本文的作者是纽约大学金融系教授Aswath Damodaran,号称“华尔街太傅”,目前在NYU的商学院教授估值课程,是华尔街最热门的教授之一,为华尔街培训了大量的精英。本文作者主要讨论了积极投资者要如何寻找自己的竞争优势:

Active Investing: Seeking the Elusive Edge!(

积极的投资者:挖掘难以寻找的优势

)

。

In my last post, I pointed to the shift towards passive investing that has accelerated over the last decade and argued that much of that shift can be explained by the sub-par performance of active investors. I ended the post on a contradictory note by explaining why I remained an active investor, though the reasons I gave were more personal than professional.

在上一篇文章中,我提到在过去十年里向被动投资阵营转变的速度在加快,主要的原因是积极投资者表现欠佳。在文末我给出了自相矛盾的结尾,我解释了自己为何仍旧是一名积极投资者,给出的原因主观性多过专业性。

I was taken to task on two fronts. The first was that I should have spent less time describing the problem (poor performance of active investors) and more time diagnosing the problem (the reasons for that poor performance). The second was that my rationale for being an active investor, i.e., that I enjoyed investing enough that I would be okay not earning excess returns, could never be used if I sought to manage other people's money and that a defense of active investing would have to be based on something more substantial.

今天我主要解决两点问题。首先,要少去描述问题(积极投资者的欠佳表现),而是更多的去诊断问题(表现不佳的原因)。第二,阐明作为一名积极投资者的依据,比如有评论说我喜欢投资,所以对是否有超额回报都能接受,但是当你管理着很多人的钱时绝对不能这样;为积极投资者辩护的内容也要更实质性一些。

Both are fair critiques and I hope to address them in this post.

这两个评论都中肯,我想在本篇文章中探讨这两个问题。

The Roots of the Active Investing Malaise

积极投资综合症的根源

There is no denying the facts. Active investing has a problem not only because it collectively under performs passive investing (which is a mathematical given) but also because the drag on returns (from transactions costs and management fees) seems to be getting worse over time.

毫无疑问,积极投资是有问题的,不仅仅是因为积极投资者的表现逊于被动投资者(从收益率上来说),还在于收益的拖油瓶(交易费用,管理费用)也变得越来越大。

Even those few strands of active investing that historically have outperformed the market have come under siege in the last decade. While there are many reasons that you can point to for this phenomenon, here are some that I would highlight:

即使是那些历史上已经超越市场的积极投资,也在过去十年里被蚕食得差不多了。解释这种现象的理由有很多,其中有一些是我想强调的。

1,A "Flatter" Investment Word: The investment world is getting flatter, as the differences across active investors rapidly dissipate.

1,

“谄媚”的投资界

:随着积极投资者之间的区别迅速消失,投资界已经变得越来越阿谀奉承了。

From information to processing models to trading platforms, professionals at the active investing game (including mutual funds and hedge funds) and individual investors are on a much more even playing field than ever before.

从信息获取,到交易模式,再到交易平台,积极投资游戏里的专业人士(包括共同基金和对冲基金)和个人投资者所处的平台比以往任何时候都更加公平。

As an individual investor, I have access to much of the information that an analyst working at Merrill Lynch or Fidelity has, whether it be financial statements or market rumors. I am not naive enough to believe that, SEC rules against selective information disclosure notwithstanding, there are no channels for analysts to get "inside" information but much of that information is either too biased or too noisy to be useful. I have almost as much processing power on my personal computer as these analysts do on theirs and can perhaps even put it to better use.

作为个人投资者,我可以获得美林证券或富达的分析师所拥有的许多信息,无论是财务报表还是市场传言。虽然SEC设定了反对选择性信息披露的规则,但我不会天真到相信分析师没有渠道获得“内部”信息,只不过他们获取的大部分信息太偏太杂,没什么用。我用自己电脑做分析的能力几乎与这些分析师的一样,甚至可以更好。

In fact, the only area where institutions (or at least some of them) may have an advantage over me is in being able to access information on trading data in real time and investing instantaneously and in large quantities on that information, leading to breast beating about the unfairness of it all. If history is any guide, the returns to these strategies fade quickly, as other large players with just as much trading power are drawn into the game.

