Surging commodities

水涨船高的大宗商品

The mountaineers

攀登者

Commodity prices are climbing. Is a new supercycle beginning?

大宗商品价格不断攀升,新一轮超级周期是否正在拉开帷幕?

The biggest commodity story of 2020 was one of decline. As the coronavirus pandemic halted travel, oil prices fell off a cliff, then briefly went subterranean: in April a futures contract for West Texas Intermediate was worth less than nothing. Oil began clawing its way above $45 a barrel in November, supported by optimism about vaccines. For other commodities, however, 2020 was not all bad. Indeed the year may have marked the start of an extraordinary ascent.

对于大宗商品来说,2020年的故事主题是衰退。疫情导致全球通行中断,油价断崖式下跌,并短期内跌至零点以下:4月,西德克萨斯中质原油期货合约一文不值。在疫苗带来乐观情绪的支撑下,原油价格在11月份开始攀升,重回每桶45美元以上。然而,对于其他大宗商品而言,2020年并非如此糟糕。事实上,这一年可能标志着一次非凡攀升的起点。

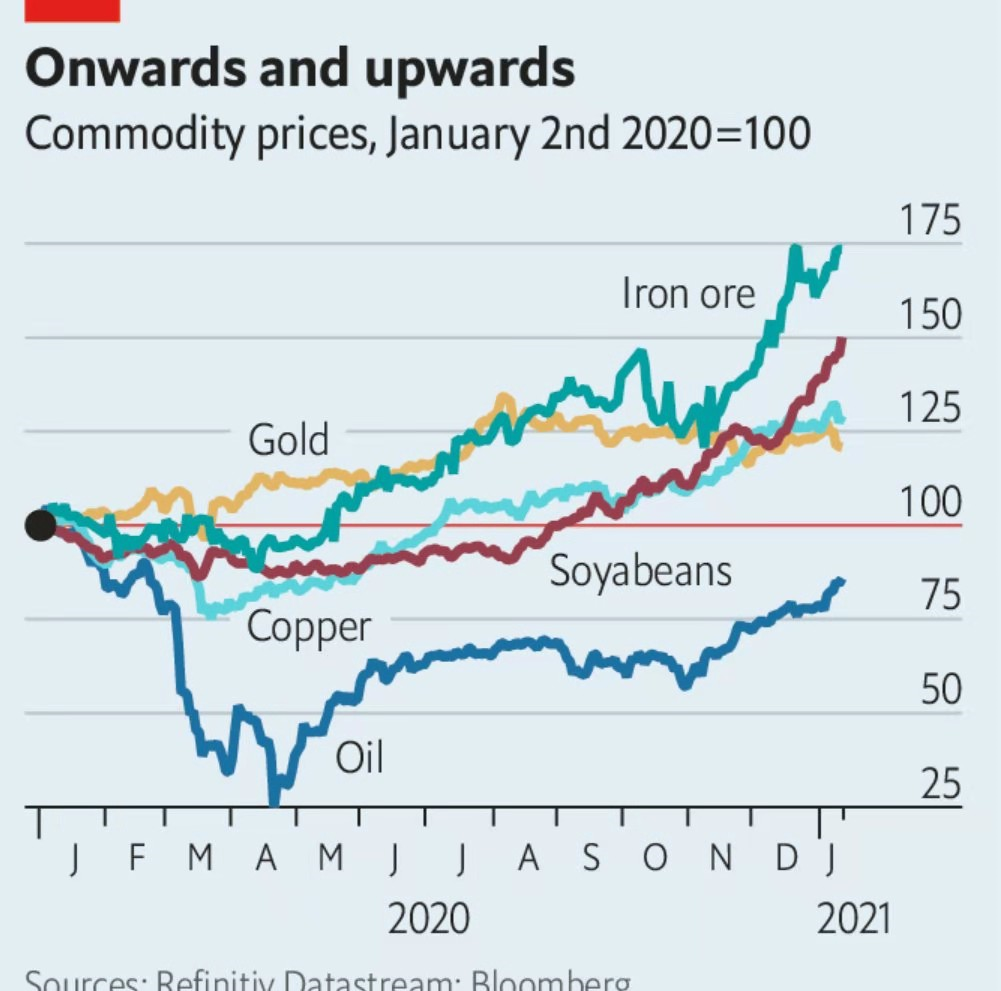

In August gold passed $2,000 an ounce for the first time ever, as low interest rates madethe precious metal more attractive. The value of other commodities rose, too, not just from the depths of virus-induced lockdowns in April but from the start of 2020, before the pandemic began (see chart). Commodity assets under management reached a record $640bn in December, estimates Citigroup, a bank, representing an annual gain of nearly a quarter. By January 11th even the oil-heavy s&p gsci commodity index had reached the level of a year ago. The debate now is how quickly oil prices will recover, and how high other commodities may soar.

