一、指数概览

2017年4月,万事达卡财新BBD中国新经济指数(NEI)为31.8,即新经济投入占整个经济投入的比重为31.8%,较上月下降1.5个百分点(图1)。NEI新经济据于以下定义:首先,高人力资本投入、高科技投入、轻资产。其次,可持续的较快增长。第三,符合产业发展方向。

二、主要分项指标

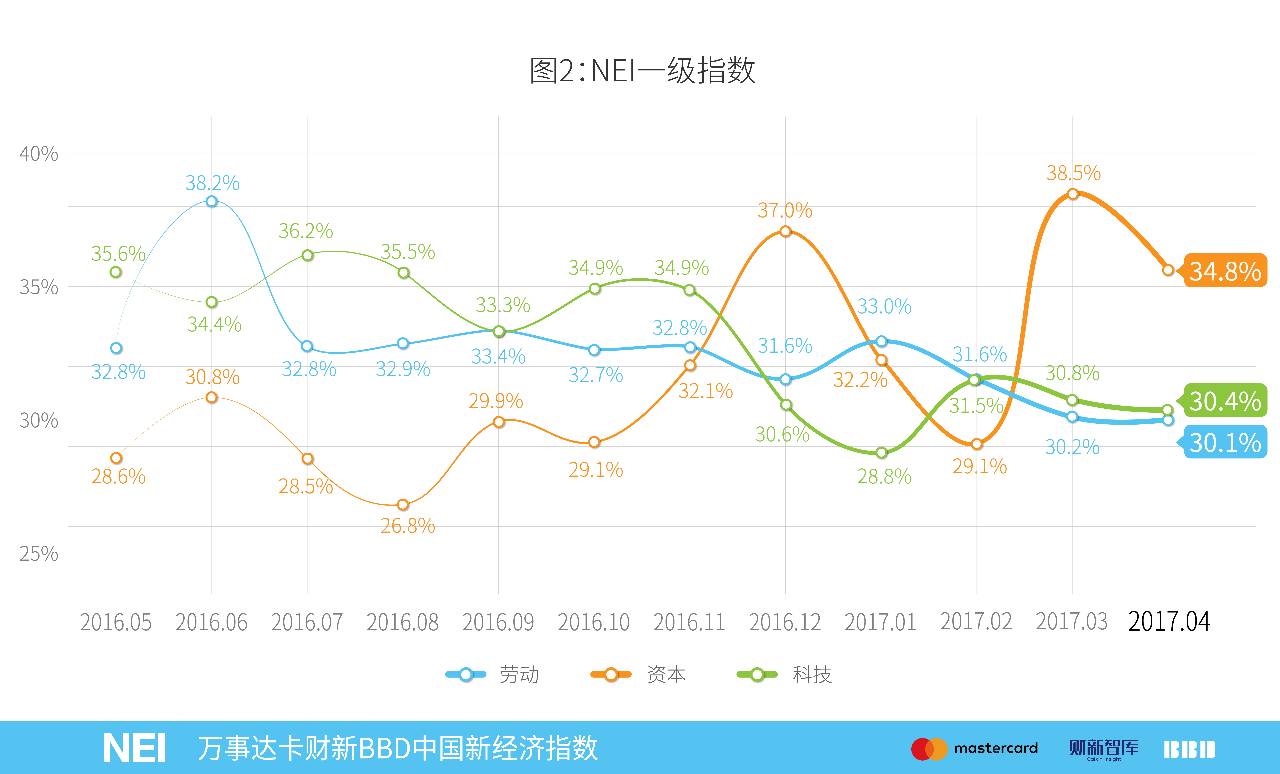

NEI包括劳动力、资本和科技三项一级指标,它们在NEI中的权重分别是40%、35%和25%。2017年4月NEI的下降主要来自资本投入的下降。资本投入指数在近半年中的波动较大,在3月出现强势反弹之后,4月有所回落,为34.8,但仍然处于较高区间内。劳动力投入指数继续下降,从2017年3月的30.2下降为30.1,为指数公布以来的最低值。科技投入指数则从上个月的30.8下降至30.4,同样出现了回落(图2)。

