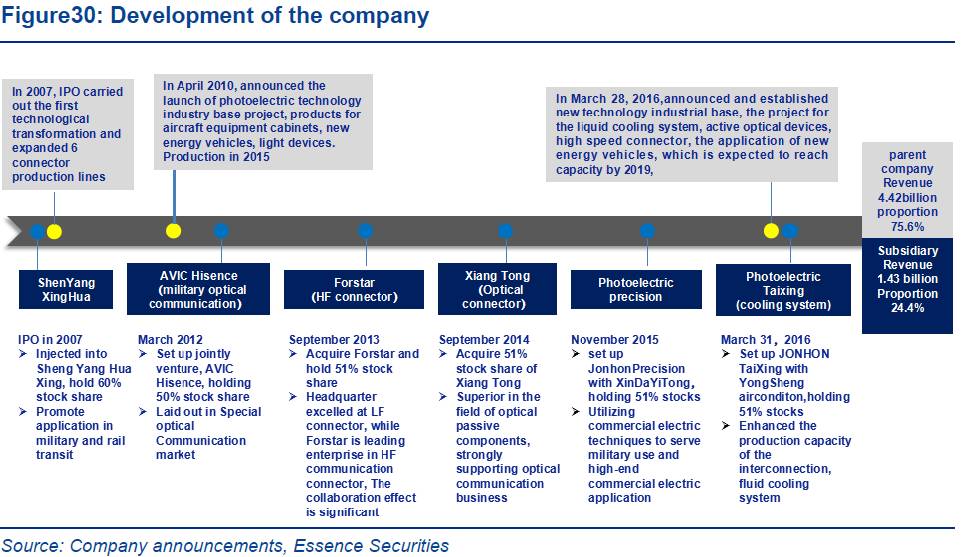

Although capital operation of JONHON is prudent, it is solid and effective. By the chance of IPO, it acquired Shenyang Xinghua and increased its capital, basically completing the integran of the group’s connector business; the establishment of a joint venture, Hisense JONHON, focusing on optical module in special market, tremendous growth potential has emerged; the acquisition of AVIC Forstar reinforced RF connection products and technology, the contribution to performance is greater than expected.

6.1. Shenyang Xinghua continues to improve, and Hisense & Forstar grow strongly

6.1.1. Shenyang Xinghua: performance bottoms out, and economies of scale continues to improve

Shenyang Xinghua (117 factory) was founded in 1957, the main products are electrical connectors, Integrated cable assemblies, rail transit appliances, automatic protection device, micro motor, which are mainly used in the field of military and railway. In March 2007, JONHON and AVICI Group signed “equity acquisitions and subscription agreement “. JONHON has granted its 20% equity to Xinghua before IPO and unilaterally increased Xinghua’s capital by RMB 100 million for two Industrialization projects--industrial connectors and motor circuit breakers after raising funds from IPO; Its shareholding ratio rised to 51% after the capital increase.

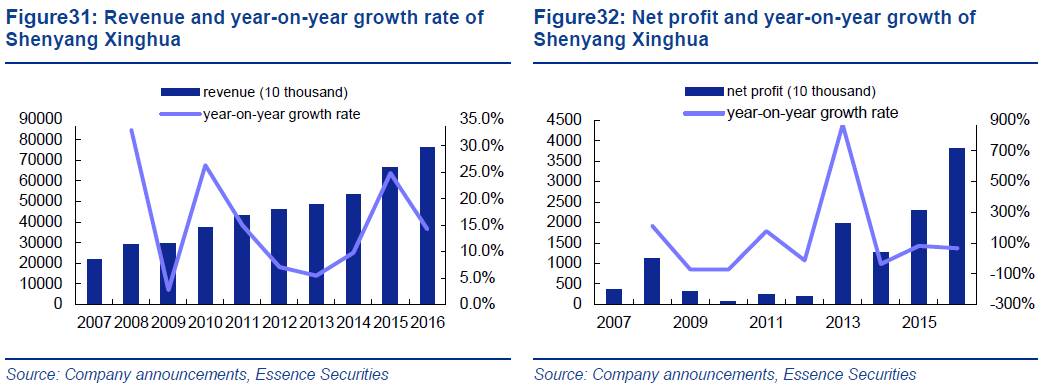

After being acquired and integrated by JONHON, Shenyang Xinghua got through relocation of the plant and operation reform. Although the income maintained stable growth, it had a poor profitability which has been improved significantly since 2013. In 2016, Shenyang Xinghua saw an operating income of RMB 762 million with the year-on-year growth of 14.2%; net profit was RMB 38.106 million with the year-on-year growth of 66.5%; Compared to 2007, net profit has been improved substantially.

