Bond Market Performance

▌

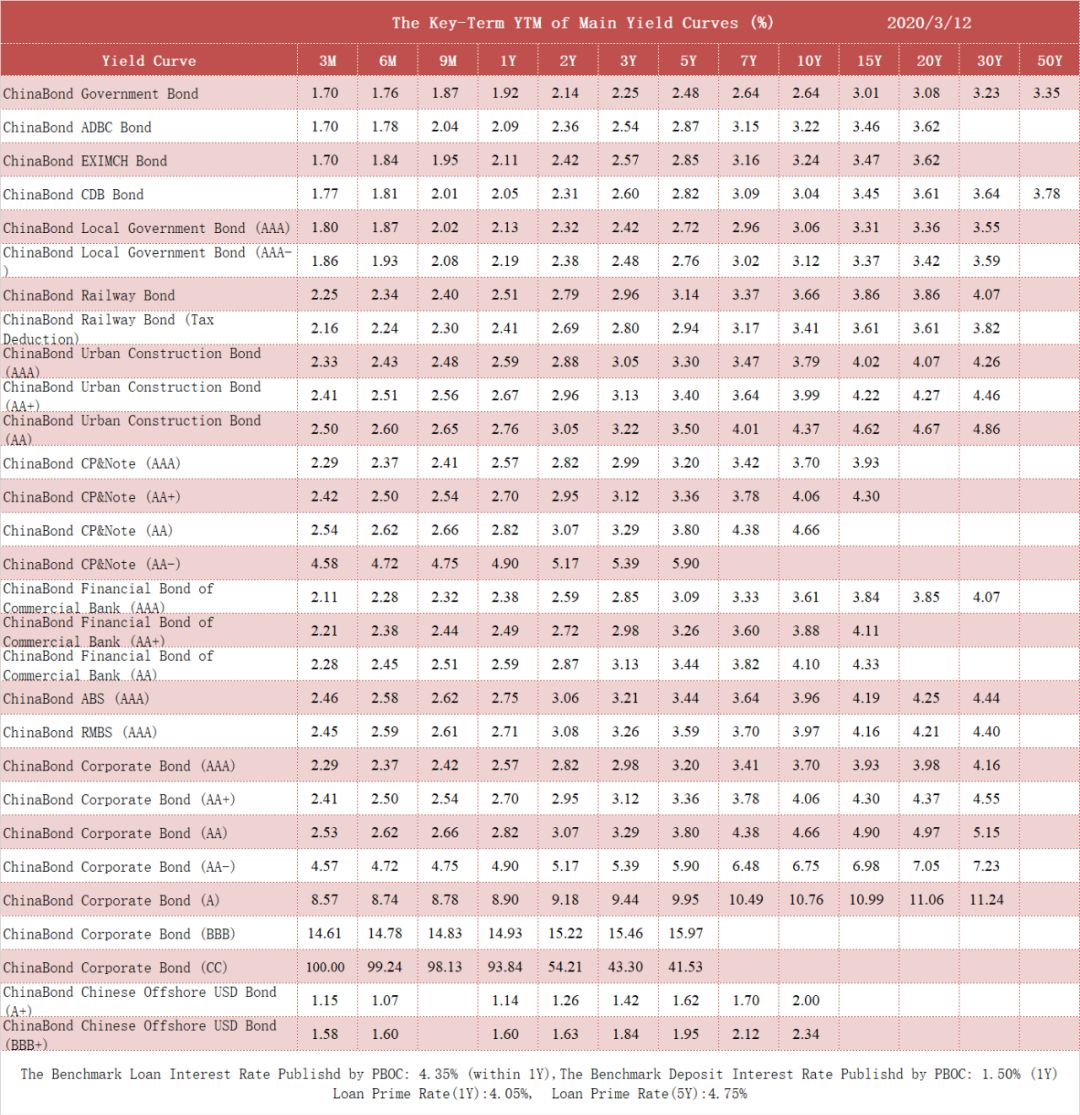

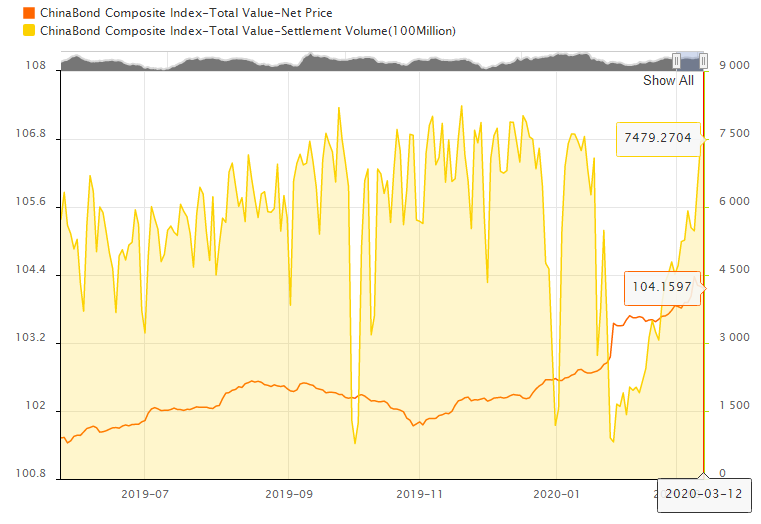

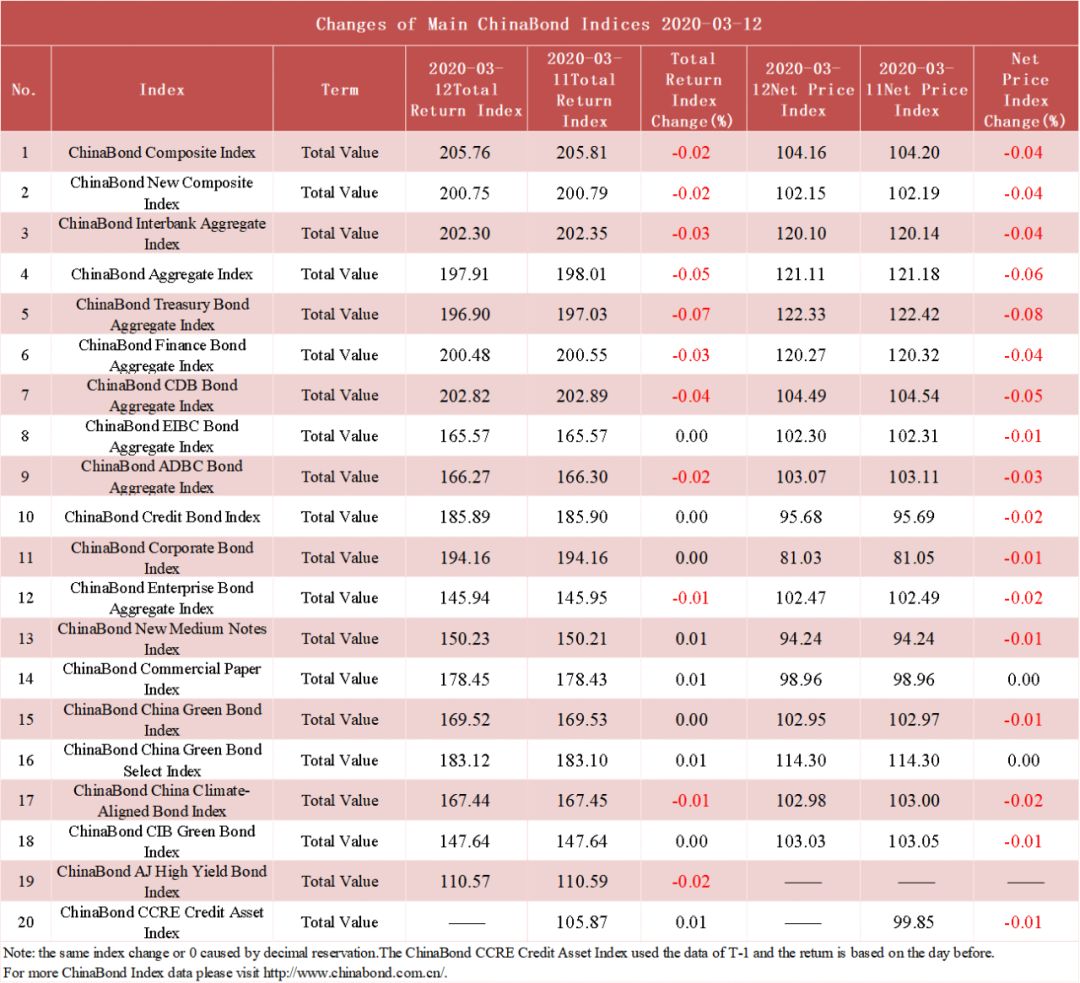

ChinaBond Index Trend Analysis

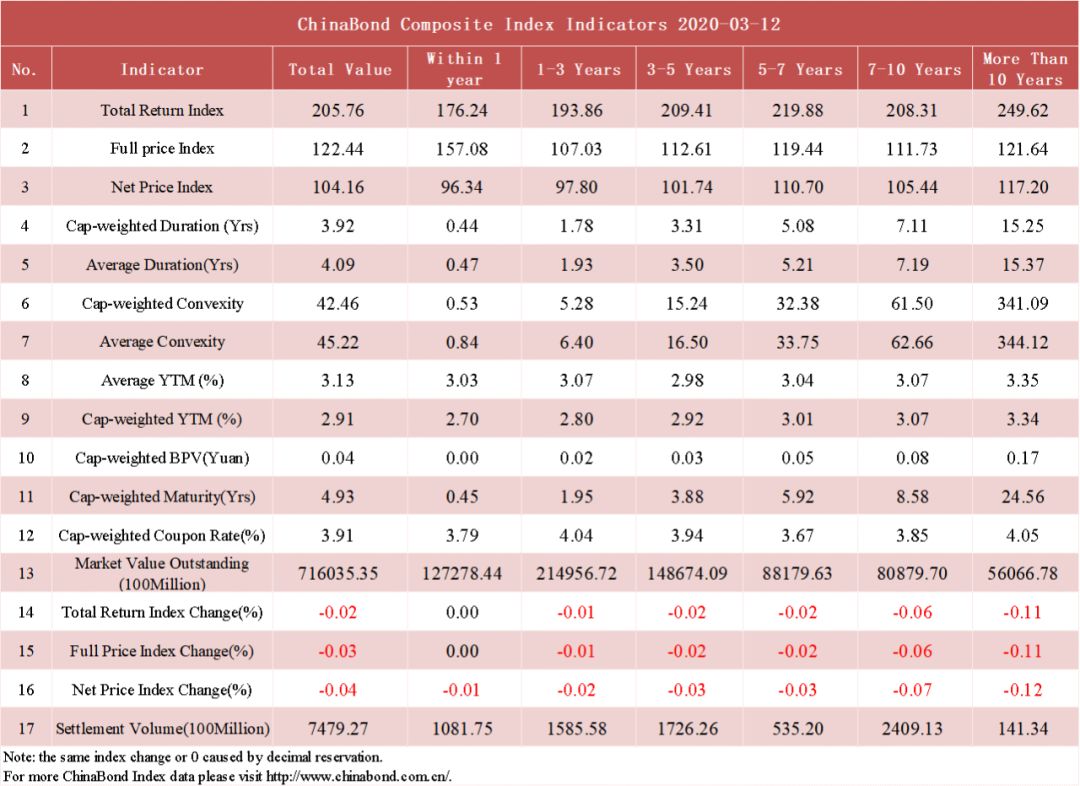

ChinaBond Composite Index tracking general performance of bond market dropped today. The net price index excluding interest revenue declined by 0.0355%; and the total return index including interest reinvested revenue declined by 0.0248%. In addition, the Cap-weighted YTM was 2.9058%. And the Cap-weighted duration was 3.9211.

▌

Sovereign Bonds

The Sovereign Bonds market went up slightly today. To be more specific, the yield of SKY_3M was stable at 1.70%; the yield of ChinaBond Government Bond_2Y went up by 2BP to 2.14%; and the yield of SKY_10Y went up by 3BP to 2.64%.

▌

Corporate Bonds

The Corporate Bonds market went up slightly today. To be more specific, the ChinaBond CP&Note Yield Curve (AAA) of 3M/3Y/5Y changed by 0BP, 0BP and -1BPto 2.29%, 2.99% and 3.20%, respectively; while the ChinaBond CP&Note Yield Curve (A) of 1Y went up by 4BP to 8.92%.

