蒙,亨。匪我求童蒙,童蒙求我。初筮告,再三渎,渎则不告。利贞。

我最近想清楚了一件事情,虽然说有教无类,我其实没有求着别人学习的义务,苦口婆心其实是不对的,只有好学想学的才有必要教,一些基本的东西问一次可以回答,两三次就是亵渎了,亵渎我凭什么要告诉他

~~~~~~~~~~~~~~~~~~~~~~~~~~

以下是第16~20条

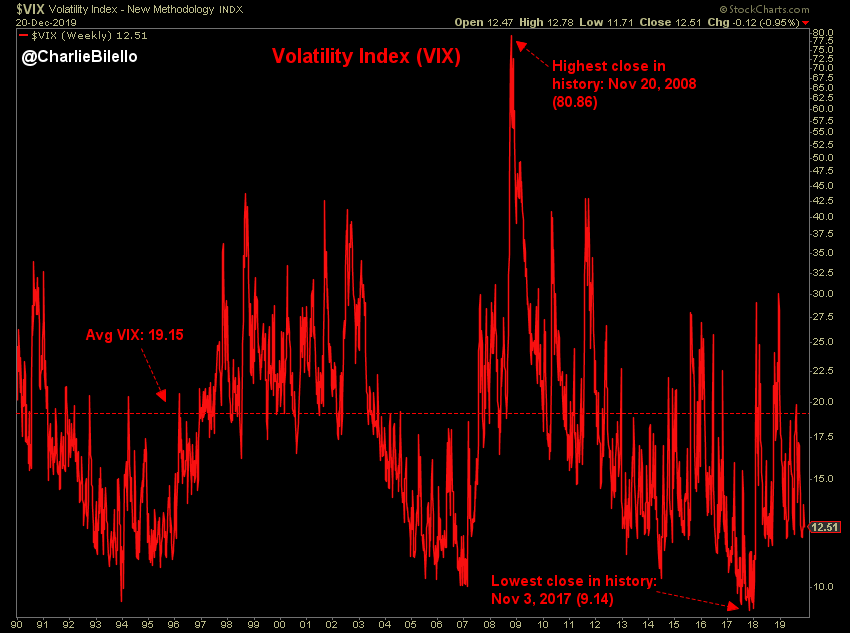

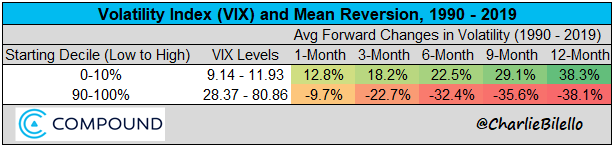

16) Volatility and Sentiment are mean-reverting at extremes.

均值是金融市场的铁律,波动率和情绪尤其如此

When volatility spikes and fear abounds, it can seem as if the bad news will never end.

But it will. Time heals all fears and good news is on the horizon.

When volatility spikes to extremes, it tends to fall. When it plummets, it tends to rise.

上面是波动率均值回归的图示和统计,这玩意对做期权确实很有借鉴意义

Reversion to the mean is the iron rule of the financial markets.

