作者:王洪武

微信:王洪武

@

天津

二八轮动是

FOF

里非常简单的一个策略,下面来简单回测一下策略的有效性。

选择三个品种:

(1)

二取沪深

300

指数;

(2)

八取中证

500

指数;

(3)

无风险取现金

.

策略逻辑:

初始状态为空仓

过去

N

个交易日,两个指数收益哪个高就持有哪个指数

N

个交易日,如两个指数过去

N

个交易日收益均为负值,则投资组合持有现金,空仓现金利息为

0.0%

,暂不考虑手续费。

第一部分:

回测分析

载入数据

: 采用沪深300与中证500价格指数

clear; clc

load data.mat

N=10;

%

持仓每

N

个交易日轮动一次

投资组合持仓数据:

1

:现金

2

:沪深

300 3

:中证

500

PortAsset=zeros(DataLength,1);

PortAsset(1:N,1)=1;

for

i=N:N:DataLength

Return=[0,IndexData(i,:)./IndexData(i-N+1,:)-1];

[Val,Idx]=max(Return);

if

i+N

PortAsset(i+1:i+N)=Idx;

%i日尾盘调仓

else

PortAsset(i+1:end)=Idx;

end

end

PortReturn=zeros(DataLength,1);

for

i=1:DataLength

switch

PortAsset(i)

case

1

PortReturn(i)=0;

case

2

PortReturn(i)=IndexData(i,1)/IndexData(i-1,1)-1;

otherwise

PortReturn(i)=IndexData(i,2)/IndexData(i-1,2)-1;

end

end

PortNav=zeros(DataLength,1);

PortNav(1)=1.00;

for

i=2:DataLength

PortNav(i)=PortNav(i-1)*(1+PortReturn(i));

