By Chief China Economist's Office Hong Kong Exchanges and Clearing Limited

SUMMARY: Hong Kong Exchanges and Clearing Limited (HKEX) launched USD-denominated cash-settled TSI Iron Ore Fines 62% Fe CFR China Futures on its subsidiary, the Hong Kong Futures Exchange (HKFE), on 13 November 2017. It is the first product in the ferrous suite offered by HKEX. Leveraged on HKFE's integrated electronic trading and clearing system, this product aims to enhance price transparency and improve price discovery efficiency in the iron ore derivatives market outside Mainland China.

Iron ore is the key raw material used for making steel and also the second-largest global commodity by trade value after crude oil(1). China is the world's single largest importer and consumer of iron ore. Given China's high reliance on imported iron ore and its rapid economic growth, the China factor, including China's major economic policies and national development strategies such as the supply-side reform and the strategic initiatives of One Belt One Road (OBOR), would have significant implications on the potential demand and pricing of this commodity.

With rapid developments in recent years, the global iron ore derivatives market, including the Mainland market, continues to gain record turnover. Notwithstanding this, there is still potential for further development. The Mainland domestic market is very active but lacks overseas participation.

As for overseas markets, the majority of liquidity resides in the over-the-counter (OTC) swap market which relies on voice broking for trade execution, while the on-exchange markets, which offer more efficient screen-based trading execution, have insufficient liquidity and market depth. Hong Kong sees opportunities in complementing the existing markets and improving the iron ore

price discovery on screen through the introduction of iron ore futures on HKEX:

HKEX's iron ore futures contract is an exchange-traded product with screen-based trading. Compared with the OTC market, it is expected to improve trading convenience, transparency and price discovery efficiency by building up liquidity on screen.

The iron ore derivatives market has a relatively short development history and its growth potential is yet to be fully realised. The launch of iron ore futures on HKEX's screen-based derivatives market would help further expand the capacity of this market by attracting a broader investor base and enhancing market access through a convenient and transparent infrastructure.

Given the transformation of the pricing model of physical iron ore in the past decade, whether the current index-linked pricing model last or evolve again in the future is to be observed. A new path to this might emerge upon the establishment of a liquid and transparent futures market facilitated by HKEX's iron ore futures.

While the China factor in the iron ore market is significant, the accessibility between the iron ore derivatives market in the Mainland and overseas is yet to be enhanced. Given Hong Kong's strategic position as a global financial centre located at the gateway to China, building a transparent and liquid offshore iron ore futures market in Hong Kong would not only help satisfy the commodity price risk management needs for users of the physical commodity and the trading community, but also offer an attractive investment product of China relevance for institutional and retail investors.

1. CHINA'S SIGNIFICANCE IN THE IRON ORE MARKET

1.1 The largest destination market of iron ore

Iron ore is the key raw material to make steel and the second-largest global commodity by trade value after crude oil(2).

Steel is heavily used in many downstream industries, such as real estate, transportation, car manufacturing, energy supply networks, machineries, ship building and home appliances. With the rapid development in the Chinese economy and the growing demand for steel over the past 20 years, China's crude steel production has seen 8-fold increase and reached 808 million tonnes in 2016, making up half of the world's total crude steel production(3). Being the primary ingredient for steelmaking, iron ore's consumption in China has grown more than 20 folds in the past 20 years to 1.3 billion tonnes in 2016(4).

China is the world's largest iron ore importer in the world, importing 1,024 million tonnes in 2016, and constituting 70% of the world's seaborne trades(5). With the domestic iron ore reserves being low in grade(6) and high in impurity, to fulfil China's huge demand on medium to high grade iron ore, it has to rely heavily on imports (about 84%(7)) from Australia, Brazil, South Africa, and India, etc.

Due to its heavy industrial reliance on this commodity, China is an active participant in both iron ore physical and derivatives trading. Many Chinese state-owned and private steel mills and trading companies have established a presence overseas. Many of them have trading and financing operations set up in Hong Kong, Singapore or other offshore tax harbours, and some owns overseas mine investment in iron ore reserve-rich regions such as Australia, West Africa, South America and North America.