In January 2014, the company increased its capital again by RMB 110 million to Shenyang Xinghua, and the shareholding ratio was raised from 51% to 62.87%, which not only directly reduced the financial costs of Xinghua Shenyang, but also helped the listed companies further enhance its control on Xinghua. Along with closure of adjustment to production, Enhancement in control on cost and the gradually increase of economies of scale, the profitability of Shenyang Xinghua is expected to improve gradually.

6.1.2. AVIC Hisense: focuses on optical module of special market, which has great growth potential

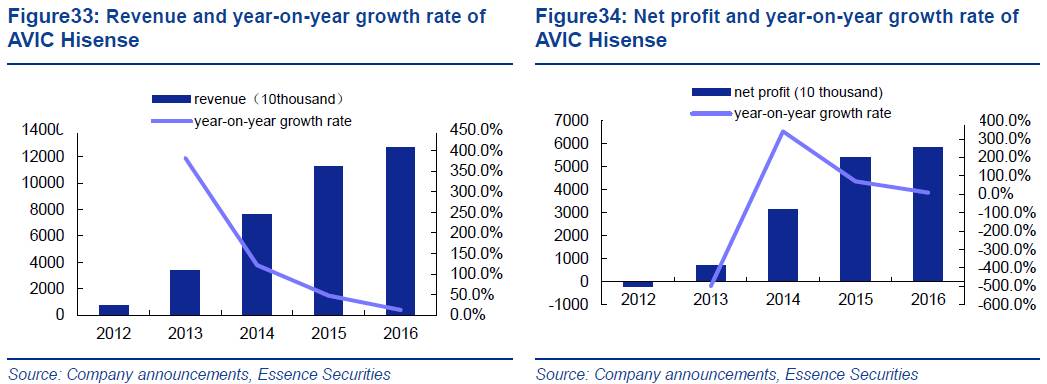

In 2012, JONHON and Qingdao Hisense Broadband Multimedia Technology Co., Ltd. set up a joint venture company, AVIC Hisense (Qingdao) Photoelectric Technology Co., Ltd. Each of them accounted for 50% equity. AVIC Hisense focuses on R&D, production, sales and service of optical modules of special market and extended products, including but not limited to optoelectronic devices and active optical cables.

Due to optical transmission’s characteristics like large transmission capacity, long-distance relay and strong anti-jamming, the application of optical transmission to new-type information equipment is more and more common. Targeting huge demand in this new field, the two companies established a joint venture, AVIC Hisense. With the rapid release of demand for weapon equipment upgrade, as well as the expansion of related products to other industrial applications, the development of AVIC Hisense is huge.

In 2016, AVIC Hisense achieved revenue of RMB 126 million with a year-on-year growth of 13.1%, net profit of RMB 58.3845 million with a year-on-year growth of 8.5%; Compared to revenue of RMB 34.2163 million and net profit of RMB 7.1483 million in 2013; AVIC Hisense has shown tremendous growth potential.

6.1.3. AVIC Forstar: enters HF connectors market, collaborative development promotes performance growth, and successfully quotes on New third market

