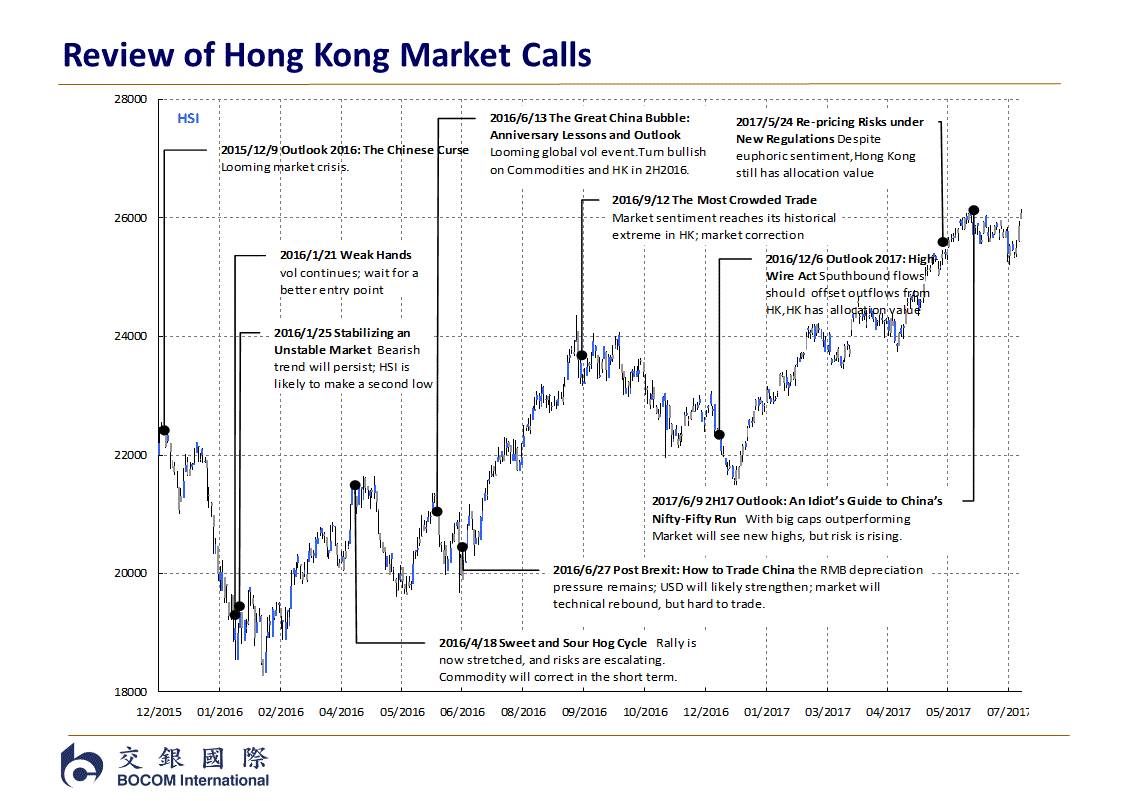

Our historical back tests suggest that large caps tend to outperform smaller caps amid moderating growth, and as such should lead the US and HK market indices dominated by large caps to their new highs. But the easiest money is behind us, and it will get even harder to beat the market. This is probably the reason why so many top macro hedge funds have underperformed so far this year.