事实上,机构(至少其中的某些机构)比我唯一有优势的地方可能在于能够实时获取交易数据的信息,并且可以根据信息立即、大手笔地进行投资,这种不公平性确实让人捶胸顿足。如果历史可以给人指引,那么这些策略的回报会迅速消失,因为其他具有同样交易能力的大型玩家也被吸引到游戏中。

In fact, while much ink was spilt on flash trading and how it has put those who cannot partake at a disadvantage, it is worth noting that the returns to flash trading, while lucrative at first, have faded, while attracting smaller players into the game.

事实上,闪存交易存在很多污点,而且它使得那些不能承担风险的人处于不利地位。但是值得注意的是,闪存交易虽然有利可图,当更多的小玩家进来时,这个收益就已经消失了。

In summary, if the edge that institutional active investors have had over individual active investors was rooted in information and processing power, it has almost disappeared in the United States and has eroded in much of the rest of the world.

总而言之,如果机构活跃的投资者相较于个人积极投资者而言的优势在于信息和处理能力,这个优势在美国几乎已经消失了,在世界上其他地方也大大削弱了。

2,No Core Philosophy: There is an old saying that if you don't stand for something, you will fall for anything, and it applies to much of active investing. Successful investing starts with an investment philosophy, a set of core beliefs about market behavior that give birth to investment strategies.

2,

没有核心的理念

:有句老话说,如果没有任何信念,你最终会一事无成。这句话适用于大多数积极的投资。成功的投资从投资理念开始,针对市场行为的产生一套核心信念才能进一步生成投资策略。

Too many active investors, when asked to characterize their investment philosophies, will describe themselves as "value investors" (the most mushy of all investment descriptions, since it can mean almost anything you want it to mean), "just like Warren Buffett" (a give away of lack of authenticity) or "investors in low PE stocks" (confusing an investment strategy with a philosophy).

有太多的积极投资者被问道自己的投资理念时,他们会将自己描述为“价值投资者”(所有投资描述中最模糊不清的,你想说它是什么就是什么),就像沃伦·巴菲特一样(缺乏真实性)或“低PE股票投资者”(将投资策略与投资理念混淆)。

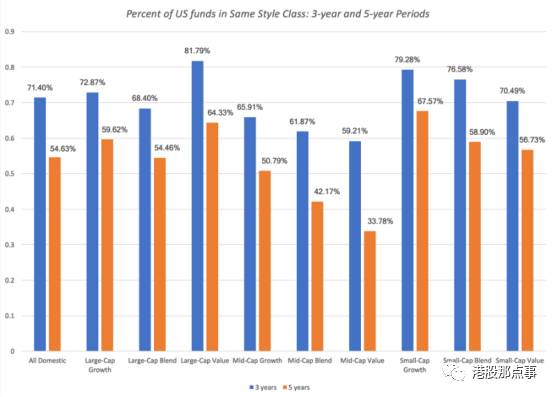

The absence of a core philosophy has two predictable consequences: (a) a lack of consistency, where active investors veer from one strategy to another, often drawn to whatever strategy worked best during the last time period and (b) me-tooism, as they chase momentum stocks to keep up with the rest. The evidence for both can be seen in the graph below, which looks at the percentages of funds in each style group who remain in that group three and five years later and finds that about half of all US funds change styles within the next five years.

缺乏核心理念有两种可能的后果:(a)缺乏一致性,活跃的投资者从一种策略转向另一种策略,只要是上一时间段投资收益最好的策略,他们就会被吸引过去(b)效仿主义,追逐大势股以跟上其他人的步伐。可以在下面的表中看到上述两个现象的证据,查看三年和五年后仍然留在某一投资风格中的基金百分比,大约一半的美国基金在五年后改变了投资风格。

3,Bloated Cost Structures: If there is a core lesson that comes from looking at the performance of active investors, it is that the larger the drag on returns from the costs of being active, the more difficult it is to beat passive counterparts. One component of these costs is trading costs, and the absence of a core investment philosophy, referenced above, leads to more trading/turnover.

