When Fundamental and Technical Analysis Diverge

It was a hot, windless, 1985 summer afternoon in Manhasset Bay. My friend Tony the floor broker and I had been drifting along in his sloop for the past hour, waiting for the two o’clock southerly to come in and send us scurrying over to the North Shore of Long Island Sound for some of City Island’s specialty - fresh clams and mussels. Sitting motionless in the still air with the only sound being the slatting of sails and rigging is b-o-r-i-n-g, and, with neither of us being avid conversationalist, we had apparently exhausted our normal subjects. This may have been why we got into the conversation I am about to relate. All my friends know my rule that I don’t want to hear anyone’s market opinion, nor do I care to give my own. But here we were all of a sudden talking about the heating oil market. Actually, we weren’t talking-it was Tony talking and me listening, but why split hairs?

1989年仲夏日的下午,曼哈斯特湾是个炎热,无风的天气。我和好友场内经纪人东尼躺在他的小帆船上,了无生趣地泡了一个小时,等候两点钟的南风,把我们送到长岛沿海的北岸,享受一些海鲜——新鲜的蛤蚌和贻贝。寂静的空气中,船身一动也不动,唯一听到的声音是帆和绳子噼啪的碰撞声,无聊地令人窒息。我们两个都不健谈,平常的话题快谈光了。也许这跟我们即将谈到的话题有关。我所有朋友都知道,我有一个作风,那就是绝不听别人的市场意见,我也不跟别人谈自己所知道的。但是就在那艘船上,突然间我们聊起了取暖油市场。严格地来讲,不能说是我们在谈,应该说是东尼在讲,而我在听,但何必在小事上争论不休?

“I’ll give you something very confidential, but first you have to promise not to disclose to anyone,” Tony whispered in a near furtive tone. “Look, why all the cloak-and-dagger stuff out here?” I asked. “No one around in any direction for maybe 500 yards. Besides, I’m not interested in you tip, and if you do tell me, I’m going to call everyone I know and say that you gave it to me.” Well, that ought to discourage him, I thought.

“我要告诉你一件非常机密的事情,但首先你得保证绝不能告诉任何人”,东尼显的很亲密,小声对我说。“干嘛总是一副神秘兮兮的样子?”我问,“放眼看去,500码内没有别人,而且,我对你的小道消息根本没有兴趣,要是你真的告诉我,我一定打电话告诉所有人,就说是你说的。”嘿,这么一来,他就不敢讲了,我心里想。

Wrong! It didn’t take him more than a few seconds to recover from that mild rebuke, and he was back for a second shot. “Tell you what,” he countered, “I’ll let you in on it, but please, don’t tell anyone I gave it to you.”

错了!我这么客气地指责他,没过几秒钟,他又开始说了:“我跟你讲,我会给你这个机会,不过还是拜托你,千万不要告诉别人。”

He was certainly determined, I thought - it must really be something. And it sure was! “Yamani is shortly going to announce that the Saudis will double oil production.” Long pause ensued. “So?” Was the best I could muster under the circumstances. But Tony was clearly not to be put off. “So? Is that all you can say? Don’t you realize that significance of this? When the oil minister of the leading producer announces he is doubling production, the market price will drop $20, maybe $30 overnight. There’s a fortune to be made here, and I’ve dropped it into your lap. Besides, all the big guys on the floor are going heavily short.”

我想,他是下决心非说不可了——这其中一定有些名堂。果然不错!“雅曼尼就要宣布沙特阿拉伯的石油产量要增一倍。”接下来是很长的停顿。这种状况下,我唯一能挤出来的话是:“那又如何?”东尼显然不相信我的话,“那又如何?你就说这么一句话?你难道真看不出来这里面的意义吗?全球最大产油国的石油部长说他要增加一倍的产量时,市场价格一夜之间不跌20元才怪,甚至30元都有可能。这里有钱可赚,我给了你机会。还有,营业厅里的大户都在大量做空。”

I had heard all I cared to. Besides, who wanted to have this junk ruin what would shortly be turning into a perfectly fine afternoon of sailing. “Look,” I snapped back, “I don’t know very much about the Saudis and their oil minister or about oil production and its effect on futures prices. And I certainly don’t know, nor do I care, about the ‘big guys’ and what they do or don’t do in the market.” (I had heard the big guys stories so often I was totally immune to them by now.) “What I do know, though, is that it’s a bull deal, and the market looks higher to me. So can we talk about something else, now?” Well, I apparently prevailed, although I never saw this unflappable professional trader look so stunned. But my tactic rescued the day, and the balance of the afternoon turned out just fine.