1.2 China's strategic policies impacting the steel industry

With its economic growth adjusted to around 6.5% in 2017 (compared with the growth rate of 6.7% in 2016), China is firmly undertaking a structural reform with a target of eliminating excess capacity and upgrading production efficiency. There are two overarching policies that impact China's steel industry, in particular.

(1) One-Belt-One-Road ("OBOR")

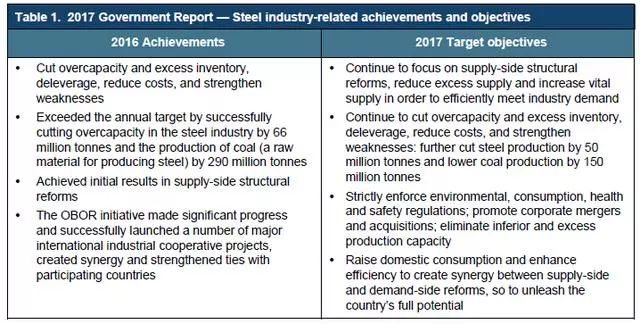

OBOR consists of the Silk Road Economic Belt and the 21st Century Maritime Silk Road. The initiative includes exporting excess capital and capacity to promote trade and building infrastructure networks that connect China with Asia, Europe and Africa along the ancient trade routes. The policy will lead to over 60 bilateral cooperation deals that worth US$100 billion and encompass some 65 countries(8). The initiative also brings historic opportunities to the steel industry to support exports and relieve overcapacities in China, as per target objectives laid down in the 2017 Government Report (see Table 1).

(2) Supply-Side Reform

The 13th Five-Year Plan stated the focus of the steel industry, which is to be on the consolidation of steel mills, reduction of excess capacity, and production efficiency upgrades. The Opinions of the State Council on Reducing Overcapacity in the Iron and Steel Industry restricts new production capacity from being registered and enforces the environmental quality standards to be strictly in compliance with relevant rules and regulations(9). As of 2016, the industry has cut down 85 million tonnes of capacity successfully, with targeted permanent capacity reduction of 100-150 million metric tonnes by 2020(10).

The OBOR initiative and the Supply-Side Reform target to resolve overcapacity, to stimulate demand and to improve profit margin for the steel-making sector. They also have profound implications on steel and steel-making raw materials prices (such as iron ore, coking coal and coke). Therefore, the importance of risk management by industrial players and other market participants against the price volatility of these commodities is ever-growing.

2. EVOLUTION OF THE PHYSICAL MARKET AND DEVELOPMENT OF THE DERIVATIVES MARKET

2.1 Transformation of the iron ore physical market

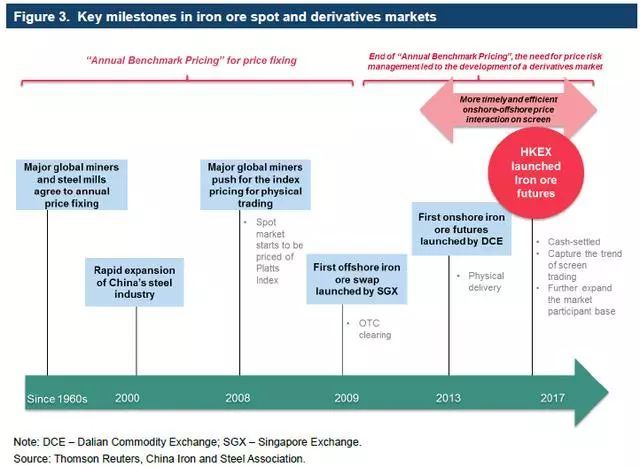

Since 1960s, iron ore physical trades followed a pattern of annual benchmark pricing, where the sale and purchase price was fixed once a year between global miners (representing the supply side) and leading steel makers (representing the demand side). The price fixed will then become the benchmark to be followed by the rest of the industry. This traditional pricing model was inflexible and lost sight of the changing spot market conditions during the year, leading to increasing defaults in contract performance once the market price deviated from the benchmark price.

