Follow us

Please click above "

德勤Deloitte

"

↑

In the extended automotive ecosystem, consumers will ultimately choose the winners and losers among the companies and brands vying to deliver convenient, low-cost and customized mobility solutions. In the new automotive consumer study on "What's ahead for fully autonomous driving: Consumer opinions on advanced vehicle technology", Deloitte surveyed over 22,000 consumers in 17 countries around the world, and focused on six countries (the United States, Germany, Japan, South Korea, China and India) to explore consumers' attitude towards self-driving technologies, their preference in advanced vehicle technologies and their choice among various mobility services etc. Following are the key findings from the study:

Consumer's attitude towards autonomous vehicles

-

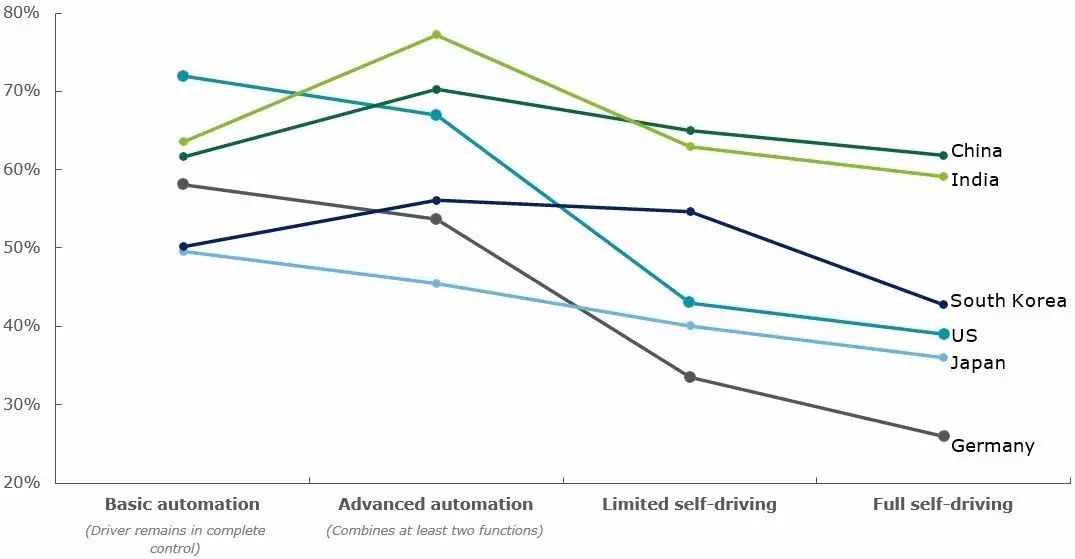

Interest in different levels of autonomous vehicle technology varies across global markets. Consumers in China and India appear most interested in vehicle automation, while German consumers are more conservative in autonomous driving. (Figure 1)

-

Although interest in full self-driving capabilities has risen in both China and the US since 2014, the same cannot be said for other global markets, where interest has remained flat or declined. In terms of generation, Gen Y/Z consumers are generally more interested in fully autonomous vehicles.

-

Consumers at present appear consistent in their concerns regarding the safety of fully autonomous vehicle. While having an established track record of fully self-driving vehicles operating safely on public roads, or if it were offered by a brand they trust would encourage consumer support for autonomous vehicles.

-

Consumer opinion appears to diverge on whom they trust to bring self-driving cars to market, consumers in Japan, Germany and the U.S. believe traditional car manufacturers will play the role, while consumers in China and South Korea trust more on new autonomous companies.

Figure 1: Percentage of consumers who prefer different levels of vehicle automation

There is significant opportunity for automakers to capitalize on the success of individual self-driving features such as self-parking and lane control.