我只听进我想听的东西,而且,我怎舍得让这种无稽之谈破坏马上就要来到的美好午后扬帆之旅呢?“你看,”我抢着打岔,“我对沙特阿拉伯这个国家懂得不多,也不认识他们的石油部长,产油量多少才算多,多少才算少,对期货价格又有什么影响,更是不懂。而且,我真的不知道,也不关心那些大户在做些什么,或没有做什么事情。”(我听过的大户故事有一箩筐,可以说,我已经有了免疫能力。)“但是我确实知道现在是做多的时候,我看到市价还会涨得更高。我们可不可以谈点别的东西?”嘿,我显然占了上风,我从没看过这位纵横沙场从来面不改色的专业交易者脸上有那么惊讶的表情。但是我的做法救了那一天下午,我们玩的很尽兴。

The conversation was very much on my mind that evening, and I wasted no time in setting out my various charts and technical studies for a careful reexamination of the market. Perhaps there was something in this scenario that I had overlooked or misinterpreted, and a careful double-check seemed a good idea under the circumstances.

那天晚上,谈话内容一直回绕在我脑子里。我马上拿出各种各样的图表和技术分析资料出来,仔细重新检查市场趋势。也许有什么地方我看漏了,或者有什么地方理解错误也不一定。这个时候,最好再检查一次。

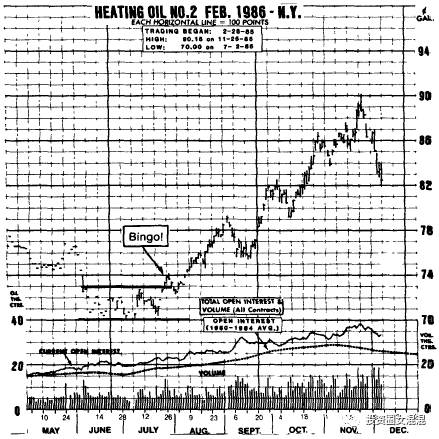

It was mid-July 1985, and the heating oil market had been locked within a tight trading range between 70.00 and 73.00 basis the February future. Some of the computer systems had already signaled to cover shorts and go long on July 10, and I just needed a close over 74.00 - and the strong market action “said” this was imminent - to turn me full bore onto the long side with the expectation of a major upside move in the offing. Let the big guys and their followers gossip and speculate on the oil minister’s announcement and its possible effect on the market. As far as I was concerned, it was a bull market, period! Yamani either would or would not make the announcement - and, even if he did, the bearish news would probably have already been discounted in the market price. And the announcement, if there was to be one, would be the final hope for the trapped bears prior to their being massacred by the strong and rampaging bull. In short, my bullish technical studies told me that we were, once again, seeing the classic bear trap in action.

那是1985年7月中旬,2月取暖油一直锁在70.00——73.00非常小的区间内。有些电脑交易系统已在7月10日发出信号,指示平掉空头仓,开始做多。但是我还必须等到收盘价站上74.00再全力以赴做多,因为我预期一波大涨行情呼之欲出——市场强劲的趋势告诉我这件事近在眼前。就让那些大户和他们的追随者去谈论和猜测沙特阿拉伯石油部长所要宣布的内容,以及这件事对市场的可能影响吧。就我来说,这是个多头市场,此外什么都别提!雅曼尼可能会,也可能不会有那种宣布,即使真讲了那种话,这种利空消息可能早已被市场所消化吸收,并反映在价格上了。而且要是真的有那种宣布,那也只能给困兽犹斗的空头最后一丝希望,接着马上会被势如破竹的多头大军踏得片甲不留。简单地说,我的技术分析是看涨,现在正是诱空行情。

