The TED Spread

TED: 短期(三个月)美国国债(Treasury)-欧洲美元(Eurodollar)利差

With the availability of alternative futures contracts based on related underlying instruments, it is often attractive to consider trading futures spreads, whereby similar futures are simultaneously bought and sold. One of the most common of these types of trades is the TED spread constructed by trading Treasury bill futures against Eurodollar futures.

随着基于相关基础金融工具的另类期货交易合约的出现,考虑交易期货价差通常是很有吸引力的,从而可以同时买卖类似的期货合约。这些类型的交易中最常见的一种是通过将国库券期货与欧洲美元期货进行交易而构建的TED价差指标。

In this case, both contracts relate to short-term (i.e., three-month) dollar-denominated interest rates. The TED spread trade thus reflects a view that these two underlying three-month rates will move differentially.

在这种情况下,两个合同都涉及短期(即三个月)以美元计价的利率。

因此,TED利差交易反映了这样一种观点,即这两个基本的三个月利率将有所不同。

Over time, the concept of the TED spread has been extended, allowing for analogous transactions that bear on interest rate differentials pertaining to a range of maturities that extends beyond the three-month point on the underlying yield curves. This evolution has come to be known as “term TED spreads.” This article describes these various trades – their rationale, trade construction, and associated implementation issues.

随着时间的推移,TED利差的概念得到了扩展,从而允许类似的交易产生与一系列到期日相关的利率差异,该到期日的范围超出了基础收益率曲线上的三个月点。这种演变被称为“术语TED利差”。本文介绍了这些不同的交易-它们的原理,交易结构以及相关的实施问题。

TREASURY BILL AND EURODOLLAR FUTURES CONTRACTS

美国国库券和欧洲期货合约

The Treasury bill futures contract is a price-fixing mechanism that locks in a rate on a three month U.S. Treasury bill with a deferred settlement date. Currently, expiration and delivery dates follow from the cycle of Treasury auctions. That is, each open Treasury bill futures contract is settled by physical delivery of $1 million par of U.S. Treasury bills. Deliverable bills must mature ninety-one days from the first of three allowable delivery days.

国库券期货合约是一种定价机制,可锁定三个月期美国国库券的汇率,并延期结算。当前,到期和交付日期从国债拍卖周期开始。

也就是说,每份未平仓的美国国库券期货合约都以实际交付的100万美元面值的美国国库券结算。可交付票据必须从三个允许的交付日中的第一天起九十一天到期。

The Chicago Mercantile Exchange (CME) schedules quarterly expirations to maximize the supply of deliverable Treasury bills, so that the qualifying population includes old one-year bills and old six-month bills, each having three months of remaining life upon delivery, as well as new-issue ninety-one-day bills.

芝加哥商品交易所(CME)安排季度到期以最大程度地提供可交付的国库券,以便合格的人口包括旧的一年期票据和六个月的旧票据,每张票据在交货时具有三个月的剩余到期日,以及 新发行的九十一天债券。

For example, the March 1997 Treasury bill futures contract expires (stops trading) on Wednesday, March 26, 1997. Bills that qualify for delivery must have ninety-one days of remaining life, counting from the next business day. So in this case, the required maturity date is June 26. Three different issues – an original one-year bill issued on June 27, 1996, an original six-month bill issued on December 26, 1996, and a new ninety-one-day bill issued on March 27, 1997 – satisfy the delivery requirements, as each has the requisite ninety-one days remaining until maturity.

例如,1997年3月的美国国库券期货合约在1997年3月26日星期三到期(停止交易)。符合交付条件的票据必须具有91天的剩余寿命,从下一个工作日算起。

因此,在这种情况下,要求的到期日期是6月26日。三个不同的发行日期– 1996年6月27日发行的原始一年期票据,1996年12月26日发行的原始6个月票据,以及新的91发行日。1997年3月27日发行的即期票据–满足交货要求,因为每个票据还有剩余的九十一天才能到期。

The Eurodollar futures contract is similar to the Treasury bill futures contract. It too is traded on a quarterly cycle, although expiration days do not correspond to those of the Treasury bill contracts. For Eurodollars, expirations always fall two London business days prior to the third Wednesday of the month. This contract is said to be “cash-settled,” meaning that no physical delivery occurs. Instead, one last mark to market is made, where the final settlement price is assigned based on cash market yields, specifically reflecting the London Interbank Offered Rate (LIBOR) for three-month Eurodollar deposits, as quoted by the British Bankers Association.1 Each contract covers a national exposure of $1 million.2

欧洲美元期货合约类似于美国国库券期货合约。尽管到期日与国库券合同的到期日不符,但它也按季度周期进行交易。对于欧洲美元,到期时间总是在该月的第三个星期三之前的两个伦敦工作日内结束。据说该合同是“现金结算的”,这意味着没有实物交割发生。取而代之的是最后一个市场标记,其最终结算价格是根据现金市场收益率来分配的,具体反映了英国银行家协会报价的三个月欧洲美元存款的伦敦银行间同业拆借利率(LIBOR)。合同涵盖了100万美元的国家风险承担。2

Prices of both Eurodollar futures and Treasury bill futures are quoted on the basis of an International Monetary Market (IMM) index, where the associated rate reflected by the price index is found simply by subtracting that price from 100.3 For example, a price of 95.10 reflects an interest rate of 4.90% – a discount rate for the Treasury bill futures but an add-on money market yield for the Eurodollars.

欧元美元期货和美国国库券期货的价格均以国际货币市场(IMM)指数为基础进行报价,其中价格指数反映的相关汇率是通过简单地从100.3中减去该价格而得出的,例如95.10的价格 反映了4.90%的利率–国库券期货的折扣率,但欧洲美元的附加货币市场收益率。

THE BASIC TED SPREAD

基础TED利差

Although three-month Treasury bill rates and three-month Eurodollar deposit interest rates generally move together – rising in times of monetary tightness and business cycle expansion and declining with monetary ease and cyclical weakness – the co-movement typically is not exactly equal. The TED spread, which reflects the difference between these two interest rates, may offer some attractive trading opportunities to those who can correctly anticipate such differential movement between the two rates.

尽管三个月的美国国库券利率和三个月的欧洲美元存款利率通常会一起变动(在货币紧缩和商业周期扩张时上升,而在货币宽松和周期性疲软时下降),但共同变动通常并不完全相等。

TED利差反映了这两种利率之间的差异,可能为那些能够正确预期两种利率之间的差异波动的人提供一些有吸引力的交易机会。

Because Eurodollar deposits are direct obligations of private, offshore commercial banks, independent of the Federal Reserve System, investors believe them to be more risky and more likely to pay a higher interest rate than Treasury bills with a common maturity. As a consequence, the IMM price index for Eurodollar futures has been – and is likely to remain – lower than the price index for Treasury bill futures. At the root of any TED spread trade is the question of whether the present differential reflected in current futures prices is likely to change; and if so, will the differential increase or decrease?

