2017年6月8日,高考结束了。

中国医药投资也进入并购期,以德福资本为主的财团花巨资收购美国纳斯达克上市公司赛生制药。标题如下:

SciClone Enters Into Definitive Merger Agreement To Be Acquired By Consortium Led By GL Capital。

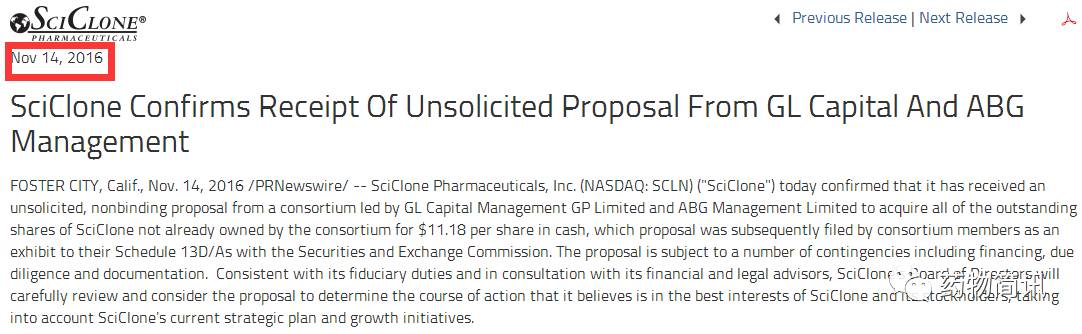

提出时间是2016年11月14日。

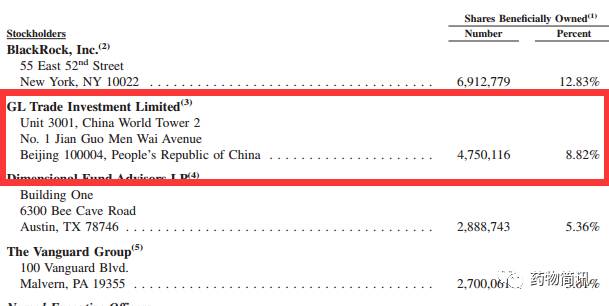

收购财团成员:

德福资本、中银集团投资、鼎晖资本、上达资本和Boying投资。财团们将以现金11.18美元每股收购赛生所有已发行股票,该交易将由财团通过由财团联盟提供的股权融资和债务融资联合完成,不受融资条件约束。该交易得到了SciClone董事会的一致通过,该公司以全面摊薄的形式对本公司估价约为6.05亿美元,比赛生于2017年6月7日的收盘股价溢价11%,溢价比其

十日加权平均收盘价

高出16%。该交易预计在今年底前需由股东批准完成。

赛生董事会主席 Jon S. Saxe说到此时董事会决定出售公司是对于股东价值回报最有意义的时刻,尽管赛生迄今为止在其增长战略上表现良好,但随着对其战略选择的不断审查,董事会已经确定,作为独立的美国上市公司继续经营的挑战是复杂的和充满竞争性的, 敏感的中国医药市场对公司保持强劲增长轨迹和实现财务目标的能力构成长期风险。 该协议使SciClone股东能够在短期内实现公司近期交易价格的现金价值和溢价,并消除长期风险和不确定性的风险。

来看看财团点评:

"On behalf of the Buyer Consortium, I would like to express my deep appreciation and admiration to the Board and the management of SciClone. They have done an impressive job navigating through China's complex healthcare landscape and built the Company into the solid and successful business it is today," said Jeffrey Li, founder and CEO of GL Capital. "

此次并购赛生独家财务顾问是:Lazard,法律顾问是:DLA Piper LLP (US)

