The last few months saw several fintech companies obtaining licenses to operate as a bank and - ultimately - become a bank. Fintechs are characteristically small, innovative and agile. They not only detest the traditional banking model - their mission is to disrupt it. For these companies to go down the same road of huge, lumbering banks and actually get a license to become one seems counterintuitive. For many of us trying to understand this new trend, it can be a long head-scratching moment.

Is getting a banking license the confirmation of a successful business model? Is it required to gain trust? Is it a cheap source of funding in the race to scale up? Or, is it simply a differentiating factor in case others succumb to crisis (reputation, financial, etc.)?

Many thought leaders in the industry have been proclaiming that we no longer need traditional banking because fintech companies are able to provide the same services much more efficiently. Indeed, many fintechs have been trying to position themselves as worthy alternatives to the incumbent players.

On the other hand, many established banks have attempted to mimic the disruptive newcomers by acquiring fintech startups, partnering with them, or trying to develop their own digital offerings. Examples of these are Citi's investment in lending companies C2FO, BlueVine, FastPay as well as JP Morgan's investment in Prosper, LevelUp or Gopago.

Now, it seems like the fintechs are trying to be more like banks.

Despite the disdain towards the culture, cumbersome KYC procedures, etc., obtaining a banking license appears to be the trusted path for many cool fintech founders. From payments to marketplace lending, we observe all sorts of newcomers across many jurisdictions moving towards obtaining a bank charter.

We witnessed PayPal take this route in the past. It applied for, and subsequently gained, a Luxembourg banking license in May 2007, thus operating under the Banking Directive with CSSF oversight. Still, the share volume of fintechs' banking application clearly points to an emergence of a whole new trend.