由于欧洲美元的存款是私人,离岸商业银行的直接义务,独立于美联储系统,因此投资者认为,与具有共同期限的国库券相比,它们具有更高的风险,并且更有可能支付更高的利率。

结果,欧洲美元期货的IMM价格指数一直(而且很可能仍将)低于美国国库券期货的价格指数。任何TED价差交易的根本问题是当前期货价格中反映的当前差异是否可能改变;如果是这样,差异会增加还是减少?

One of the attractive aspects of the TED spread is its simplicity. An expectation that the spread will widen justifies buying the spread (i.e., buying Treasury bill futures and selling Eurodollar futures), while an expectation of a narrowing of the differential justifies selling the spread. The appropriate trade proportions are one-to-one.4

TED利差指标的吸引力之一是它的简单性以及易用性。对价差将扩大的预期证明买入价差是合理的(即购买美国国库券期货并出售欧洲美元期货),而对差价收窄的预期则证明了卖出价差是合理的。适当的交易比例是一对一的。4

1. Eurodollar deposits are dollar-denominated bank deposits held by commercial banks outside the continental U.S.

1.欧洲美元存款是指美国大陆以外的商业银行持有的以美元计价的银行存款。

2. A revision of the Treasury bill contract currently under consideration will result in analogous cash settlement processes for Treasury bill futures.

2.当前正在考虑修订的国库券合同将导致类似的国库券期货现金结算程序。

3. The International Monetary Market is the division of the Chicago Mercantile Exchange that lists interest rates and currency futures and options.

3.国际货币市场是芝加哥商品交易所的子部门,列出了利率,货币期货和期权。

4. This trade proportion will foster zero gains and losses as long as the futures price (rate)

4.只要期货价格(汇率)高,这种交易规模以及比例将导致零损益

Generally, trades are executed with a single order to buy or sell the TED, and prices are assigned to the respective “legs” of the spread. Note that, as long as the differential is appropriately reflected by the assigned prices, the individual prices are irrelevant, because any “error” would be offsetting on the two legs.

通常,用一个买卖TED的订单执行交易,并将价格分配给价差的各个“腿”。请注意,只要分配的价格适当反映了差异,则各个价格就无关紧要,因为任何“错误”都会在两条腿上抵消。

The cash market TED spread (i.e., based on spot market interest rates, rather than futures prices) has shown fairly extended periods of relative stability, interrupted by sharp movements and higher volatility. The 1979-1982 period was one high-volatility time span, when the spread ranged from a high of about 400 basis points to a low of about 100. This episode was associated with the effects of Paul Volcker’s monetary policy and the Mexican debt crisis.

现货市场的TED利差(即基于现货市场利率而不是期货价格)显示了相对稳定的相对稳定期,被急剧的波动和更高的波动打断了。

1979年至1982年是一个高波动时期,当时的价差范围从大约400个基点的高点到大约100个低点。这一事件与保罗·沃尔克的货币政策和墨西哥债务危机的影响有关。

A few years later, another bout of volatility appeared in May 1984, in connection with the Continental Illinois National Bank crisis. At that time, it appeared that a major money center bank was on the threshold of failing. The entire banking system seemed vulnerable, and investors became considerably less certain of the safety of Eurodollar deposits. As a consequence, a “flight to quality” ensued, whereby investors shifted their holdings out of Eurodollar deposits and into U.S. Treasury bills. Banks were forced to counter this shift by bidding up yields on Eurodollar deposits.

几年后,与伊利诺伊州国家银行(Continental Illinois National Bank)危机相关的另一波动荡于1984年5月出现。当时,一家大型的货币中心银行似乎已经破产。

整个银行体系似乎很脆弱,投资者对欧洲美元存款的安全性的把握大大降低了。结果,随之而来的是“质量飞行”,投资者将其持有的资产从欧洲美元的存款转移到了美国国库券上。

银行被迫通过提高欧洲美元存款的收益率来应对这种转变。

In response to the prospect of a major bank failure, the U.S. government (the FDIC, the Federal Reserve System, and the Comptroller of the Currency) took measures to keep Continental Bank afloat by protecting its depositors (uninsured, as well as insured). The crisis was defused, confidence in the system was restored, and the TED spread worked its way from its high of about 200 basis points to its pre-crisis level of about 100, in a span of a few months.

为了应对可能出现的主要银行倒闭的情况,美国政府(FDIC,美联储系统和货币主计长)采取了措施,通过保护其储户(无保险和受保)来保持大陆银行的运转。

危机得以缓解,人们对该系统的信心得以恢复,而TED的蔓延在短短几个月内从其约200个基点的高点发展到了危机前的约100个基点。

Since the mid-1980s, the TED has been much more quiescent. In the most recent two years, for example, interest rates have been remarkably stable. Even so, during this time the TED spread has oscillated over a 40-basis point range, allowing ample opportunity for trading activity.

自1980年代中期以来,TED指标变得更加安静。例如,在最近的两年中,利率一直非常稳定。即便如此,在这段时间内,TED价差在40个基点的范围内波动,为金融机构的交易活动提供了充足的机会。

Besides the flight to quality issue, the TED is also traded as a surrogate for a play on the level of interest rates. Exhibit 1 shows a direct relationship between the level of interest rates and the size of the TED. That is, during the interest rate cycle shown, the TED generally narrowed when rates declined and widened when rates rose. This relationship is by no means certain in any given short-run situation.

除了金融机构本身的安全投资转移(Flight-to-Quality) 的问题外,TED还被用作替代利率水平的手段。图表1显示了利率水平与TED规模之间的直接关系。也就是说,在所示的利率周期内,TED通常在利率下降时变窄,而在利率上升时变宽。在任何给定的短期情况下,这种关系都不是确定的。

安全投资转移(Flight To Quality)

这种投资行为是指投资者将其资本从风险较高的投资品转移到现有的最安全的投资工具。这种迁徙行为通常是由金融市场或国际市场的不确定所引发的。然而,在某些情况下,这种行为也可能并非出于对国际市场的担忧,而是投资者为了减轻手头风险波动较大的投资品的仓位,转向保守投资品的一个举措(比如多元化投资)。

Differential remains constant, independent of the fact that the two respective interest rates are quoted using different rate quotation conventions (i.e., discount rates for Treasury bills versus add-on yields for Eurodollars).

差异保持不变,这与使用不同的利率报价惯例(即,国库券的贴现率与欧洲美元的附加收益)来报价两个各自的利率无关。

TRADE IMPLEMENTATION ISSUES

交易层面上的执行问题

When trading futures contracts, it is often appropriate to consider the “basis,” the difference between the futures price and the spot price of the associated underlying instrument. Specifically, if the expected change in the spot price over the horizon to the futures expiration date is already embedded in the futures price, the rationale for initiating a position could be mitigated.