收购联盟财务顾问是:Morgan Stanley ,法律顾问是:Skadden, Arps, Slate, Meagher & Flom LLP。

关于赛生制药

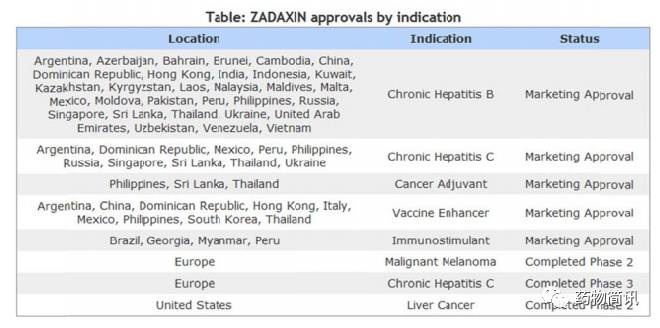

赛生药业公司 (SciClone Pharmaceuticals) 是一家盈利的专业制药公司,在中国拥有大量业务,且产品组合横跨肿瘤、传染性疾病和心血管疾病等主要治疗药物市场。赛生公司的主要专卖产品日达仙(胸腺法新) 已在全球30多个国家获得批准,还可根据当地监管机构的许可用于治疗乙型肝炎(HBV)、丙型肝炎(HCV)及某些癌症,并且也可作为疫苗佐剂使用。赛生公司放眼于有潜力在未来市场跻身领军地位并推动公司长远发展的产品,已成功获得这些产品的授权并实现其商品化,如治疗肝癌的新型产品DC Bead®在中国已获得批准,其他一些产品在中国也处于后期开发阶段。赛生公司还与制药行业的合作伙伴一起进行业务推广,在中国销售多个面向不同治疗方向的品牌产品。赛生公司是一家上市公司,总部位于美国加利福尼亚州福特市,在纳斯达克 (NASDAQ) 全球精选市场的股票交易代码为 SCLN。

In US for China

此则收购不得已想到了去年的:

三胞集团成功在旧金山与加拿大威朗制药达成股权收购协议,以8.199亿美元(约合人民币56.7亿元)现金收购威朗旗下的美国生物医药公司丹德里昂(Dendreon)100%股权。对此,有业内人士分析三胞集团重金收购的国外专利前列腺癌原创新药或许很难在国内及亚欧市场达到该集团的预期目标,前景不太乐观。但其董事长袁亚非却持乐观态度。

而收购赛生也是国内财团收购美国合同销售代理公司(CSO),然而这个公司的主要营收来自于中国市场,中国市场的收入主要来自于一个“神药”-

ZADAXIN® (thymalfasin)日达仙(胸腺法新)

,该药在全球30多个国家批准上市,唯独没有在美国获批上市,也被国内同行戏称为辅助用药

。

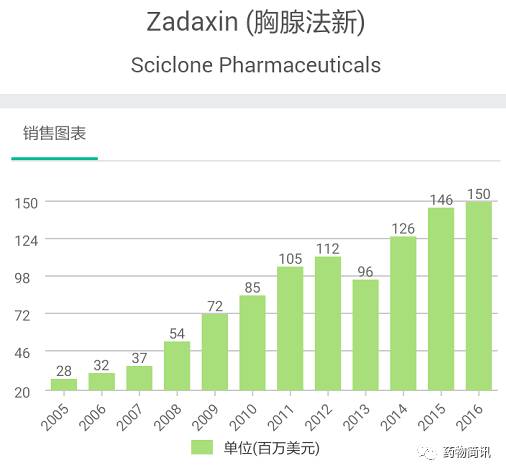

日达仙历年销售数据

日达仙适应症以及上市国家-堪称一绝

公司2016年年报关键信息:

We launched ZADAXIN in China in 1996 and by 2016 our annual worldwide sales of this product reached more than $150 million, 95% of which were sales to China. Today, ZADAXIN is one of the largest imported pharmaceutical products in China, measured by revenue. We estimate our market share of thymalfasin by units is approximately 17%.

China accounted for approximately 95%, 96%, and 97% of our net revenues for each of the years ended December 31, 2016,2015, and 2014, respectively. In 2016, 2015 and 2014, Sinopharm Holding Lingyun Biopharmaceutical (Shanghai) Co., Ltd.(“Sinopharm”) accounted for 93%, 97% and 94% of our net revenues, respectively.

The Chinese government is continuing its efforts to reduce overall health care costs, including pricing controls on pharmaceutical products.