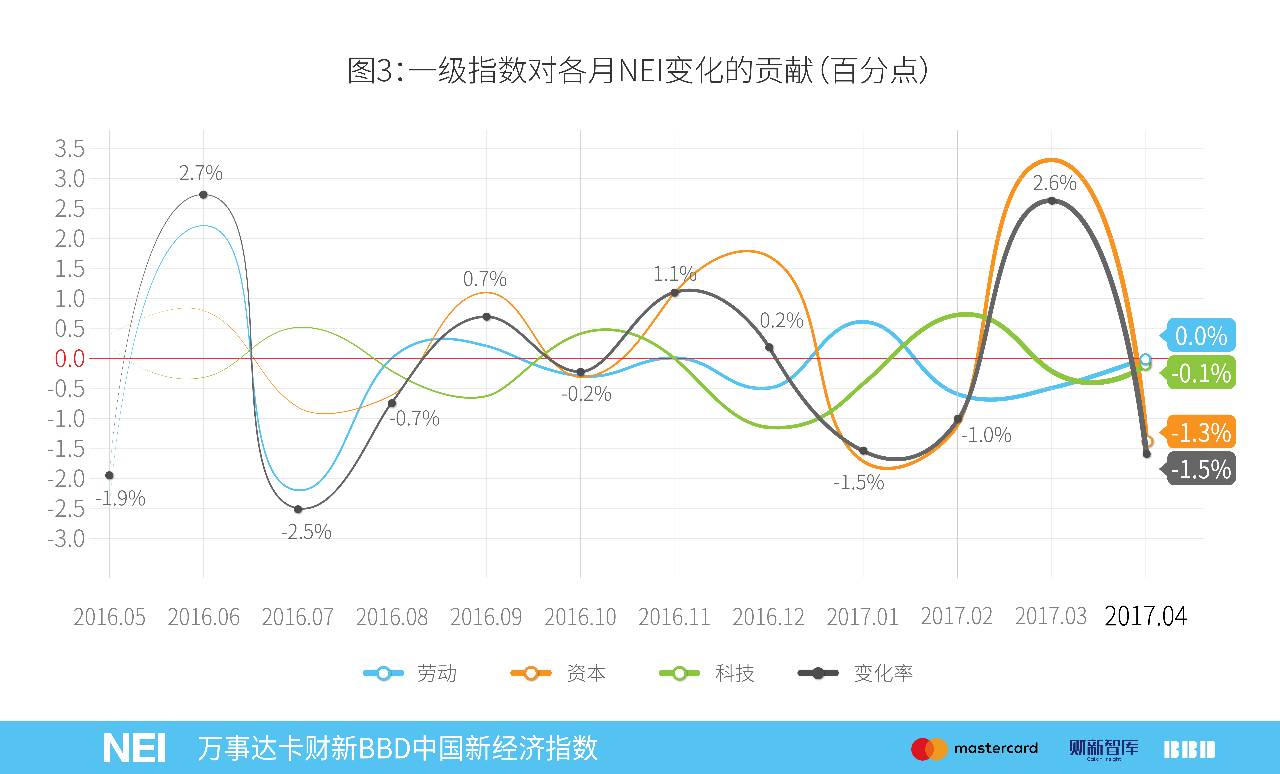

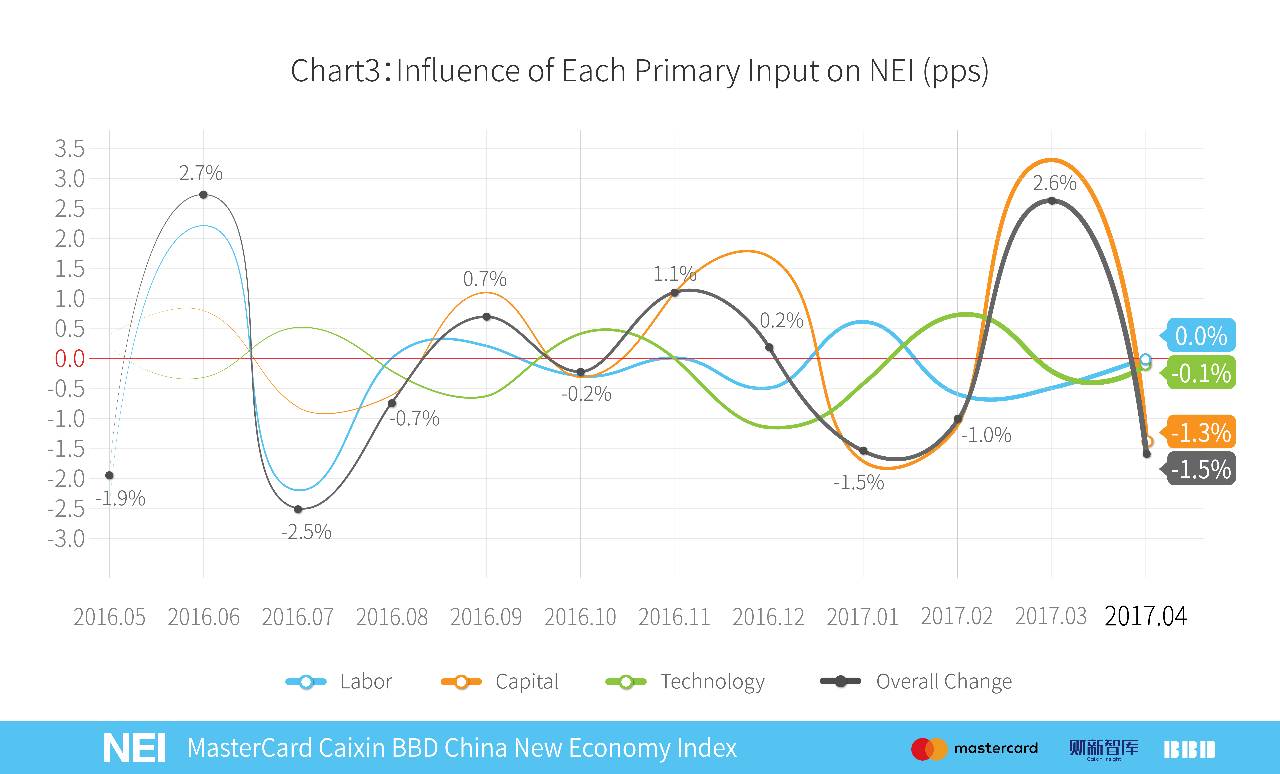

劳动力、资本和科技投入的变化绝对值分别为-0.1,-1.3,和-0.1个百分点,与权重相乘求和后,对2017年4月NEI变化的贡献值为-1.5(图3)。

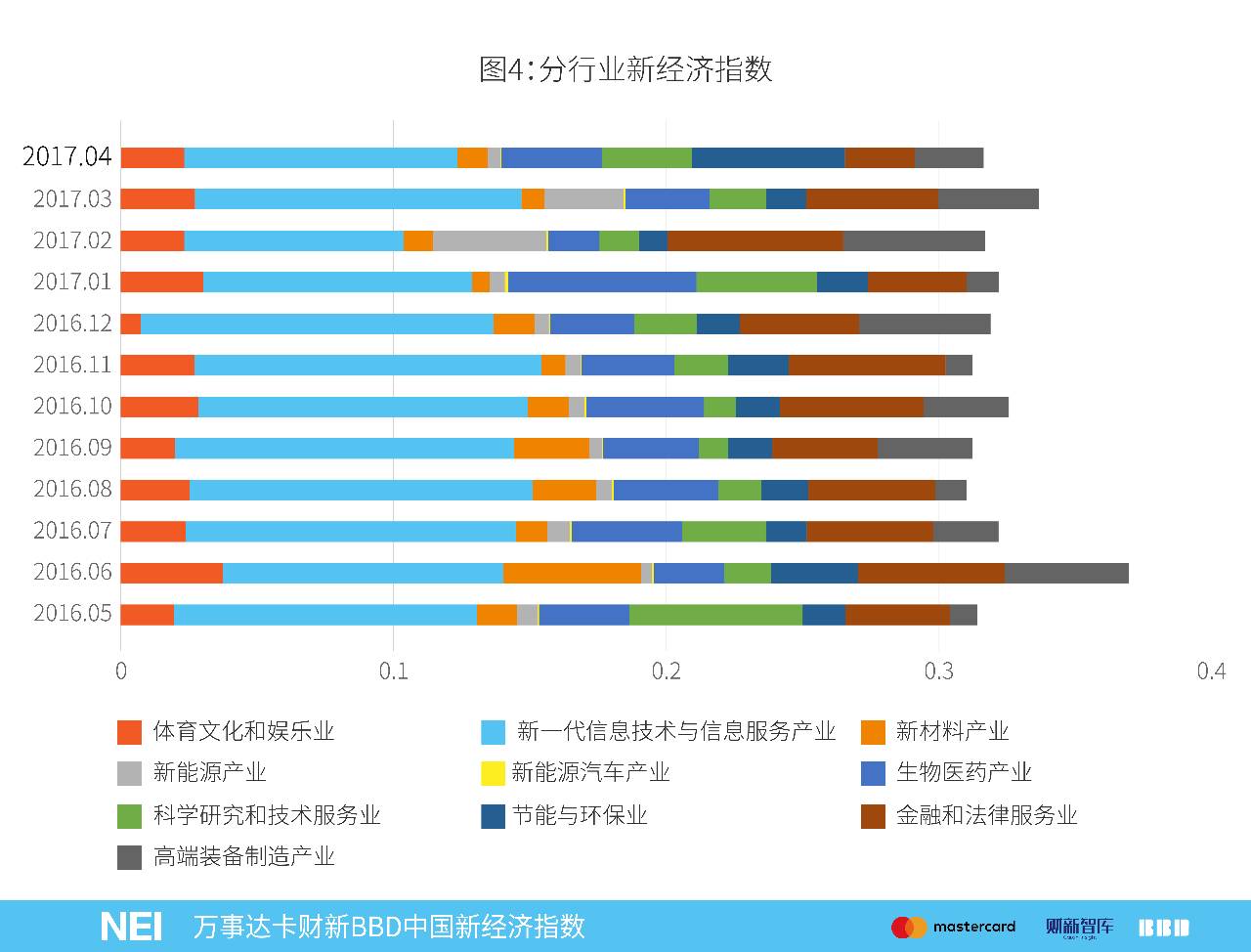

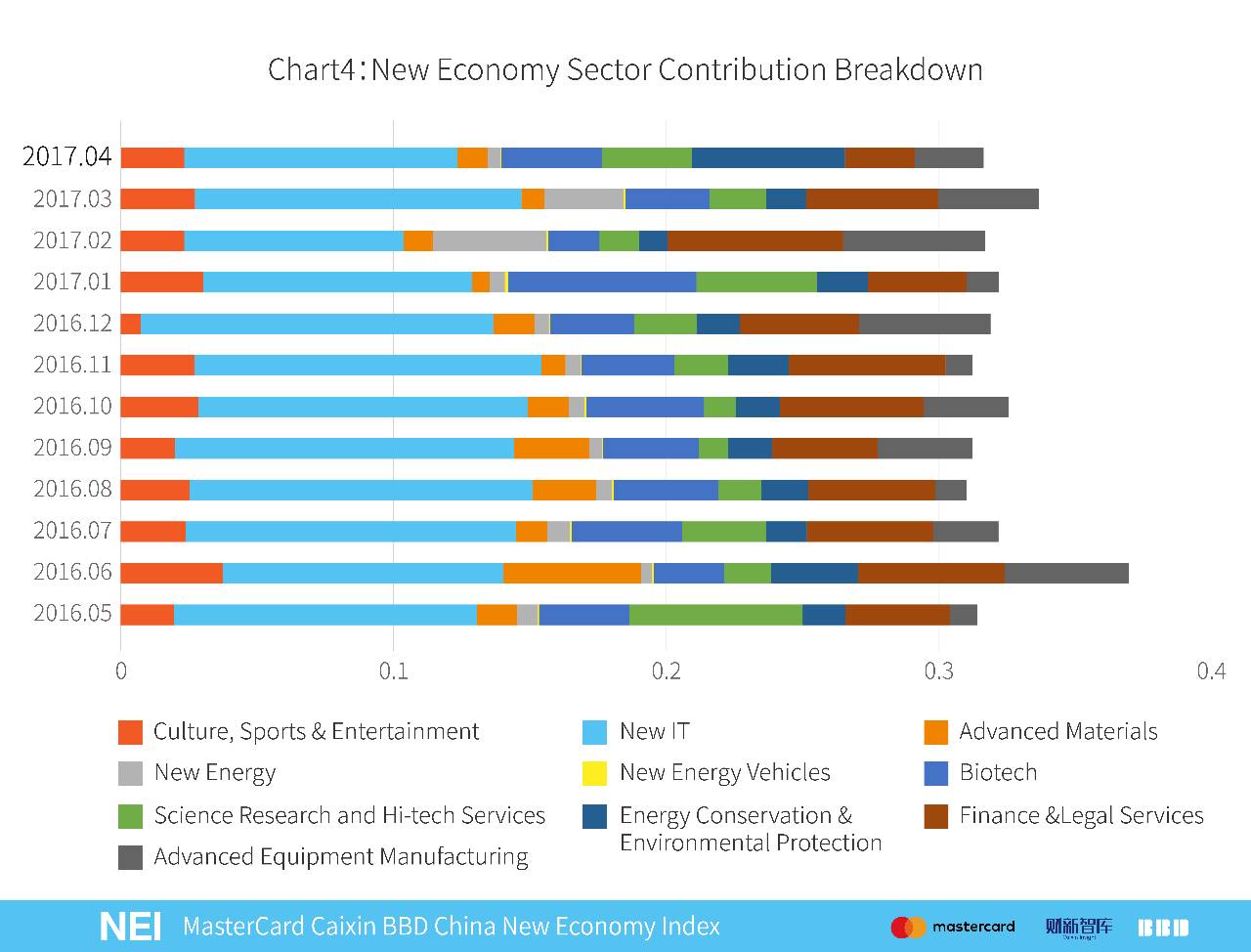