end

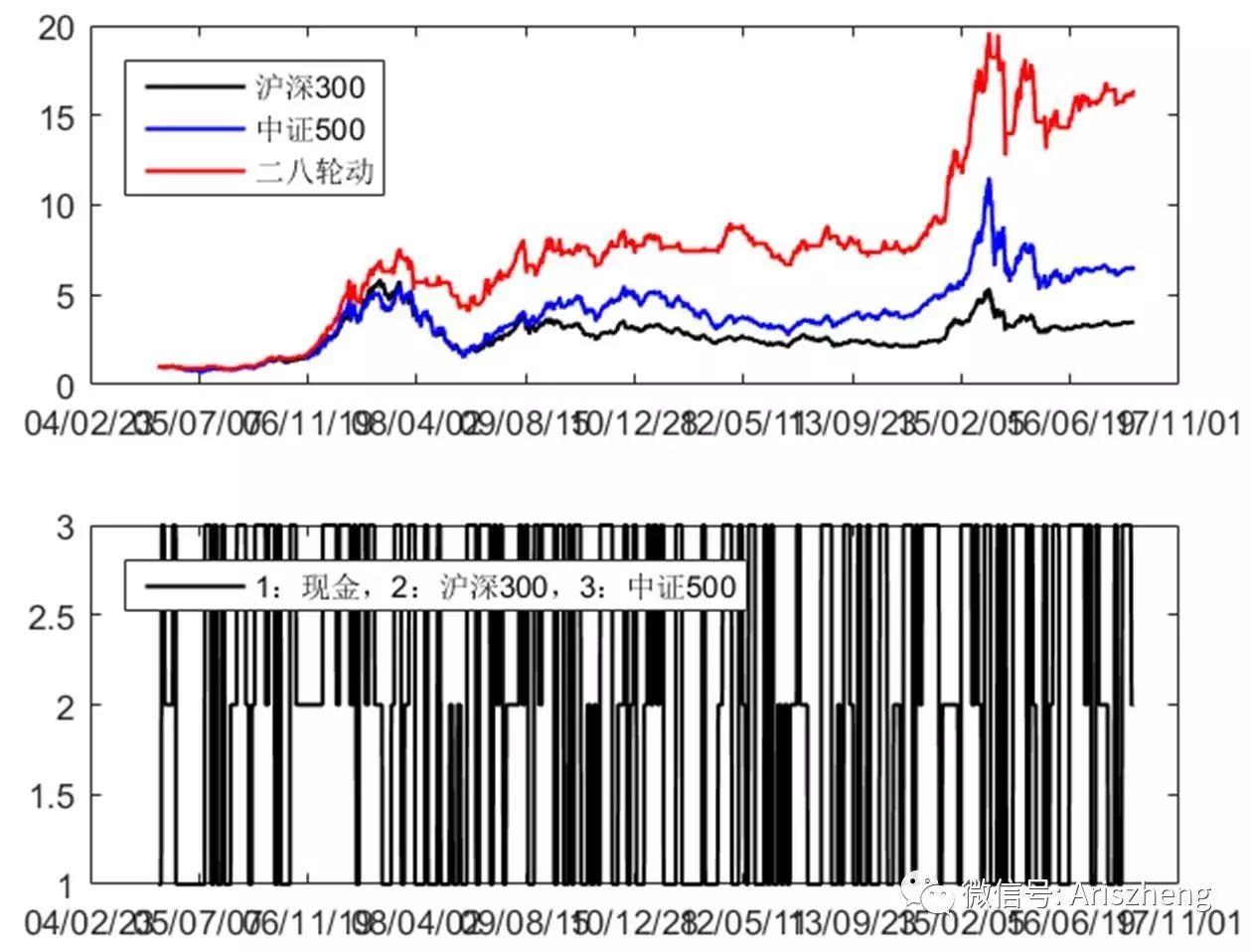

figure;

subplot(2,1,1)

plot(Date,IndexData(:,1)/1000,

'k'

,

'LineWidth'

,1.2);

hold

on

;

plot(Date,IndexData(:,2)/1000,

'b'

,

'LineWidth'

,1.2);

plot(Date,PortNav,

'r'

,

'LineWidth'

,1.2);

dateaxis(

'x'

,17);

legend(

'沪深300'

,

'中证500'

,

'二八轮动'

,

'Location'

,

'NorthWest'

)

subplot(2,1,2)

plot(Date,PortAsset,

'k'

,

'LineWidth'

,1.2);

dateaxis(

'x'

,17);

legend(

'1:现金,2:沪深300,3:中证500'

,

'Location'

,

'NorthWest'

)

prices1=[IndexData PortNav];

%

价格数据

changes1=tick2ret(prices1);

%收益率数据

prices_std=ret2tick(changes1);

%标准化价格

names=[IndexName,{

'二八轮动'

}];

time_span=Date(end)-Date(1);

time_span_year=time_span/365

time_span_year =

12.2740

(

1

)

return

totalYield=prices_std(end,:)-1

totalYield =

2.5175 5.5787 15.4020

公式

(

1+yieldYear

)