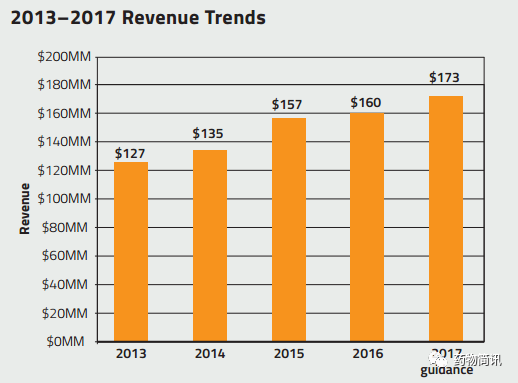

公司近五年销售数据:由此看来其他产品销售额可以忽略不计。

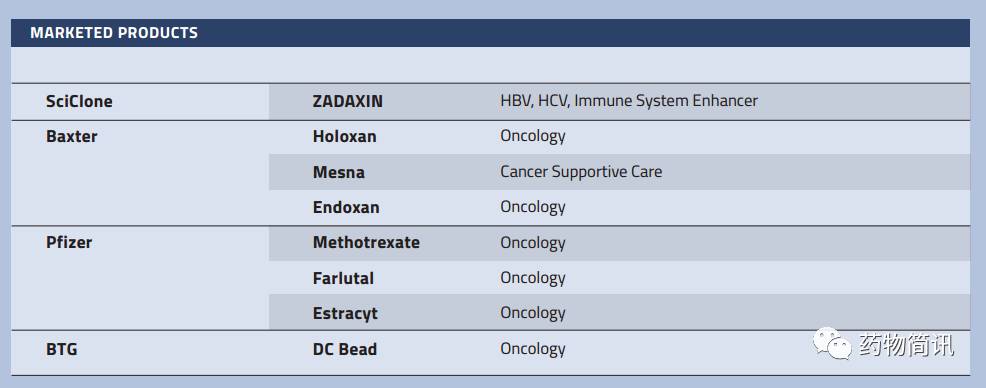

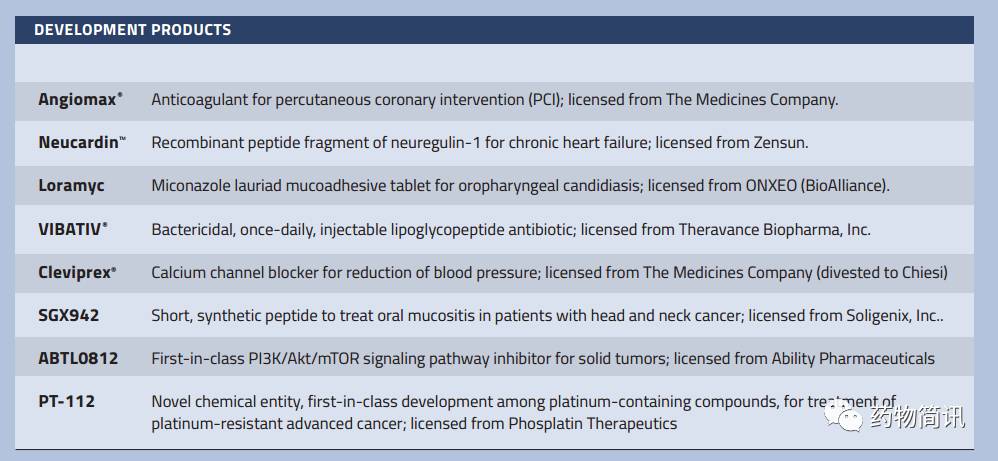

其他产品CSO情况:

其实由以上数据可以得出一个结论,这个公司的上市产品和license in的产品都很不错,也证明了他家BD和MR的能力非常强大,如此丰富的产品线销售额为啥只神药一支独秀呀?明显身在福中不知福啊。

So----De 福来收购你了。。。。

这家公司人员构成:

2016年底,570名员工,540名在中国、20名在美国、10人在其他国家。

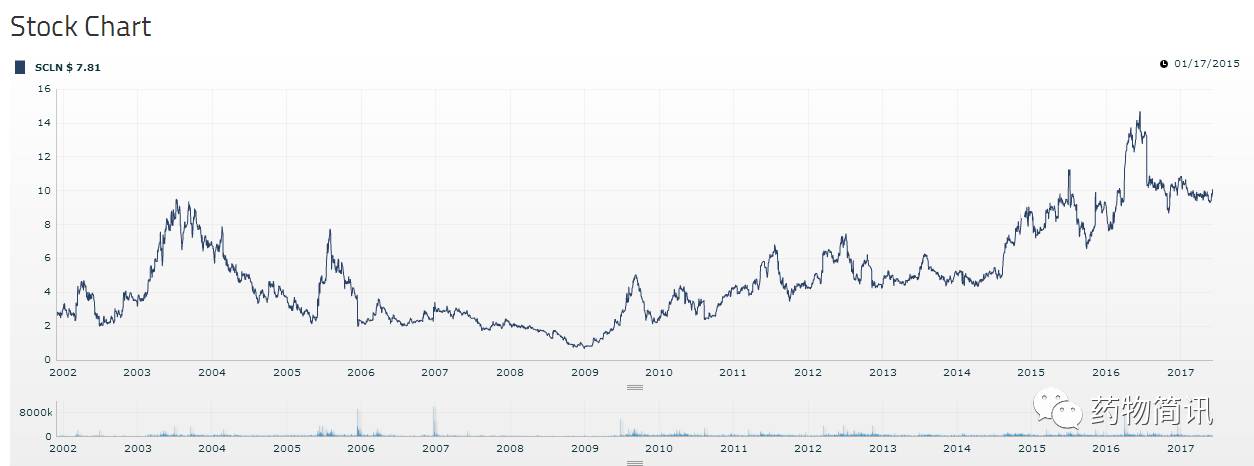

看了年报就知道了这个公司如果仅靠神药未来难以持续,此时被溢价并购绝对赚足。

In February 2017, a new NRDL was published by Government agencies in China. Thymalfasin,and thus ZADAXIN, remain listed as a Category B product. However, since the Catalogue is amended every few years, there is no assurance that thymalfasin will remain on the Catalogue with subsequent amendments. Furthermore, since the provinces have the discretion to exclude Category B products in the Catalogue from the provincial catalogue within certain limits, there is no assurance that ZADAXIN will be included in all the provincial catalogues.

Even if ZADAXIN is included in the catalogue of a province, we

may not be the successful bidder in the government bidding process.

看完整个年报我的感觉是:中国医药政策研究信息最全面的CSO公司,BD能力五颗星、销售能力五颗星(99%给予神药团队)。

公司官网图片-颇具讽刺意味!

股价也是过山车啊

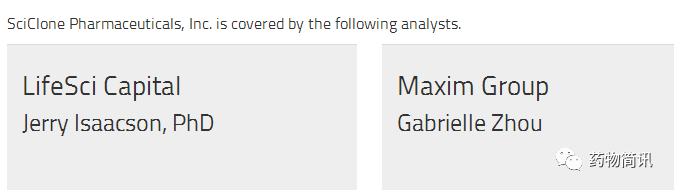

分析师有一位在我们群里啊!-欢迎加入Global invest group!

Gabrielle Zhou is both a Senior Analyst on the Biotechnology team and the leader of the firm’s efforts in China. Her coverage focus is on emerging healthcare and related companies that have a connection to China and the US. Examples include companies like BeiGene, SciClone Pharmaceuticals, CASI Pharmaceuticals etc. As part of this effort Gabrielle in March of 2017 hosted the firm’s Inaugural Healthcare Investor and Partnering Conference in Shanghai, China. This effort brought 21 US life sciences companies to present and meet with over 300 Chinese institutional investors and business development representatives from Chinese pharma companies. Gabrielle is fluent in both Mandarin and Cantonese as well as her third language, English. Gabrielle has worked in the Biotechnology sector in different roles, initially supporting IR functions prior to her transition as a research analyst at Maxim. She is a graduate from New York University where she holds a Master’s degree in Communications. She received her undergraduate degree in English and minor in Accounting from Guangdong University of Foreign Studies.

欢迎关注药物简讯公众号,扫描下方二维码!最新国内外医药行业热点一起共同探讨学习!