The Three Most Important Sepculative Attributes: DISCIPLINE, DISCIPLINE, and DISCIPLINE

It was Wednesday, March 23, 1983. I had been restless the previous night, had awakened earlier than usual and got to the office by 8:30, positioning myself in front of the price screen and my various charts and studies. It was still a full two hours before the opening of the Chicago grain markets, but I could already feel the mounting excitement. Momentarily distracted by a ringing phone, I settled back to reexamine the soybean market and to review my strategy for the morning.

1983年3月23日星期三,我前一个晚上没睡好,比平时起得早,8点30分以前就到了办公室,在报价屏幕,各种各样的图表和研究报告前面坐下。离芝加哥谷物市场开盘还有整整两个小时,但我已经感觉到了上涨的兴奋。接了一通让我暂时分心的电话之后,我又重新检查了一下黄豆市场的趋势和早上我所要采取的策略。

May beans had closed at 6.11 the previous day, and my market analysis, which I’d scribbled on a manilla card, read, “The trend in beans will not turn up until May can close or gap open above 6.23. I would be a buyer on either a close or a gap opening above that level. Following such a dynamic breakout, I would expect prices to soar.”

前一天5月黄豆以6.11收盘,我在卡片上面做了市场分析,我是这样写的:“如果5月黄豆收盘能够站上6.23或开盘能够跳空到6.23,黄豆市场的趋势就会向上。收盘或跳空开盘到这个水准之上时,我会买入。在这种有力的突破之后,价格会飙涨。”

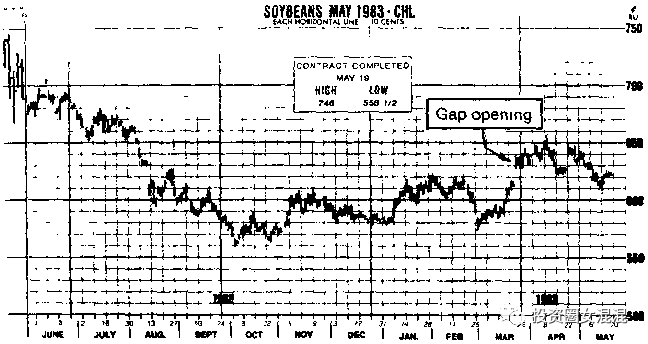

The action of the past few sessions told me that the long-awaited bull breakout should be imminent, and a quick call to my Chicago floor man confirmed that the floor was looking for a sharply higher opening. That ought to do it! I entered my buy orders for the opening, sat back, took a deep breath, and waited for the first ticks on my little green screen (see Figure 10-1).

过去几天的趋势告诉我,长久等待的多头市场突破即将到来,我马上拨电话给我在芝加哥营业现场的人,也证实了营业厅内预期开盘价会大幅上涨。我非得采取行动不可!我挂进了开盘时的买单,往后一躺,深深吸了一口气,等着眼前的绿色屏幕跳出第一根线。(见图10-1)。

图10-1 1983年5月黄豆 (文字:跳空开盘)

【On the morning of March 23, the market gapped up through the 6.23 resistance level in a decisive show of strength. Following this impressive breakout, prices turned reactionary for three months, retracing some 50 percent of the previous up-leg. This brief price reaction proved to be the bears’ final chance; the market then commenced a rally of monumental proportions. Three months later, the bull deal of 1983 was the big news in Chicago. The market had advanced by $3.75, equal to about $18,000 per contract. And that ain’t hay, brother!

3月23日早上,开盘涨势强劲,跳空突破6.23的阻力点。强力突破之后,3个月内价格回调,一度拉回到前一个涨幅的50%左右。短暂的回调证明是空头最后的机会;市场接着发动了惊人的上涨。3个月后,1983年的这次多头趋势,是芝加哥最大的新闻。市价涨了3.75元,每份合约赚18000元。老兄,这可不是小数!】

My opening gambit - putting on or adding to a position on a significant opening breakout gap - has been one of my favored tactics for many years. It is a risky but potentially valuable move for the aggressive operator. I endorse it primarily when the gap opening is in the direction of the ongoing major trend. As a secondary tactic, you can trade the gap opening when it represents a clear breakout from a broad sideways trading range that would either, (a) establish a major trend reversal or (b) constitute a continuation of an ongoing trend out of the lateral area. I would be very cautious about buying or selling gap openings that are clearly against the major ongoing trend because these gaps are often traps set up by trade or floor operators to “sucker” commission house speculators into untenable positions. Such brash anti-trend gap plays may look tempting, but they are best left to seasoned professionals who can run quickly if the trade starts to turn sour.