^time_span_year-1=totalYield

yieldYear=(totalYield+1).^(1/time_span_year)-1

yieldYear =

0.1079 0.1659 0.2560

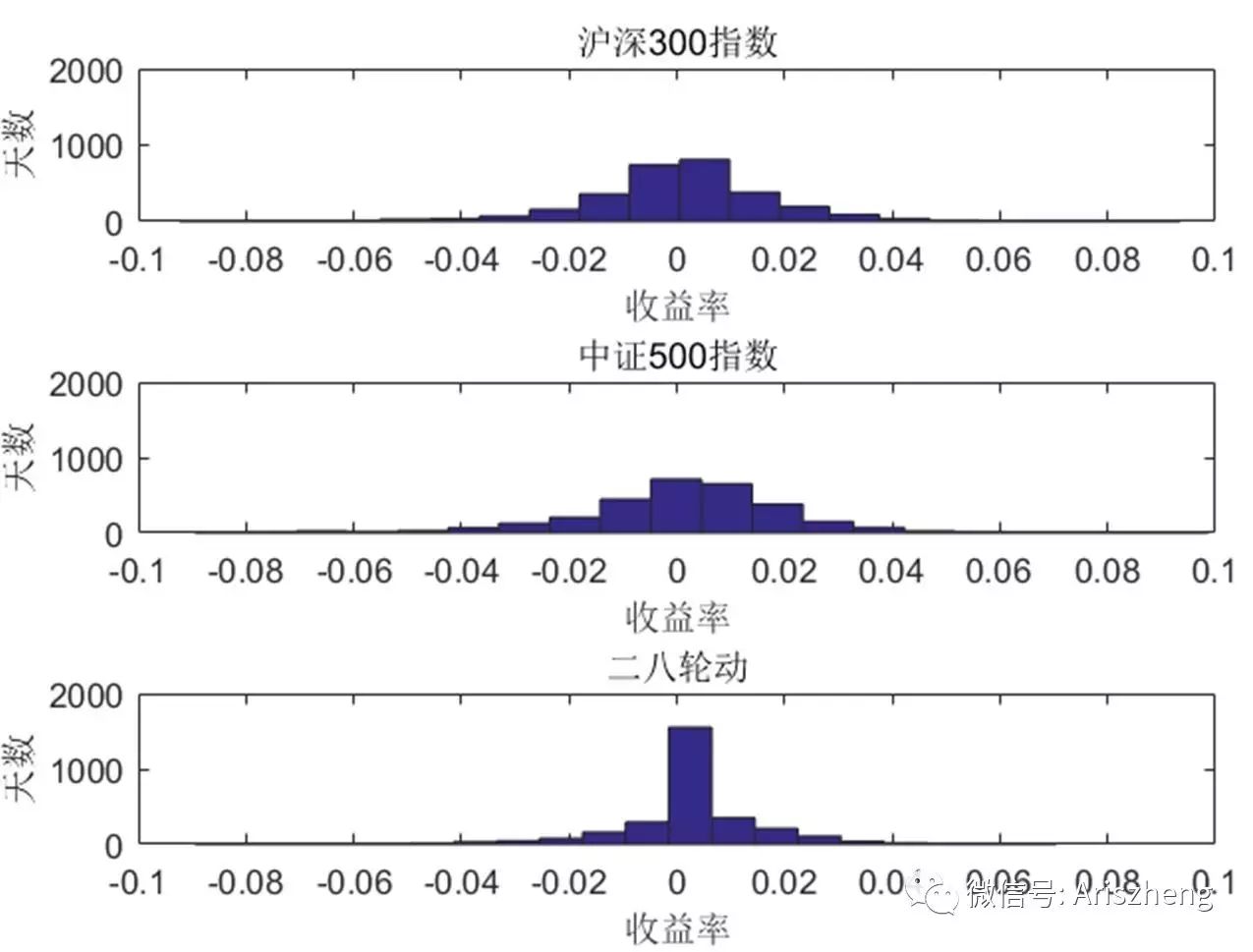

figure

subplot(3,1,1)

hist(changes1(:,1),20);

xlim([-0.1 0.1])

ylim([0 2000])

title(names{1})

xlabel(

'

收益率

'

);

ylabel(

'天数'

);

subplot(3,1,2)

hist(changes1(:,2),20);

xlim([-0.1 0.1])

ylim([0 2000])

title(names{2})

xlabel(

'收益率'

);

ylabel(

'天数'

);

subplot(3,1,3)

hist(changes1(:,3),20);

xlim([-0.1 0.1])

ylim([0 2000])

title(names{3})

xlabel(

'收益率'

);

ylabel(

'天数'

);

(

2

)

risk

volatility=std(changes1);

%

波动率

volatilityYear=volatility*sqrt(250)