分行业看,NEI中占比最大的行业为新一代信息技术与信息服务产业,2017年4月为总指数贡献了10.0个百分点。节能与环保业贡献了5.6个百分点,排名第二,是最近半年以来排名最高的一次;生物医药产业贡献排名第三,本月为3.7个百分点;金融与法律服务业贡献排名滑落至第五,本月贡献2.6个百分点,约为2017年3月的一半(图4)。

三、新经济就业

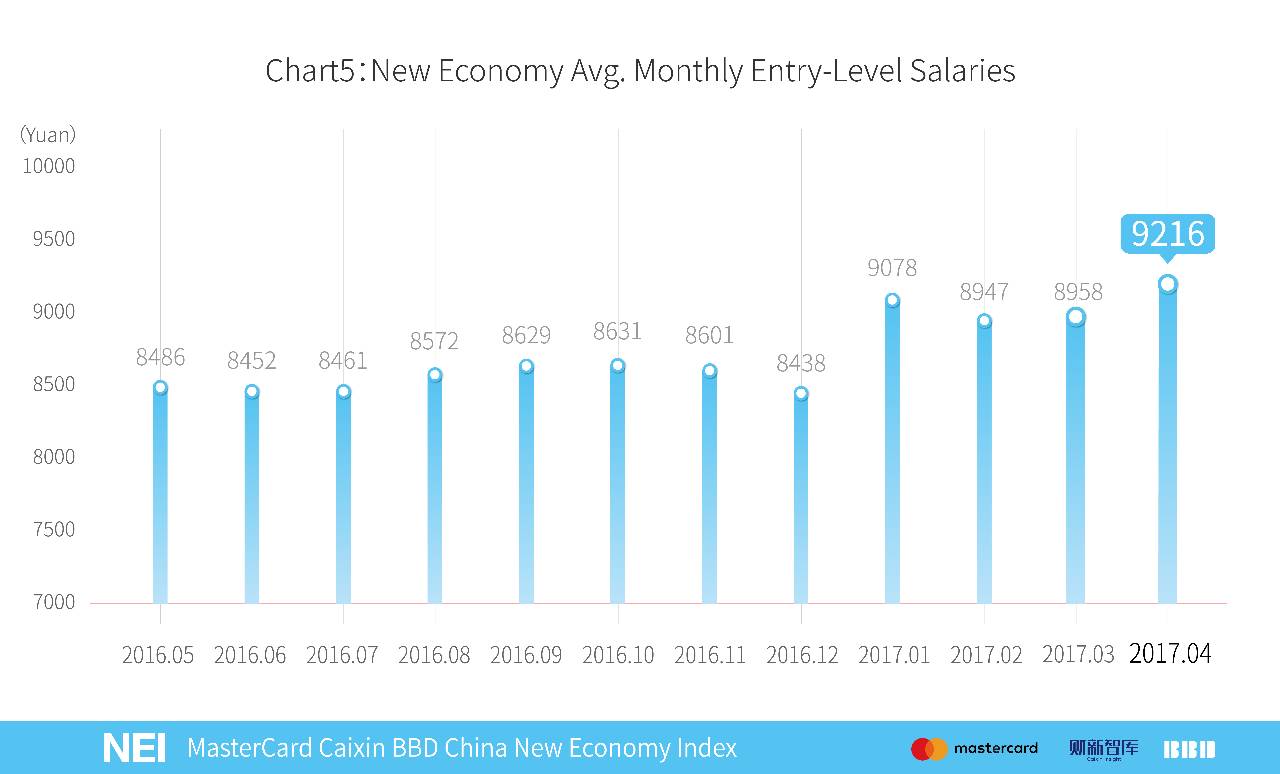

2017年4月,新经济行业入职平均工资水平与上月基本持平,为每月9216元,上月为8958元(图5)。新经济工资主要来自51job、智联招聘、拉钩、赶集网等数个招聘网站的招聘信息,即对劳动力的需求工资。