The turning point was in 2010, when China rejected the price set by Vale, BHP Billiton and Japanese steel mills. This marked the end of the decades-old annual benchmark pricing and the industry moved on to a quarterly and eventually monthly index-based pricing model. Iron Ore is not the only commodity that underwent such transformation. In fact, similar evolution had happened to thermal coal (in early 2000s), aluminium (in early 1980s), and crude oil (in late 1970s), where the annual benchmark pricing model was abolished and replaced by shorter-term and more flexible pricing models.

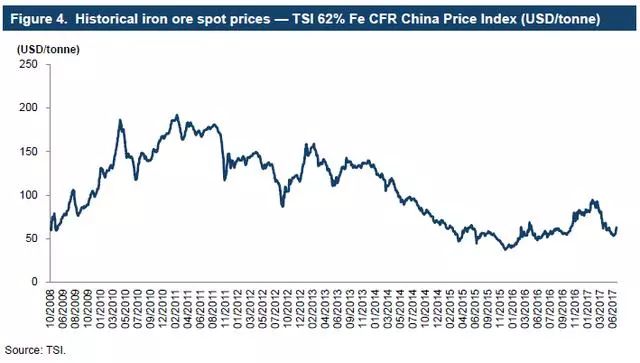

For index-based pricing, the physical iron ore price is negotiated based on the monthly average of one or more market-recognised spot price indices, published by price reporting agencies like Platts, The Steel Index (TSI), Metals Bulletin (MB) or some Chinese index providers. This creates flexibility and ensures that the price aligns with the spot market and reflects current market supply and demand. Since then, the spot market in iron ore, which had been constrained by the inflexible annual benchmark pricing model, has started to grow.

2.2 Emergence of the offshore iron ore derivatives market

Following the rise of indexation and the growth of the iron ore spot market, prices have been increasingly volatile and the need to manage price risks became essential for all users along the value chain — producers, consumers, shippers, traders and financers (banks). The burgeoning needs marked the beginning of the iron ore derivatives market. The first iron ore swap was launched in 2009 by the Singapore Exchange Limited (SGX).

Over the past 9 years, the global iron ore derivatives market (excluding Mainland China) has grown exponentially at an annual rate of 89%(11). The annual trading volume and year-end open interest in cleared iron ore derivatives outside China reached approximately 1.42 billion tonnes and 72 million tonnes respectively in 2016(12). To date, a handful of overseas exchanges including SGX, Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), LCH Clearnet(13) and Nasdaq Clearing(14) have offered trading and/or clearing services for the products in the offshore market outside Mainland China. Amongst the underlyings of the offshore derivatives, the TSI Iron Ore Fines 62% CFR China Price Index (TSI 62 Index) is the most commonly referenced benchmark index, representing spot physical iron ore price in USD delivered to North China(15).

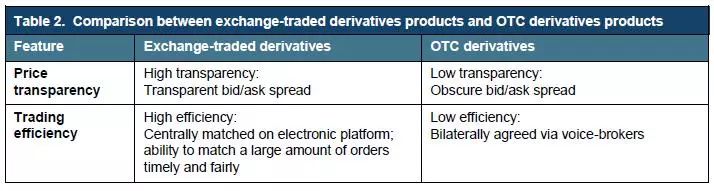

After development for a decade, the global iron ore derivatives market outside Mainland China has successfully attracted participation from steel mills, traders, producers and banks. However, as understood from market participants, the market is still predominantly over-thecounter (OTC) with trades matched through voice broking via inter-dealer brokers, with relatively thin liquidity and market depth on screen (transactions are only about 10% of the OTC volume on-exchange(16)). The OTC market has its merit for negotiating large trade or tailor-made transactions. However, it is not an efficient and cost-effective way for trading vanilla products where there are naturally plenty of buyers and sellers. Lacking an active screen-based trading platform prevents a diverse investor base from participating in this market. This limits, to some extent, the growth of the iron ore derivatives market outside Mainland China.

2.3 Rapid development of the Mainland's iron ore derivatives market

Dalian Commodity Exchange (DCE) launched a RMB-denominated physically deliverable iron ore futures contract in October 2013, the first iron ore derivatives in Mainland China. Given China's huge risk management and speculative demands, DCE has quickly grown into the world's largest iron ore derivatives market, with annual trading volume and year-end open interest reaching 34 billion tonnes (more than 24 times the entire offshore market trading volume in the period) and 55 million tonnes respectively in 2016(17), surpassing all its counterparts globally.