%按照250个交易日计算

volatilityYear =

0.2881 0.3289 0.2404

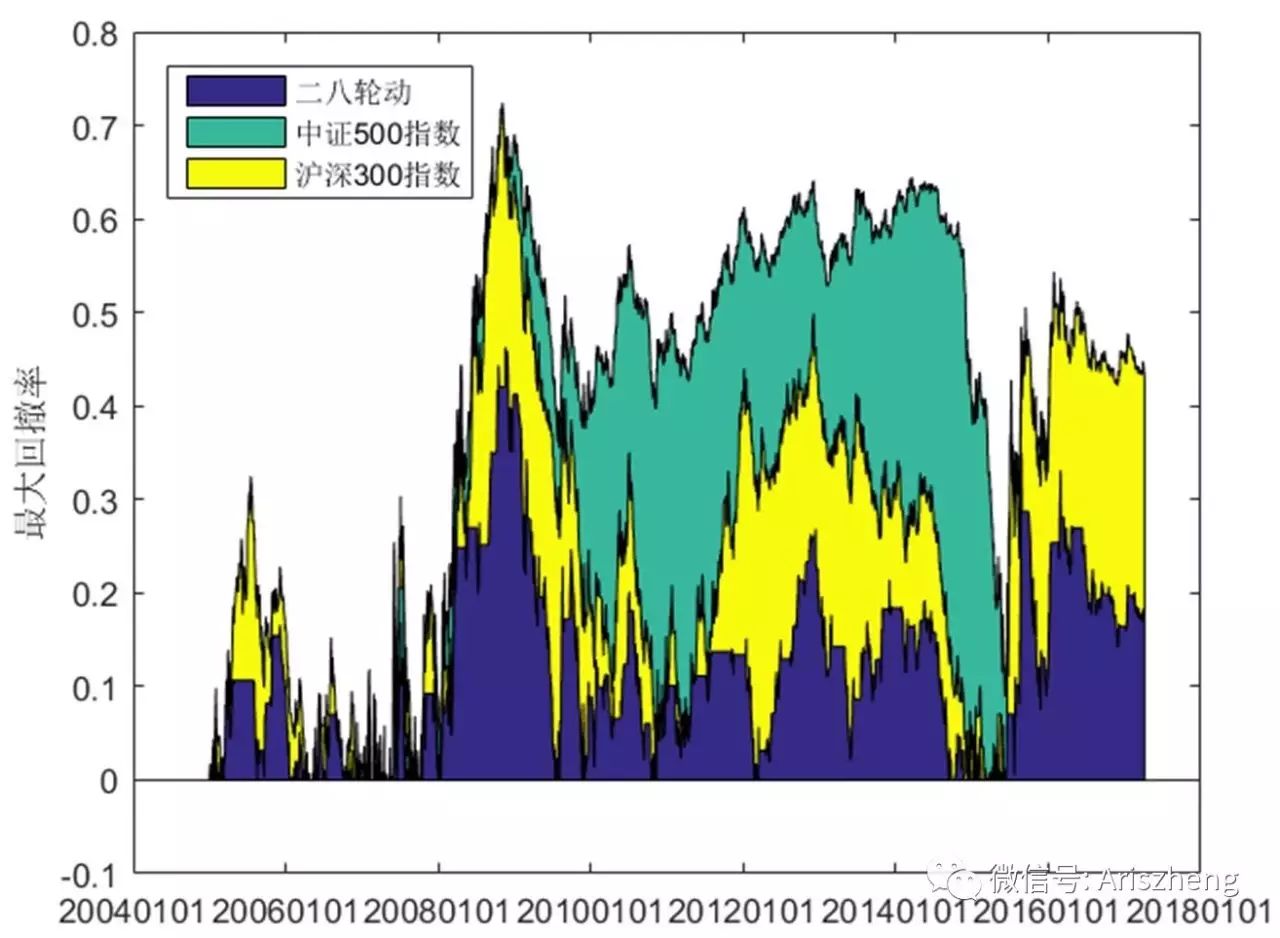

C=cummax(prices_std);

maxDrawVector = (C-prices_std)./C;

%

最大回撤向量

maxDrawRate=max(maxDrawVector)

maxDrawRate =

0.7230 0.7242 0.4627

figure

% bar(Date,maxDrawVector)

area(Date,[maxDrawVector(:,1), maxDrawVector(:,2)-maxDrawVector(:,1),maxDrawVector(:,3)-maxDrawVector(:,2)]);

legend(fliplr(names),

'Location'

,

'northwest'

)

ylabel(

'最大回撤率'

)

datetick(

'x'

,

'yyyymmdd'

)

beta1=regress(changes1(:,3),changes1(:,1))

%

相对于沪深

300

beta2=regress(changes1(:,3),changes1(:,2))