在交易该类期货合约时,通常应该考虑“基点(basis)”,即期货价格与相关基础工具的现货价格之间的差额。具体来说,如果期货价格中已经包含了预期范围内现货价格的预期变化,则可以削减其交易头寸。

To clarify, first consider the issue in the context of an outright futures trade, rather than a spread trade. Suppose, for example, that the discount rate on the three-month (spot) Treasury bill is 5.00%, and you expect this rate to rise by, say, 25 basis points, to 5.25% by the next futures expiration. You would likely be tempted to sell the nearby Treasury bill futures contract.5

为了澄清起见,首先在直接期货交易而不是点差交易的背景下考虑该问题。例如,假设三个月(即期)国库券的折现率为5.00%,并且您预计该利率在下一个期货到期时将上升25个基点,达到5.25%。

您可能会想出售附近的美国国库券期货合约。5

5 Recall that futures prices reflect 100 minus futures interest rates. An expectation that the interest rate will rise is equivalent to an expectation that the futures price will fall.

5回想一下,期货价格反映了100减去期货利率。利率将上升的预期等同于期货价格将下降的预期。

If the futures price were currently trading at 94.75 (already reflecting a rate of 5.25%), however, the trade would not be appropriate. That is, if expectations were realized, the futures price would remain at its current price of 94.75, so that no profit would result from the trade. In fact, if the current futures price were below 94.75, and you thought the increase in the spot rate would be limited to no more than 25 basis points (i.e., the futures price would go no lower than 94.75), a long futures position would be justified.

但是,如果当前期货价格为94.75(已经反映了5.25%的汇率),则该交易将不合适。也就是说,如果实现了预期,则期货价格将保持在其当前价格94.75,因此交易不会产生任何利润。

实际上,如果当前期货价格低于94.75,并且您认为现货汇率的涨幅将被限制在不超过25个基点(即期货价格将不低于94.75),那么持有多头期货头寸将 被证明是合理的。

The same basis consideration applies when trading spreads. Prior to the expiration of one of the underlying futures contracts (i.e., the first of the two relevant expirations), the TED spread constructed with spot interest rates will likely differ from the spread constructed with futures prices, but spot and futures spreads will generally converge as the expirations approach. As long as the Treasury bill futures require physical delivery, convergence to the spot price will not necessarily be complete, as the Eurodollar and Treasury bill futures expirations do not occur simultaneously. An intended change to a cash-settled Treasury bill contract, however, will synchronize the expirations and foster complete convergence.

交易该利差工具时适用相同的基本考虑。

在基本期货合约之一到期(即两个相关到期的合约中的第一个)之前,以现货利率构建的TED利差可能与以期货价格构建的TED利差不同,但是现货和期货利差通常会收敛 作为到期日的方法。只要国库券期货需要实物交割,由于欧洲美元和国库券期货不会同时到期,因此与现货价格的收敛不一定会完成。但是,有意更改以现金结算的国库券合同将使到期时间保持同步并促进完全收敛。

To demonstrate, consider the conditions shown in Exhibit 1, reflecting prices (rates) some months prior to the expiration of the Eurodollar futures contract.

为了证明这一点,请考虑图表1中所示的情况,这些情况反映了欧洲美元期货合约到期前几个月的价格(价格)。

In this case, the futures TED is trading at a 35-basis point premium to the spot TED. As a consequence, if spot rates remain unchanged over the next two months, the futures spread would have to adjust downward, generating a gain for the short TED spread position. Put another way, for a long futures TED spread to be profitable, the spot spread would have to rise by more than 35 basis points by the time the first component futures contract expires. Thus, the spread basis fosters an edge to one side of the trade and somewhat of a penalty to the other. In this case, the edge accrues for the short TED position, while the penalty applies to the long.

在这种情况下,期货TED的交易价格比现货TED合约高35个基点。

结果,如果现货价格在接下来的两个月中保持不变,则期货价差将不得不向下调整,从而为空头的TED价差头寸带来收益。

换句话说,要使多头期货TED利差获利,当第一部分期货合约到期时,现货价差将必须上涨超过35个基点。因此,点差基础有利于交易的一面,而对另一面则有一定的惩罚作用。在这种情况下,边缘会出现在空头TED位置,而惩罚则适用于空头。

The basis consideration is particularly important in the context of using a TED spread as a surrogate for an outright interest rate position — particularly when yield curves are steeply sloped. When yield curves are steeply upward-sloping, outright futures prices generally trade at a large discount to spot prices; when yield curves are downward-sloping, futures trade at a large premium.

在使用TED利差作为完全利率头寸的替代项时,尤其是在收益率曲线陡峭倾斜时,基本考虑尤其重要。当收益曲线急剧上升时,直接期货价格通常比现货价格有很大的折让。当收益率曲线向下倾斜时,期货交易溢价很大。

As noted earlier, to the extent that basis conditions reflect expectations of a prospective market move, the rationale for trading is mitigated. If the basis conditions were roughly equivalent for both Treasury bill and Eurodollar futures, however, the TED basis would be close to zero (i.e., the two basis effects are offsetting). As a consequence, no basis edge or penalty would apply to the TED. Thus, when basis conditions appear to be unattractive for outright futures, the TED spread may not suffer the same unattractive characteristics.

如前所述,在基本条件反映了对未来市场走势的预期的程度上,交易的理由得以缓解。但是,如果国库券和欧洲美元期货的基本条件大致相等,那么TED的基础将接近零(即,两个基础影响相互抵消)。

结果,没有基础优势或惩罚将适用于TED合约。

因此,当基本条件似乎对完全期货没有吸引力时,TED利差可能不会具有同样的吸引力特征。

THE TERM TED SPREAD

TED利差合约

Beginning in the early to middle 1990s, the market took trading basic TED spreads a step further. Participants started trading longer-term Treasury notes against strips of Eurodollar futures.6 For example, buying (selling) a two-year term TED would involve buying (selling) a two-year cash Treasury note in the spot market and selling (buying) a two-year Eurodollar futures strip (i.e., a strip composed of eight contracts).

从1990年代初到中期开始,市场交易TED的基本价差进一步扩大。参与者开始用欧洲美元期货条交易长期国库券。6例如,购买(出售)两年期TED将涉及在现货市场中购买(出售)两年期现金国库券,然后出售(购买)。两年期欧洲美元期货带(即由八份合约组成的带)。

6 Strips are a construction that employs a sequence of successive Eurodollar expirations (e.g., March, June, September, etc.).

6条带是采用一系列连续的欧洲美元到期期限(例如3月,6月,9月等)的构造。

The decision to enter a term TED spread (rather than the traditional TED) is justified by the same kind of interest rate expectations that motivate the traditional TED spread, albeit for a different point on the yield curve. The earlier example, for instance, focuses on the two-year points on the Treasury and Eurodollar yield curves. Just as before, a judgment that the spread will widen would justify buying the Treasury instrument and selling the strip, and vice versa for the reverse expectation.