Although the iron ore derivatives market on DCE continues to attract retail investors, financial institutions and physical users, it is still a domestic market and is not yet opened for direct access to international investors. There are also certain key challenges to be addressed, such as building liquidity across contract months and encourage a higher participation from industrial users.

The establishment and fast development of the onshore derivatives market, nevertheless, has facilitated the liquidity build-up in the offshore market and improved the overall price discovery mechanism for the iron ore market. After DCE introduced its own futures contracts, the trading volume of the iron ore futures on overseas market such as SGX doubled and trading was found to be the most active during the DCE trading hours(18). According to market observation, cross-market price interaction also became more timely. This proves that a healthy development of the Mainland's onshore futures market adds significant value to the overall price discovery efficiency and also the growth of the offshore market.

3. OPPORTUNITIES FOR HONG KONG TO DEVELOP AN IRON ORE DERIVATIVES MARKET

3.1 The offshore market calls for higher price transparency

While the overseas iron ore derivatives market was established in 2009, the Mainland market did not come into existence until late 2013. Yet the current size ratio of the Mainland's onshore market to the offshore market is about 24:1(19). The exponential growth seen in the onshore market could be attributed to a number of reasons such as the abundance of investment money and increased speculative trading. Nevertheless, the screen-based trading model of the onshore market undoubtedly has contributed to the market's rapid growth by facilitating price transparency, thereby attracting diverse participants. In contrast, as understood from market participants, trading in the offshore market (mainly in iron ore swaps) still remains largely OTC via voice broking and the liquidity on screen is still thin. Will a more liquid and transparent offshore screen-based trading benefit the market? The answer is definitely yes.

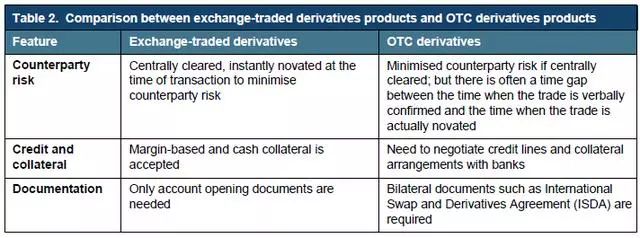

An OTC swap market has its merits too, which include (1) being bilateral and off-the-screen (i.e. without market impact) for big trade volumes, and (2) the flexibility to negotiate on bespoke structures. However, voice broking for execution in the OTC market is a very traditional way to discover price and conclude trades. There is no comparison in its speed, accuracy and efficiency with modern electronic trading platforms that offer centralised automatching and clearing. In addition, the market price lacks transparency as it is not widely accessible by market participants. This leads to higher cost of trading and asymmetric information. The advantages of screen-based trading (generally adopted for exchange-traded derivatives) are apparent as stated in Table 2 above. Given these comparative advantages, a rising trend in both volume and open interest in exchange-traded derivatives is observed in recent years.

Given the benefits and the increasing market preference for electronic trading, the launch of an exchange-traded iron ore futures contract on HKEX, with integrated price discovery, trading and clearing on one platform, is expected to bring higher transparency, a smoother price discovery process and lower transaction cost to the iron ore market.