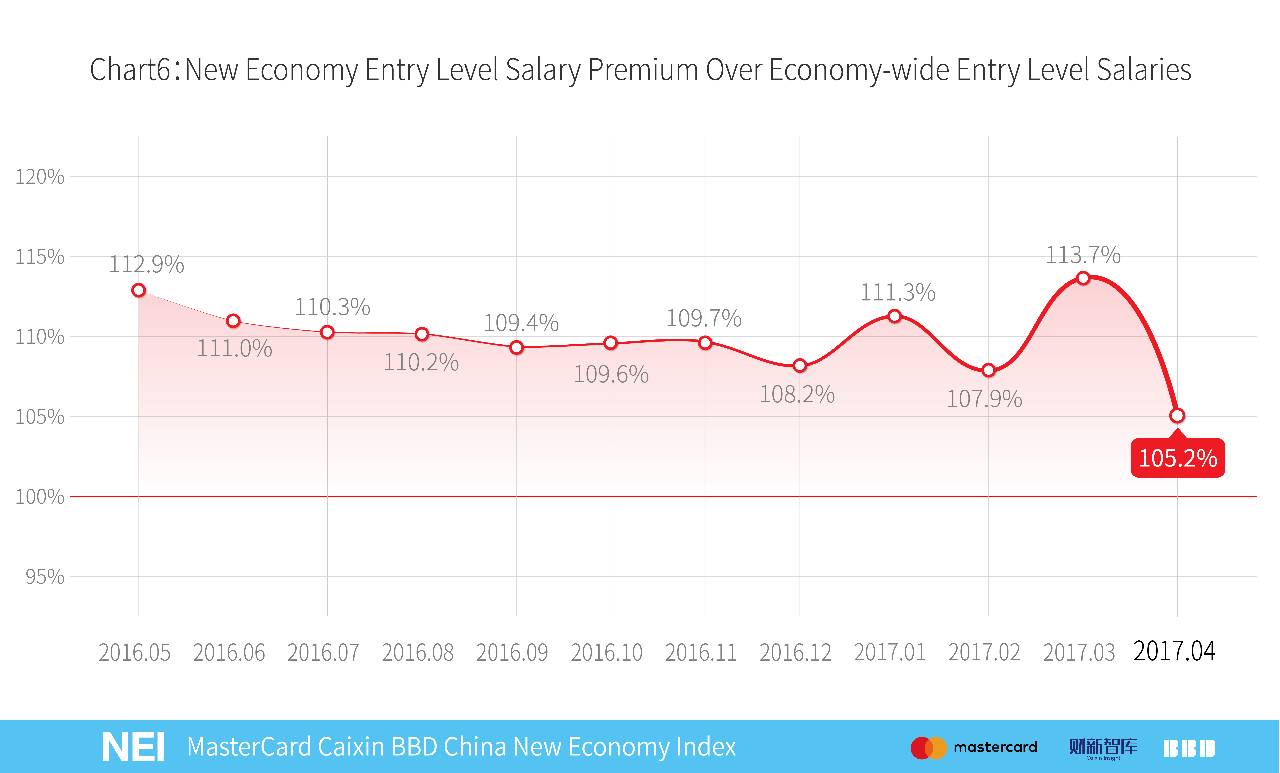

2017年4月新经济行业招聘人数占全国总招聘人数比例有所上升,从28.2%上升为29.3%,但新经济行业招聘总薪酬占全国总薪酬比重却出现了下降,从32.1%降至30.9%。这意味着新经济行业的平均入职工资水平相对于全国平均入职工资水平有所下降,2017年4月新经济入职工资“溢价”为5.2%,显著低于上月的13.7%(图6)。近半年来,新经济行业的平均工资溢价仅在春节前后出现了上升,其余时间都出现了稳步下降,本月已经达到了新经济指数公布以来的最低值。

四、从各大机场流量看经济活力

目前,2017年第一季度的经济数据已经陆续发布,本月我们对机场流量数据进行跨年度分析。我们比较的对象为2017年第一季度和2016年第一季度的各大机场流量数据。

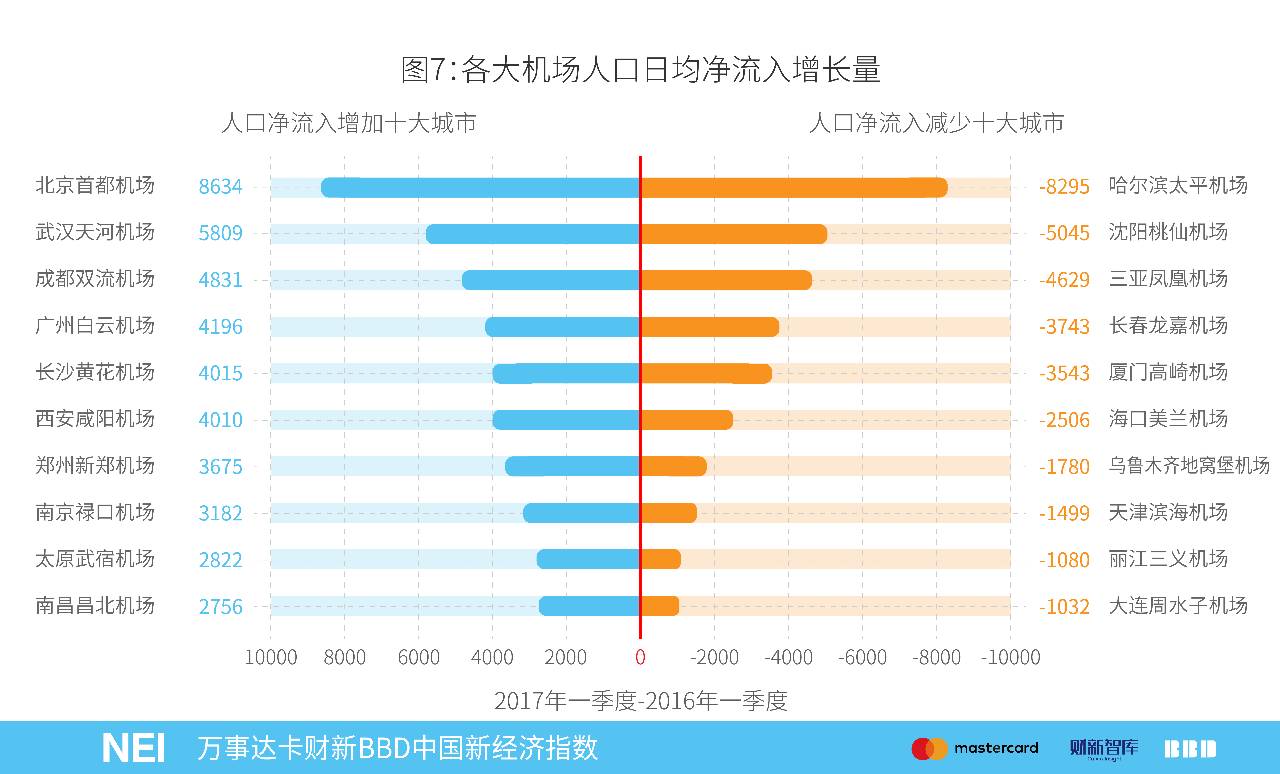

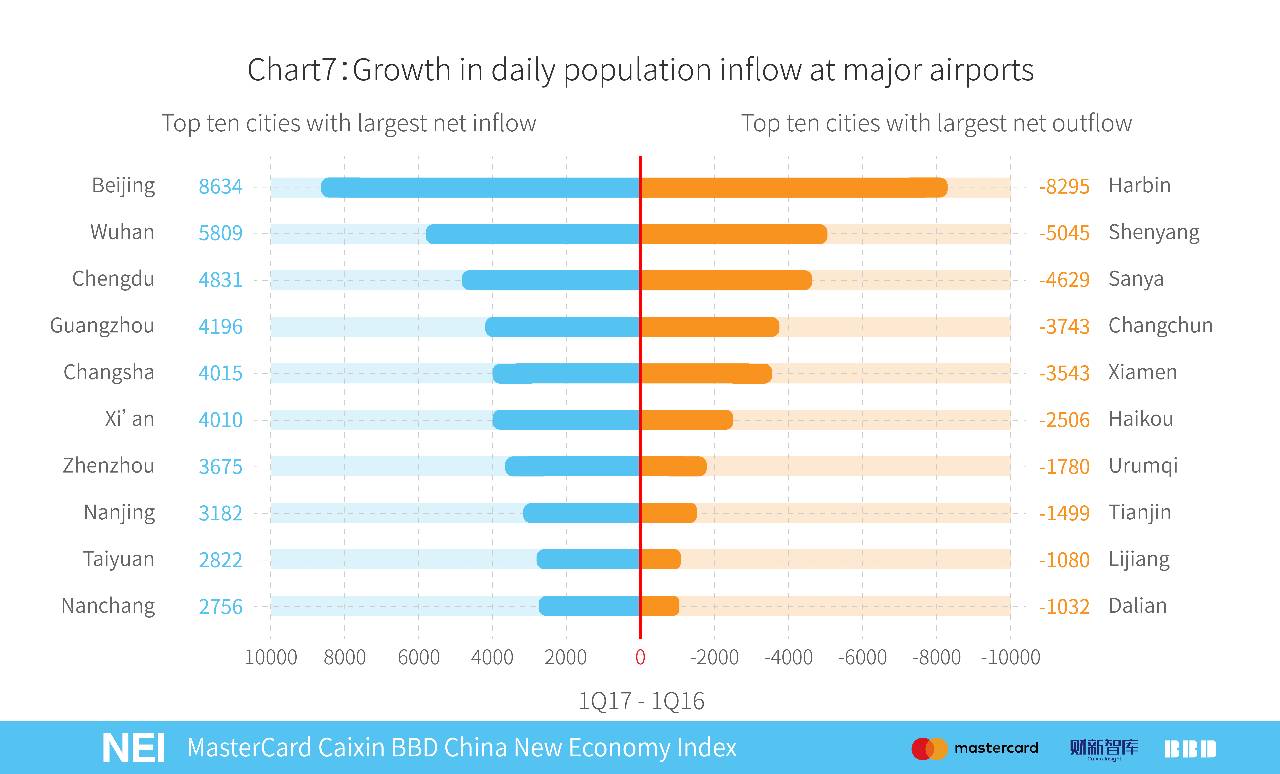

首先,我们将2017年第一季度平均每天的人口净流入量减去2016年第一季度平均每天的人口净流入量,并按照两者差的绝对值进行排序,得到了净流入增加量最快城市与净流入减少量最快城市。(图7)

