The reflation trade is fading fast

. China’s PPI is starting to roll over, and CPI is weaker than expected. Chinese import volume, excluding the effects of a weakened RMB and surging commodity price, has failed to impress. Surging sales of excavators and heavy trucks are due to nothing much more than seasonality in the first quarter of every year. Property sales growth in 3rd and 4th-tier cities is plunging into negative due to increasingly extended policy curbs on property speculation in many Chinese cities. Passenger car sales growth has also turned negative. Within a month, iron ore has plunged more than 20% into the bear market territory, after suffering the biggest single-day drop for more than a year. These are definite signs that the reflation trade is fading (

Focus Chart 1

).

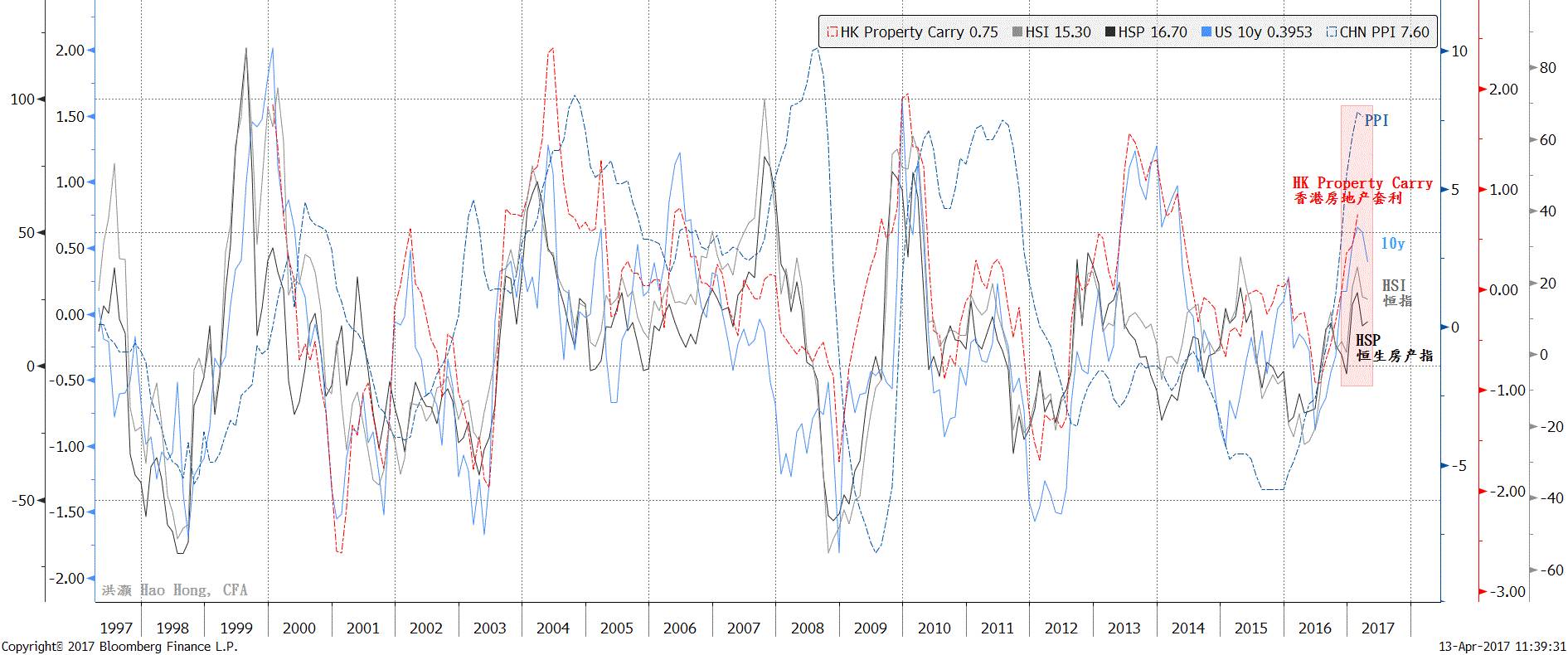

Focus Chart 1: China’s PPI, a signpost for the reflation trade, is rolling over with other cyclicals.

Market irregularities, price inefficiency and the Visible Hand

. Yet the market remains speculative, and ignores the emerging evidence.

The gap between Hong Kong’s property interest cost and its yield is rising fast, and indicates the speculative fervor in Hong Kong

, as well as heightened probability of government intervention (

Focus Chart 1

). However, market irregularities flare up. For instance, the Hang Seng Index was depressed by the disappointing price inflation data for most of yesterday, till the final hour of the afternoon session when mysterious buyers scooped up big Chinese banks and the “Two Oil Barrels” (a collective nickname for PetroChina and Sinopec among Chinese traders), with very large orders to push the index to close up by more than 200 points.

Meanwhile in the A-share market, PingAn and Industrial Banks plunged 4% within minutes under very large sell orders, before regulators started to investigate the validity of these trades. But last minute buying was also seen in other index heavy-weights such as the “Two Oil Barrels” in A-shares, just as the Shanghai Composite was falling yesterday. The trades based on the XiongAn New Zone indeed started to see very large sell orders since April 11, towards the day’s end of trading session.

There are public discussions that the size of some orders coincided with the number of shares owned by some entities with state background. And this morning, a number of companies under the XiongAn theme that traded limit-up for a number of days consecutively issued notice of trading halt due to “irregularities in stock price”. (We believe that the construction of the new zone will take more than a decade, with cumulative fixed asset investment of around two trillion yuan. In an economy that at times invested about 60 trillion yuan in fixed asset, XiongAn will be a small but important part). Further, after industrial commodities’ plunge yesterday, commodity exchange lowered margin requirements for iron ore, coking coal and coke, three futures contracts that have been under severe selling pressure.

The attention from the “visible hand” is bewildering, and may be preventing stocks from pricing in the waning momentum in China’s economic rehabilitation. Recall that “directing and stabilizing expectations” was discussed as part of the mandates in this year’s “Government Work Report”. As the mainland’s stocks are still dominated by retail trades, and the prescience of Chinese stocks to forecast future economic events has endured for more than two decades, it is not difficult to understand how stocks can be maneuvered as an instrument to set public expectations.

Of course, the cost to such tactics is that stocks gradually stop reflecting the underlying fundamental, and volatility on either up or downside gradually subsides - till eventually few could profit from trading

. The drying liquidity in the offshore RMB market has already made it less relevant for traders.

Defensive rotation to unfold soon

. In our recent notes “

The Reflation Trade is Over; Get Set for Defensive Rotation

” on March 7 (

Focus Chart 2

) and “

A Definitive Guide to China’s Economic Cycles

” on March 24 (

Focus Chart 3

), we discussed China’s 3-year property inventory investment cycle and its looming peak, the upstream commodity restocking cycle and the prescience of Chinese cyclical’s relative performance. We concluded that :

1) the reflation trade is fading soon, and global cyclical will start to underperform; 2) bond yield’s surge will lose momentum; 3) China’s property price cycle has peaked, although the bubble has been proved to be resilient

. Indeed, some of these trends are becoming more and more palpable.

As the defensive rotation unfolds in the coming weeks, volatility will return

.

Focus Chart 2: Peak relative performance of Chinese cyclical augurs that the reflation trade is fading

.