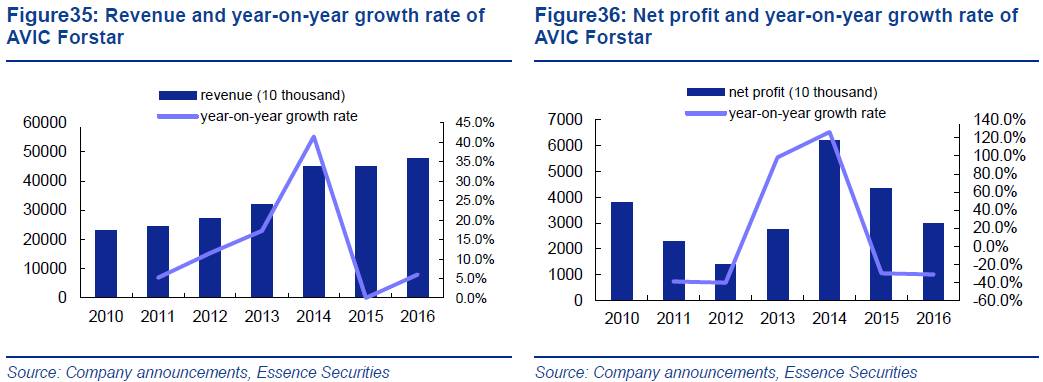

Xi'an Forstar was founded in 1998, mainly engaged in R&D, production and sales of RF coaxial connector, RF coaxial cable assemblies. The products are mainly used in communications, aerospace and other fields. Forstar has obvious competitive advantage in RF connection technical field and dominated/participated in formulating 6 international standards, 8 national standards, and participated in revising 2 international standards; currently it has more than 70 patents, including 4 invention patents.

In November 2013, JONHON completed acquisition of 48.18% stake of Forstar. Forstar directly reinforced the listed company’s technological strength in RF connection, and further enriched its product line, which is conducive to consolidation of the company’s dominant position in the domestic connector market; At the same time, with the help of AVIC ‘s channel advantage, Forstar’s products is expected to enter more military areas. In April 2014, the company increased its holdings of Forstar by 10% shares again, improving its shareholding ratio to 58.18%, achieving absolute control. After JONHON acquiring Forstar in 2013, Forstar’s revenue rose from RMB319 mn in 2013 to RMB451 mn in 2015 and net profit rose from RMB27.4 mn in 2013 to RMB43.53 mn in 2015.The growth rate are 41.4% and 126% respectively. It is not only conducive for Forstar to undertake more military research and production tasks, but also has a direct and positive effect on performance of the listed companies. AVIC Forstar launched quote on new third market in August 2015 and realized it in February 2016, expanding access to capital, further improving its prestige. Driven by collaborative development by headquarters, AVIC Forstar sees substantial improvement in its defense business.

Influenced by start-up of 4G constructions and development of military market, performance of AVIC Forstar after the acquisition continued to exceed expectations. In 2016, it achieved revenue of RMB 479 million and net profit of RMB 29.95 mn. The slowdown is mainly due to sales and service fees, R&D fees and personnel salaries, etc. increased by RMB 34 .4798mn compared with 2015, thereby affecting the net profit.

Forstar case does not have substantial impact. On March 27, 2017, Sen applied to the Xi'an court for compensation of total RMB542 mn. On May 8 Sen applied to Xi'an court for withdraw and may again applied to the court for recognition and enforcement of the judgment. The core content of the litigation dispute is whether and Forstar should calculate and settle commission based on agency agreement signed in 2004. The company believes that the two companies signed the agency agreement since Sen need to apply for a loan in August 2004, However the agreement is not fulfilled after the signing; the two sides are still pay and settle commission in the way of a single commission or purchase contract, so the company should not pay the Commission to the plaintiff Sen.

6.1.4. Xiang Tong: perfects high-end optical device industry chain layout, and explores the medical device Market

Xiang Tong is an optical communication component supplier with independent intellectual property rights in China. Its main product, laser / detector fiber optic interface module is the core component of optical fiber communication. Xiang Tong’s OSA component embodies domestic leading technology, and it has the largest scale of production and the highest sales in the domestic industry; in domestic medical and dental industry, Xiang Tong is one of the few manufacturers that produces zirconium dioxide porcelain, CNC equipment for engraving teeth and supporting part at the same time. After years of development, Xiang Tong has accumulated rich professional experience in the fields of active and passive device products, new ceramic materials, design technique and test of zirconia ceramic block. It masters a series of core technology and has a number of technological innovations and the national patent

In October 2014, the company successfully acquired 51% of Xiang Tong stakes, and perfected the layout of high-end optical device industry chain. With the help of Tong Xiang’s R&D and manufacturing capabilities, the company has great insight into technical characteristics of optical fiber connector industry and industry trends, and is more likely to grasp the national industrial policy, industry development and technical progress trend; at the same time, the promotion of standardization of industry standard will promote the international competitiveness of products. At the same time, the acquisition will help the company to open up new medical devices markets.