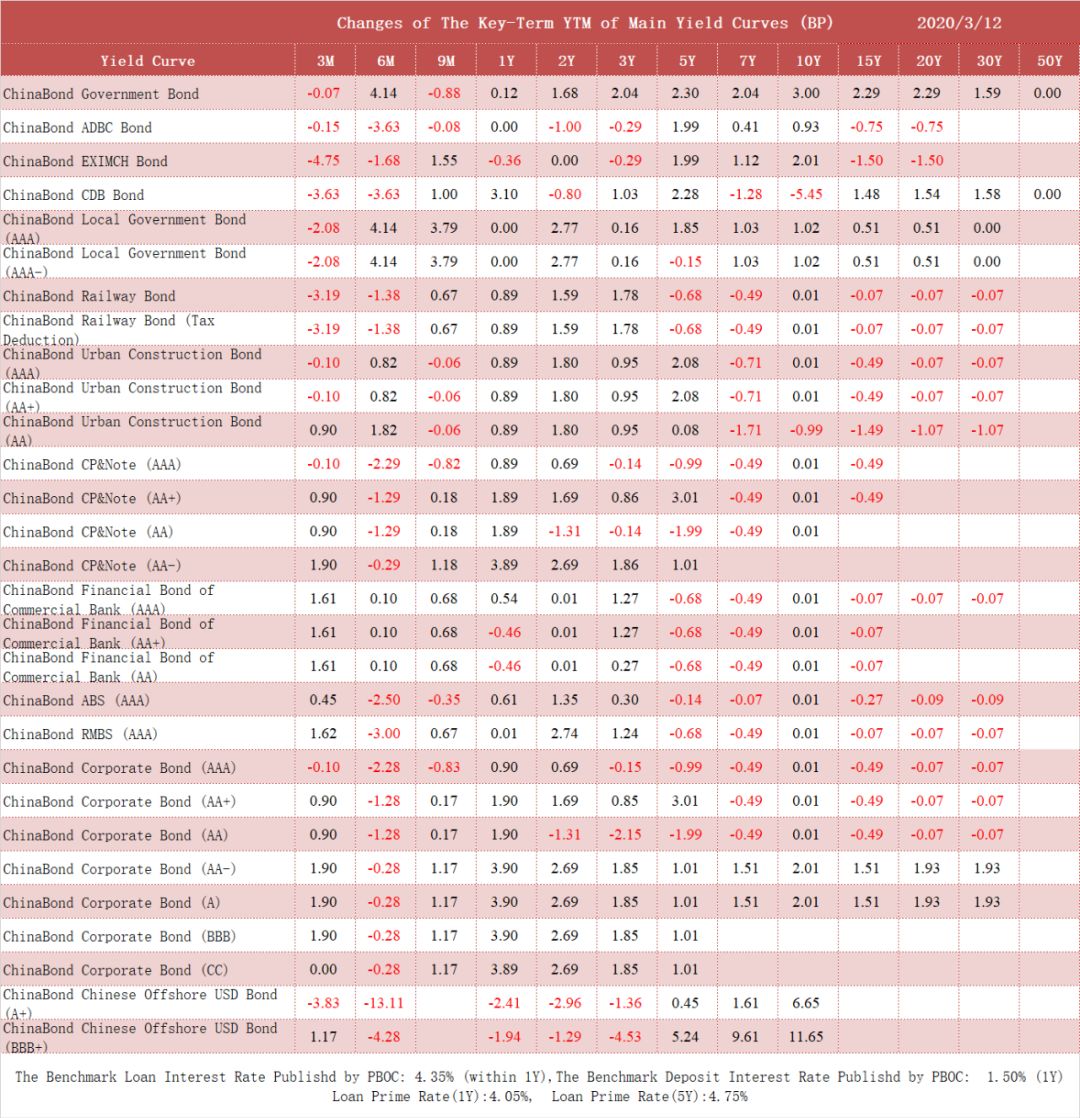

Further information about fluctuations of bond market yields please refer to the chart of Changes of The Key-Term YTM of Main Yield Curves.

▌

Notes

1. SKY is derived from ChinaBond Government Bond Yield Curve, including six key terms on 3M/1Y/3Y/5Y/7Y/10Y. It will be published on ChinaBond website at 5:30 every trading day of inter-bank bond market by ChinaBond Pricing Center.

2. The ChinaBond yield curves of corporate bonds are based on ChinaBond Market Implied Rating.

3. The daily update of ChinaBond Market Implied Rating please refer to Client terminal of ChinaBond Integrated Operation Platform and ChinaBond data download channel under ChinaBond Yield Curve and ChinaBond Market Implied Rating.

Data and Statistics

▌

OMO

As the liquidity is reasonable and adequate in the current banking system, the People’s Bank of China decides not to conduct reverse repo operations on March 12, 2020.

▌

Money Market

The Shibor went down today. The overnight Shibor went down by 45.40BP to 1.6640% and 1M Shibor went down by 1.50BP to 2.1300%.

▌

Trea

sury Futures

On March 12th, TS2006 was stable at 101.105, the yield went down by 5.15BP to 3.0636%; TF2006 went down by 0.04% to 101.790, the yield went up by 0.08BP to 3.3161%; T2006 went down by 0.14% to 101.315, the yield went up by 6.63BP to 3.5425%.

▌

Foreign Exchange Data

On March 12th, the intermediate value of USD/CNY quotation was 6.9641 with CNY down by 29BP.

▌

Stock Market

The stock markets went down today. SSE composite index went down by 45.03 points (or -1.52%) to 2923.49 points, Shenzhen component index went down by 259.04 points (or -2.31%) to 10941.01 points, and ChiNext price index went down by 55.53 points (or -2.64%) to 2045.93 points.

scan the below barcode to join 'ChinaBond Pricing Center' Wechat