我的这个绝招——在开盘显著的突破缺口建立仓位或加仓交易——是我多年来一直偏爱的战术。这一招有风险存在,不过对积极型的交易者来说,也有潜在的价值。如果跳空开盘的方向和主趋势是一致的,我一般同意用这一招。作为备用战术,如果在宽广的横向盘整有了明显的突破,会出现两种情况,(a)相对于主趋势的反转;或者是(b)主趋势的继续。跳空开盘如果明显与行进中的主趋势相反,我在买入或卖出时会十分小心谨慎,因为这些缺口往往是场内交易者故意做的“陷阱”,引诱经纪行投机客建立错误的仓位。这种激进的反趋势跳空缺口看起来诱人,不过最好是留给经验老道的专业交易者去做,因为如果所做的交易突然变坏,他们有本事快速出场。

May beans had opened at 6.265, closing the trap on the hapless bears. While waiting for my reports, my mind drifted back 10 years to the first time I had seen this opening gambit in action. My mentor in this art of trading on gap breakouts was Mike Green, a shrewd and aggressive Comex floor trader. As a new Comex member during the early 1970s, I frequently walked over to the exchange and down into the ring to study the pit action. I used to watch in awe as Mike Green, standing in the center of the copper crowd, his body and voice straining, would be buying at the opening... 50 lots... 100 lots... 150 lots at a clip. It was a bull market, and Mike knew it well. He seemed a master at waiting patiently until his well-honed instinct told him that each successive minor reaction had run its course and that the underlying bull trend was about to reassert itself. Then, and only then, did he spring into action - “buy 50... buy 100...buy 150.”

5月黄豆以6.265开盘,空头很倒霉。在我等待交易报告的时候,心思不禁飘回到10年前,当时我是第一次看见在突破缺口进场的操作方式。教我突破缺口交易方法的是迈克·葛林老师,他是纽约商品交易所里面十分精明,作风大胆积极的现场交易者。当时是70年代初,我刚成为纽约商品交易所的新会员,经常走进交易所,到场内研究交易时的情况。我总是瞪大双眼,看着葛林挤在做黄铜期货的人群当中,身体和声音扭曲到极点,在开盘时买入……50手……100手……150手。那是个多头市场,葛林很清楚。他看起来就像是个大师,很有耐心地等候他那经过千锤百炼的直觉告诉他,每一次的回调气数竭尽,基本的多头趋势就要再次展示雄风。这个时候,只有在这个时候,他才会一跳而起——“买50手……买100手……买150手。”

Knowing when not to trade - patiently standing aside until just the right moment to enter the market is one of the toughest challenges facing the trader. But it is essential if you are to stand in the winners circle.

I have known countless days when the compulsion to overtrade was so strong that I had to resort to little ploys to keep myself from entering orders. These have included the following:

知道何时不要交易,很有耐心地等候在一边,直到正确的时候才进场——是交易者所面对最艰难的挑战之一。但是如果你想进入赢家的行列,这一点非常重要。

曾经有过无数的日子,我内心的冲动强烈到要逼我多做一点,使我不得不想想办法,好让自己不要下单。我的办法有以下几种:

1. Affixing a Livermore quote, “Money is made by sitting, not trading,” to my order phone.

把利弗莫尔的名言贴在下单专用的电话上面:“钱是坐着赚来的,不是靠交易赚来的。”

2. Positioning a boating magazine atop my desk (that would normally suffice to take my mind off doing some unwarranted trades).

放一本航海杂志在我的桌子上面(通常这就足够让我的大脑不再去想一些不必要的交易)。

3. In extreme cases, leaving the office for a brief walk or a bout with the flounder, blue fish, or whatever was then running in Manhasset Bay.