Xiang Tong began to gradually move production base from Shenzhen to Dongguan since 2013, which had a great impact on production, resulting in a significant decline in profits in 2013. With the Dongguan Xiang Tong company officially went into operation in April 2014, the production capacity has been effectively guaranteed. Meantime the start-up of domestic 4G project construction will drive growth of Xiang Tong’s performance. In 2016, it achieved revenue of RMB221 mn, net profit of RMB 34.37 million compared to revenue of RMB 189 mn and net profit of RMB 25.43 million in 2015, there is a year-on-year increase of 16.9% and 35%.

6.1.5. AVIC precision electronics: develops consumer electronics market, integrates civilian resources and serves military defense

In January 2015, the company announced that the company intends to invest RMB 50 mn with Xin Da Yi Tong to set up JONHON (Shenzhen) Precision Electronics Co. Ltd., for which JONHON invested RMB 25.5 thousand, accounting for 51% stake. The company will give full play to the advantages of technology and market, expand the market size of precision connectors and achieve good profitability.

Xin Da Yi Tong's main business is the design of precision connector and parts and the production of OEM precision connector. The main products include FPC, LVDS, WTB, BTB and customized products, which are applied to LCD panel, LCD TV, LCD, computer and peripheral equipment, mobile phone and other digital products. The core management of Xin Da Yi Tong has experience of more than ten years in the field of precision connector and a deep understanding of consumer electronics product and direction of the technology development, Xin Da Yi Tong represents the forefront of domestic industry of precision connector.

JONHON and Xin Da Yi Tong set up item company to undertake Xin Da Yi Tong’s business, assets, personnel, market and customer relationship, engaging in professional design, production, sales and service of precision connectors and components, which is helpful for the company to expand in broader consumer electronics markets like LCD panel, computer and peripheral equipment, mobile terminal, etc. The establishment of item company is of great significance for integration of civil aviation resources to serve military defense, promotion of the company's core capabilities, and expansion of influence in the industry.

6.2. Internal and external conditions are gradually met, and industry mergers and acquisitions are expected to continue to advance

We expect AVIC’s acquisition strategy to be further promoted, which are underpinned by three drivers:(1) the increasing trend of domestic connector market concentration is obvious; (2) the experience of overseas leading enterprises achieving expansion through merger; (3) company needs to develop and meanwhile it has plenty of cash.

6.2.1. Domestic connector market concentration gradually increases, which is beneficial for the implementation of industrial integration among advantageous enterprise