–JACK BOGLE

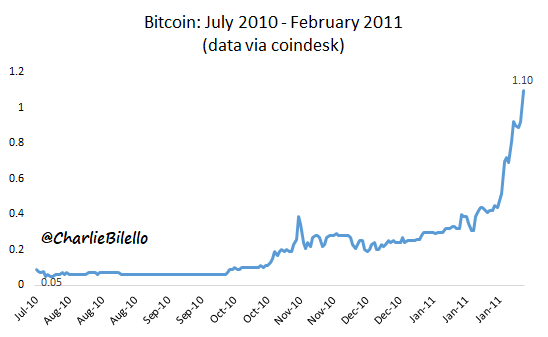

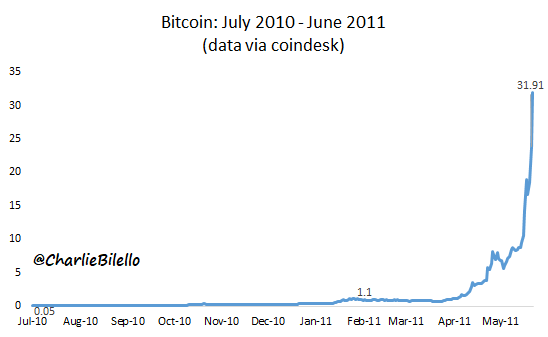

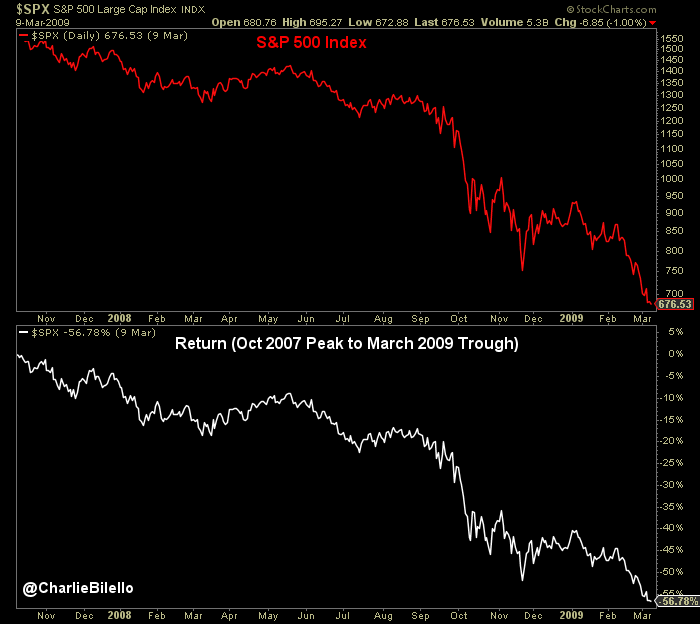

17) NO ONE RINGS A BELL AT THE TOP OR THE BOTTOM. MANY RING IT IN HINDSIGHT.

没人知道顶部或者底部除了骗子

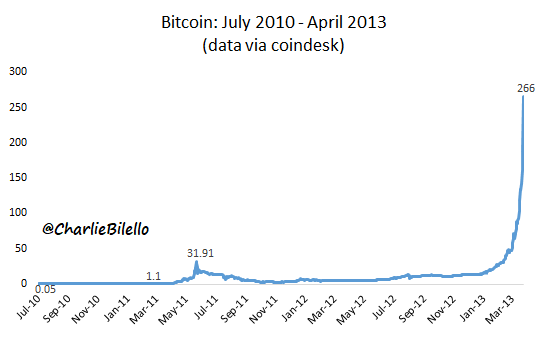

Take a look at this chart. Does it look like a top to you?

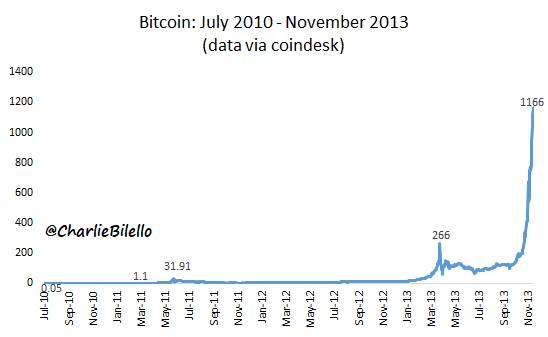

How about this one?

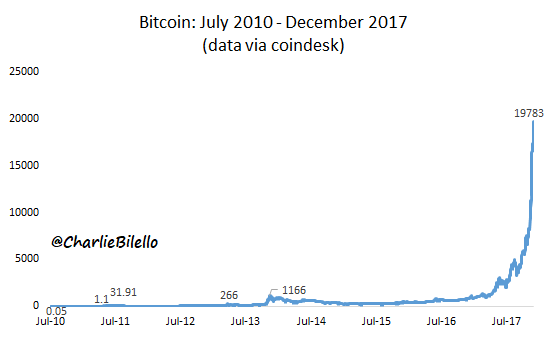

Or this this one?

