Performance in line with expectations, ZTE sets sail

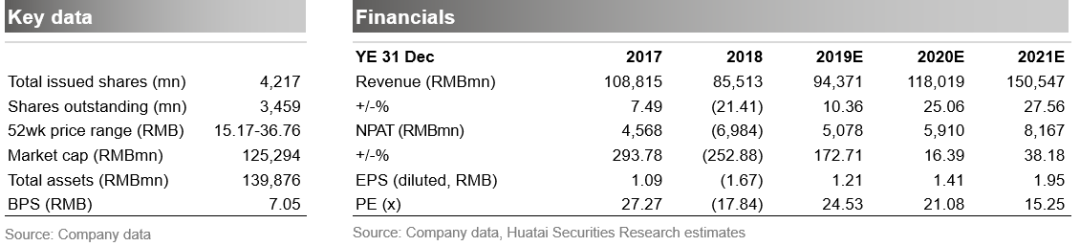

ZTE 1H19 revenue totaled RMB44.61bn (+13.12% yoy); NPAT reached RMB1.47bn (+118.80% yoy), in line with expectations. The company projects NPAT to reach RMB3.8-4.6bn for 1Q-3Q19. The interim report revealed strong growth in its international carrier segment. We believe the company will usher in market opportunities brought by the release of previously repressive demand overseas, setting sail once again amidst the new round of industry expansion sparked by 5G. We maintain our EPS of RMB1.21/1.41/1.95 for 2019E-2021E. With the 35x 2019E average PE of comparables, we maintain our PE of 35-36x for 2019E and TP of RMB42.35-43.56. Maintain BUY.

Strong growth in international carrier business to trigger market revaluation

By region, overseas business was the main driving force behind revenue growth, contributing revenue of RMB17.19bn (+25.57 yoy), of which Asia grew 83.16% and Africa grew 111.61%. By segment, carrier network revenue increased 38.19% yoy, propelled by increasing demand for FDD system equipment and optical transport products both domestically and abroad, and government-enterprise revenue increased 6.02%. We believe the recovery and development of ZTE’s overseas business has entered a new stage, fueled by improved market positioning owing to its technical strengths. It also reflects favorable changes in international competitive landscape, and the company could have an opportunity for market revaluation.

Improved GPM, commitment to R&D investment

The company’s GPM in 1H19 improved significantly (39.21%, +8.97% yoy), due to: 1) higher proportion of high-GPM carrier network business; and 2) improved GPM of carrier network, government-enterprise and consumer segments. The improvement in GPM of overseas business fully reflects ZTE’s changes in competitive capability. Sales expenses decreased 14.88% yoy. The company remained committed to R&D investment, injecting RMB6.47bn in 1H19 (+27.89% yoy). We believe R&D investment will solidify the foundation for 5G growth. Net operating cash flow in 1H19 was RMB1.27bn, a significant improvement over the previous year (RMB-5.05bn).

ZTE to reap benefits from 5G commercialization

During the reporting period, 5G business development was comprehensively advanced: 25 5G commercial contracts were won worldwide, partnership with 60 carriers was established globally; 5G bearer networks completed for more than 30 commercial Intranet and existing network tests; core technical indicators and commercial testing progress remain atop the industry. We believe 5G development has reached the level of commercial use, as domestic carriers set clear targets for deployment this year. Bidding for SA construction next year is about to kick off, with ZTE standing to benefit handsomely.

Maintain BUY

With 5G commercialization underway, we are optimistic about the company’s growth opportunities in the 5G cycle. We maintain our EPS of RMB1.21/1.41/1.95 for 2019E-2021E respectively. With the 2019 average PE of comparables of 35x, we maintain 35-36x for 2019E PE and TP of RMB42.35-43.56. Maintain BUY.

Risks: domestic carrier capex and overseas business expansion both fell short of expectations

王林

华泰证券通信行业首席分析师 经济学博士,15年通信行业工作经验,7年证券行业经验。2017年金牛奖第一名,新财富第四名,保险资管最佳分析师第二;2016年新财富第三,水晶球第二。

付东