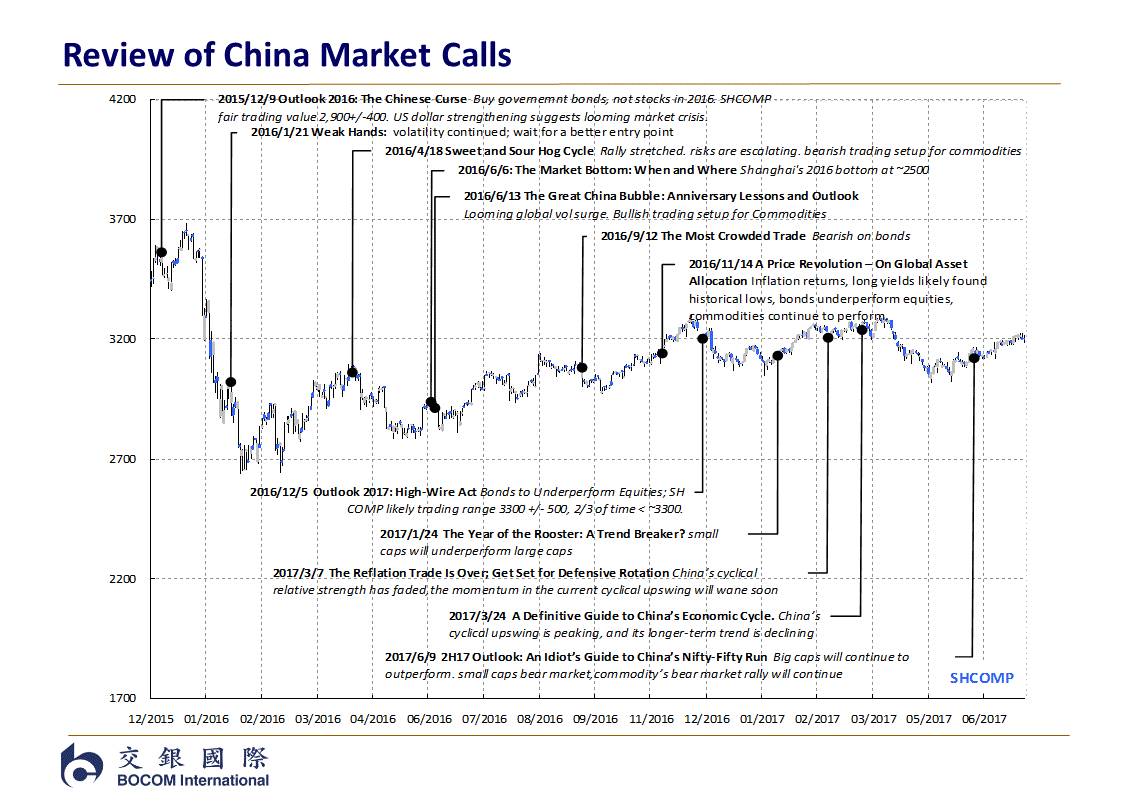

Our Earnings Yield/Bond Yield (EY/BY) model helped us predict the inception and the end of China’s stock market bubble in 2015, and negotiate the trouble waters after the bubble burst.

In early December 2015, we used this quantitative model to forecast the trading range for the Shanghai Composite in 2016 to be 2500-3300. And in 2016, the actual range was 2638-3301.

In early December 2016, the market consensus has turned bullish. But our EY/BY model forecasted that the Shanghai Composite would spend 2/3 of its time trading below 3300 in the subsequent twelve months after the forecast. It has now been seven and a half months, and the peak in the Shanghai Composite so far since our forecast was 3295. Further, the model forecasted the trading range for the Shanghai Composite to be 3300+/-500, and foretold that 2017 to be a better year than 2016.

But because of the index level forecasts in the remaining time were rather dispersed, these model results from more than half a year ago also presaged market risks ahead.

Below is a video excerpt from a TV program that I did in early December 2016 with Mr. Wu Xiaobo, one of the most famous Journalists in China who also runs one of the most-watched TV shows. During the program, I recommended large cap blue chips and the Hang Seng, and suggested avoiding small caps and ChiNext.

As my reasons, logic and results are coming together and becoming increasingly palpable, I am sticking to my calls. In our report titled “

Outlook 2017: High-Wire Act

”

on December 5, 2016, we recommended buying financials, materials, energy, industrials, technology/internet and consumer discretionary. In the second half, we continue to like financials, technology/internet, consumer and healthcare. We believe these recommendations should help break the market trilemma in the second half.

Below are the summary charts of my reports and calls last year. I hope that I have been right more often than wrong. Please vote for us in this year Asia Money and II poll.

Thank you! And wish you a good summer.

Review of Last Year

2017 Asiamoney Voting Guide

1) Please click the following webpage to participate the poll:

https://www.euromoney.com/article/b13j49qfcr6jpp/asiamoney-brokers-poll-2017-vote-now

2)

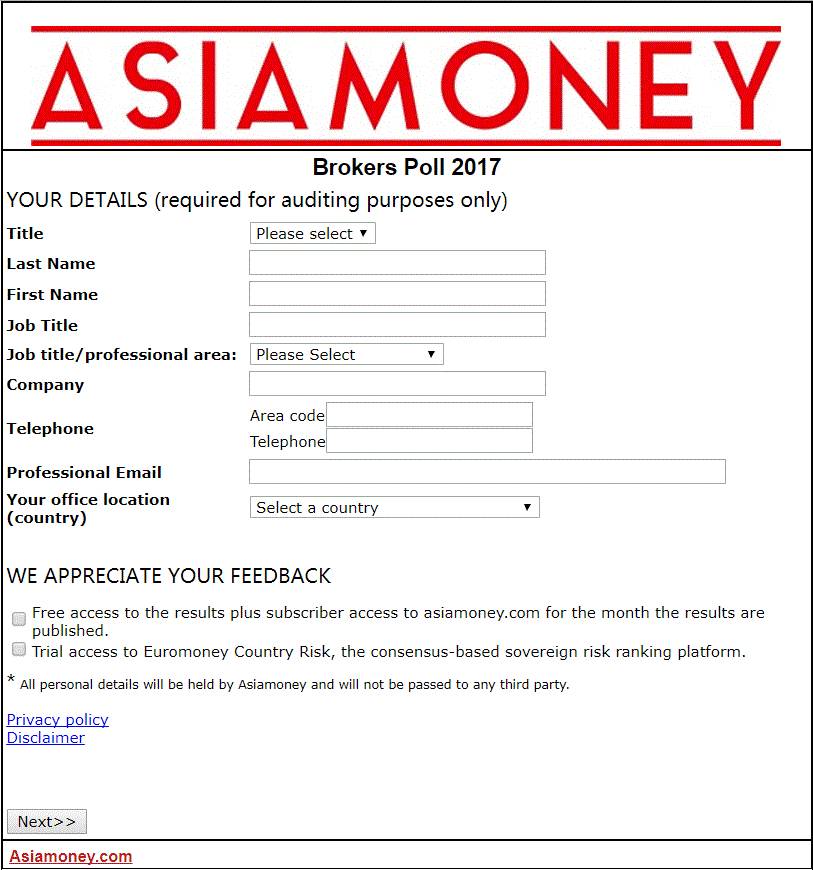

Please select a language and fill in your details. Then click Next>>

3)

Please fill in your company details, then click Next>>