持续低利率使得黄金更具吸引力,8月黄金价格有史以来首次突破每盎司2000美元。其他大宗商品的价值也有所上升,不仅比疫情最严重的四月份高,比疫情尚未开始的2020年初也要高。(见图表)。据花旗银行(Citigroup)估计,去年12月大宗商品资产管理规模达到创纪录的6400亿美元,占其全年收益近四分之一。截至2021年1月11日,即便是重油型标普高盛商品指数 (S&P GSCI) 也已恢复至一年前的水平。现在争论的焦点更多是油价将以多快的速度复苏,以及其他大宗商品价格可能飙升至多高。

That in turn depends on whether the forces that pushed up certain commodities in 2020 will continue in 2021, or indeed be supplanted by even more powerful engines of growth. Last year China proved a voracious importer as it increased investment and filled strategic stockpiles. Beneficiaries included iron ore and copper, used in steel and electricity projects, as well as soft commodities such as wheat, soyabeans and pork. This coincided with restrained supply. Outbreaks of covid-19 prompted the closure of some iron-ore mines in Brazil. Scant rain in South America, caused by La Niña, a large-scale cooling of Pacific Ocean temperatures, raised grain prices.

反过来这又取决于在2020年使大宗商品价格水涨船高的市场动力,是否会在2021年延续,或会被更强大的增长引擎所替代。去年,中国增加了投资,填补了战略储备,证明了其进口大国的地位。铁矿石和铜(用于钢铁制作和电力项目)、小麦、大豆和猪肉等软商品从中受益。不巧的是,需求增长的同时,供应却捉襟见肘。疫情的蔓延迫使巴西关闭了一些铁矿。拉尼娜现象导致南美洲雨水稀少,太平洋温度大规模降温,由此推升了粮食价格。

注:

拉尼娜(La Niña)现象就是太平洋中东部海水异常变冷的情况,与厄尔尼诺现象相对。东南信风将表面被太阳晒热的海水吹向太平洋西部,致使西部比东部海平面增高将近60 厘米,西部海水温度增高,气压下降,潮湿空气积累形成台风和热带风暴,东部底层海水上翻,致使东太平洋海水变冷。

This year has already presented signs of limited supply. On January 11th Argentina lifted a ban on corn exports, but imposed a cap. Russia plans to tax wheat exports from mid-February. Low supply and cold weather have powered Asian prices of liquefied natural gas to a record high of well over $20 per million British thermal units. Big mines still face risks of restrictions. Protests at Las Bambas copper mine in Peru, for instance, have stoked fears of disruptions.

今年其实已经出现了供给受限的迹象。1月11日,阿根廷解除了玉米出口禁令,但是设置了出口上限。俄罗斯计划从2月中旬开始对小麦出口征税。由于供应不足和寒冷天气,亚洲液化天然气价格升至每百万英热单位20美元,创下历史新高。大型的煤矿同样也面临一些限制。例如,秘鲁拉斯班巴斯(Las Bambas)铜矿发生了抗议活动,引发了铜矿生产中断的担忧。

注:

impose a cap 设置上限

liquefied natural gas 液化天然气

Meanwhile oil has continued its tentative recovery, alternately inflated by hopes for vaccines and depressed by news of lockdowns. To boost prices, Saudi Arabia has said it will limit output by a further 1m barrels a day in February and March.

同时,石油的初步复苏也在持续,疫苗带来的希望推动油价上涨,疫情封锁的消息又令油价下跌。沙特阿拉伯已表示,为了提振油价,在2月和3月将石油日产量进一步减少100万桶。

Two important developments may provide further support. The roll-out of vaccines across the world’s largest economies will eventually inspire higher levels of travel and trade. And a big spending bill by a Democratic American government, together with continued loose monetary policy from the Federal Reserve, would stimulate economic activity and therefore commodity consumption. That might also weaken the dollar, which would make oil and other commodities denominated in dollars cheaper for buyers in emerging markets, lifting demand and pushing commodity prices even higher.