Not yet? Surely this one looks like a top, right?

Yup, there it is. As clear as day. If only someone rang a bell.

上面没什么好翻译的了,猜顶和猜底是卖方最喜欢干的事情,主要是需求特别高,因为更傻啦吧唧的人一堆堆的

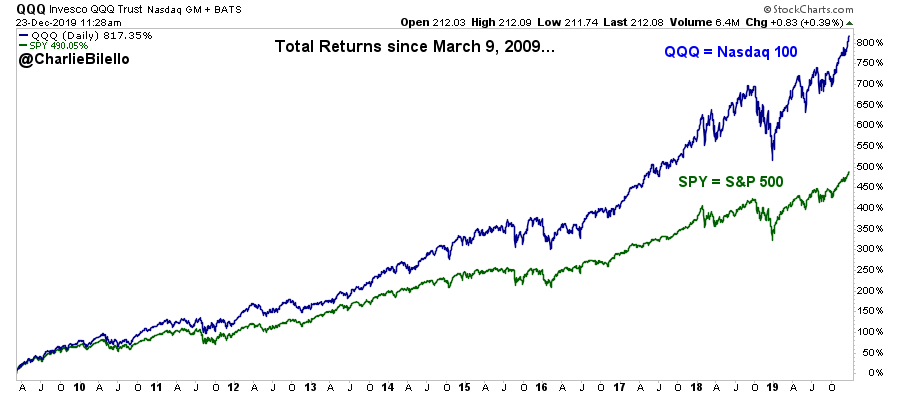

18) The best strategy is the one you can stick with long enough to reap the benefits of compounding.

长期贪婪才能享受复利的好处

Identifying the “best” performing strategy is an impossible task, but harder still is sticking to such a strategy.

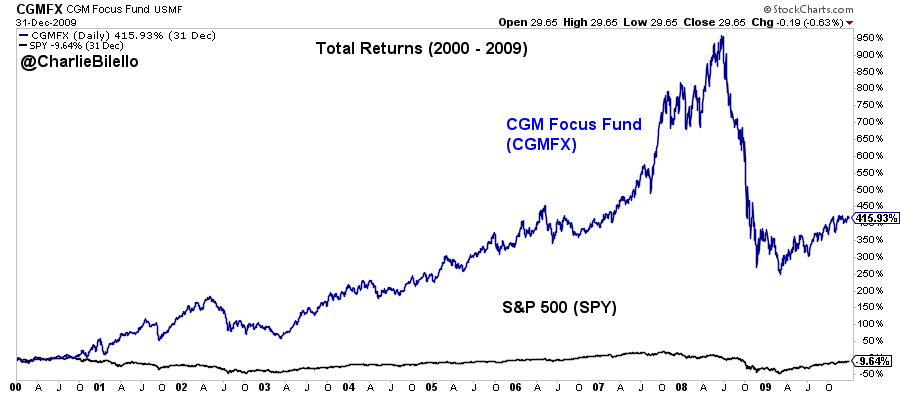

Take the “fund of the decade” from 2000 to 2009: CGM Focus. It gained over 18% annually (more than 3% better than its closest rival) while its shareholders lost 11% annually.

How is that possible?

Investors poured money into the fund after strong performance and pulled money out after weak performance. They bought high and sold low, unable to stick with it when times got tough.

