中文导读

香港人口老化问题日益严重,必然有人要为此买单,香港各界对全民退保存在分歧,各有顾忌。港府认为全民退保太贵,加强入息审查系统会更好;全民退保支持者提出可推行由雇主、雇员、政府三方供款的方案;些许反对者则认为养老责任应由老人家庭承担。

Rapid ageing threatens to strain Hong Kong's public coffers, and its social contract

THE chief executive of Hong Kong, Carrie Lam, says she wants to heal the territory’s “serious” divisions. On October 11th, in her most important policy-related speech since she took office in July, she is expected to announce her plans for achieving that. One of the most bitter divides is evident in the membership of the Legislative Council, or Legco, to which she will deliver her proposals. There is a rift between advocates of democracy and those who support Mrs Lam’s government and its backers in Beijing. But on political issues Mrs Lam’s hands are tied. The Communist Party opposes any concessions to democrats. Instead she will focus on other problems—including, many Hong Kongers hope, the suffering of the elderly in a city that is rapidly ageing. Views on how to deal with this are nearly as divided as they are over demands for universal suffrage.

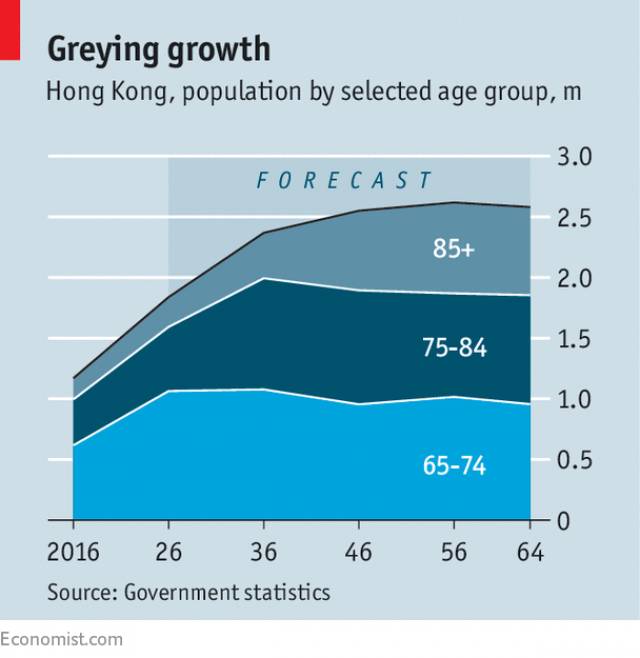

Life expectancy in Hong Kong pips that of Japan. On average, male Hong Kongers live for 81.3 years and women for 87.3, helped by the city’s affluence and low incidence of smoking. That is welcome, but a huge problem when coupled with a dwindling fertility rate which has resulted in ever fewer working-age people to support the elderly, and implacable public opposition to looser controls on immigration which would allow more workers to enter. The number of people aged 65 or older will double to 2.4m in 2036, or just over 30% of the population, the government reckons (see chart). Last year the proportion was less than 17%.

As their numbers swell, so do demands that the government do more to help the elderly. But Hong Kong has always prided itself on its low taxes and fiscal conservatism. It has consistently enjoyed budget surpluses. Giving pensioners more money could break those principles. As often in Hong Kong politics, the debate over what to do pitches democrats, who generally support the idea of more handouts, against pro-establishment politicians, who worry that Hong Kong may become less business-friendly if it turns into a welfare state with high taxes.

Public funds for the elderly are currently aimed at those living in poverty. For such a rich society, the poor are surprisingly numerous. The most visible are the “cardboard grannies”, old women who collect boxes in poor neighbourhoods to sell for recycling in order to make ends meet. Yet many more elderly poor are hidden from view, say charity workers. Official figures show that in 2015, more than 300,000 people aged 65 and over, or 30% of the total, languished below the official poverty line, which is set at a monthly income of HK$3,800 ($490).

Anyone aged 70 or over can get an allowance of at least HK$1,325 a month. In 2015 144,000 of the very poorest among the over-65s received higher monthly payments of at least HK$3,240 (as well as health-care discounts and, in many cases, subsidised public housing). Others under the poverty line as well as 244,000 above it also qualified for higher payments, at a slightly lower rate than the amount to which the poorest are entitled.

The system involves means-testing, which some Hong Kongers find degrading. Past studies have concluded that over 10% of those who could claim social security do not do so—some of them for fear of losing face. But the handouts are a pittance. At a vast public-housing complex in Kwun Tong district, elderly residents tell of just scraping by. One says she eats the cheapest of noodles to economise on food. With the power-hungry air-conditioning turned off, the heat in her flat is stifling.

Critics call for a “universal” state pension paid out to all, regardless of their income. Radically, some even call for tax increases to pay for this (the majority of people in Hong Kong pay very little income tax). They also want changes to the Mandatory Provident Fund (MPF), a compulsory pension scheme that is privately managed. It covers about 2.8m people, or nearly three-quarters of those in work, but the jobless fall beyond its reach. For many who are covered, payouts are low. In a recent study, PwC, a consultancy, noted that since the MPF was set up in 2000, its annual returns had been 2.8% on average. That is above the inflation rate, but still poor compared with similar schemes in other rich economies.

Opponents of change express horror at Western countries’ ballooning welfare bills. Some even say that families should shoulder the burden of caring for the old, as is traditional in Chinese societies. The government is in a quandary. It believes that the anger of the poor has exacerbated conflict between democrats and the establishment. To show its concern, it held a public consultation last year on how to ensure “retirement protection”. But its response to the suggestions made by participants was clear: universal pensions would be too expensive. Boosting the means-tested system would be a better choice.

Damned if you don’t

The ageing of Hong Kong means the government is having to fork out more on the elderly anyway. Spending rose by around half to HK$65.8 billion between the fiscal years of 2012-13 and 2016-17. A new annuity scheme will allow pensioners to invest a lump sum and receive a guaranteed return. Eventually, argue some supporters of state pensions, the government will have to raise taxes to pay for all this anyway. Better, they say, to introduce a pension now that is paid for jointly by employers, employees and the government.

Polls suggest the public supports the idea. One conducted last year by the Open University of Hong Kong found that 72% of 1,800 people interviewed would be willing to pay at least a little extra in income tax if it would secure a state pension. But Mrs Lam is digging in her heels. To the government and to Hong Kong’s tycoons, democracy is scary for two reasons. It might produce a leader who is inimical to the party in Beijing, and it would probably produce one who is more sympathetic to the public’s demands than to those of businesses. Universal suffrage might pave the way for universal pensions. That is one more reason why Mrs Lam does not want to tinker with the political system.

——

Oct 5th 2017 | China | 1103 words