09.24.2019 Tue, Sunny, Air Polluted

The Fed Behind the Curve

Summary:贸易消息面风声鹤唳,叠加德法PMI继续大幅下滑导致欧洲市场risk-off情绪,而美股则在相对较好经济数据和连续多位Fed委员鸽派讲话鼓舞下反弹。在财政政策配合之前,全球经济下滑态势不改。

EU

Another supposed to quiet and slow start to this week since Japan left on holiday again. Asia bourses traded weak led by A share, which saw a bleeding session despite marginal positive developments on the trade front over the weekend. The words of 'productive' and ' constructive' are used by both sides to describe the trade talks on last Thursday and Friday respectively. Concerns that the talks had deteriorated on the cancelled farm visit were eased after reports that it was at US request and unrelated to progress.

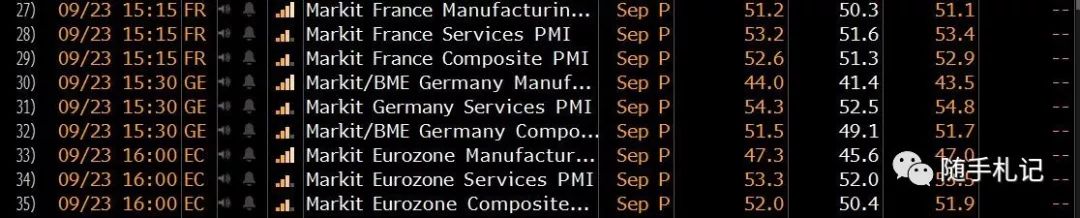

The series of PMIs from DEU/FRA/EC did catch the market off guard. 3:15 France PMI lower than expected; 3:30 German PMI extremely poor; 9:00 Euro area composite down to 50.4 from 51.9 in August. Just as Phil Smith from IHS Markit said 'All the uncertainty around trade wars, the outlook for the car industry and Brexit are paralyzing order books, with September seeing the worst performance from the sector since the depths of the financial crisis in 2009'. Most EU stocks slumped while EGBs were in strong bid tone .

Draghi testified before at EU parliament , which is his final appearance in ECON as Chair of Europeans systemic risk board.

Knot said low interest rates look 'quasi-permanent' and Vasle sees likely need for further action.

UK's supreme court rule

data

US

USTs traded bull steepened amid a number of Fed speakers and poor European flash PMIs right before the midnight. 10yr yields dipped as low as 1.665 at one point before drifting the remainder of the New York session all the way back towards 1.72. Part of the pressure might have been related to the $10bln 5y/10y/30y deal from new issue of credit. But SPX rose a tad higher as the market appeared to interpret comments from the Fed’s Williams and Bullard. And as to the US Markit series, neither the manufacturing nor services component slipped into contractionary territory today in the US. This may have also helped boost US risk assets, as the European PMIs printed quite badly yesterday.

As to Fed, Bullard (dovish, voter) said the key risk is that the US economy slows more than expected, and that trade uncertainty is a disincentive for global investment. Daly (nonvoter) said she supported the Fed’s rate cuts in July and September, but that the US economy is still “in a good place,” as growth is being buoyed by consumers.

NY Times reported that the US-Japan trade deal may be delayed over President Trump’s ongoing threats of taxing Japanese automobiles.

data

8:30, Chicago Fed national activity index 0.10 vs -0.03, prior -0.36 down to -0.41

9:45, US Markit manufacturing PMI 51.0 vs. 50.4, prior 50.3

service PMI 50.9 vs 51.4, prior 50.7

composite 51, prior 50.7

events

DEU IFO

FRA manu confidence

US FHFA, Richmond Fed, Conf. Board Consumer confidence

40bn 2yr

comments

Fed lower the rates but split on decision. And now ECB have adequate reason to act more now. But what the global economy is enduring is structural issues rather than cyclical. More and more sound called on fiscal policy to cooperate , even the all-mighty YANGMA joined the campus as high rank official as Draghi. At the same time , the limitness of conventional and un-conventional monetary policy , especially of negative rates, started to be taken into account. Whatever next step it is, fiscal policy or any adjustment of MP , there could be high vol ahead.