上面讲的例子是一只名为CGM Focus的明星基金产品,2000年到09年年化复利18%(比排名第二的多3%),然而这只产品的持有者却年均亏损11%,为什么呢?因为基金持有人追涨杀跌,基金净值表现好就追买一跌就赶紧赎回,结果统计下来持有人年均亏损11%,当然图上面08年大跌应该贡献了大部分的亏损。

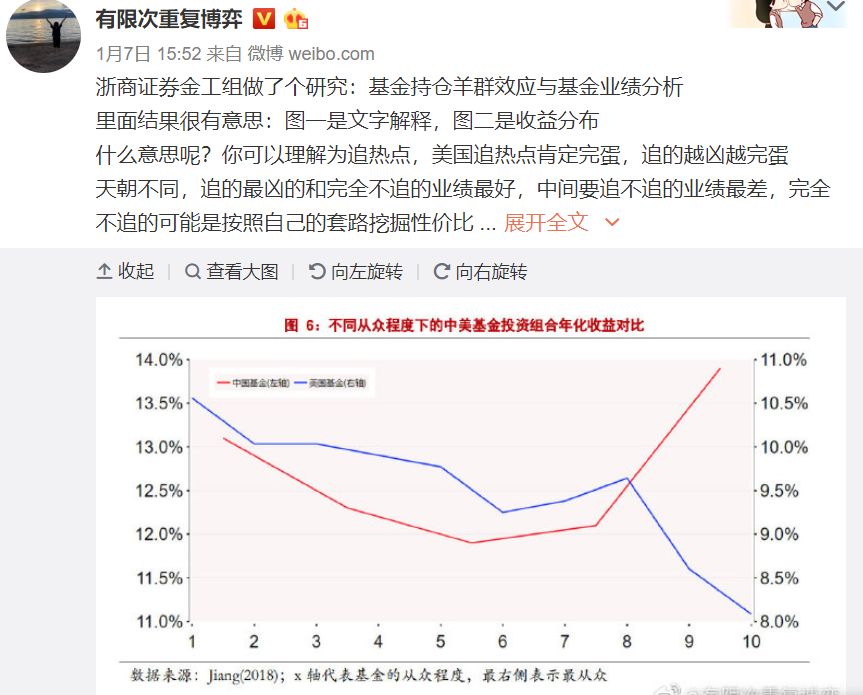

长期的贪婪从个人投资角度我个人的理解是坚持一个长期的盈利策略,不要一会这一会那,会得不偿失的,我微博上发了个帖子各位可以参考一下:

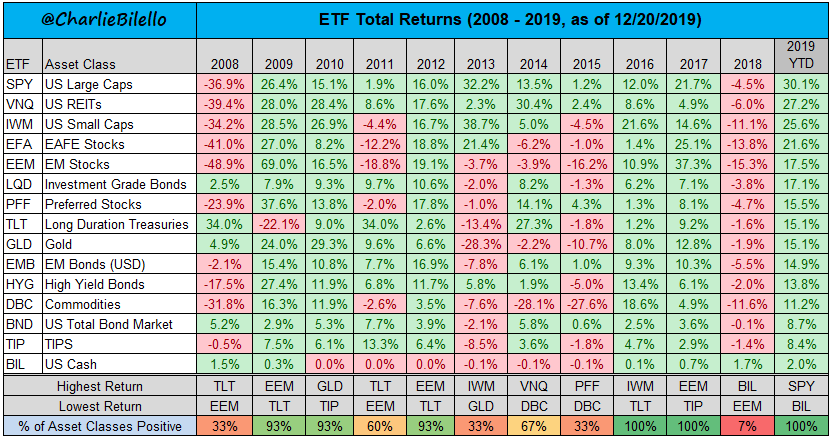

19) Diversification and asset allocation protect us from the inability to predict the future.

多元化和资产配置使我们免受无法预测未来的困扰

What asset class is going to be the best in 2020? How about the worst?

If we could predict the future, we would own all of the best and none of the worst.

But alas, such prognostications are impossible, which is why we diversify.

Data via YCharts

往后看黄金万两,往前看一片迷茫。大家都可以说茅台怎么怎么样,然而茅台董秘透露没有一家机构持有茅台三年以上,承认自己的无知,适度分散其实是对我们无知的一种保护。

20) Learn to control your emotions or your emotions will control you.