3.2 The significant growth potential for iron ore derivatives market

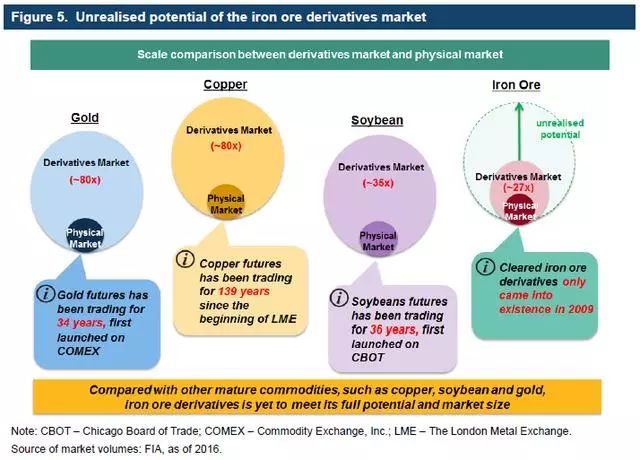

In the past several years, the iron ore derivatives market has grown from scratch to a size of 36 billion metric tonnes globally (including Mainland China) in 2016(20). Despite this rapid growth, the global derivatives-to-physical trading volume ratio for iron ore is only around 25 times in 2016, compared to the ratio of around 80-100 times for more mature commodities such as gold and copper(21). The ratio for iron ore is even down to 1.25 times if only the USD-denominated iron ore derivatives volume outside Mainland China was counted(22). This is due to the shorter history of the iron ore derivatives market. Compared to the derivatives markets of base metals, energy and precious metals, which have a trading history of decades or over a century, iron ore derivatives are still in its early stage of development and the growth potential is yet to be fully realised. (See Figure 5.)

Given their hedging needs, the trading community of the physical commodity are often the first and the core participants of the commodity's derivatives. As the market evolves, more diverse participants including various types of financial institution, investment funds and retail investors will join the market for hedging or speculation. As the investor base becomes more diversified, the market will become more sophisticated, driving up the capacity and the liquidity of the market. This is exactly what is happening for iron ore derivatives now. The transparency and convenience offered by screen-based trading will greatly improve the price discovery efficiency and enables the market to expand.

No one could have correctly envisioned the growth trajectory of the iron ore derivatives market when it was first launched in 2009. Looking forward, it is certain that the iron ore derivatives market structure and dynamics, the composition of market participants and the product offerings will all evolve and improve over time.

3.3 What is the future for iron ore pricing?

Tremendous changes have taken place in the physical iron ore market since 2010, when the "annual benchmark pricing" model ceased to function and was succeeded by index pricing. The index pricing model, along with the emergence of index-linked derivatives, have fundamentally changed the physical pricing and how market manages its price risk. However, as the market continues to evolve, will new pricing model emerge in the future that better suits the market needs?

Referencing to the trajectory of some commodities with a longer derivatives market history, such as soybeans, copper and crude oil, a "pricing" mechanism is widely adopted in their physical spot trading. This is a spot pricing mechanism to determine a spot commodity price between a buyer and a seller by agreeing upon a basis (premium or discount) over a futures market price for a particular month. So when the spot trade is negotiated, the terms agreed is not a fixed sales price, but an agreed basis (the price difference between the physical spot price and the futures price) plus a futures price. The buyer will have the right to fix the price based on the prices of futures contracts traded on a specific commodity futures market during the agreed Quotational Period ("QP"). This pricing model is considered an effective and market-reflective price determination mechanism. It minimizes the default risk as the buyer has some flexibility in determining the timing of "pricing" and therefore the price. Moreover, by fixing the physical price with reference to a futures market, it facilitates seamless hedging as it eliminates the basis risk between physical and futures market at the time of pricing.

One of the core functions of the futures market is price discovery. By using the futures price to form the basis of physical spot trade, the pricing model based on futures prices is an ultimate demonstration of the price discovery role of the futures market.

For iron ore, an interesting trial application of the pricing model was seen in November 2016. At that time, there was a physical deal of 10,000 metric tonnes transacted on Beijing Iron Ore Trading Center Corporation (COREX) which was priced on the iron ore futures price on DCE with a basis.

Usually, for this pricing mechanism to work, certain key conditions have to be fulfilled:

(1) Having a fully functional liquid and transparent futures market is the key. The futures price at any point of time must be visible and accessible to all market participants so that the pricing can be done at any given time during the day.

(2) The buyers and sellers in the market need to trust and recognise the price of the futures market as indicative and representative of the underlying physical market.

Change will take time. The ferrous market will itself determine what the best for the industry is and whether to evolve out a new pricing model or craft something of its own. This is worth paying close attention to.

3.4 The strategic positioning of Hong Kong and HKEX

As a global financial centre located at the gateway of China, which is the world's second largest economy and the biggest iron ore importer and dominant consumer, Hong Kong has been acting as a "super-connector" between Mainland China and the rest of the world. It is well positioned to build up an iron ore derivatives market to better serve the risk management needs from Chinese enterprises, regional commodity trading firms as well as their business partners across the globe.

