中文导读

中国四十多年来的经济改革在曲折中前进,但总体的趋势都是在加大市场在经济运行中所起的作用。2013年十八届三中全会提出“发挥市场在资源配置中的决定性作用”,与这一趋势也是相一致的。不过近几年来国有企业所占的市场份额并未呈现下降趋势,其背负的债务却越来越多,这对于中国及世界的经济都有可能带来不好的影响,应当引起足够的警惕。

Government-owned businesses are becoming more, not less important. That is bad for China and the world.

THE 40-year process of reforming China’s economy has seen occasional retreats. But the general trajectory has seemed plain enough: towards a greater role for market forces. Since the early 1980s, private business has grown far faster and been much more profitable than the state sector. Back then state companies were responsible for roughly four-fifths of output; now they account for less than a fifth.

President Xi Jinping’s commitment in 2013 to give market forces “a decisive role” in allocating resources seemed to presage more of the same. Yet the retreat of state-owned enterprises (SOEs) has stalled, and in some respects gone into reverse. China still has more than 150,000 SOEs. Their share of industrial assets hovers stubbornly near 40%. They account for about half of bank credit, and when the economy slows the state presses them to spend more. Since 2015 investment by SOEs has outpaced that by private firms.

Mr Xi remains well aware of the need for reform; on July 15th he repeated warnings about indebtedness at SOEs. But only some of the initiatives rolled out on his watch are aimed at slimming the state sector. Two of them point in another direction entirely. One is the merging of competing SOEs. The arm of the government responsible for looking after these firms has engineered mergers of ports, railway-equipment makers and shipping companies; a vast chemicals combination is planned. Such deals often seem intended to spawn national champions, not to pare overcapacity.

The other disturbing trend is the proliferation of “state capital investment and operation” companies (SCIOs). The state has thus far tended to dominate in heavy industries, transport and energy, leaving private firms to forge ahead in technology. SCIOs will, in part, function like state-run private-equity funds whose remit is to extend the reach of government. Provincial governments have published plans to push funds into areas such as biotechnology and cloud computing.

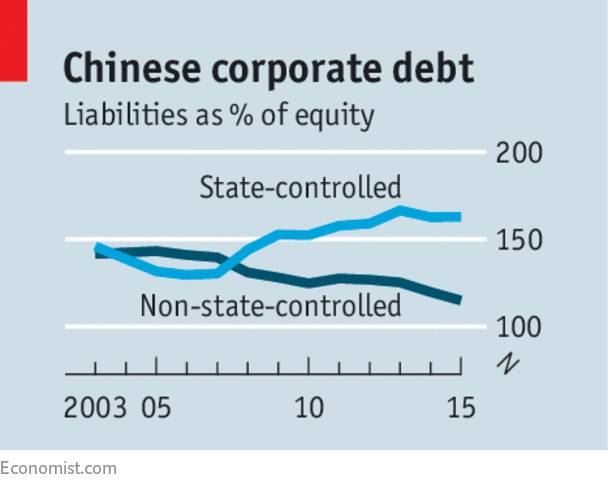

The entrenchment of state firms brings dangers both for China and for the wider world. Domestically, evidence shows that SOEs underperform private businesses. A bigger role for them will mean more inefficiency and slower growth over the long term. State enterprises are also a principal culprit in the alarming build-up of corporate debt in China (nearly 170% of GDP at the end of last year). The IMF estimates that reform of SOEs could bring a $1trn economic dividend over the course of a decade. Their persistence will impose concomitant costs.

SOEs also risk provoking a backlash as they target increased foreign sales. With their opaque finances and domestic privileges, Chinese state enterprises are easily accused of having unfair advantages when they venture abroad. That could nourish protectionist sentiment, or prompt other countries to increase state support for their own firms.

Beat the retreat

Optimists hope for a repeat of a familiar pattern, where a period of retrenchment is followed by a spurt of reform. In this narrative, progress will be made again after the party’s five-yearly congress this autumn, when Mr Xi will have a freer hand to pursue reforms. Sadly, that is wishful thinking. Strengthening the SOEs is consistent with Mr Xi’s belief in tighter state control of just about every aspect of society. A regulatory clampdown on bank lending to big companies, for example, is a way not just to clean up shadowy financial practices but to influence how private firms spend their cash.

Previous leaders have managed the tension between a liberalising economy and an obsession with stability through a mix of rapid growth and political repression. Mr Xi does not want to change that recipe. But he is doing something more radical: reversing the state’s retreat from the economy.

——

July 20th 2017 | Leaders | 615 words