可以看到,净流入量增加最大的城市是北京、武汉、成都、广州和长沙;其中,北京排名第一,这与2016年北京市常住人口仅仅增加了0.1%的结果在直觉上并不完全吻合。但是,同样在2016年,北京市的居民用水量和居民用电量的增长率却双双达到了2010年以来的最高值,这与机场流量数据的结果较为匹配。

成都和长沙维持了2016年以来的强势人口吸引力,成为中西部的亮点。深圳和上海在航班净流入人口增加量上未能进入前十名。

在净流出量减少最多的城市中,哈尔滨、沈阳和长春分别排名第一、第二和第四,从侧面呈现出东北三省仍然缺少对人口的吸引力。三亚和丽江分别名列第三和第九,可能与这两个旅游城市近一年来不断出现的负面消息有关。

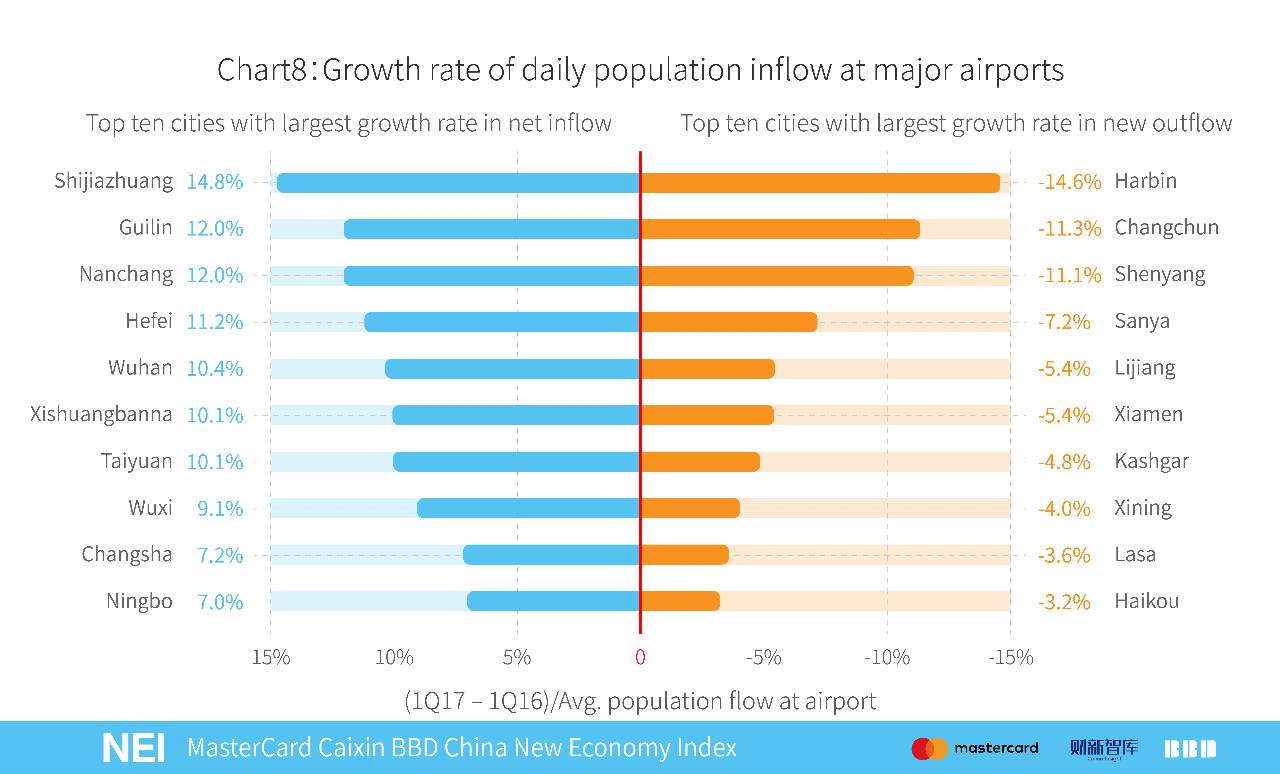

其次,我们将上表算出的净流入量除以该机场的人口总流量,便可从增速上判断不同城市的吸引力,这样的排序对二线城市较为公平。

在下图中,我们的排序针对全国最大的60个机场。可以看到,石家庄、桂林、南昌、合肥和武汉名列净流入量增速最快的城市前五名,其中石家庄的增速排名全国第一,可能与雄安成为国家级新区的政策有关。值得一提的是,下表数据仅仅包括了第一季度的比较,而雄安新区设立公布的时间是2017年4月1日(图8)。