真的没办法忍耐时,只好暂时离开办公室,到外面走一走,或者跟曼哈斯湾里的比目鱼,海豚或其它任何东西较量一下。

More often than I care to admit, I’ve closed out all or part of a winning position prematurely. Other times, I’ve just missed the move completely, then watched the action from the sidelines awaiting the next reaction to get back aboard. I once spent over a month stalking both copper and silver, having gained eight pounds snacking instead of trading (all in the line of duty) before reentering the market on a minor trend reversal. Despite all this, the simple truth remains:

The successful trader maintains the discipline and objectivity to remain on the sidelines until he can enter the market in the direction of the major trend. Even then, you must be careful not to jump in on a random spurt when big orders from uninformed and weak speculative operators are thrown at the market. Even if you are trading in the trend direction, you’ll need even more discipline and patience to sit through the inevitable price reaction created by the floor traders and commercial firms, designed to shake out the weak holders from their positions and as much of their bankrolls as possible.

有好多次,次数比我敢承认的还多,我都太早平掉全部或部分的赚钱仓位,有些时候,则是完全错过某个行情,只好眼睁睁地在外面看着别人大玩特玩,等待下一次的回调再进场。我曾经花了一个多月的时间,偷偷注意铜和银的趋势,(上班的时间)一点事情也没做,结果因为吃零食而胖了8磅,最后才在一次小回调中重新进场。虽然如此,

简单的真理依然是:成功的交易者永远严守纪律,在场外保持客观的态度,直到他能往主趋势行进的方向进场为止。即使在那个时候,你还是要小心翼翼,不要被到毫无章法的市场陷害,因为有可能是没经验的投机者,莫名其妙下了一张大单子造成市场变化。即使你是往趋势行进的方向交易,在不可避免的价格回调(反弹)期间,你更要严守纪律和发挥耐心。回调(反弹)是场内交易者和商业公司造成的,目的在于洗出心志不坚的持有者,以便给自己创造更多的财富。

It is too bad that futures trading tends to bring out the worst in most speculators. By and large, traders should perform better than their bottom-line results indicate. Their underperformance is principally attributable to their lack of discipline, and that inevitably leads to a lack of confidence. As a case in point, I recall a phone conversation I had with Dr. F. from San Diego, who told me that he had a long position in T bonds and wanted my opinion of what to do about it. I learned that he had been long for several weeks, from a much lower level, so that the position was showing a big paper profit. “Look,” I countered, “why ask me what you should do with the position? You were smart enough to have gotten aboard near the beginning of the bull move and to have held on for the rise. Just follow the same instinct or the same technique, and you should be fine. Besides, “I mused, almost as an afterthought,” I missed the long side of that bull market. After the surge breakout, I kept waiting for a 40 or 50 percent pullback, which didn’t occur, and I never did get aboard.”

期货交易老是会给大部分投机者造成很悲惨的命运,这是件非常遗憾的事情。大体来说,交易者的表现应该会比帐面上显示的要好才是。他们的不佳表现,主要的原因是缺乏纪律,而这不可避免地会造成信心不足。讲到这一点,我就想起跟圣地牙哥F博士在电话中交谈的往事。F博士说,他建立了个债券多头仓,问我接下来该怎么做。我知道他从好几个星期前就从很低的价位做多到当时,所以那个仓位已经有很高的帐面利润。我反问他:“喂,为什么要我告诉你该怎么处理你的仓位?你老兄已经够聪明的了,要不然怎么会在这波多头趋势开始发动的时候就上了车,而且一直持有到今天都没放手?只要依照你原来相同的直觉或同样的技巧去做,应该没问题。更何况,我错过了这一波多头市场,等到大涨突破后,我一直在等回调40%或50%,却都没等到,之后就没上过车。”

In fact, Dr. F. had just been intimidated by a spate of contradictory information in the financial press during recent weeks. I diagnosed his current malady as ALOSC (Acute Lack of Self-Confidence). After a brief confidence-restoring pep talk, I prescribed a couple of days rest, a return to his drawing board for an objective analysis of the market, and a disciplined adherence to trend-following strategy.