尽管有收益率曲线上的不同点,但决定采用期限TED利差(而不是传统的TED)的决定是通过激发传统TED利差的相同利率预期来证明的。例如,前面的示例着眼于国债和欧洲美元收益率曲线的两年点。

像以前一样,对价差会扩大的判断将证明购买美国国库券和出售该票据是合理的,反之亦然。

The starting point for assessing whether a term TED is an attractive trade requires evaluating the strip yield from a set of component Eurodollar futures prices and then comparing this calculated yield to the yield on a government obligation of similar maturity. A rigorous calculation of strip yield, which reflects the compounding of interest, requires a two-step process.

评估TED合约是否是有吸引力的交易的起点,需要评估一组欧洲货币期货价格中的带钢收益率,然后将计算出的收益率与类似期限的政府义务的收益率进行比较。严格地计算带钢产量,以反映目标复合,需要两步过程。

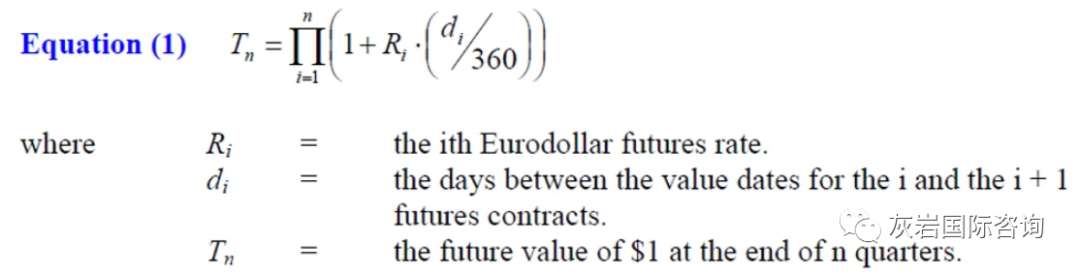

First, explicitly using the days between successive Eurodollar futures value dates in the calculation, we find the terminal value of a dollar by assuming a quarterly reinvestment/refunding rate based on successive futures rates, as per Equation (1):

首先,在计算中明确使用连续的欧洲美元期货价值日期之间的天数,我们根据等式(1)假设基于连续期货价格的季度再投资/退款率来找到美元的终值:

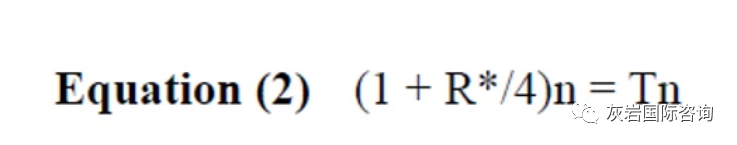

Given this value of Tn, the yield to maturity of the n-quarter strip is found by solving Equation (2) for R*:

给定该Tn值,通过求解R *的公式(2)可得出n四分之一带材的到期收益率:

R* therefore pertains to the yield to maturity of a zero-coupon instrument with quarterly compounding.

因此,R *涉及零息票息债券按季度复利的到期收益率。

Strictly speaking, this rate calculation is not comparable to rates quoted on Treasury notes and bonds for two reasons:

While the strip yield pertains to a zero-coupon instrument, the Treasury is a coupon-bearing security with semiannual compounding.

1.带材收益率属于零息票票据,而美国财政部是带有半年期复利的附息债券。

2. The strip corresponds to a forward time interval beginning with the first futures value date and extending three months beyond the last futures value date, while the Treasury pertains to an imminent time span from today’s spot value date to the maturity date.7

2. 该条对应于一个从第一个期货起息日开始到延长至最后一个期货起息日之后三个月的远期时间间隔,而美国国债则涉及从今天的现货起息日到到期日的即将到来的时间跨度。7

7 Some analysts deal with the latter concern by adjusting the strip yield calculation to include a “stub” – a multiplicative term [1 + Rs(ds/360)] to reflect the period preceding the strip, where Rs is the stub rate and ds is the number of days from the spot value date to the first futures value date. Additionally, the weight given to the last futures contract in the yield calculation would typically be adjusted to make the coverage of the combined stub plus strip correspond to the remaining life of the bond or note.

7一些分析师通过调整带钢产量计算以包括“存根”(一个乘数项[1 + Rs(ds / 360)]来反映带钢之前的时期,其中Rs是存根率和ds)来处理后一种问题。是从现货起息日到第一个期货起息日的天数。此外,通常会调整收益率计算中赋予最后期货合约的权重,以使合并的存根加条带的覆盖范围对应于债券或票据的剩余寿命。

PREDOMINANT TRADE CONSTRUCTION METHODOLOGY

优势交易构建方法论

Although no unique method for arranging a term TED is universally accepted, a number of analytical subscription services offer algorithms that are widely used. While the precise Eurodollar futures positioning may differ somewhat from model to model, most of these services recommend a disproportionate weighting of successive futures contracts, with declining numbers of futures for more distant expirations. This outcome follows if one conceptualizes the Treasury security as a series of zero-coupon components.

尽管没有一种通用TED合约的独特方法被广泛接受,但许多分析订阅服务提供了被广泛使用的算法。尽管不同模型之间精确的欧洲美元期货仓位可能有所不同,但大多数服务建议连续期货合约的加权比例不成比例,而随着期货数量的增加,到期日越来越远。

如果将国库券的概念化为一系列零息票券,则可以得出这一结果。

For example, a two-year semiannual coupon-bearing security is identical to the following pieces: three zero-coupon instruments of six-, twelve-, and eighteen-month maturities, each with a terminal price equal to the coupon amount, plus a fourth zero-coupon instrument with a twenty-four-month maturity and a redemption value equal to the sum of the original par amount plus the final coupon payment. The price of this bond, then, is the sum of the respective present values of the four pieces, where the four different discount rates necessarily reflect the four different maturities (i.e., six months, twelve months, eighteen months, and twenty-four months, respectively).8

举例来说,两年期半年息附息证券与以下证券相同:三个零息票据,分别为六个月,十二个月和十八个月,最终价格等于息票金额加上第四种零息票据,到期日为二十四个月,赎回价值等于原始票面金额加上最终息票付款之和。

那么,该债券的价格是这四个债券各自现值的总和,其中四个不同的折现率必然反映了四个不同的到期日(即六个月,十二个月,十八个月和二十四个月) ).8

To hedge this bond properly, it would be necessary to hedge each component with an equally weighted Eurodollar futures strip – the first two Eurodollar contracts to hedge the first component, the first four contracts for the second, the first six contracts for the third, and the first eight contracts for the last.9 The complete hedge would then be a consolidation of the four component hedges.