在流出量增速最快的城市中,哈尔滨、长春、沈阳这三个东三省的省会与三亚、丽江这两个旅游城市同样名列前五。

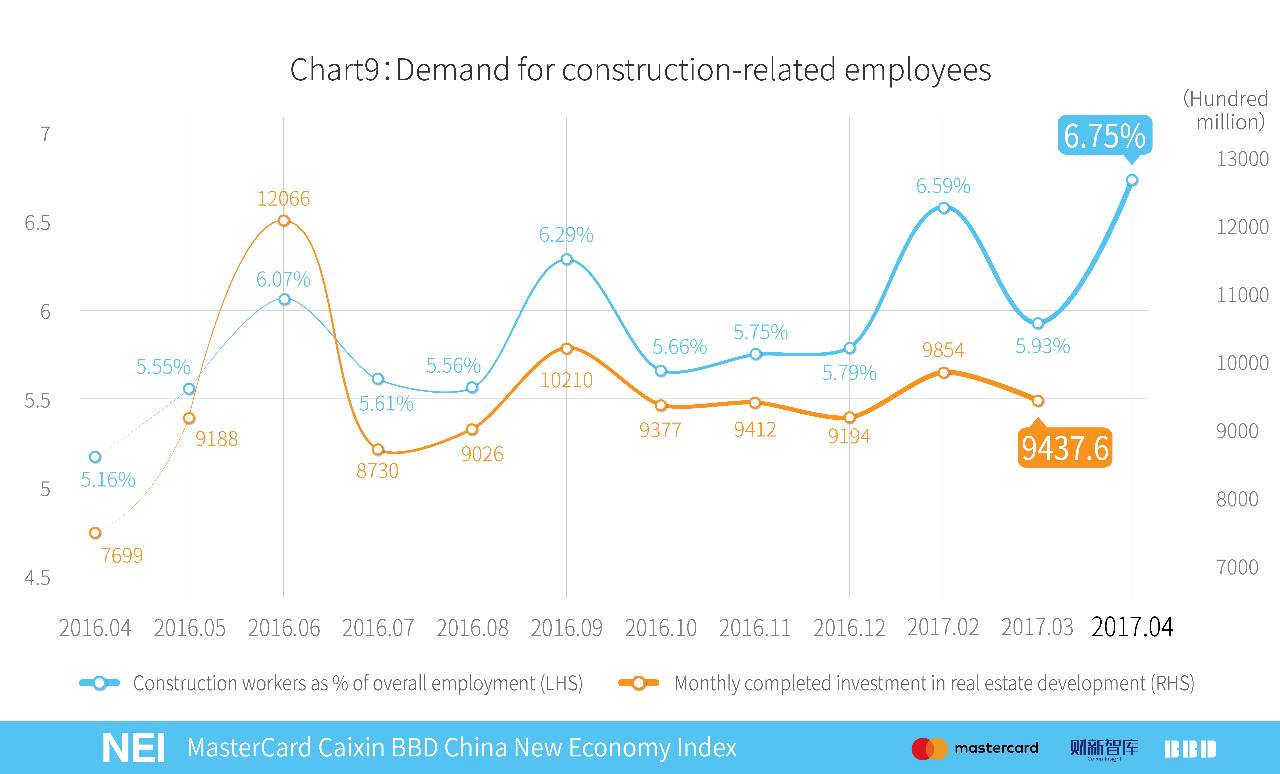

五、从劳动力数据看投资复苏

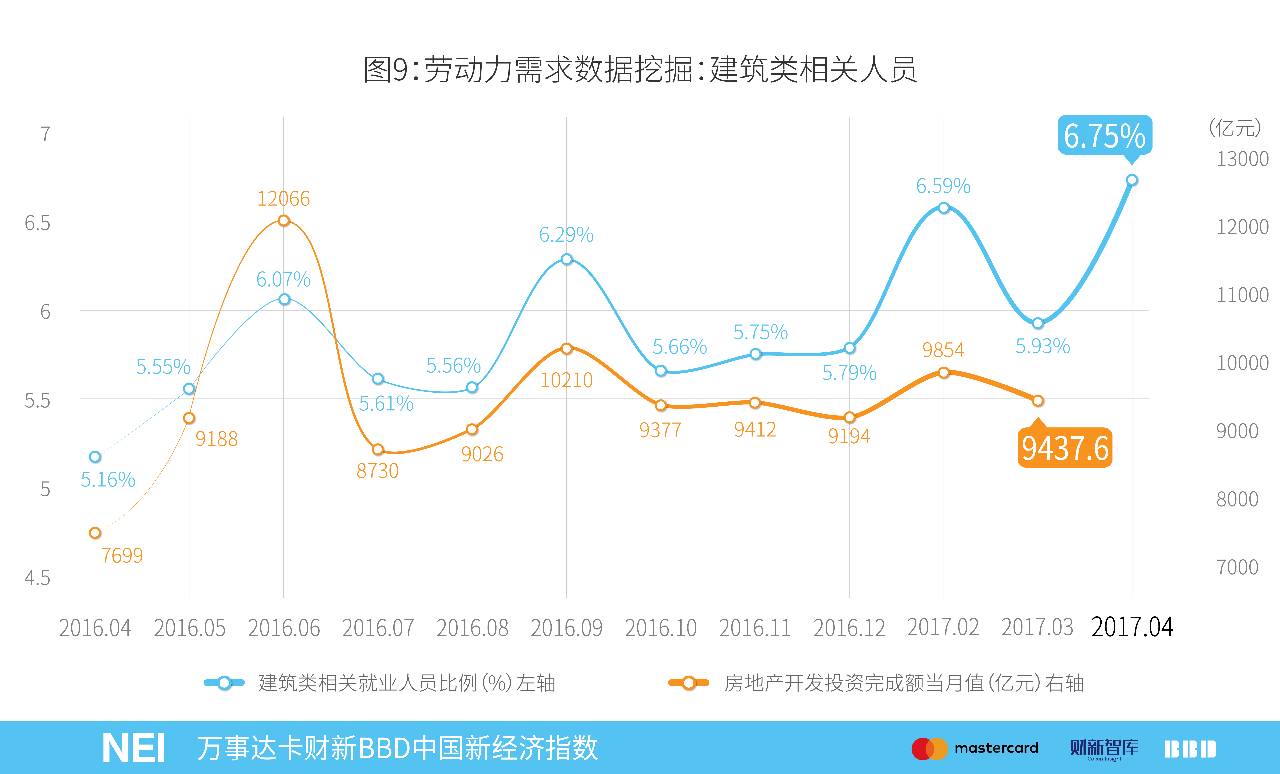

在2016年10月,我们曾经使用劳动力大数据对目前的投资进行分析,并得到了很好的预测效果。本月,我们重复这套预测方案——使用中国每月的房地产开发投资完成额当月值与劳动力数据建筑类就业人员的需求占比进行比较,可以看到两者走势高度一致。而从劳动力数据可以看出,建筑类劳动人员的需求占比已经达到了6.75%,比去年同期的5.16%高出1.59%,也是我们测算该数据以来的最高值。这预示着下一个月的房地产投资数据会出现显著上升,也从侧面说明2017年房地产投资可能会达到一个相当高的水平。