两项重要的发展可能会进一步推动价格上涨。一是疫苗在全球各大经济体的大范围推行,会最终刺激旅游和贸易。二是美国民主党政府的巨额刺激法案,加上美联储持续的宽松货币政策,都将刺激经济的活力,进而带动大宗商品的消费。这也可能会削弱美元,对于新兴市场的买家来说,石油和其他以美元计价的大宗商品会更加便宜,推动需求增加,进一步推动价格走高。

Commodity bulls, led by Jeff Currie of Goldman Sachs, a bank, argue that longer-term trends will support prices through the coming decade. “The pandemic itself is a structural catalyst for a commodity supercycle,” Mr Currie contends. In addition to a weaker dollar and the accompanying boost for commodities, the pandemic may help synchronise activity across some of the world’s biggest economies.

高盛银行的杰夫•柯里看多大宗商品,他认为,未来十年的长期趋势将支撑大宗商品的价格。柯里说:“疫情本身是大宗商品超级周期的结构性催化剂。”除了美元走弱和随之而来的大宗商品价格上涨,疫情可能会推动世界上一些最大经济体的经济活动走向趋同。

注:

catalyst n. 催化剂,刺激因素

synchronise v. 使同步,使同时发生

Governments in America, China and Europe profess to champion green investment and efforts to narrow gaps in income. Assistance for poor households has an outsize effect on consumption, Mr Currie points out, which in turn supports commodity prices. And green investment—in electric-charging stations, for instance, and wind farms—is commodity-intensive. The early years of green spending may even lift oil demand, by boosting employment and economic activity. Goldman estimates that a $2trn stimulus over the next two years would raise American oil demand by about 200,000 barrels a day, or 1%.

美国、中国以及欧洲政府都公开宣称拥护绿色投资,并努力缩小收入差距。柯里指出,提供援助给贫困家庭会对消费产生巨大影响,从而支持大宗商品价格的提升。另外,充电站和风力发电场等绿色投资,都是大宗商品密集型。早些年的绿色支出甚至可以通过促进就业和经济活动来提升石油需求。高盛预估:未来两年内实施的两万亿美金的刺激计划,将使美国每日石油需求增加1%,即约20万桶。

注:

1. profess:vi 声称;公开表明

2. champion:n.冠军;捍卫者;拥护者

3. 杰夫·柯里(Jeff Currie)是高盛全球投资研究部的经济学家兼商品研究全球主管。在2000年代,他通过预测大宗商品超级周期和油价突破每桶100美元而声名显赫。

信息来源:维基百科

https://en.wikipedia.org/wiki/Jeffrey_Currie

延伸阅读:

https://www.bbc.com/zhongwen/simp/business-55674279

即将正式上任的拜登,公布了一项规模达到1.9万亿美元的刺激计划,旨在挽救新冠病毒肆虐下的美国经济。

Sceptics expect more muted growth. In the short term, Ed Morse of Citigroup points out, investors’ bets on copper are not supported by trends in supply and consumption. The Democrats’ slim majority in the Senate hardly guarantees that president-elect Joe Biden’s climate plan will be passed. “There is nothing on the demand side that is nearly as commodity-intensive as the first decade of the 21st century,” says Mr Morse.

怀疑论者预计增长则会更加趋缓。花旗银行的埃德·莫尔斯(Ed Morse)指出,短期内投资者虽然看好铜,但却无法得到供需趋势的支撑。民主党在参议院仅占微弱多数,难以保证当选总统拜登的气候计划会被通过。莫尔斯先生说:“在需求方面,没有什么像本世纪头十年那样大宗商品密集了。”

That earlier supercycle was driven by urbanisation, investment and an ascendant middle class in emerging markets—and China, in particular. Governments from Berlin to Beijing now declare that they intend to bring a new type of transformation. The price of commodities in the coming decade depends in large part on whether they do what they say.

早期的超级周期是由城市化、投资以及新兴市场(尤其是中国)中产阶级的崛起所驱动。如今,无论是德国还是中国政府都宣布计划实行新型的转型。未来十年的大宗商品价格在很大程度上取决于这些政府是否说到做到。

翻译组:

Martina,女,爱电影爱生活,爱金融经济

Jerry,男,金融专业研究生,经济学人铁粉

Ashley,女 ,金融硕士,爱宠物 爱英语,爱旅游,经济学人粉丝

校对组:

Chloe,女,翻译硕士,经济学人忠实读者

Emily,女,食物链底端金融民工,经济学人粉丝