3,

膨胀的成本结构

:

如果从积极投资者的表现可以得出一个核心的教训,那必然是:积极投资所获收益的成本越大,就越难胜过被动投资者。这些成本的组成之一是交易成本,上面提到的缺乏核心投资理念会导致更高的交易费用/收益比率。

As fund managers undo entire portfolios and redo them to match their latest active investing avatars. Another is the overhead cost of maintaining an active investing infrastructure that was built for a different market in a different era. The third cost is that of active management fees, set at levels that are not justified by either the services provided or by the returns delivered by that management team. Active money managers are feeling the pressure to cut costs, as can be seen in expense ratios declining over time, and the fund flows away from active money managers has been greatest at highest cost funds.

因为基金经理会撤消整个投资组合,然后重新建立组合,以更新其积极投资者的形象。另一个是为维持另一时代、市场的积极投资结构所付出的间接成本。第三个成本是积极管理费用,该费用设置在跟管理曾提供的服务或收益不想关的水平。积极的资金管理者有削减成本的压力,正如从不断下降的成本比率中看出,从积极的资金管理者手中流出的基金都是成本最高的。

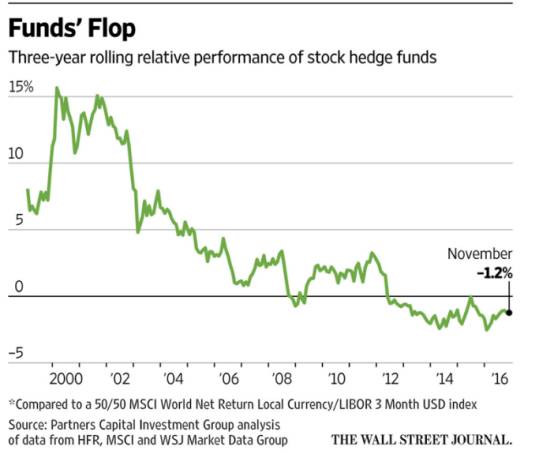

I can only speak for myself but there is not one active investor (nope, not even him, and not even if he was forty years younger) in the world that I have enough reverence for that I would pay 2% (or even .5%) of my portfolio and 20% (or 5%) of my excess returns every year, no matter what his or her track record may be. To those who would counter that this is the price you have to pay for smart money, my response is that the smart money does not stay smart for very long, as evidenced by how quickly hedge fund returns have come back to earth.

我只想说,不论过往的投资记录有多好,在这个世界上绝对没有任何一个积极投资者能让我愿意支付投资组合的2%(甚至.5 %),或是支付每年超额回报的20%(或5%)。对于那些反对说这是你必须为赚得聪明钱付出的代价,我的回应是聪明一时不代表聪明一世,已有证据表明对冲基金的收益率已经急速跌到了尘埃里。

4,Career Protection: Active money managers are human and it should come as no surprise that they act in ways that increase their compensation and reduce their chances of losing their jobs. First, to the extent that their income is a function of assets under management (AUM), it is very difficult, if not impossible, to fight the urge to scale up a strategy to accommodate new inflows, even if it is not scaleable.

4,

职业保护

:积极的基金经理也是人,毫无疑问,他们会为了增加报酬、减少失去工作的机会采取行动。首先,如果基金经理的收入跟管理资产(AUM)相关,只要有可能,他就很难抑制住扩张投资则略以适应新战略的冲动,即便是这个投资策略根本无法被扩展。

Second, if you are a money manager running an established fund, it is far less risky (from a career perspective) to adopt a strategy of sustained, low-level mediocrity than one that tries to beat the market by substantial amounts, with the always present chance that you could end up failing badly. In institutional investing, this has led some of the largest funds to quasi-index, where their holdings deviate only mildly from the index, with predictable results: these funds deliver returns that match the index, prior to transactions costs, and systematically under perform true index funds, after transactions costs, but not by enough for managers to be fired.