Discretion being the better part of valor, I opted to sit this bear tip out from the safety and serenity of my long position in February heating oil. And fortunately for me because, following a few more weeks of sideways backing and filling, during which time the big guys and their hapless follower had ample time to get fully committed on the short side, the market on Friday July 26 closed strong, just below 74.00 for February. That did it! The trap had been sprung on the unfortunate bears, and following a brief final reaction, the market commenced an impressive rally that ultimately carried some 16.00 cents, equal to $6,700 per contract (see Figure 6-1). What was even more amazing, the Saudi oil minister did, in fact, announce that he would be doubling production (Tony was at least right on that part of his story) and predicted a sharp drop in prices. The market, however, was not impressed-in its frantic race towards higher levels, it barely stumbled over the minister’s epic announcement. This must have absolutely unglued the intrepid and greatly painted short payers, who, in the end, lost considerable millions due to their blind acceptance of a bear tip in a bull market.

有勇有谋是很好的,我没有相信空头小道消息,安心地持有2月取暖油多头仓。幸运之神很照顾我,因为接下来几个星期,大盘横向盘整,上下起落,让那些大户和可怜的追随者有充足的时间满仓做空。终于这一天来到了!7月26日星期五,2月期货强势收盘,接近74.00,有苗头了!不幸的空头们终于沦陷了,然后又来了一次短暂的回调,最后市场开始一波强劲的上涨,最后涨了约16.00分,相当于每份合约6700元(见图6-1)。更叫人吃惊的是,沙特阿拉伯石油部长真的宣布了产量要加倍的消息(东尼所讲的故事至少这一部分是真的),而且也预测价格会大跌。但是市场却不为所动——在它像万马奔腾般迈向更高价位之际,并没有因石油部长熊壮的宣布而摔一大跤。这件事情一定叫那些勇猛的空头斗士泄气,也给他们造成很大的痛苦:他们在多头市场中听信利空小道消息,最后输掉了上千万。

图6-1 1986年2月取暖油 (文字:猜对啦!)

【During June and July 1985, the market was locked within a tight trading range between 70.00 and 73.00. Despite major short positions on the part of many floor traders anticipating a bearish announcement from the Saudi oil minister, the market broke out on the upside on July 26, commencing a major bull move to the 90.00 level. This resulted in losses of many millions of dollars to the big guys and their hapless followers, who had been caught in the classic bear trap that they had so often engineered in the past. Their mistake? Following a bear tip in a bull market.

1985年6月——7月间,市场锁在70.00——73.00的狭窄区间内。后来很多现场交易者预期沙特阿拉伯石油部长就要发表利空的宣布,纷纷做空,仓位很大,虽然如此,7月26日市场向上突破,开启了大多头趋势,直到90.00。很多大户和追随者掉入空头陷阱(以前他们常对别人玩这种把戏),亏损了上千万。他们犯了什么错?他们在多头市场中听信利空消息。】

There is a very clear-cut moral to this unfortunate story: Play in the real world. Beware of tipsters and other well-intentioned worthies bearing gossip and free advice. And when the fundamental and technical conclusions and market projections are at odds, disregard the technical conclusions or hang onto an anti-trend position without projective stops at your extreme peril!

这个不幸的故事给了我们上了一课:要玩就要在真实的世界中玩。我们必须当心那些爱传消息的人,以及一些好心的小道消息和免费的建议。当基本面和技术面的结论与市场的预测趋势相反时,不管技术性的结论,死守逆势仓位且不设止损点的话,很容易面临险境!

This lesson was reinforced sometime later when, on a trip to Geneva, a Swiss colleague and I were discussing interest rate trading, “How can your speculators possibly trade these markets on the basis of the gossip and so-called news analyses carried on your TV and newspapers?” he asked incredulously. “Every time some learned expert makes a pronouncement about inflation or the deficit, about balancing the budget, about higher or lower interest rates, the market almost seems to jump in cartwheels. Why you even have some prominent economist nicknamed Dr. Death, whose followers have merely to announce that he will make some speech and the markets suddenly plummet.”