%相对于中证500

beta1 =

0.5874

beta2 =

0.5199

(

3

)

return to risk

yieldYearDividemaxDraw=yieldYear./maxDrawRate

yieldYearDividemaxDraw =

0.1492 0.2291 0.5532

xx=sum(changes1(:,3)>0);

yy=sum(changes1(:,3)~=0);

winRate=xx/yy

winRate =

0.5963

Riskless=0;

Sharpe = (yieldYear-Riskless)./volatilityYear

Sharpe =

0.3745 0.5043 1.0646

(

4

)

return to benchmark

Returns=changes1(:,3);

Benchmark=changes1(:,1);

Cash=0;

alpha1=portalpha(Returns, Benchmark,Cash,

'capm'

)

Returns=changes1(:,3);

Benchmark=changes1(:,2);

Cash=0;

alpha2=portalpha(Returns, Benchmark,Cash,

'capm'

)

alpha1 =

7.1139e-04

alpha2 =

6.1517e-04

Jensen1=yieldYear(3)-beta1*yieldYear(1)

%

相对沪深

300

Jensen2=yieldYear(3)-beta2*yieldYear(2)

%相对中证500

Jensen1 =

0.1926

Jensen2 =

0.1697

Returns=changes1(:,3);

Benchmark=changes1(:,1);

InfoRatio1 = inforatio(Returns, Benchmark)

Returns=changes1(:,3);

Benchmark=changes1(:,2);

InfoRatio2 = inforatio(Returns, Benchmark)

InfoRatio1 =

0.0354

InfoRatio2 =

0.0140

第三部分:

参数优化

N=5:1:60;

h=@Wheeled28;

[return11, maxDraw11, sharp11]=arrayfun(h,N);

figure

bar(N,return11');

title(

'

持仓周期与回报率的关系

'

)

% 标记最佳标的

[maxReturn, maxN]=max(return11);

hold

on

bar(N(maxN),maxReturn,

'FaceColor'

, [1 .25 .25],

'EdgeColor'

,

'none'

);

text(N(maxN),maxReturn ,[

'Best:'

,num2str(N(maxN))],

'HorizontalAlignment'

,

'center'

,

'VerticalAlignment'

,

'Bottom'

);