HKEX, after its acquisition of the London Metal Exchange (LME) in 2012, has also geared up to better serve the real economy in commodities. The launch of the HKEX Iron Ore Futures contracts on 13 November 2017 is considered a constructive move.

(1) Hong Kong's strategic positioning: The key gateway to China and the "Super-Connector" between China and the world

Hong Kong, strategically positioned as the gateway of China, is a "super-connector" between China and the world. Hong Kong has achieved many breakthroughs and innovations by connecting the two in respect of the financial market. These include the launch of the Stock Connect scheme(23) and various initiatives that have driven itself to become the world's largest offshore RMB centre.

As a major shipping centre and an international trade centre in Asia, around half (US$454 billion in 2016) of Hong Kong's trade was re-exports(24). Around 20% of Mainland's international trade is routed via Hong Kong. Busy shipping routes and highly efficient ports and logistics make this city prosper. Hong Kong is also a world-class international financial centre (IFC) offering a comprehensive range of financial products and services and a business centre with a large number of international and Mainland enterprises setting up offices in it. Thanks to its free market economy and rule of law, Hong Kong establishes itself as the single largest destination market for Mainland outbound investments, providing a one-stop solution with a wide range of financial services. It also accumulates the world's largest offshore RMB liquidity pool. On the other hand, Hong Kong is the market-of-choice for international investors to access Mainland China. The HKEX securities market ranked first among global market in terms of funds raised by initial public offerings in 2015 and 2016. More than half of the companies listed on HKEX are Mainland enterprises(25) and there are over 150 listed companies in the natural resources related sector as of 31 December 2016(26).

Hong Kong provides the necessary financial infrastructure to serve the business needs of enterprises in all dimensions of import/export activities, fund raising, trade finance, asset management and financial risk management. Among these, financial risk management, in particular the management of asset price risk, is especially important for enterprises engaging in commodities trading. Commodities price risk management is therefore considered a key area of development in the Hong Kong financial market. On one hand, such value-added service would be essential for the commodities trading community to prosper in Hong Kong. On the other hand, it would facilitate China in gaining international pricing power in commodities.

(2) Strategic initiatives like OBOR has given Hong Kong a historic opportunity to facilitate Chinese enterprises to expand their market and services abroad

As mentioned in Section 1.2 above, China's policy initiative OBOR brings historic opportunities to the steel industry to support exports and relieve overcapacities in China.

This stimulates risk management and investment needs in the iron ore industry as Chinese enterprises in the industry to expand their market and services abroad. As a result, Hong Kong is provided with a historic opportunity to contribute by leveraging on its strengths in finance, trade and logistics, and its wealth of professionals in a wide range of services. Hong Kong's expertise and unique position as the gateway of China will allow it to continue to play an important role in raising capital, managing risks, leading projects and exporting professional services. Hong Kong is therefore well positioned to develop an offshore iron ore derivatives market for Chinese enterprises to manage their offshore risks.

(3) HKEX, as the financial market operator in Hong Kong, shall enhance Hong Kong's status as an IFC by building a steady and liquid commodity derivatives market to better serve the asset price risk management needs of Mainland, local and international enterprises

Given the unique position of the Hong Kong financial market in connecting Mainland China and the world and the historic opportunities offered by China's strategic development initiatives, HKEX has the comparative advantages, as the financial market infrastructure operator in Hong Kong, to excel in its role to better serve the needs in the commodity derivatives market for China and the world. These advantages include:

Running one of the most robust securities and derivatives trading, clearing and settlement systems in the world;

Offering a wide range of products and services covering the segments of equities, equity derivatives, fixed-income and currency (FIC) products and commodity products;

Operating in a sound regulatory regime, with market rules and regulations aligned with the highest international standards and with emphasis put on investor protection.