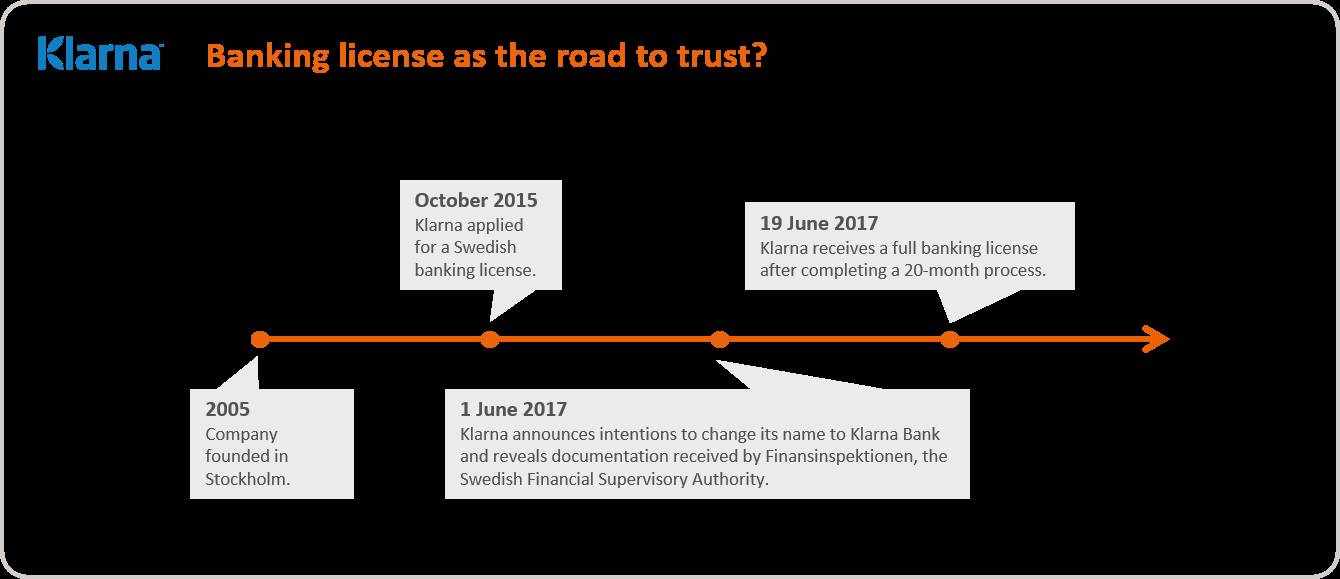

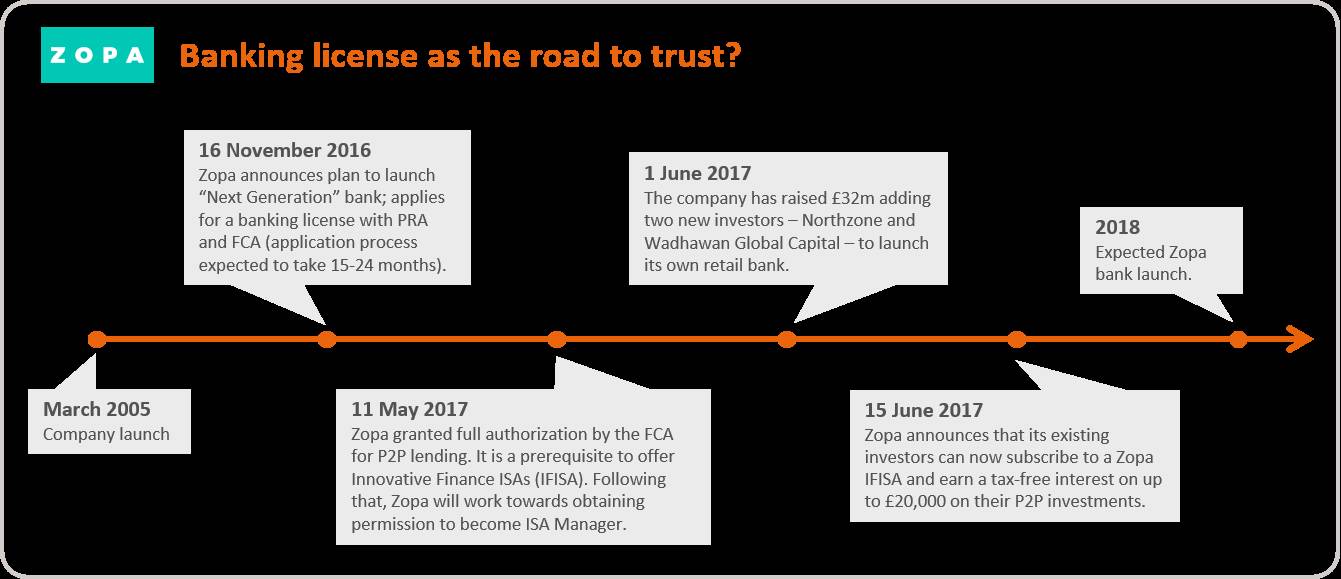

Being granted a banking license essentially means that fintech companies no longer need to rely on partnerships with incumbent banks. However, choosing to partner with established banks may be an easier alternative for smaller fintech players. As the above table indicates, a bank charter application can be a lengthy and tedious process - it took 20 months for Klarna to obtain a license!

So, what could be the reasons for taking the licensed road?

Despite all the woes and hassles, a banking license can offer several advantages for fintechs:

broader scale and a larger customer base, especially in retail (deposits!);

gain retail depositors trust via deposit guarantee schemes;

long-term efficient capital base;

competitive advantage in the increasingly more crowded fintech startup space;

validation of their business model to the entire ecosystem;

passporting benefits in the EU's single market;

preparation for new opportunities and a level playing field for PSD2.

A banking license can open up a whole new range of banking products, which fits into the emerging trend of customers favouring digital offering in a one-stop-shop format (i.e., a single comprehensive digital banking application). It can also be a significant move in terms of marketing or brand perception. For example, there is the possibility of issuing branded payment cards and therefore, allowing online-based companies to venture deeper into the "offline".

Indeed, a banking license can be perceived as the fintechs finally receiving broader acknowledgement and legitimacy. This will help overcome barriers and suspicions. More importantly, it elevates their standing in the wider financial landscape. With thousands of fintech companies having different control levels, one scandal can negatively impact the entire sector. This was evident in the Lending Club incident in 2016. Having a banking license can be a differentiating factor in these circumstances.

The Art of Possibilities comes with a cost

Due to much lighter (or lack of) regulation, fintechs have long been criticised for not being on the same level playing field as traditional banks. This will change as more and more start applying for a banking license and become subject to the regulations. It can be signal a fundamental shift in the landscape. Incumbent players will no longer be able to claim that fintechs enjoy a relative regulatory advantage. This will undoubtedly put pressure on them to step up the game regarding efficiency, costs, consumer-orientation and flexibility, particularly towards the so-called millennials.

A banking license also implies additional obligations, such as (increased) capital requirements, costs, procedures and a deposit insurance scheme. Will fintech companies be able to sustain their business model and competitive advantage when faced with the same level of regulation as incumbent players? Time will tell.

Key questions remain...

How will the business models evolve? Will fintechs keep their cost advantages and maintain their "cool, small and agile" appeal? Will they continue their positive impact on the setup of existing banks? Will Banks 1.0 be able to repair their negative image and reputation among consumers? Will the gap between Banks 1.0, Banks 2.0 and Fintechs Without License widen or tighten?

Looking at it from a broader view, this banking license trend may contribute to creating a more robust and safer fintech ecosystem.

Who would have thought 10 years ago that in 2017, the market cap of PayPal will be 2 times that of Deutsche Bank? One thing is sure: in 10 years time, the banking landscape will look very, very, very… different.