过了不久,我到日内瓦去,关于这个教训,又上了一课。当时有个瑞士同行跟我聊了起来,谈到交易利率的事情。他用十分怀疑的语调问:“你们那里的投机者怎么能靠闲谈,电视,报纸上所谓的新闻分析去交易呢?每次有所谓的博学专家大谈通货膨胀、赤字、预算平衡和利率涨跌时,市场总会鸡飞狗跳。甚至于你们那边有个绰号叫死亡先生的著名经济学家,追随者只要宣布他要出来讲话,市场就会大跌,怎么会这样。”

Well, I couldn’t really disagree with my friends, whose familiarity with our vernacular led him to describe financial futures trading as “a mugs game.” Indeed, we have all heard the myriad pronouncements and predictions concerning interest rates and the diverse factors that influence them. For example, talks to reduce budget deficits hit a snag, the Fed is about to loosen (or tighten) credit, the vice-chairman of one of the Reserve Banks says that the economy might be starting to overheat, or an apostle of disinflation is rumored to have altered his projection for the inflation index.

我非常同意这位朋友的看法。他对美国风土人情的了解,使他把金融期货交易描述成不可能赚钱的活动。没错,我们全都听过不少人高谈阔论,预测利率的可能趋势,大谈影响利率的各种因素。比如说,削减预算赤字的努力碰壁,联邦储备委员会就要放松(或紧缩)银根,储备银行的副主席表示经济可能开始过热,某位本来认为通货膨胀压力下降的人士据说已经改变了他对通货膨胀的看法。

Just about every time that one of the above hits the TV screen or the printed page, the Fed watchers and the financial futures gamblers try to make some logical sense of it and try to equate it with what is happening or what they expect to happen in the market. Meanwhile, the few canny and disciplined operators who follow price trends and objective technical analysis rather than political statements and slogans place their (usually) winning bets, sit back to watch the show, and wonder what the big fuss is all about.

当上面所说种种看法见诸电视屏幕或报章杂志时,观察联邦储备银行动向的人和金融期货市场上的赌徒就想从中找出逻辑上的含义,并与市场上正出现的情况联想在一起,或者去探测市场可能出现什么样的趋势。与此同时,极少数精明谨慎,严守纪律的交易者,还是一如既往,追随价格趋势和客观的技术分析,下好(通常是)必赢的赌注。他们不理政治性的声明和任何口号,坐在一旁看着别人表演,也看不明白别人在忙乎什么。

Particularly during volatile market periods, it’s necessary to focus on an objective analysis of market trends, both short-and long-term, and to ignore (and admittedly, that’s not easy) the hysteria and sounds of alarm that accompany all the learned pronouncements.

尤其是在市场激烈波动的期间,更有必要把注意力焦点放在市场趋势的客观分析上,短期和长期趋势都要分析,同时要忽视全部专家所说的话,以及伴随而来的骚乱和警报(当然,要做到这一点并不容易)。

I found myself entrapped in this way recently, and I should have known better. There I was, sitting peacefully in front of my charts and my little green screen having successfully resisted, at least to that point, getting suckered into the long side of interest rate futures during a pronounced bear cycle. Going through the daily business paper, I could feel my pulse quicken while reading what the president had said about the ongoing bipartisan deficit reduction talks. Why should I care about all the and, above all, why should that have influenced me to get into the market? Yet moments later I picked up my Chicago phone and calmly bought, at the market, a quantity of T bond futures. Clearly, I was buying against a strongly entrenched downtrend and on a minor technical rally no less. If anything, the order should have said sell and not buy. So why didn’t I “lie down till the feeling passed?” In retrospect, I realized that I had succumbed to a combination of undisciplined wishful thinking and wanting to be in that market (it seemed too low to sell, I rationalized) at that time. The red ink from that trade will serve as yet another reminder-not that I need any more reminders-that trying to pick off tops or bottoms against strongly entrenched price trends is invariably dangerous to one’s financial health.