In recent years, HKEX has spearheaded a series of innovations and strategic moves to offer support to the gradual opening up of the Mainland financial market. In the equities segment, it launched the Stock Connect scheme jointly with the Shanghai Stock Exchange in October 2014 and the Shenzhen Stock Exchange in December 2016, which essentially led to the establishment of a cross-border mutual market(27). In the FIC segment, it launched the world's first exchange-traded deliverable RMB currency futures product in September 2012 ― the US dollar / offshore RMB (USD/CNH) currency futures, and Bond Connect Northbound trading(28) in July 2017. In the commodities segment, it acquired in 2012 the world's largest base metals marketplace, LME, and launched its first physically delivered dual-currency gold futures on its own Hong Kong platform in July 2017. Further product offering and expansion are being made into the ferrous product line, with the launch of iron ore futures as the first product. This new product aims to serve the needs of the region's physical trading community and financial institutions for the commodity's price risk management. (See Appendix 1 on the product's key features and Appendix 2 on the product's contract specifications.)

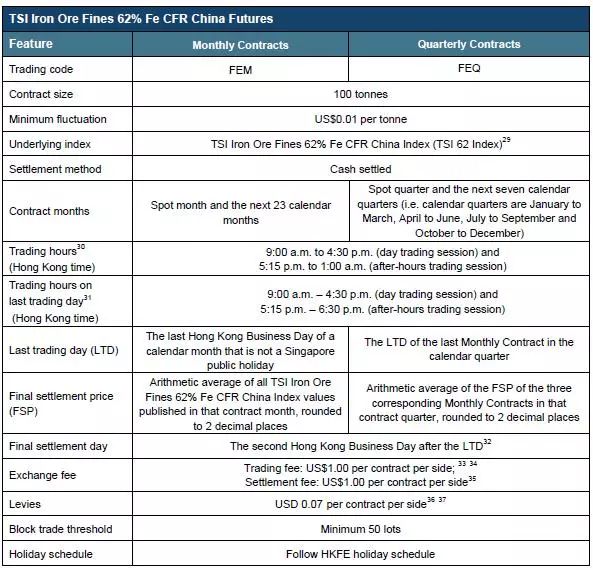

APPENDIX 1. KEY FEATURES OF HKEX'S IRON ORE FUTURES

(1) Exchange-traded futures

The Iron Ore futures contract provides a high level of price transparency and an efficient price discovery process.

(2) Quarterly contracts

The product makes available the first quarterly contracts in the global on-exchange market. This offers market participants a more transparent and convenient platform than OTC swaps to execute order and hedge their positions in quarterly trades, and to facilitate price discovery in forward price curve.

(3) Day trading session and after-hours trading (AHT) session

Trading hours span, from 9:00 am to 1:00 am the next morning (Day trading session: 9:00 am to 4:30 pm; AHT session: 5:15 pm to 1:00 am the next morning). This would serve market participants from across the globe, covering business hours of Mainland China and major offshore markets.

(4) Block trades

Block trade facility is available to facilitate the ease of reporting OTC volume, for them to be cleared on the exchange, reducing counterparty risks.

(5) Tracks the most recognised derivatives benchmark as underlying

The contract settles against the TSI Iron Ore Fines 62% Fe CFR China Index, which is widely referenced in the physical trade of iron ore and is also chosen as the settlement price for the majority of USD-denominated iron ore derivatives contracts.

Appendix 2. CONTRACT SPECIFICATIONS OF HKEX IRON ORE FUTURES

Notes

(1) Source: "The lore of ore", The Economist, 13 October 2012 (http://www.economist.com).

(2) Source: "The lore of ore", The Economist, 13 October 2012 (http://www.economist.com).

(3) Source: Wind, data as of 2016.

(4) Source: China Iron and Steel Association, Bloomberg, as of 2016.

(5) Source: General Administration of Customs of People's Republic of China, as of 2016.

(6) China domestic iron ore is around 30% in iron (Fe) content.

(7) China has a high reliance on imported iron ore — in every 100 tonnes of iron ore it consumes, 84 tonnes are imported. Source: China Iron & Steel Association, as of 2015.

(8) Source: National Development and Reform Commission (NDRC), as of 2016.

(9) Source: Ministry of Industry and Information Technology.

(10) Source: The State Council's "Government Work Report 2017".

(11) Source: SGX and CME websites.

(12) Source: Futures Industry Association (FIA), as of 2016.