为了适当地对冲该债券,有必要用加权平均的欧洲美元期货条对冲每个部分–前两个欧洲美元合约对冲第一个部分,前四个合约对冲第二个,前六个合约对第三个,以及 最后的前八份合约。9然后,完整的套期将合并四个组成部分的套期。

Note that this complete hedge will end up with a disproportionate weighting along the strip, giving greater weight (i.e., more contracts) to the first pair of contracts, as these appear in all the component hedges, and declining weights to successive pairs. Unfortunately, this weighting may be undesirable for the TED spread trader who simply wants to bet on the raw difference between strip yields and Treasury yields.

请注意,这个完整的对冲最终将沿着交易带不成比例的权重,对第一对合约赋予更大的权重(即更多的合约),因为它们出现在所有成分对冲中,而对连续对的权重则下降。不幸的是,这种加权对于TED利差交易员来说可能是不希望的,他只是想押注带状债券收益率与国债收益率之间的原始差额。

Consider a situation where offsetting price changes occur in two specific Eurodollar futures contracts, leaving the strip yield unchanged. Under this assumption, the speculator who focuses on the raw rate differential would hope to realize a zero effect on the futures portion of the trade – neither a gain nor a loss – irrespective of what happens with the Treasury security. If declining weights are assigned to successive Eurodollar contracts, however, this outcome will not follow.

考虑这样一种情况,在两个特定的欧洲美元期货合约中发生抵消价格变化,而使带钢收益率保持不变。在这种假设下,专注于原始汇率差异的投机者将希望对交易的期货部分实现零影响,无论收益还是亏损,无论国库券发生什么情况。

但是,如果将权重下降分配给连续的欧洲美元合同,则结果不会随之而来。

8 Given that this is a government security, discount rates should reflect risk-free, zero-coupon rates.

8鉴于这是政府担保,折现率应反映无风险的零息票率。

9 Although the notional value of zero-coupon instruments increases with the accrual of interest, a proper hedge applies a present value factor that offsets this effect. Under the assumption that the underlying three-month periods are of uniform lengths, hedges should thus be constructed with equal weighting across all contracts. See Kawaller [1995] for a broader discussion of the point that an equally weighted strip serves as the appropriate hedge construction for zero-coupon securities.

9尽管零息票证工具的名义价值随应计利息的增加而增加,但适当的套期会采用现值因子来抵消这一影响。因此,假设基础三个月的期限是相同的,则应在所有合约中以相同的权重构建对冲。参见Kawaller [1995]的更广泛讨论,即相等权重的条带可作为零息票证证券的适当对冲结构。

ALTERNATIVE METHODOLOGY

替代方法

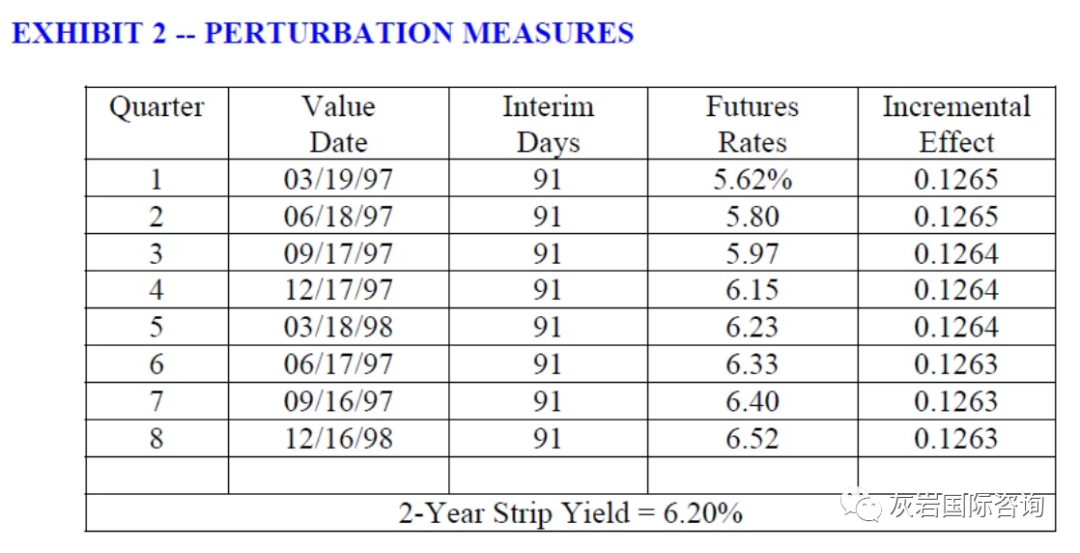

An alternative approach is demonstrated by an example. Assume a focus on the two-year Treasury versus an eight-quarter Eurodollar strip. Using the prices shown in Exhibit 2 and using Equations (1) and (2), the strip yield is calculated to be 6.20%. We then perturb each futures contract individually, varying its price (rate) by 1 basis point, to measure that specific future’s influence on the strip yield.

一个示例演示了一种替代方法。

假设重点是两年期国库券,而不是八个季度的欧洲美元债券。使用表2中所示的价格,并使用等式(1)和(2),可计算出带钢的合格率为6.20%。

然后,我们分别扰动每个期货合约,将其价格(汇率)变动1个基点,以衡量特定期货对带钢收益率的影响。

For example, changing the first-quarter rate from 5.62% to 5.63%, while keeping all other futures rates the same results in a 0.1265-basis point change in the strip yield. This process is repeated for each component of the strip, with the results shown in the last column of Exhibit 2.

例如,将第一季度利率从5.62%更改为5.63%,同时保持所有其他期货利率相同会导致带钢收益率变化0.1265个基点。对试纸的每个成分重复此过程,结果显示在图2的最后一栏中。

As long as the time intervals (i.e., interim days) for each of the relevant futures contracts are uniform, as they are here, the incremental effects of the various futures contracts will be fairly comparable. But they will not be precisely equal unless the successive futures rates are constant across the strip.

只要每个相关期货合约的时间间隔(即过渡日)是一致的(如此处所示),各种期货合约的增量效果将是相当可比的。但是,除非连续的期货利率在整个条带上保持恒定,否则它们将不会精确相等。

At least in theory, as long as the component time intervals are uniform, the impact of a change in the contract with the lowest interest rate will have the largest influence on the strip yield, while the contract with the highest rate will have the smallest impact. These distinctions, however, can easily be lost in the rounding. In the current case, with forward rates rising as the horizon extends, the incremental influences edge lower and lower for successive contracts.

至少从理论上讲,只要成分时间间隔是一致的,则利率最低的合约变更的影响对带钢收益率的影响最大,而利率最高的合约的影响则最小。。但是,这些区别很容易在四舍五入中丢失。在当前情况下,随着远期汇率随着范围的扩大而上升,对于连续合约而言,增量影响越来越小。

The appropriate position size for each expiration is found by assuming that the Treasury security’s yield changes by the identical incremental yield change that follows from each perturbation, which in turn results in a given price effect on the security. A sufficient number of contracts are then used to generate that same dollar value.