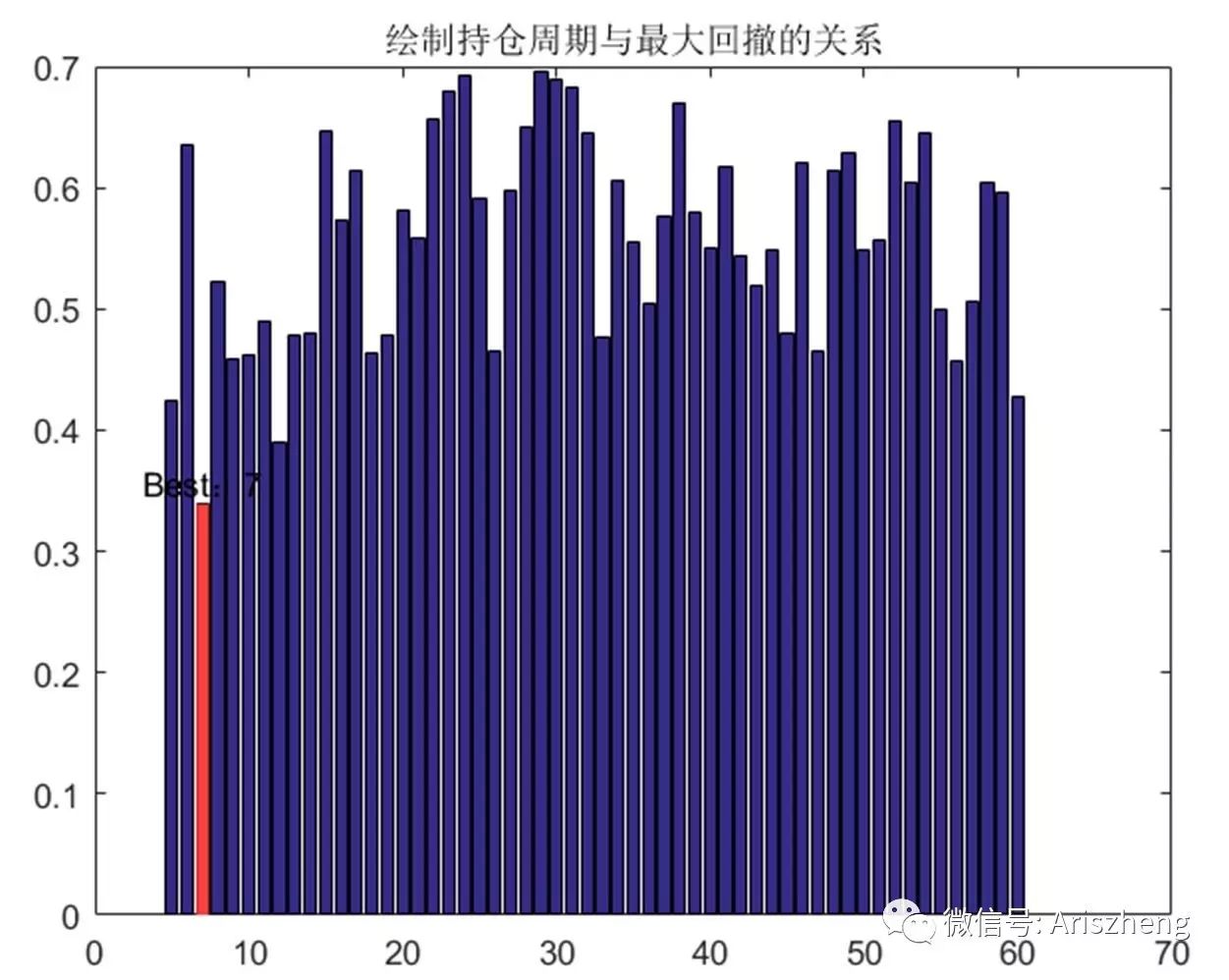

figure

bar(N,maxDraw11');

title(

'

绘制持仓周期与最大回撤的关系

'

)

% 标记最佳标的

[minDraw, minN]=min(maxDraw11);

hold

on

bar(N(minN),minDraw,

'FaceColor'

, [1 .25 .25],

'EdgeColor'

,

'none'

);

text(N(minN),minDraw ,[

'Best:'

,num2str(N(minN))],

'HorizontalAlignment'

,

'center'

,

'VerticalAlignment'

,

'Bottom'

);

figure

bar(N,return11'./maxDraw11');

title(

'

持仓周期与收益回撤比的关系

'

)

% 标记最佳标的

[maxSharp, maxN]=max(return11'./maxDraw11');

hold

on

bar(N(maxN),maxSharp,

'FaceColor'

, [1 .25 .25],

'EdgeColor'

,

'none'

);

text(N(maxN),maxSharp ,[

'Best:'

,num2str(N(maxN))],

'HorizontalAlignment'

,

'center'

,

'VerticalAlignment'

,

'Bottom'

);