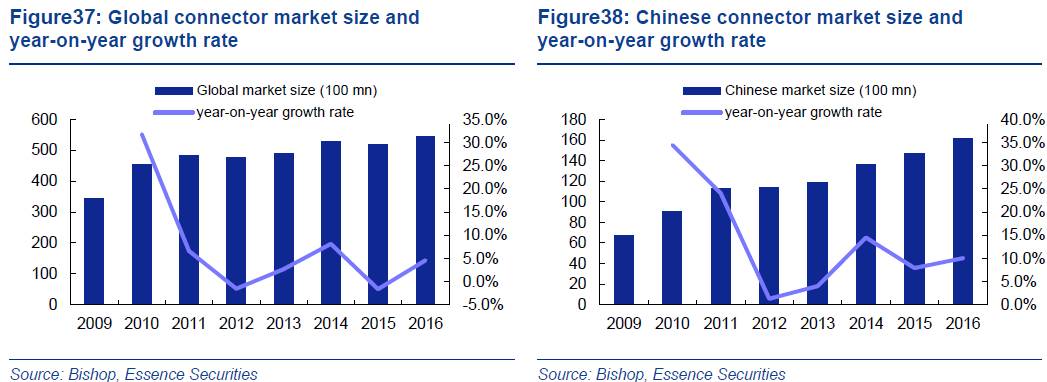

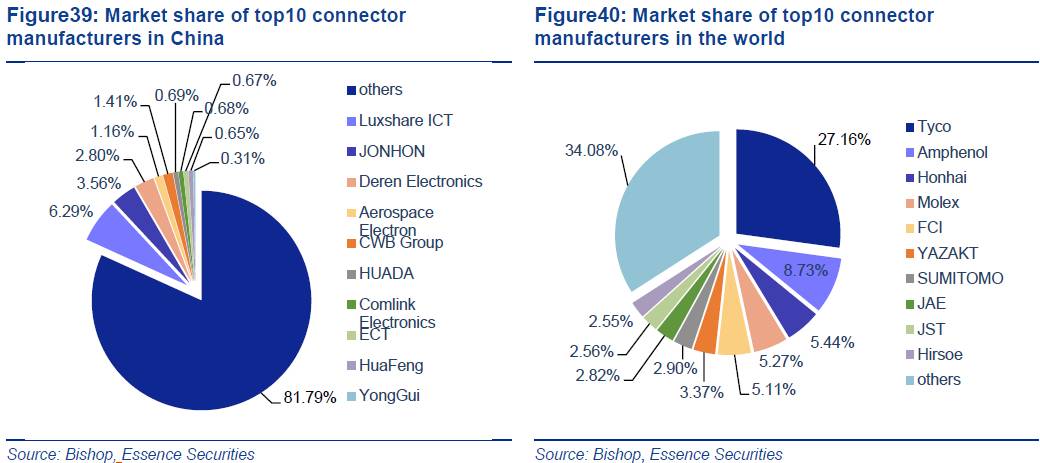

Global connector market re-entered steady developing stage after hammered by the financial crisis. In 2016, the global market size achieved 54.4 billion dollar and year-on-year increase is 4.6%. The competitive situation demonstrates obvious competitive advantage of Europe, America and Japan, occupying 9 positions among the top ten connector enterprises in the world. There is an upwards trend of market concentration, and the market share of top ten enterprises has risen from about 40% in 80s to about 65% in 2014. It can be described as “the stronger become stronger “.

China has become one of the most important markets of global connectors, with a market size of 14.5 billion dollar in 2015, and its share has gradually increased from 20.9% in 2008 to 26.1% in 2014. However, the market concentration is still very low, and the market share of top ten enterprises is less than 20%. Compared with global average, it has a lot of catch-up to play, which provides the necessary conditions for enterprises that have initially gained competitive advantages to integrate industrial resources.

6.2.2. Development of world-leading connector enterprises indicates JONHON’s likely promotion for its merger strategy

Development of world-leading connector enterprises shows that outbound M&A played an important role in companies’ expansion. Tyco became leading connector enterprise in 1998~1999 by acquiring AMP and Raychem. Even after having developed competitive advantage, the company continued outbound M&A. From 2010 to 2014, the acquisition implemented by Tyco amounted to dozens of times, including acquisitions worth more than 1 billion dollar project like ADC (1.332 bn dollar), Deutsch (2.1 bn dollar), and Measurement Specialties (1. 663 mn dollar).

The development of Amphenol, the second largest connector enterprise in the world, is fully supported by M&A, and a large number of advantageous businesses have been strengthened by acquisitions. For example, in 2001, the company acquired Teradyne’s military aerospace connector and backplane business; in 2003, it acquired Radsok, a series of high current connectors business of K&K company and industrial / avionics department of Presision Connector Design industrial / avionics department; in 2005, it acquired Fiber Systems International (military and Aerospace), Intercom Systems (computer and communication connector) and Teradyne’s connecting system business.

Acquisition of Xi'an Forstar is the first acquisition of external assets after the company went public, which is initial indication of the company's positive changes in M&A. Accourding to the developing route of many global connector leading enterprises, JONHON will expand based on its core capability business after achieving current scale with its advantage in the field of military and industrial connector, which is the icing on the cake

the external requirements for JONHON implementing mergers and acquisitions are gradually met, and the acquisition of Xi'an Forstar is just the beginning of the company's extensive development and business expansion based on core competence. The company is expected to continue to promote outbound M&A, which facilitates growth of the industry.