事实上,F博士这几个星期以来,一直被财经报纸上相互矛盾的消息弄得心神不宁。我把他目前的症状诊断为患了极度缺乏信心。经过短暂的谈话,给他打了气,并给他开了药方,要他休息几天,再回到画图桌,对市场做个客观的分析,而且一定要严守纪律,遵守顺势而为的交易策略。

And it isn’t just commission house speculators or even professional operators whose lack of effective discipline frequently stands between them and profitable trading results. Over the course of some 30 years, I’ve observed a curious anomaly between the market judgment of commodity producers and the eventual price action of their products. Invariably, producers tend to be more bullish than the market warrants. During the summer of 1983, I spoke with a number of midwestern corn farmers, whose crop outlook was dismal - reduced acreage, smaller yields, and stunted stalk growth. And who should know better about crop conditions than the people who actually grow the corn? All in all, a tremendously bullish situation, right? And clearly a golden opportunity for us speculators to get aboard and take advantage of the forthcoming crop disaster. Well, a funny thing happened to the long speculators on the way to the bank with their winnings-the market declined by 60 cents, a move of $3,000 per contract representing some six times the margin per contract. And if the (long) speculators were surprised at the market weakness, it was nothing compared to the amazement of the Midwest farmers, many of who were among the speculators who got killed on the long side of the corn market.

因为缺乏纪律,以至利润不多的,不仅仅是经纪行的投机者和专业交易者。约30年来,我观察到一个非常反常的现象,也就是商品生产商的市场判断老是跟商品最终的价格趋势不合。生产商总是比市场所允许的要乐观些。1983年夏,我跟中西部很多玉米农民谈过。这些农民的收成展望十分凄惨——种植面积缩小,收成率降低,作物发育不全。谁能比这些实际种植玉米的人更了解收成的状况呢?所有这些,不正是大利好消息吗?显然我们这些投机者逮到了大好机会,可以趁即将来临的作物灾难大捞一笔。但是,有一件很有趣的事情发生了,也就是市场反而下跌了60分,不只是做多的投机者,中西部的农民也很吃惊。因为在做多玉米市场而惨遭杀害的投机者里,不少正是中西部的农民。

In fact, it seems commonplace for commodity producers, particularly growers of agricultural crops, to take an excessively bullish view of their market. This is due to crop or weather situations in their particular growing area, the hype from local politicians about how much better off they are going to be, or just plain wishful thinking. Unfortunately, when the crop is finally harvested and the serious hedge selling materializes, these bullish expectations often turn sour and prices head south.

事实上,商品生产商,特别是农作物的生产者,对于自己的市场持过分看多的态度,似乎已是个通病,原因出在他们栽种地区的作物生长或气候状况,当地政治人士对明天会更好的看法,或者纯属一厢情愿的想法,都过分偏向乐观。很遗憾的,到了作物最后收成的时刻,严重的避险卖压出现时,这些看多的期望往往转差,价格便一路下滑。

There are times when widespread bullish expectations can substantially mesmerize an entire universe of producers; if the anticipated price advance actually turns into a price rout, the outcome for the producers can be devastating. The Maine potato market during the mid-1970s comes to mind-and

it provides an object lesson in the need for discipline in any kind of market operation, be it speculative or trade hedging.

It was a period of exuberant, uninhibited speculation in Maine potatoes on the New York Mercantile Exchange. Margins were low (you could trade for $200 margin per contract, or even less), and even memberships on the exchange were low (I bought my membership on the Merc for around $1,800). This environment allowed experienced growers, their bankers and brokers, all who should have known better to create the amazing strategy for which a special name was coined-the Texas Hedge.

有时,普遍性的多头期望,会使整个生产商产生如痴如醉的想法:如果预期中的价格涨势实际上不但没有出现,而且节节下跌,生产商便会面临灾难性的打击。讲到这,我们就想起70年代中期缅因州的马铃薯市场——从这里,

我们得到一个客观的教训:不管是投机性交易,还是避险交易,进出任何市场都要严守纪律。

那时,纽约商业交易所里缅因州马铃薯的投机性交易简直到了无法无天,漫无节制的地步。保证金很低(你可以用低到200元甚至更少的钱交易一份合约),甚至于交易所的会员会费也很低(我用约1800元的价格买到纽约商业交易所的会员资格)。在这个环境下,有经验的农民,往来的银行家和经纪人,创造了一个很令人惊讶的策略,并给它取了个特别的名称,叫做德州避险。

(本章未完待续)