六、城市新经济排名

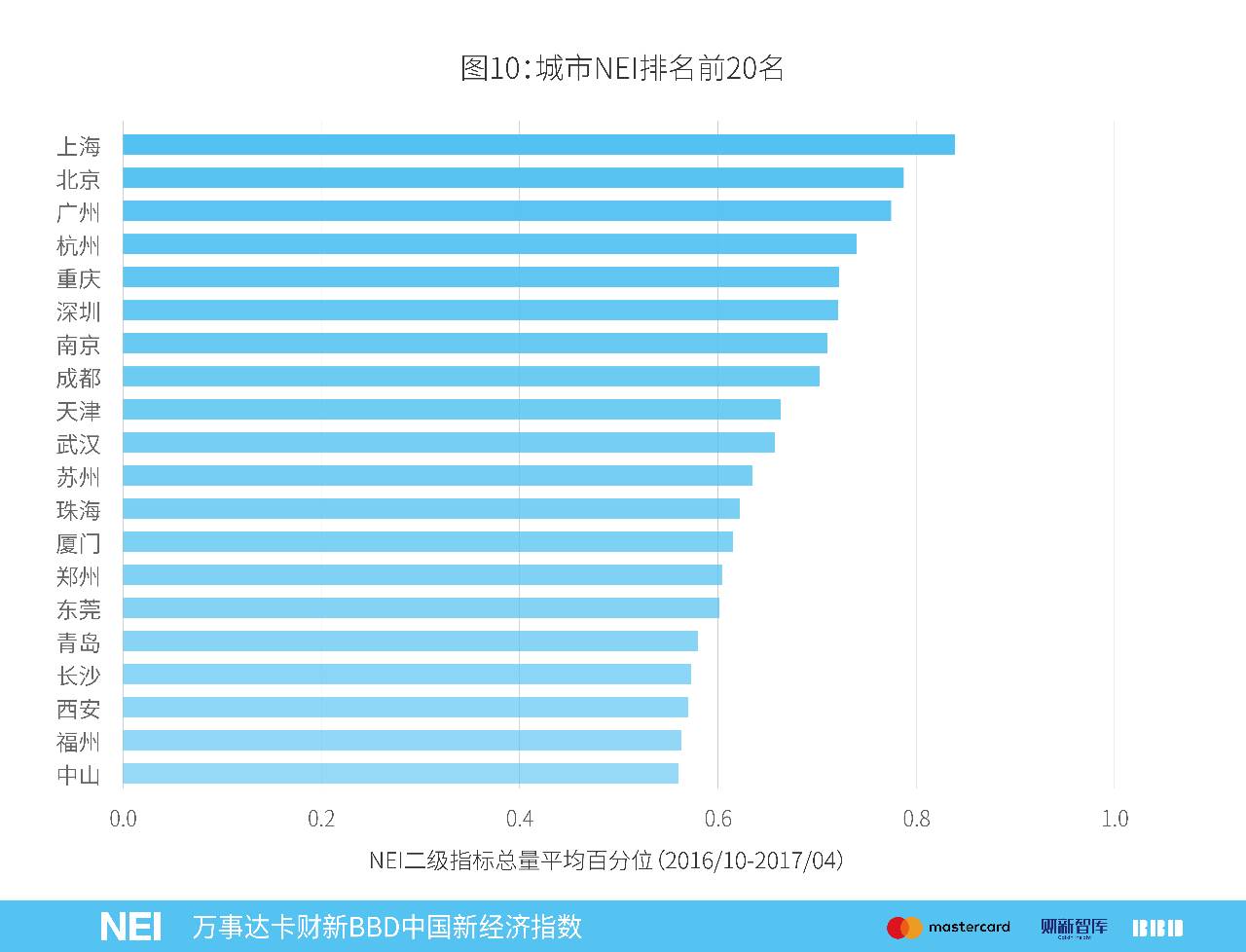

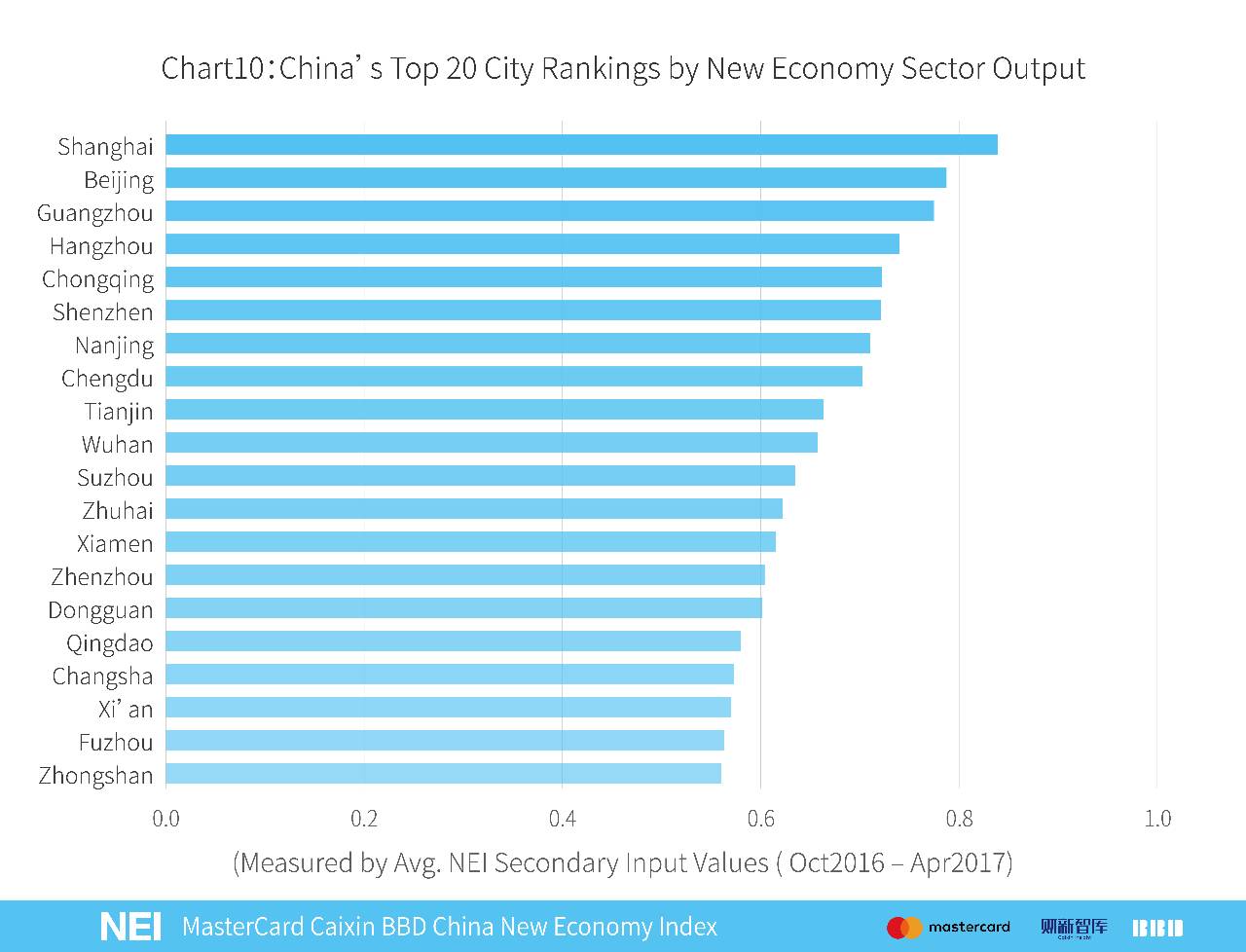

2017年4月新经济总量指数城市排名前20名如图10所示,上海、北京、广州、杭州、重庆排名前五。该排序计算每个投入指标在所有城市中的排序百分位,再将百分位加权平均,体现的是近半年城市间新经济总量排名。

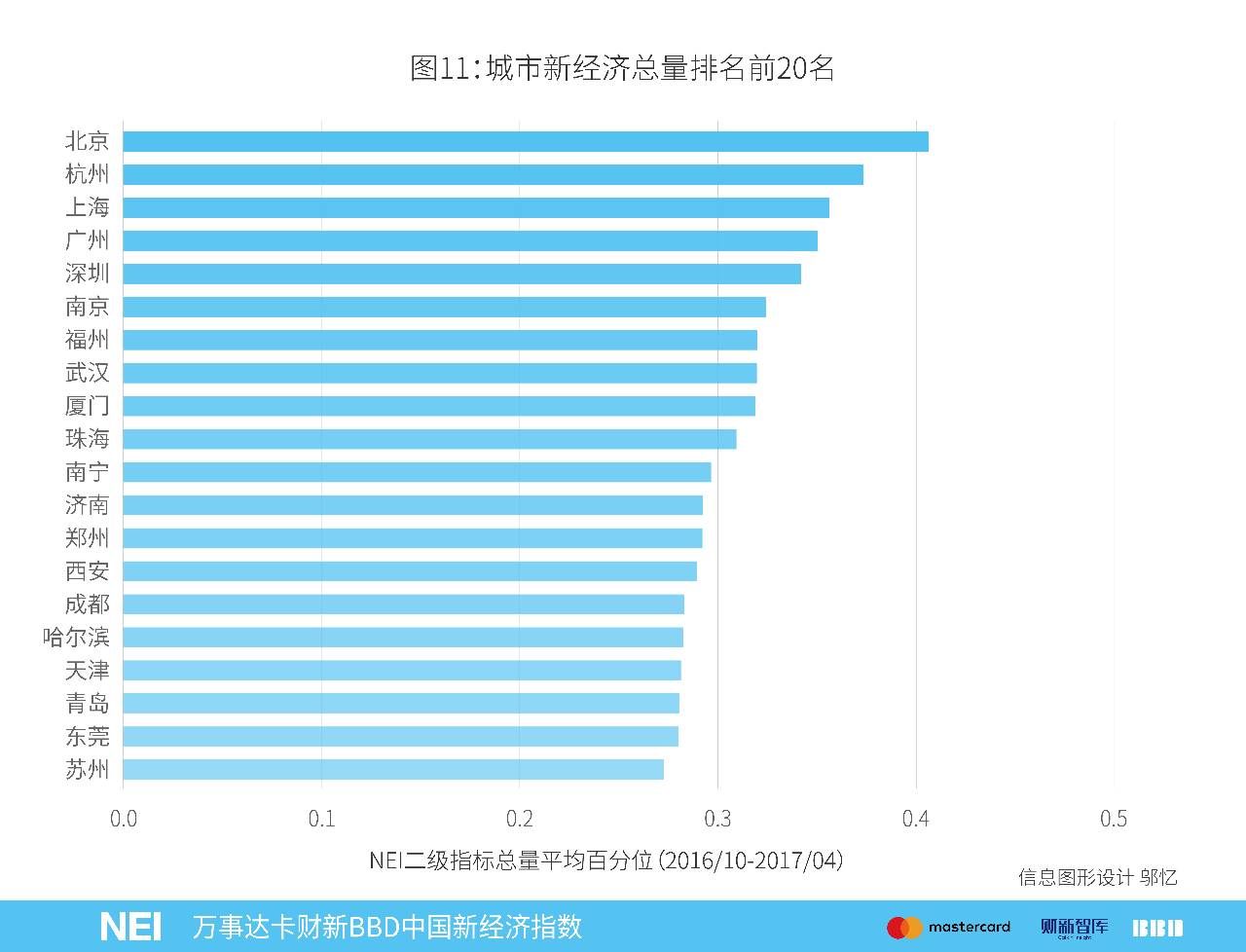

图11计算了2016年10月到2017年4月城市NEI平均排名,前五名为北京、杭州、上海、广州、深圳。

更多咨询敬请联络:

万事达卡

公共关系副总裁 吴焕宇

电话:+86-10-8519-9304

电邮:[email protected]

财新智库

财新智库总裁兼首席经济学家 沈明高

电话:+86-10-8518-8170 转8618

电邮:[email protected]

公关总监 马玲

电话:+86-10-8590-5204

电邮:[email protected]

BBD(数联铭品)

BBD(数联铭品)首席经济学家 陈沁

电话:+86-28-65290823

电邮:[email protected]

版权声明

万事达卡财新BBD中国新经济指数,是由财新智库(深圳)投资发展有限公司和成都数联铭品科技公司共同研发,与北京大学国家发展研究院合作,经过近一年努力,于2016年3月2日在北京首发的指数产品,此后每月2日上午10:00发布上月数据。

