当今世界最宝贵的资源不再是石油,而是数据

The world’s most valuable resource is no longer oil, but data

译者:Jenny_Peng

A NEW commodity spawns a lucrative, fast-growing industry, prompting antitrust regulators to step in to restrain those who control its flow. A century ago, the resource in question was oil. Now similar concerns are being raised by the giants that deal in data, the oil of the digital era. These titans—Alphabet (Google’s parent company), Amazon, Apple, Facebook and Microsoft—look unstoppable. They are the five most valuable listed firms in the world. Their profits are surging: they collectively racked up over $25bn in net profit in the first quarter of 2017. Amazon captures half of all dollars spent online in America. Google and Facebook accounted for almost all the revenue growth in digital advertising in America last year.

有一种全新商品孕育了一个快速发展且利润丰厚的产业,这使反垄断监管者不得不介入以约束商品流动的控制者。上个世纪,存在相同问题的资源是石油。如今,数据就是数字时代的石油,数据交易巨头们同样产生了担忧。这些企业巨头看起来不可阻挡,如Alphabet(Google的母公司)、亚马逊、苹果、脸书和微软。它们是五大世界上估价最高的上市公司。其利润激增:

2017年第一季度它们的净利润加起来超过250亿美元。美国的网络消费额有一半都来自亚马逊。谷歌和脸书几乎占据美国去年所有数字广告的增长收益。

Such dominance has prompted calls for the tech giants to be broken up, as Standard Oil was in the early 20th century. This newspaper has argued against such drastic action in the past. Size alone is not a crime. The giants’ success has benefited consumers. Few want to live without Google’s search engine, Amazon’s one-day delivery or Facebook’s newsfeed. Nor do these firms raise the alarm when standard antitrust tests are applied. Far from gouging consumers, many of their services are free (users pay, in effect, by handing over yet more data). Take account of offline rivals, and their market shares look less worrying. And the emergence of upstarts like Snapchat suggests that new entrants can still make waves.

这种市场地位引发人们对呼吁分解科技巨头企业,就像二十年代早期分解美国美孚石油公司一样。本报(《经济学人》)过去反对过如此激进的行为。企业规模庞大无罪可言。这些巨头的成功同时也是消费者受益。所有人都离不开谷歌的搜索引擎,亚马逊的次日到货,以及脸书的新闻推送。这些企业在标准反垄断审查实行后,也未引起警觉。他们并没有对消费者漫天要价,许多服务都是免费的(实际上,用户也会买单,只不过方式是不断发回数据)。如果考虑到线下竞争者,他们的市场份额并没有庞大到那么令人担忧。此外,新兴创业公司的出现,如Snapchat,表明后来者也能“兴风作浪”。

But there is cause for concern. Internet companies’ control of data gives them enormous power. Old ways of thinking about competition, devised in the era of oil, look outdated in what has come to be called the “data economy” . A new approach is needed.

但是,担忧是有原因的。互联网公司对数据的操控赋予了它们无限权利。所谓的“数据经济”已经到来,石油时代产生的对竞争的传统观点已经过时。现在需要新途径新方法。

Quantity has a quality all its own

数量中自有质量

What has changed? Smartphones and the internet have made data abundant, ubiquitous and far more valuable. Whether you are going for a run, watching TV or even just sitting in traffic, virtually every activity creates a digital trace—more raw material for the data distilleries. As devices from watches to cars connect to the internet, the volume is increasing: some estimate that a self-driving car will generate 100 gigabytes per second. Meanwhile, artificial-intelligence (AI) techniques such as machine learning extract more value from data. Algorithms can predict when a customer is ready to buy, a jet-engine needs servicing or a person is at risk of a disease. Industrial giants such as GE and Siemens now sell themselves as data firms.

有哪些东西发生了改变?智能手机和互联网使数据变得丰富繁多,无所不在,价值更大。

无论你是在跑步,看电视,或甚至堵在路上,几乎所有活动都制造了数字痕迹——数据处理库里的原始数据愈发庞大。

随着各种设备都连接到互联网,如手表,汽车,数据的容量也在增加。据估计,一辆自动驾驶汽车每秒将会产生100千兆字节。同时,人工智能(AI)技术挖掘数据的价值更大,比如机器学习。算法可以预测顾客何时想购物,喷射发动机何时需要维修,以及人类何时有患病的风险。包括美国通用和西门子在内的工业巨头,现在都自我宣传为数据公司。

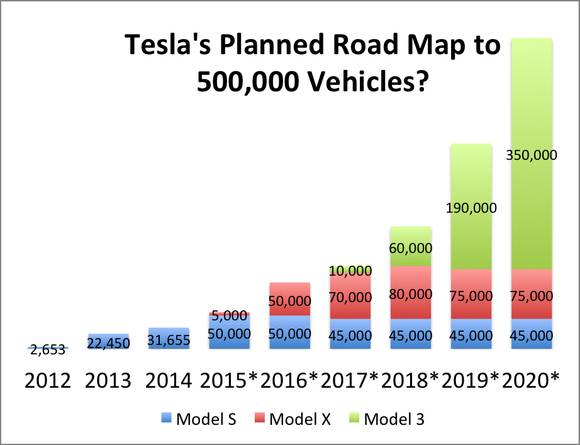

This abundance of data changes the nature of competition. Technology giants have always benefited from network effects: the more users Facebook signs up, the more attractive signing up becomes for others. With data there are extra network effects. By collecting more data, a firm has more scope to improve its products, which attracts more users, generating even more data, and so on. The more data Tesla gathers from its self-driving cars, the better it can make them at driving themselves—part of the reason the firm, which sold only 25,000 cars in the first quarter, is now worth more than GM, which sold 2.3m. Vast pools of data can thus act as protective moats.

数据的庞大改变了竞争的性质。技术巨头企业总是能从网络效应受益:注册脸书的用户越多,就会有越来越多的人被吸引去注册。由于数据的存在,网络效应更加凸显。一个企业通过收集更多的数据,能获得更大空间改善产品,这相反又能吸引更多用户,产生更多数据,以此类推。特斯拉从其自动驾驶汽车获取的数据越多,它就能生产出更好的自动驾驶汽车——这也是为什么该公司第一季度只销售了25,000辆车,其股价却超过销售额达到23万辆的美国通用的部分原因。由此可见,庞大的数据池也可以充当护城河。

Access to data also protects companies from rivals in another way. The case for being sanguine about competition in the tech industry rests on the potential for incumbents to be blindsided by a startup in a garage or an unexpected technological shift. But both are less likely in the data age. The giants’ surveillance systems span the entire economy: Google can see what people search for, Facebook what they share, Amazon what they buy. They own app stores and operating systems, and rent out computing power to startups. They have a “God’s eye view” of activities in their own markets and beyond. They can see when a new product or service gains traction, allowing them to copy it or simply buy the upstart before it becomes too great a threat. Many think Facebook’s $22bn purchase in 2014 of WhatsApp, a messaging app with fewer than 60 employees, falls into this category of “shoot-out acquisitions” that eliminate potential rivals. By providing barriers to entry and early-warning systems, data can stifle competition.