通过假定国库券的收益率变化与每次扰动后相同的增量收益率变化来找到每种到期日的合适头寸大小,从而对证券产生给定的价格效应。然后使用足够数量的合同来产生相同的美元价值。

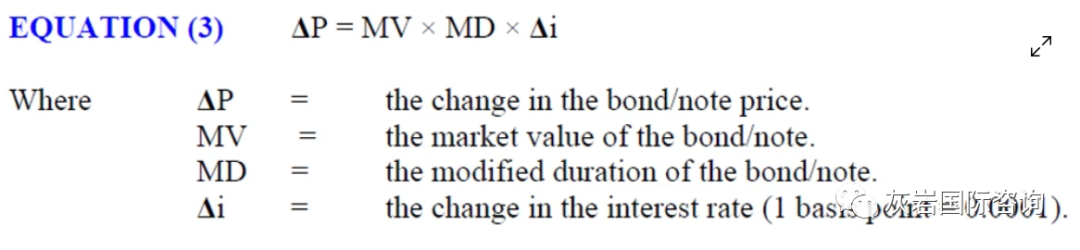

Again, by example, the perturbation of the first contract results in a strip yield change of 0.1265 basis points. The price effect on the Treasury security is found by substitution into Equation (3):

同样,举例来说,第一份合约的扰动导致带材产量变化0.1265个基点。通过代入公式(3),可以发现价格对国库券的影响:

For illustrative purposes, assume the bond in question is a two-year instrument with present value of $8.8885 million and a modified duration of 1.942. Recognizing that each basis point change in the futures rate fosters a $25 mark-to-market effect, the proper position size for each futures expiration is found by dividing the associated ΔP by $25. For example, for the first futures contract, the proper position is 8.8885 million x 1.942 × 0.00001265/25 = 8.73 contracts.

出于说明目的,假设所讨论的债券为两年期票据,现值为888.85万美元,修改期限为1.942。认识到期货利率的每个基点变化都会产生25美元的市值效应,因此,将相关的ΔP除以25美元,即可找到每个期货到期的合适头寸规模。

例如,对于第一个期货合约,适当的头寸是8.8885万x 1.942×0.00001265 / 25 = 8.73张合约。

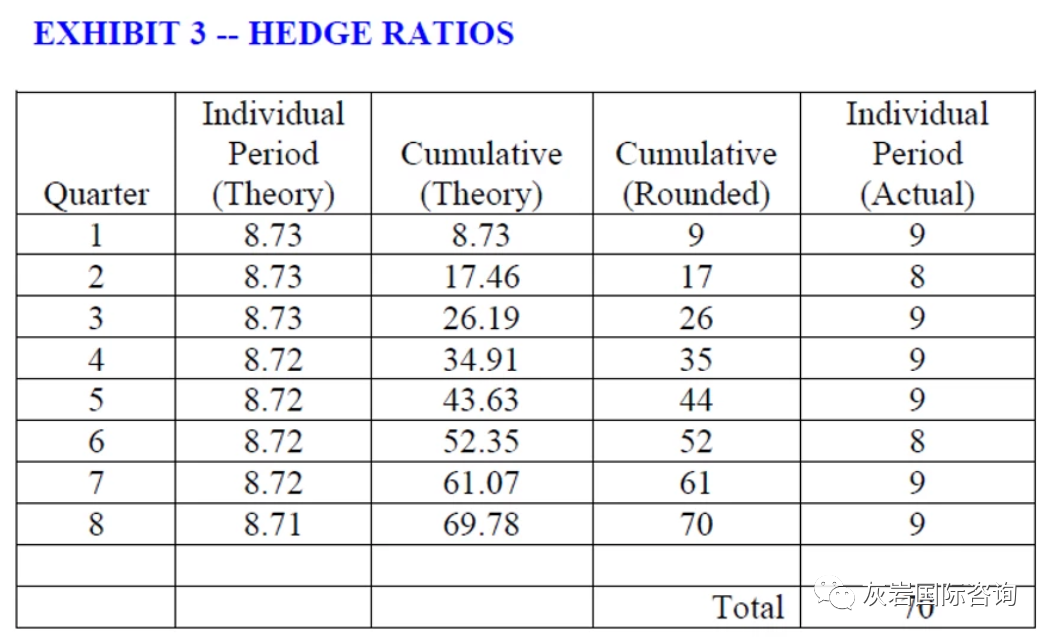

Repeating this process for all eight contracts yields hedge ratios that show a barely perceptible decline over the expiration horizon, as one moves to later and later expirations, only discernible if calculations are carried to the second decimal place. These results are displayed in the second column of Exhibit 3.

对所有八份合同重复此过程,将产生对冲比率,该对冲比率在到期期限内几乎看不到下降,因为一个移动到后来的到期日和以后的到期日,只有计算到小数点后第二位时才可以看出。

这些结果显示在图表3的第二栏中。

In most cases, implementation of the strip position is complicated by rounding considerations, as only whole numbers of contracts can be traded. In this case, rounding all the positions up to nine contracts each would result in a total futures exposure of seventy-two contracts – two greater than what is needed. Selecting the specific contract months to have eight contracts (rather than nine), however, is a subjective decision.

在大多数情况下,考虑到四舍五入的原因,头寸的实施非常复杂,因为只能交易全部数量的合约。在这种情况下,将所有头寸均四舍五入将导致期货总敞口为72张合约–比需要的多2张。

但是,选择特定的合同月份以拥有八份合同(而不是九份合同)是一个主观决定。

Ultimately, one’s view of the prospective movement of the yield curve should drive this choice. That is, if buying Eurodollar futures contracts, fewer contracts should go to the expirations expected to post the smallest relative price increase. If selling, fewer contracts should go where the smallest relative price decline is expected.10 A more neutral approach, however, would arrange the strip to keep the cumulative number of contracts equal to its rounded requirement. This weighting is shown in the last column of Exhibit 3.

最终,人们对收益率曲线的预期运动的看法应该会推动这一选择。

也就是说,如果购买欧洲美元期货合约,则预期到期的相对价格上涨幅度最小的合约应该更少。

如果出售,则去往预期最小相对价格下降的合约应该减少。10但是,如果采取更为中立的方法,则应安排试条以使累计合约数量等于其四舍五入的要求。

图表3的最后一栏显示了此权重。

In executing this trade, take into consideration that “packs” and “bundles” can be traded with a single order. Packs are equally weighted four-contract strips, or one year of futures contracts, corresponding to contracts in Eurodollar futures years 2 through 10. The CME color codes for prospective years are: 2-red; 3-green; 4-blue; 5-gold; 6-purple; 7-orange; 8-pink; 9-silver, and 10-copper.

在执行此交易时,请考虑到“包装”和“捆绑包”可以通过一个订单进行交易。每包均等权重为四重合约,即一年的期货合约,对应于欧洲美元期货第2年至第10年的合约。预期年份的CME颜色代码为:2红色;3绿 4蓝色; 5金; 6-紫色; 7-橙色 8粉红 9银和10铜。

Orders are placed for the desired number of futures required in each expiration (rather than the total number of contracts), at a price change from the average of the previous day’s settlement prices on the relevant underlying futures. The minimum price increment for packs is a half-tick or 0.005.