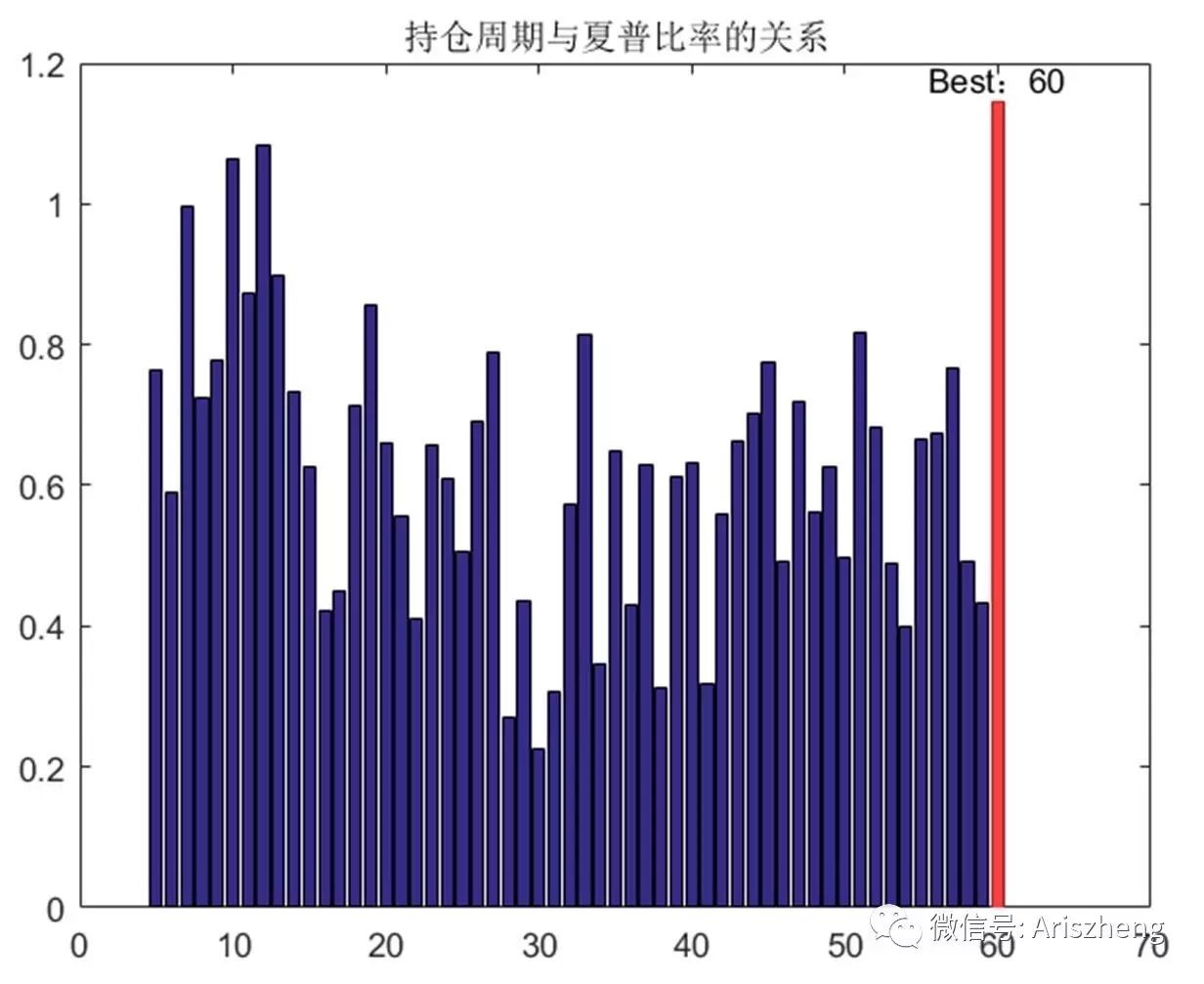

figure

bar(N,sharp11');

title(

'

持仓周期与夏普比率的关系

'

)

% 标记最佳标的

[maxSharp, maxN]=max(sharp11);

hold

on

bar(N(maxN),maxSharp,

'FaceColor'

, [1 .25 .25],

'EdgeColor'

,

'none'

);

text(N(maxN),maxSharp ,[

'Best:'

,num2str(N(maxN))],

'HorizontalAlignment'

,

'center'

,

'VerticalAlignment'

,

'Bottom'

);

第四部分:

总结

(

1

)二八轮动策略逻辑是趋势追踪,靠轮动控制品种和仓位,和大多数趋势策略一样,长期能跑赢指数;

(

2

)缺点是回撤比较大,可以考虑加入动态止盈止损来控制回撤;

(

3

)从参数寻优的结果来看

7-12

稳定性较强,莫陷入参数过度优化的陷阱。

第五部分:

改进

(

1

)计算时增加手续费和滑点

(

2

)调仓周期改为自然周、自然月或者自然季度

(

3

)策略中增加动态止盈止损

勤劳的老郑,最近以码字维生

打赏与购书请点击原文链接!