📖

明天我要开学啦,也许是我学生生涯的最后一年了,要好好珍惜

( ⸝⸝•ᴗ•⸝⸝ )੭⁾⁾

我们继续一起加油!

📖

这篇文章

选自经济学人20170708期,原文比较长,我选取了前三段进行剖析,希望大家读完收获满满。

📖

建议大家自主阅读原文,再学习精读笔记。这篇文章比较长,大家不用强求自己一口气读完,每次打开,

阅读1-2段

即可,既轻松、

记忆效果也更好。

📖 阅读完笔记后,回头再读原文段落,测试自己是否能够流畅阅读,是否能回忆起补充的写作要点,并且从整体上把握文章脉络。

📖

关注本公众号

“独霸上海的妖怪”

,后台回复

“外刊”

,可得

2017年全年及2018年

最新的经济学人原版外刊及音频的获取方式。

建议大家先独立阅读原文,不理解的地方不要紧,后面会有详解

Finance

Your money and your life

IN 1965 ANDRÉ-FRANÇOIS RAFFRAY, a 47-year-old lawyer in southern

France, made the deal of a lifetime. Charmed by an apartment in Arles, he persuaded the widow living there that if he paid her 2,500 francs (then about $500) a month until she died, she would leave it to him in her will.Since she was already 90, it seemed like a safe bet. Thirty years later Mr Raffray was dead and the widow, Jeanne Louise Calment, was still going strong. When she eventually passed away at 122, having become the world’s oldest person, the Raffray family had paid her more than twice the value of the house.

Underestimating how long someone will live can be

costly, as overgenerous governments and indebted private pension schemes have been discovering. They are struggling to meet promises

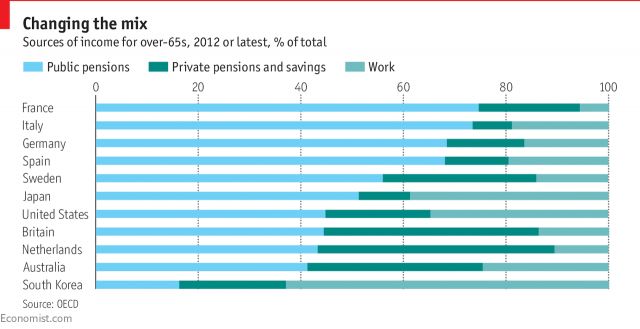

made in easier times. Public pensions are still the main source of income for the over-65s across

the OECD, but there are big differences between countries (see chart). In both America and Britain public provision replaces around 40% of previous earnings, but in some European countries it can be 80% or more. Where it

makes up a big share

of total pension income, as in Italy, Portugal and Greece,

a shrinking workforce

will increasingly struggle to

finance

a

bulging

group of

pensioners.

Private pension schemes, which

supplement

state provision, have been

shifting from

defined-benefit plans, where workers are promised a fixed amount of income in retirement,

to

defined-contribution plans, where workers themselves

take on the risk.

Such schemes a

re good for employers but

tricky

for individuals, who become personally responsible for ensuring they do not

outlive

their savings. The new stage of life now emerging between work and old age

adds a further complication.

To

accommodate

these changes, the financial industry needs an

overhaul.

Finance 金融

Your money and your life 你的钱与你的人生

As lives get longer, financial models will have to change

寿命越来越长,金融模型不得不变

IN 1965 ANDRÉ-FRANÇOIS RAFFRAY, a 47-year-old lawyer in southern France, made the deal of a lifetime. Charmed by an apartment in Arles, he persuaded the widow living there that if he paid her 2,500 francs (then about $500) a month until she died, she would leave it to him in her

will.

Since she was already 90, it seemed like

a safe bet

. Thirty years later Mr Raffray was dead and the widow, Jeanne Louise Calment, was still going strong. When she eventually passed away at 122, having become the world’s oldest person, the Raffray family had paid her more than twice the value of the house.

-

作者在第一段中讲述了一个极端个案,引出后文的观点——

低估一个人能活多久可能要付出高昂的代价

(

Underestimating how long someone will live can be costly)

。

-

make the deal of a lifetime

做出了一辈子的交易,在文中

of a lifetime

就是字面的意思,而

sth of a lifetime

还有一个引申义:一生最

…

的,千载难逢的,终身难遇的,比如

◇

It is the chance of a lifetime.

这是一个千载难逢的机会。

-

will

n. [C]

a legal document that says who you want your money and property to be given to after you die

遗嘱

-

a good/safe bet

指“稳妥的做法,保险的做法”

(an action or situation that is likely to be successful or does not involve much risk)

◇

If you're looking for long-term growth, the government's own saving certificates are a pretty good bet.

如果你希望长期增值,政府的储蓄券是比较保险的。

1965

年,法国南部一名

47

岁的律师安德雷

-

弗朗索瓦

·

拉弗雷(

André-François Raffray

)做了一笔一辈子的交易。他钟情于阿尔勒的一间公寓,并说服了住在那里的寡妇:如果他每个月支付

2,500

法郎(约合

500

美元)直到她去世,她将会在遗嘱中把公寓留给他。由于她已经

90

岁了,这似乎是一个稳赢的赌注。

30

年后,拉弗雷先生去世,而寡妇让

·

路易斯

·

卡尔芒(

Jeanne Louise Calment

)依然生气勃勃。当她最终于

122

岁去世时,她是世界上年纪最大的人,而拉弗雷家族向她支付的金额超过了公寓价值的两倍。

Underestimating how long someone will live can be

costly

, as overgenerous governments and indebted private pension schemes have been discovering. They are struggling to

meet promises

made in easier times. Public pensions are still the main source of income for the over-65s across

the OECD

, but there are big differences between countries (see chart). In both America and Britain public provision replaces around 40% of previous earnings, but in some European countries it can be 80% or more. Where it

makes up a big share

of total pension income, as in Italy, Portugal and Greece,

a shrinking workforce

will increasingly struggle to

finance

a

bulging

group of

pensioners

.