``以每个到期日所需的期望数量的期货(而不是合约总数)下订单,价格与相关基础期货的前一天结算价格的平均值相比有所变化。

每包的最低价格涨幅为半价或0.005。

For example, one could buy a pack of four reds at 1.5 ticks up (i.e., four contracts in each of expirations five through eight), where the average price is 1.5 ticks higher than the average of the prior settlement prices of the respective contracts. As with TED spreads, prices of individual contracts are assigned later.

例如,一个人可以以1.5个ticks的价格购买一包四个红色的债券(即,五到八个到期日中的每个合约有四个合约),其中平均价格比相应合约的先前结算价格的平均值高1.5ticks。。与TED价差一样,单个合约的价格也会在以后分配。

Bundles are longer Eurodollar strips covering one, two, three, five, seven, or ten years of contracts, generally beginning with the nearby contract.11 Like packs, prices for bundles are quoted as a change from the prior day’s average settlement price, but quotations can be made in quarter-tick increments. A formal algorithm is used to assign prices to component expirations.12

捆绑包是较长的欧洲美元带,涵盖了一年,二,三,五,七或十年的合同,通常从附近的合同开始。11与打包包一样,捆绑包的报价与前一天的平均结算价格有所不同,但是 报价可以四分之一刻度。使用正式算法将价格分配给组件到期12

10 This evaluation is ultimately driven by one’s view of prospective yield curve adjustments. See Kawaller [1991].

10这项评估最终是由人们对预期收益率曲线调整的看法驱动的。

参见Kawaller [1991]。

11 As the nearby contract approaches expiration, bundles starting with the “second-to-expire” will be introduced.

11随着附近合同即将到期,将引入从``第二个到期日''开始的捆绑包。

12 For a more complete discussion of this algorithm, as well as a general discussion of packs and bundles, see Sturm and Barker [1996].

12有关此算法的更完整讨论以及对包装和捆的一般讨论,请参见Sturm和Barker [1996]。

Given the requirements shown in Exhibit 3, it is likely that the futures portion of the term TED would be executed as an eight-contract, two-year bundle (i.e., eight contracts in each of the first eight Eurodollar futures), plus six additional single contracts in all but the second and sixth expirations.

考虑到图表3所示的要求,TED的期货部分可能会以八份合约,两年期捆绑合同(即,前八份欧洲美元期货中的每份八份合约)的形式执行,另加六份 除第二和第六个有效期外的所有其他合同。

For those cases where the desired weighting is virtually uniform across the span of the strip (as above), one might be tempted to use a shortcut method for determining hedge ratios. For instance, assuming a one-for-one relationship between Eurodollar rates and Treasury yields, the total futures requirement is found by dividing the desired dollar value of a basis point for the bond by $25. The dollar value of a basis point is found using Equation (3), plugging in 0.0001 for Δi.

对于那些期望的权重在条带跨度上实际上是均匀的情况(如上所述),可能会尝试使用一种快捷方法来确定套期保值比率。

例如,假设欧洲美元利率与美国国债收益率之间存在一对一的关系,则通过将债券基点的期望美元价值除以25美元,可以找到总期货需求。使用等式(3)找到基点的美元价值,将0.0001插入Δi。

In this example, the total is 1,725/25 = 69 contracts – one less than the total dictated by the perturbation method. This difference arises because the starting assumption is not quite correct: A single basis point change in all the forward rates fosters a slightly larger-than-1-basis point effect on the strip yield. Clearly, when trading with small notional values, this level of precision is lost in the rounding, but for professional traders dealing with larger amounts, the more precise perturbation method for determining hedge ratios is preferred. Even for larger positions, however, this quick-and-dirty calculation has the benefit of providing a ballpark estimate for the appropriate size of the futures position.

在此示例中,总数为1,725 / 25 = 69张合约–比扰动方法所指示的总数少一个。之所以会出现这种差异,是因为开始的假设并不完全正确:所有远期汇率中的单个基点变化都会对带钢产量产生大于1个基点的影响。

显然,当以较小的名义价值进行交易时,这种精确度在舍入过程中会丢失,但是对于处理较大金额的专业交易者而言,更精确的确定对冲比率的摄动方法是首选。

但是,即使对于较大的头寸,这种快速计算也具有为适当的期货头寸规模提供估算的好处。

FURTHER CAVEATS

其他注意事项

Just as the basis warrants consideration in the decision to employ the originally discussed one-for-one futures TED spread, an analogous issue applies in the case of term TEDs. With the purchase or sale of a cash Treasury security, there is an associated “carry,” reflecting the difference between the financing (or opportunity) cost and the associated interest accrual. Depending on which is greater and whether the security is bought or sold, this carry consideration may be either beneficial or adverse.

正如在决定采用最初讨论的一对一期货TED价差决定中需要考虑的基础一样,TEDs等合约也适用类似的问题。在购买或出售现金国库券时,会有一个关联的“套息”,反映了融资(或机会)成本与关联的应计利息之间的差额。取决于哪个更大,以及是否购买或出售证券,此套利对价可能是有利的也可能是不利的。

Turning to the Eurodollar strip side, a basis convergence adjustment applies, just as it does for an individual futures contract. Measuring this consideration for a strip, however, is more difficult than for a single contract, as the strip’s theoretical underlying zero-coupon Eurodollar deposit with a maturity in excess of one year is not traded actively in the marketplace. Thus, the magnitude (and even the direction) of this convergence effect is likely to be uncertain.

转到欧元兑美元方面,适用基础调整,就像对单个期货合约所做的那样。但是,衡量这种考虑的难度比单张合约要困难得多,因为该剥夺的理论基础的零息欧洲美元定期存款的期限超过一年,在市场上交易并不活跃。

因此,这种收敛效应的大小(甚至方向)可能不确定。

As an estimate of this effect, one could try to identify a dollar-denominated Eurobond or note with a credit standing equal to that of the banks reflected in the British Bankers’ Association LIBOR survey, with the caveat that these coupon-bearing rates need to be converted to their zero-coupon equivalents.13 Because of the lack of transparency of this hypothetical underlying yield, however, this component of the carry/basis consideration should be viewed with uncertainty. Note that the carry/basis issue becomes moot if one “day-trades” this spread, making sure that all positions are offset before the close of business each day.

作为对此效果的估计,人们可以尝试识别以美元计价的欧洲债券或票据,其信用额度与英国银行家协会LIBOR调查中反映的银行信用额度相同,但需要注意的是,这些票息率必须 13由于这种假设的基础收益率缺乏透明性,因此,应不确定地考虑进位/基础考虑的这一组成部分。

请注意,如果这种“日间交易”价差导致利差/基准价问题变得无足轻重,请确保在每天营业结束前抵消所有头寸。

13 The bootstrapping method allows for the conversion of coupon-bearing rates to their zero-coupon equivalents. See Caks [1977].