我发现自己最近也跌进同样的陷阱里,而这是很不应该的。我本来是很心平气和地坐在桌前,看着图形和那小小的彩色屏幕,至少到那时为止,还很成功地避免在明显的空头趋势里做多利率期货。但是当我翻开某份商业日报,看到总统对于当时进行中的两党赤字缩减谈判的谈话,可以感觉自己的脉搏加快。为什么我要去注意这种事情,而最重要的,为什么要让这种事情影响我进出市场的判断?但是没多久,我拿起直通芝加哥的电话,平静地以市价买入不少债券期货。很明显的,我是在趋势稳固的强大空头市场里逆势交易,而且是在一个小小的技术性反弹处买入。如果要有什么动作的话,那应该是卖出,不是买入。那为什么我没有“躺下来,直到情绪过去为止”呢?事后回想起来,我当时是屈服于两种因素之下,第一是我没有纪律,想当然;第二是希望自己能尽快买点东西(我给自己找理由说,价格看起来似乎太低了,再卖也没多少空间)。这笔交易亏了钱,可以给我一个教训——在明确的价格趋势中,想要逆势抓头部或底部,对个人的财富绝对是有害的。

The need for a disciplined and objective approach to futures trading is a recurring theme in this book. We have all had the experience of relaxing our vigilance, of ignoring the technical picture of the market, which is generally quite clear if we are willing to see clearly. And the results are uniformly predictable, aren’t they? I used to think that I knew most of the ways eggs can be served. However, after nearly 30 years in this business, I have come to appreciate one form of egg that, for lack of a better description, can be called “the commodity trader’s special.” I am referring, of course, to egg on the face, and, at one time or another, each one of us has had it served up. It has to be one of the most expensive dishes you’ll encounter. And, although the trader tries to wipe it off as quickly as possible, regrettably there are compelling human forces - hope versus fear, greed, impatience, and, above all, lack of discipline-that counter these will-intentioned attempts.

本书会一而再,再而三地提到两件事情,一件事是交易期货时必须守纪律,另一件事是要采取客观的方法。我们都有这样的经历,放松警惕,忽略了市场的技术面。大体来说,只要我们想看清楚,市场通常都是很清楚的。结果呢?很惭愧。过去,我总是认为自己知道大部分做鸡蛋的方法。但是,在这个行业打滚了近30年,我才知道有一种蛋的做法,无以名之,姑且叫做“商品交易者特制蛋”。这种蛋是丢在人的脸上的。我们每个人或早或晚,都曾经吃过这种蛋。这是你吃过最贵的一道菜。而且,虽然脸上有蛋的交易者极力想把蛋抹掉,很遗憾,似乎有一股强大的力量抵抗着这种努力。这就是希望和恐惧的斗争,贪婪,没有耐心,以及最重要的,不守纪律。

相关阅读:

【原文推送】克罗谈投资策略(01)

【原文推送】克罗谈投资策略(02)

【原文推送】克罗谈投资策略(03)

【原文推送】克罗谈投资策略(04)

【原文推送】克罗谈投资策略(05)

长按图片点击“识别图中二维码”关注本混混的公众平台~

................................................................................

▋投资圈女混混 版权声明

[版权声明]本文(除标注非投资圈女混混的作者外)系原创稿件,全文及配图所有权利皆为署名为投资圈女混混的原作者所有。非商业用途转载:请标明出处,并保留投资圈女混混公众号信息及署名,必须与本文严格一致,不得修改/替换/增减本文包含的任何文字和图片,不得擅自增加小标题、引语、摘要等。除特别声明和单独授权,本公众号一切内容禁止纸媒,即印刷于纸张之上的一切组织包括但不限于转载、摘编的任何应用和衍生。商务合作转载:请联系投资圈女混混公众号(INVEST_SmallPotato)。本文所提供的报告下载链接,仅限于学习用途,不得用作商业用途,下载后请于24小时内删除,谢谢。