Consumer's preference on advanced technology features

-

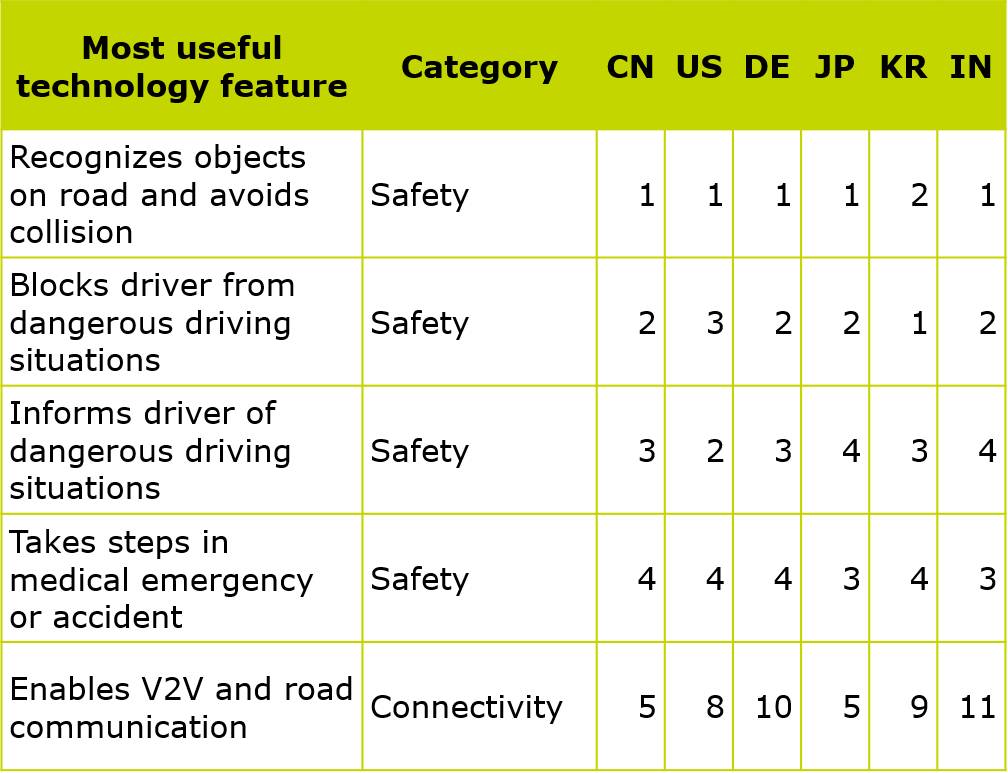

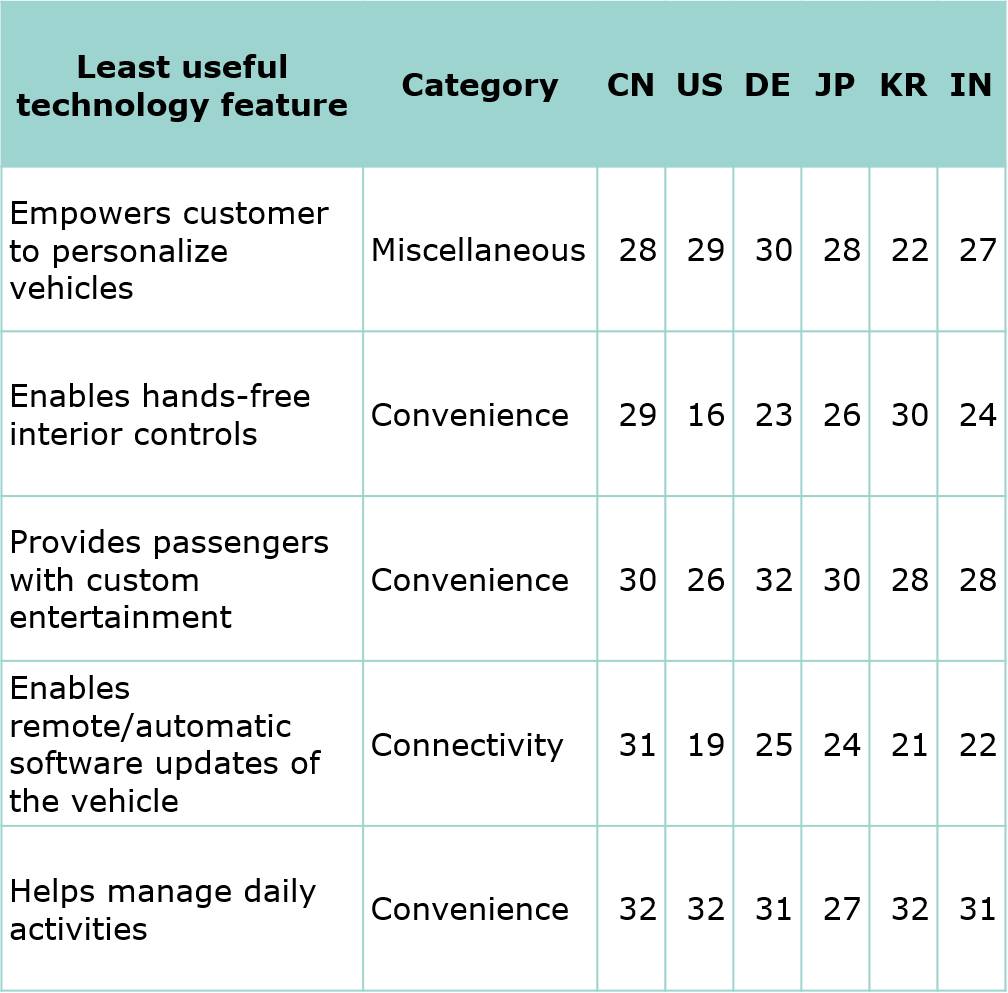

Compared to a variety of advanced technology features, we found technologies that deliver advanced, predictive safety capabilities were ranked as the most preferred, while features that provide customized entertainment, notification of places of interest and technologies that manage daily activities are viewed as least useful. (Figure 2)

-

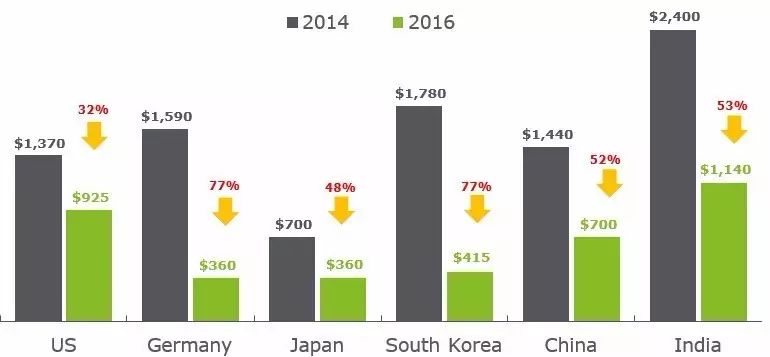

Consumers are generally willing to pay a little extra for access to advanced tech features, but the amount consumers willing to pay has declined significantly since 2014. (Figure 3)

Figure 2: Advanced technology features that consumer say are most and least useful (rank order by country)

Figure 3: Overall expected price which consumers are willing to pay for advanced automotive technologies (2014 and 2016)*

* The dollar value for each country represents the average of overall weighted prices across the five technology categories (safety, connectivity, cockpit/convenience, self-drive, and alternative powertrain). The non-USD currency has been converted into USD by using the average exchange rates in 2016.

Consumers expect advanced technology features that were once considered premium options to become standard features that do not increase the price of the vehicle.

Consumer's option for mobility services