关于万事达卡:

万事达卡(纽交所股票交易代码:MA),

www.mastercard.cn

,是全球性的支付与科技公司。通过运营全球最快的支付处理网络,万事达卡将超过210个国家和地区的消费者、金融机构、商户、政府和企业连接在一起。万事达卡的产品和解决方案使得每个人在购物、旅行、企业经营、财务管理等日常商业活动都变得更容易、更安全和更高效。敬请关注我们的“万事达卡”官方微信以及在新浪的官方微博@万事达人,以获悉动态并参与互动。也可访问万事达卡新闻中心或万事达卡互动中心获取更多资讯。

关于财新:

财新传媒是提供财经新闻的全媒体集团,依托专业的团队和强大的原创新闻优势,以网站、移动端、期刊、视频、图书、会议等多层次的业务平台,为中国最具影响力的受众群,提供准确、全面、深入的财经新闻产品。财新智库是财新传媒通过孵化另行建立的高端金融资讯服务平台,旨在通过发展金融数据业务,壮大宏观经济研究队伍,服务于智库业务客户。详细信息,敬请浏览

www.caixin.com

。

关于BBD:

BBD(数联铭品)是行业领先的大数据解决方案提供商,紧密围绕新经济,通过动态尽调、信用评级、风险定价和经济指数四个步骤,BBD提供从微观到宏观的大数据服务。详细信息,敬请浏览:

http://www.bbdservice.com

。

报告英文版:

April 2017

MasterCard Caixin BBD China NewEconomy Index

Released:10:00am Beijing Time May-02-2017

Overview

In April 2017, the MasterCard Caixin-BBD New Economy Index (NEI) reading came in at 31.8, indicating that the New Economy accounted for 31.8% of overall economic input activities that month, down 1.5 ppts from March (Chart 1). New economy is defined as following: 1) human capital intensive, technology intensive and capital light; 2) sustainable rapid growth, and 3) in line with the strategic new industries defined by the government.

Primary Inputs

The NEI includes labor, capital and technology inputs that account for 40%, 35% and 25% of the total weight of the index, respectively. Among the primary inputs, the decrease in the April NEI reading came primarily from decreasing capital investment. Capital investment showed wide fluctuations in the recent half year; it rebounded strongly in March but declied in April, coming in at 34.8, still in a relatively high range. Labor inputs continue to decline, dropping to 30.1 from 30.2 in March, the lowest number since the release of NEI. Technology input declined to 30.4 from 30.8 a month ago (Chart2).

Percentage changes in labor, capital and technology inputs were -0.1, -1.3 and -0.1 ppts, respectively. After accounting for the sum of their weightings, the net NEI change was a 1.5 ppts decrease from March (Chart 3).

Looking at the sub-sectors, the New IT industry formed the largest proportion of the New Economy Index, contributing 10.0 ppts to NEI. Energy Conservation & Environmental Protection came second, contributing 5.6 ppts, the highest ranking since the recent half year. The third largest contributor was Biotech with 3.7 ppts. Finance & Legal Services dropped to the fifth contributor with 2.6 ppts, about a half of the number in March (Chart 4).

New Economy Employment

In April 2017, the average monthly entry level salary of the New Economy was RMB 9,216 per month, an increase from last month’s level of RMB 8,947 (Chart 5). New Economy wage information is compiled from online websites of career platforms and recruitment services including 51job and Zhaopin, as well as other sites that list job demands.

Hiring in the New Economy sectors accounted for 29.3% of total hiring in February, an increase from the previous month’s 29.3%. The compensation share of New Economy sectors saw a decline, from 32.1% to 30.9%. The entry level salary premium of the New Economy was 5.2% as compared to economy-wide counterparts, a significant decrease from 13.7% in March (Chart 6). In the recent halt year, the average salary premium of the New Economy only saw an increase around the Chinese New Year and declined for the rest of the time. It came to the lowest reading in this month since the release of the NEI.

Economic Activities Based on Major Airport Traffic

This month, we analyze airport traffic data by comparing major airport traffic in 1Q17 and 1Q16.

First, we subtract the 1Q16 average daily population net inflow from that in 1Q17 to obtain cities with the fastest increase in new inflows as well as the cities with the fastest decrease in new inflows.

Based on our analysis, cities with the largest net inflows are Beijing, Wuhan ,Chengdu, Guangzhou, and Changsha. Among them, Beijing ranked the first, which seemed inconsistent with the low level of 0.1% growth in Beijing resident population in 2016. However, in 2016, both the growth rates of water consumption and residential electricity consumption in Beijing reached new highs since 2010, which is consistent with the airport traffic data.

Chengdu and Changsha are two of the Midwest cities that have maintained strong ability to attract population inflow from 2016. Shenzhen and Shanghai failed to rank into the top ten cities according to airport traffic data.

Among the cities with the largest net outflows, Harbin, Shenyang, and Changchun are ranked the first, second, and fourth respectively, implying that the northeastern provinces still fail to attract population inflows. Sanya and Lijiang are ranked the third and ninth, possibly due to negative news associated with these two tourist cities over the past year.

Second, we use the net population inflow calculated in the table divided by the total population of the airport to determine the attractiveness of different cities based on growth rates. This method is more fair for the comparison among second-tier cities.

In the following chart, we showed rankings for China’s largest 60 airports. Based on our analysis, Shijiazhuang, Guilin, Nanchang, Hefei, and Wuhan are ranked as the top five cities with the fastest growing net inflows. Shijiazhuang’s high ranking might be related to the establishment of Xiong’an New Area in Hebei Province. It is worth mentioning that the data only shows comparison between first quarters, while the establishment of Xiong’an New Area was accounced only in April 1st.

Among the cities with the largest net outflows, the top five are Harbin, Changchun, Shenyang, Sanya, and Lijiang.

Recovery in Investment Based on Employment Data

We use monthly completed investment in real estate development and demand for construction employees to analyze the current state of incestment. In the following chart, the two indexes showed a similar trend. From the labor force data, demand for construction workers reached 6.75%, up 1.59% from 5.16% in April last year, which is also the highest figure since we measured the data. This suggests that investment in real estate development might show a significant rise next month, and real estate investment throughout the year might reach a high level.

City Rankings of the New Economy

Based on overall New Economy rankings, the top twenty cities are shown in Chart 10. The top five cities are Shanghai, Beijing, Guangzhou, Hangzhou, and Chongqing. Rankings are based on a moving average of the percentile rank of indicators for the city in the past 6 months.

Chart 11 showed the average NEI city rankings between October 2016 and April 2017. The top five cities are Beijing, Hangzhou, Shanghai, Guangzhou, and Shenzhen.

For further information please contact:

MasterCard

Mr. Wu Huanyu, Vice President of Public Relations

Tel: +86-10-8519-9304

Email: [email protected]

Caixin Insight Group

Dr. Minggao Shen, President & Chief Economist

Tel: +86-10-8104-8016

Email: [email protected]

Ma Ling, Public Relations

Tel: +86-10-8590-5204

Email: [email protected]

BBD

Chen Qin, Chief Economist

Tel:+86-28-65290823

Email:[email protected]

The MasterCard Caixin BBD China New Economy Index is the fruit of a research partnership between Caixin Insight Group and BBD, in collaboration with the National Development School, Peking University. The subject of a year of research, the NEI was first publically released on March 2, 2016 and will be issued the 2nd of every month at 10:00am China Standard Time.

About Caixin

Caixin Media is China's leading media group dedicated to providing financial and business news through periodicals, online content, mobile applications, conferences, books and TV/video programs. Caixin Media aims to blaze a trail that helps traditional media prosper in the new media age through integrated multimedia platforms. Caixin Insight Group is a high-end financial data and analysis platform. For more information, please visit

www.caixin.com

.

About MasterCard

MasterCard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. We operate the world’s fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MasterCardAP and @MasterCardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

About BBD (Business Big Data)

BBD is a leading Big Data and quantitative business analytics firm specializing in the analysis of the high-growth industries emerging in Mainland China. Through dynamic data tracking, credit analysis, risk pricing and economic index construction, BBD provides its clients with a wide range of services at both the macro and micro level. For more information, please visit

http://www.bbdservice.com/

.