其次,如果你管理着已成立的基金,(从职业生涯来看)采取一个持续的、低水平的平庸战略的风险远低于想要大幅度战胜市场的策略,机会看似总在眼前,但是你最终可能惨败。在机构投资中,这会使那些最大型的基金变为准指数,持有量跟指数偏离不大,交易成绩也可预测:这些基金的收益率跟指数收益率相当,但在付出交易成本之后,总体而言其收益比真实的指数基金收益还低,不过这还不足以让基金经理被解雇。

Third, at the other end of the spectrum, if you are a small, active money manager trying to make a name for yourself, you will naturally be drawn to high-risk, high-payoff strategies, even if they are bad bets on an expected value basis. In effect, you are treating investing as a lottery, where if you win, more money will flow into your funds and if you do not, it is other people's money anyway.

第三,如果你是一个小型的积极投资者,旨在为自己赚取名声,即使大家觉得这不是个好赌注,你也自然而然会被高风险,高收益的策略吸引。实际上,你把投资当成了彩票,赢了就会有更多的钱流入你的基金,即便输了,输的也是别人的钱。

There are macroeconomic factors that may also explain why active investing has had more trouble in the last decade, but it is not low interest rates or central banks that are the culprits. It is that the global economy is going through a structural shift, where the old order (with a clear line of demarcation between developed & emerging markets) is being replaced with a new one (with new power centers and shifting risks), upending historical relationships and patterns.

某些宏观经济因素也可以解释为何在过去十年中积极投资遇到更多麻烦,但低利率或中央银行不是罪魁祸首。主要是因为全球经济正在经历结构性转变,旧秩序(发达市场和新兴市场之间有明确的分界线)被一个新的(新的权利中心和转移风险)颠覆历史关系和模式的秩序所取代。

Given how much of active money management is built on mean reversion and lessons learned by poring over US market data from the last century, it should come as no surprise that the payoff to screening stocks (for low PE ratios or high dividend yield) or following rigid investing rules (whether they be centered on CAPE or interest rates) has declined. In all of this discussion, I have focused on the faults of active institutional investors, be they hedge funds or mutual funds, but I believe that their clients bear just as much responsibility for the state of affairs.

活跃的资金管理建立在均值回归,以及从上世纪美国市场数据中吸取的经验教训之上,毫无疑问,筛选股票(寻找低市盈率或高股息率)或遵循一成不变的投资规则(无论是以CAPE还是利率为中心)的收益率已经下降。在上述讨论中,我主要例举了积极的机构投资者的缺陷,包括对冲基金和共同基金,但我认为他们的客户对这种现状也负有同样的责任。

They (clients) let greed override good sense (knowing that those past returns are too good to be true, but not asking questions), claim to be long term (while demanding to see positive performance every three months), complain about quasi indexing (while using tracking error to make sure that deviations from the index get punished) and refuse to take responsibility for their own financial affairs (blaming their financial advisors for all that goes bad). In effect, clients get the active money managers they deserve.

客户让贪婪重战胜了理智判断(他们知道过去的收益率高得近乎不真实,但从不感到疑惑),说自己是长期投资者(却要求每三个月就看到积极的表现),抱怨准指数(同时使用错误跟踪确保偏离指数会受到惩罚),拒绝自己承担财务责任(把一切坏结果都赖在自己的财务顾问身上)。实际上,客户遇到这样的积极基金经理都是他们应得的。

A Pathway to Active Investing Success

通往成功的积极投资之路

If you accept even some of my explanation of why active investing is failing, there is a kernel of good news in that description. Specifically, the pathway to being a successful active investor lies in exploiting the weakness of the active investment community, especially large institutional investors. Here are my ingredients for active investing success, though I will add the necessary caveat that having all these ingredients will not guarantee an investment payoff.