[小结]

表示“昂贵

”

的词语

high

used about prices, rents, or charges

高的〔用于形容价钱、租金或收费〕

fancy

used about restaurants, cars, or clothes that look expensive

昂贵的〔用于形容看上去昂贵的餐馆、汽车或衣服〕

posh

used about hotels, restaurants, or cars that look expensive and are used by rich or high-class people

豪华的〔用于形容有钱人或上流人士使用的酒店、餐馆或汽车〕

cost a lot/bomb

(informal) to be very expensive

十分昂贵的

be out of sb's price range

to be more than someone can afford to pay

贵得让某人买不起

be a rip-off

(informal) to be much too expensive, so that you feel you have been cheated

要价高得离谱,敲竹杠

exorbitant

exorbitant prices are much too high

价格过高的

-

meet promises

兑现承诺

keep/fulfill promises

也可以指兑现承诺

-

the OECD

abbr.

the Organization for Economic Cooperation and Development a

group of rich countries who work together to develop trade and economic growth

经济合作与发展组织(发达国家致力于发展贸易和经济增长的组织)

the OECD

在经济学人中出现频率很

高,比如:

◇

Even in the mostly rich countries of the OECD about 30% of teenagers fail to reach proficiency in at least one of these subjects

.

即使在大 多为富裕国家的经合组织成员国中,也有大约

30%

的青少年未能熟练掌握其中至少一门科目。

◇

Online learning requires some IT literacy, yet one in four adults in the OECD has no or limited experience of computers.

在线学习需要一些基本的计算机知 识,然而在经合组织国家里,四分之一的成年人没有或只有有限的计算机知识。

[外刊高频]

-

A makes up a big share of B.

A

占据了

B

的大部分。如果想说最大的一部分,可以用更地道的

the lion's share of sth

来表达,比如

◇

The firm has captured the lion's share of the UK market.

这家公司已经占有了英国最大的市场份额。

-

a shrinking workforce

不断萎缩的劳动力

[写作推荐]

-

finance

v.

to provide money, especially a lot of money, to pay for something

为

…

提供资金

=fund

◇

The concerts are financed by the Arts Council.

音乐会由艺术总会出资举办。

[熟词僻义]

-

bulging

指不断激增的,

a bulging group of pensioners

即日益膨胀的退休群体,与前面

a shrinking workforce

形成对比,所以翻译时也要体现出

bulging

和

shrinking

的对立。

-

pensioner

指领取养老金、退休金的人,也可以说

an old-age pensioner

简称为

OAP

-

A shrinking workforce will increasingly struggle to finance a bulging group of pensioners.

这句话可以直接背下来用在老龄化话题的作文中。

低估一个人能活多久可能要付出高昂的代价

——

过度大方的政府和负债累累的私人养老金计划已经发现了这一点。日子好过时做出的承诺,如今履行起来却痛苦不堪。在所有的经合组织国家,公共养老金仍然是

65

岁以上老人的主要收入来源,但各国之间存在着很大的差异(见图表)。在美国和英国,公共经费能够替代工作时收入的

40%

左右,但在一些欧洲国家这个比例可以达到

80%

甚至更高。在意大利、葡萄牙和希腊这样的国家,公共经费占到了养老金总收入中很大一部分,不断萎缩的劳动力将越来越难以支撑日益膨胀的退休群体。

Private pension schemes, which

supplement

state provision, have been

shifting from

defined-benefit plans, where workers are promised a fixed amount of income in retirement,

to

defined-contribution plans, where workers themselves

take on the risk.

Such schemes

are good for employers but

tricky

for individuals, who become personally responsible for ensuring they do not

outlive

their savings. The new stage of life now emerging between work and old age

adds a further complication.

To

accommodate

these changes, the financial industry needs an

overhaul.

-

supplement

[ˈsʌplɪmənt]v.

to add something, especially to what you earn or eat, in order to increase it to an acceptable level

补充,增补,增加

[熟词僻义]

-

shift from A to B

从

A

转变为

B

-

defined benefit

是一个术语,指固定福利金,固定收益,加上连字符变成形容词,

defined-benefit plans

即固定收益计划。如果不知道这个术语也没有关系,《经济学人》非常贴心,对于读者可能不太熟悉的术语、专业名词一般都会给出解释,比如文中就用一个非限制性定语从句解释了

defined-benefit plans

是什么:

where workers are promised a fixed amount of income in retirement

保证员工退休后获得固定收入的固定收益计划。同样的

defined contribution

指固定供款,固定缴费

defined-contribution plans

指固定缴费计划,后文也有定语从句进行说明:

where workers themselves take on the risk.

员工自行承担风险的固定缴费计划。

-

take on the risk

承担风险

take on sth

指“承担,接受”,后面一般跟重大责任、艰巨的任务、风险等等,比如上一篇精读文章中滴滴的道歉信提到“在这悲伤的时刻,我们唯一能做的,就是带领团队去面对痛苦,承担责任

…”

原文给出的翻译便是

The only thing we can do at this moment of pain is to face the pain and

take on our responsibility

.

[写作推荐]