(13) LCH Clearnet is part of the LCH Group, which is a leading multi-asset class clearing house, serving a broad number of major exchanges and platforms as well as a range of OTC markets.

(14) Nasdaq Clearing is a leading, European Market Infrastructure Regulation (EMIR)-authorised, clearing house providing central counterparty clearing for a broad range of markets and asset classes.

(15) The TSI 62% CFR China index refers to the delivery price into North China excluding Qingdao port.

(16) An informal estimation by clearing brokers for this research exercise.

(17) Source: FIA.

(18) Source: SGX website.

(19) Reference is made to the trading volume data in tonnes of reported exchanges for 2016 in FIA statistics.

(20) In terms of notional trading volume of reported exchanges in FIA statistics.

(21) The ratio for a specific commodity is the global derivatives trading volume (including Mainland China) in tonnes on that commodity divided by the global trading volume (including Mainland China) of the physical commodity in tonnes. (Source: FIA, World Gold Council, Bloomberg.)

(22) The Mainland iron ore derivatives market offers only futures contracts while the offshore derivatives markets offer swaps, futures and options contracts.

(23) Stock Connect is a pilot programme established upon the Mutual Market Access model. For the first time ever, investors in the Mainland China and Hong Kong markets are able to have direct access to each other's stock markets.

(24) Source: Hong Kong Trade Development Council (HKTDC) Research website. Subsequent quotations of Hong Kong's economic data in this paragraph are also from this source.

(25) As of 31 December 2016, out of a total of 1,973 companies listed on HKEX Main Board and GEM, 1,002 were Mainland enterprises. (Source: HKEX)

(26) Source: HKEX

(27) See HKEX research report, Shanghai and Shenzhen Stock Connect ― A "Mutual Market" for Mainland and global investors, March 2017, on the HKEX website.

(28) Bond Connect is a mutual market access programme that enables overseas investors to trade bonds on the China Interbank Bond Market in the Mainland (Northbound trading), and Mainland investors to trade bonds in the Hong Kong market (Southbound trading) through the connectivity links established between the institutional financial infrastructure in the Mainland and Hong Kong. The initial launch is confined to Northbound trading.

(29) According to an announcement from Platts on 6 July 2017, TSI 62 Index will merge with the Platts IODEX index starting from 2 January 2018. For details, please refer to Platts Subscriber Notes and Methodology and Specifications Guide.

(30) There is no trading after 12:30 p.m. on the eves of Christmas, New Year and Lunar New Year. The trading hours on those three days shall be 9:00 a.m. – 12:30 p.m.

(31) There is no trading after 12:30 p.m. on the Last Trading Day that is the last Hong Kong Business Day before New Year's Day or the Lunar New Year, and which is also the last day before New Year's Day or the Lunar New Year on which the TSI Iron Ore Fines 62% Fe CFR China Index is published. The trading hours on those two days shall be 9:00 a.m. – 12: 30 p.m.

(32) Final Settlement Day shall be the first Hong Kong Business Day after the Last Trading Day if (i) the Last Trading Day is on the last Hong Kong Business Day before New Year's Day or the Lunar New Year, (ii) the Trading Hours of the Spot Month Contract and the Spot Quarter Contract end at 12:30 pm., and (iii) the day trading session of other Contract Months ends at 4:30 pm. For further details please refer to the related Regulations and Contract Specifications on the HKEX website.

(33) The amount indicated above is subject to change by the Exchange from time to time.

(34) Waived from 13 November 2017 to 11 May 2018, both dates inclusive, excluding the After-Hours Futures Trading Session on 11 May 2018.

(35) The amount indicated above is subject to change by the Exchange from time to time.

(36) The current rate is set at HK$ 0.54 per contract, for which the USD equivalent will be determined by the Exchange from time to time.

(37) Waived from 13 November 2017 to 11 May 2018, both dates inclusive, excluding the After-Hours Futures Trading Session on 11 May 2018.

文章来源:香港交易所官方网站 2017年11月13日(本文仅代表作者观点)

本篇编辑:彭淳懿

温馨提示:现微信最新版本“订阅号”已实现公众号置顶功能,广大读者可点开“金融读书会”公众号,点“置顶公众号”键,即可将“金融读书会”置顶,方便查阅。