学会控制情绪,不要让情绪控制你

Fear and greed are primal emotions. We’re wired to respond to them. This served us well from an evolutionary perspective but in investing they do more harm than good.

When markets are falling, we fear losing everything and are induced to sell to stop the pain.

When markets are rising, we fear missing out on future gains and are driven to buy to end the regret.

When tempted to act based on fear or greed, step away. Take a deep breath, go for a long walk, read a book, watch your favorite movie. The market will be there when you get back and you’ll be in a better state of mind to make any decision.

There are three great forces in the world: stupidity, fear and greed.

-ALBERT EINSTEIN

三种巨大的力量统治着这个世界:愚蠢、恐惧和贪婪。

——阿尔伯特.爱因斯坦

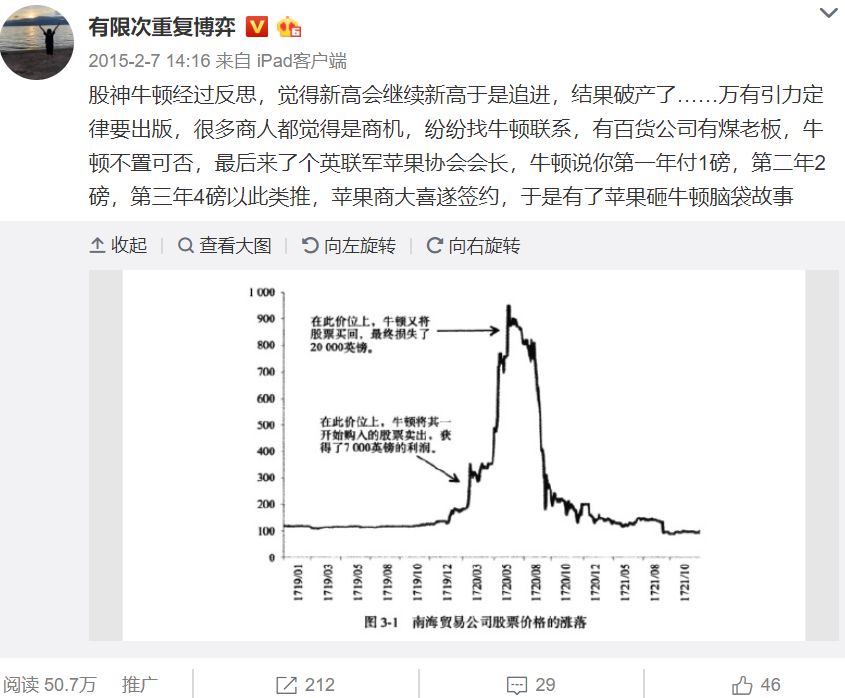

牛顿都躲不过的三大力量,这货追高的时候还给自己找了个理由:“An object at rest tends to stay at rest and an object in motion tends to stay in motion with the same speed and in the same direction.”这句话说的是牛顿第一定律:任何物体都保持静止或匀速直线运动的状态,直到受到其它物体的作用力迫使它改变这种状态为止。

恐惧与贪婪外加愚蠢,大部分投资悲剧都是这么诞生的,要控制其实很难,认为自己对的应该坚持如果错了就一刀剁了,问题是很多人根本不知道自己错了还是对了,也就是愚蠢的问题无解,那么恐惧和贪婪其实根本无所谓了。

能分清对错的基础之上才能谈恐惧和贪婪,这是大部分人没搞懂的地方。恐惧和贪婪通过训练能够极大的改善,愚蠢却是无解的,因为很多蠢人不知道自己蠢,我是牛顿,我怎么可能蠢?最后只能哀叹一声我可测算出天体运动轨迹,却算不出人性的贪婪

~~~~~~~~~~~~~

后记:总算意译完了,我感觉我写的比原作好,我自己都忍不住多读了两遍,感觉这篇文章的精华原来是我的点评,喜欢的点个在看吧。