Besides the carry/basis issue, another feature of the term TED deserves mention, relating to the convexity of bonds and notes. The hedge ratio determination method is designed to generate gains when an interest rate differential moves in the direction anticipated. At the same time, if the differential remains constant – even if component interest rates vary – the properly designed term TED should generate near-zero results.

除了套息交易/基点问题,TED合约的另一个特征值得一提,它涉及债券和票据的凸度。套期比率确定方法旨在当利率差异沿预期方向移动时产生收益。

同时,如果差异保持恒定(即使成分利率变化),则设计合理的TED合约应该会产生接近零的结果。

Unfortunately, because bonds and notes are convex (i.e., falling interest rates generate larger price effects than rising interest rates), the proper matching on term TEDs occurs only for “small” interest rate changes.

不幸的是,由于债券和票据是凸形的(即,利率下降带来的价格影响大于利率上升带来的价格影响),因此仅在“小”利率变化时才对术语TEDs进行适当的匹配。

For example, consider the effects on the above term TED trade of changing all futures rates by 50 basis points. In theory, the resulting strip yield change would be 50.56 basis points. For the term TED spread to remain constant, the yield to maturity on the two-year note would have to adjust by the same 50.56 basis points.

例如,考虑将所有期货利率改变50个基点对上述TED交易的影响。

从理论上讲,最终的带钢产量变化将为50.56个基点。为了使TED利差期限保持不变,两年期国债的到期收益率必须调整相同的50.56个基点。

Irrespective of whether interest rates rise or fall, the futures will generate an $87,500 effect (= 50 basis ×points × 70 contracts × $25 per contract). The Treasury side will generate slightly more with rising interest rates, slightly less with falling rates.

不管利率是上升还是下降,期货都会产生$ 87,500的效果(= 50个基点×点数×70张合约×每张合约$ 25)。在利率上升时,财政部将产生更多收益,而在利率下降时,其收益将下降一点。

It should be clear, then, that this convexity effect will consistently benefit the long-term TED position. That is, keeping the yield differential constant, rising interest rates will result in larger gains on the Eurodollar futures than losses on the Treasury bond, and falling interest rates will result in larger gains on the bonds than losses on the futures. The convexity of the Treasury securities thus imparts a bias of the trade.

那么,应该清楚的是,这种凸面效果将始终有利于持有更长期的TED交易头寸。也就是说,保持收益率差恒定,利率上升将导致欧洲美元期货收益大于美国国债的损失,而利率下降将导致债券收益大于期货的损失。

因此,国库券的凸度(Convexity) 会给交易带来偏差。

While this effect needs to be recognized, it should not be overstated, because the magnitudes of these effects may not be considered significant. Moreover, these imbalances would be mitigated if hedge ratios were periodically adjusted, reflecting the changing bond/note modified durations that result from changes in interest rate levels or the passage of time.

尽管需要认识到这种影响,但不应夸大其词,因为这些影响的大小可能不被认为是重要的。此外,如果定期调整对冲比率,以反映由于利率水平或时间的流逝而改变的债券/债券修改期限,则这些失衡将得到缓解。

CONCLUSION

结论

The TED spread trade allows for the taking of positions designed to profit from correctly anticipating changes in credit risks associated with U.S. Treasury securities, on one hand, and Eurodollar deposits on the other. If properly constructed, these trades generate rewards if expectations are realized, irrespective of whether interest rates generally rise or fall.

TED利差交易允许采取头寸设计,目的是从一方面正确预测与美国国债有关的信用风险的变化中获利,另一方面从欧洲美元存款中获利。如果构建得当,这些交易会在实现预期的情况下产生回报,而不管利率通常是上升还是下降。

Given the capability of trading Eurodollar futures contracts on a quarterly cycle that extends to forty quarters, these trades can target specific points on the yield curve, ranging from three months to ten years. At the three-month horizon, proper trade construction is trivial, requiring a one-for-one offset of Eurodollar and Treasury bill futures. With longer horizons, TED trades are generally taken to mean offsetting positions in cash Treasury securities and strips of Eurodollar futures.

鉴于欧洲美元期货合约的交易能力可以扩展到四个季度的一个季度周期,因此这些交易可以针对收益率曲线上的特定点,范围从三个月到十年不等。

在三个月的时间范围内,正确的贸易结构是微不足道的,需要一对一抵消欧洲美元和国库券期货。更长的时间里,TED交易通常被认为是指抵消现金国债和欧洲美元期货的头寸。

Implementation of such term TEDs is somewhat more complicated, because the appropriate trade proportions are not fixed as they are with three-month TED spreads. Nonetheless, having the capacity to design these trades makes it possible to seek out trading opportunities from a host of possible interest rate pairs.

此类专业术语(词汇)TED指标的实施要稍微复杂一些,因为适当的交易比例并没有像TED的三个月价差那样固定。尽管如此,具有设计这些交易的能力使得有可能从大量可能的利率对中寻找交易机会。

REFERENCES

Caks, John. “The Coupon Effect in Yield to Maturity.” Journal of Finance, Vol. 32, No. 1 (March 1977).

Kawaller, Ira G. “Eurodollar Bundles and Hedging Considerations.” Journal of Financial Engineering, Vol 4, No. 1 (March 1995).

__ “Stacking vs. Stripping with Eurodollar Futures.” CME Strategy Paper, 1991.

Sturm, Frederick, and Peter Barker. “What’s New in CME Interest Rates – Bundles, Packs & Stubs.” CME Strategy Paper, 1996.

其实对于很多对于全球宏观交易感兴趣的朋友,其实可以考虑加入我的知识星球,我基本上是每天更新,包括不定期的更新交易想法还有持股清单。

以及我对于宏观经济大趋势的判断,更整合了不同的研报,各家投行的观点。

同时也囊括了A股,港股,期权,美股,ETF,还有外汇等交易干货。

通过订阅星球可以更系统性的去理解全球地缘政治以及交易的核心。星友大多数都是机构的专业投资者以及硬核的人群。

越早建立投研国际观越早能够改变格局,一顿火锅钱改变自己的思维加强自己的金融能力,何乐而不为。在未来竞争越发激烈的时代中,你需要通过金融的能力赚钱,改变自身的命运,收获真正的思想自由,财务自由!

请关注小号,搜索微信公众号:灰岩国际咨询,防失联,谢谢!

未来我会更多在新号上面发布文章!

全新会员网站将在近期上线,敬请关注。

最后给大家发个福利,D君这里可以低佣开A股,

龙头券商,万1.2开户,期权手续费2元一张(含规费)。

欢迎加微信:1185199221

咨询,备注灰岩科技粉丝可享更低佣金优惠。