What’s new

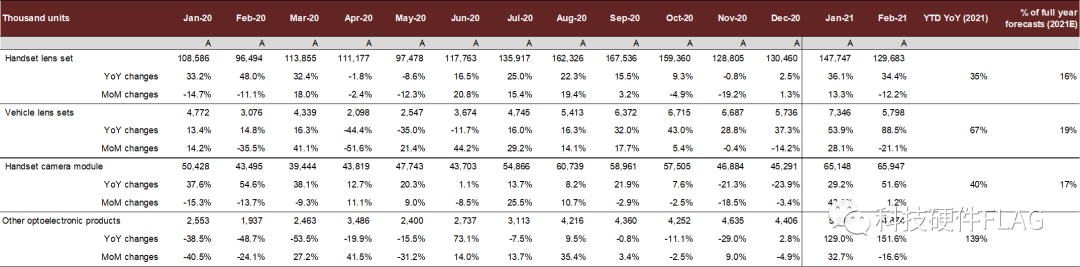

Sunny reported a strong February shipment data on March 9. The shipment volume of four major business segments in January–February (including CCM, handset lens, vehicle lens, and other optoelectronics products) recorded strong YoY growth, mainly due to solid market share improvement in major customers.

We maintain OUTPERFORM and a target price of HK$225

on Sunny’s long-term positives, including new Apple business and market share gains in major customers. Sunny will announce its 2020 annual results on March 17 and hold its annual analyst meeting on March 18. We expect solid guidance from management after this positive monthly result.

Comments

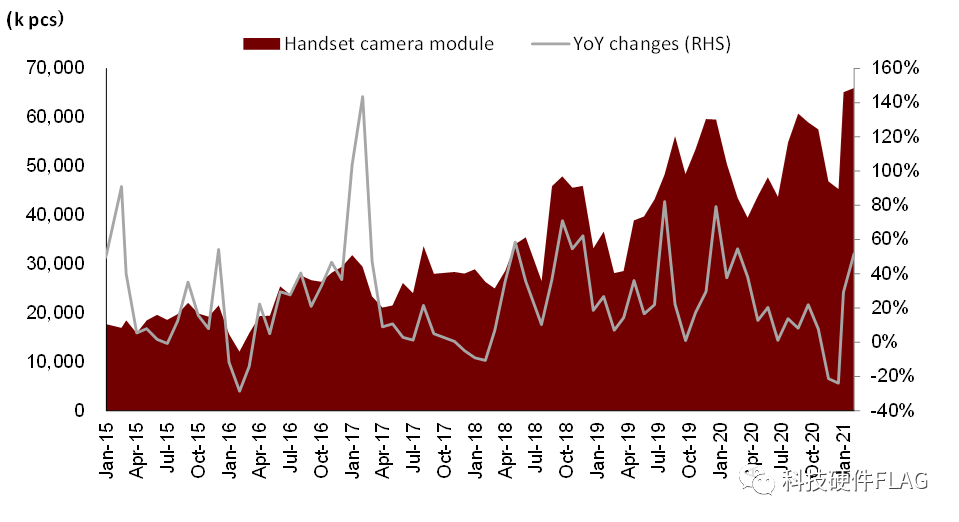

CCM recorded strong growth with market share improvement.

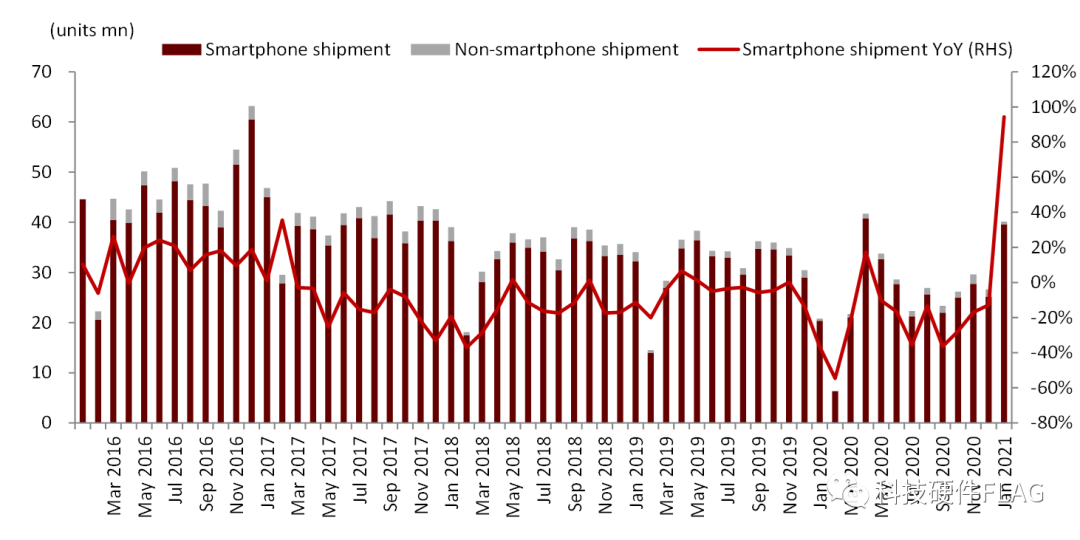

Sunny recorded 40% YoY growth for CCM shipments in January–February, thanks to increased market share in major customers (i.e. Samsung and Xiaomi). We believe Sunny has already accomplished a transition from Huawei to other customers, and we expect Sunny will continue to benefit from the global market recovery from COVID-19 in 2021.

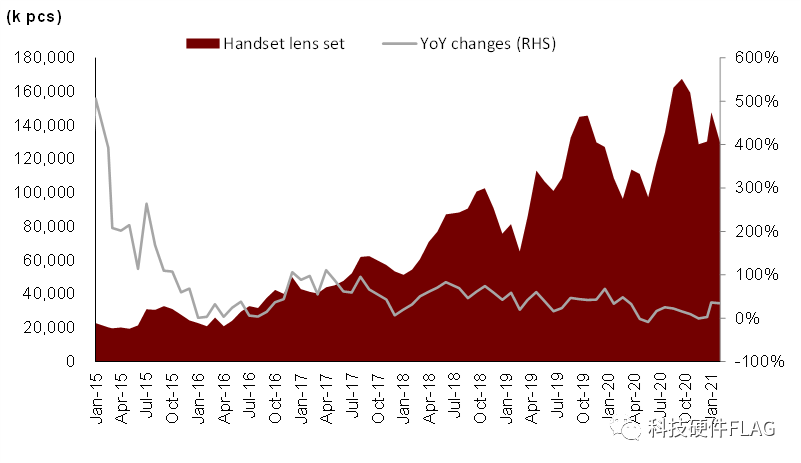

Handset lens shipment maintains robust growth.

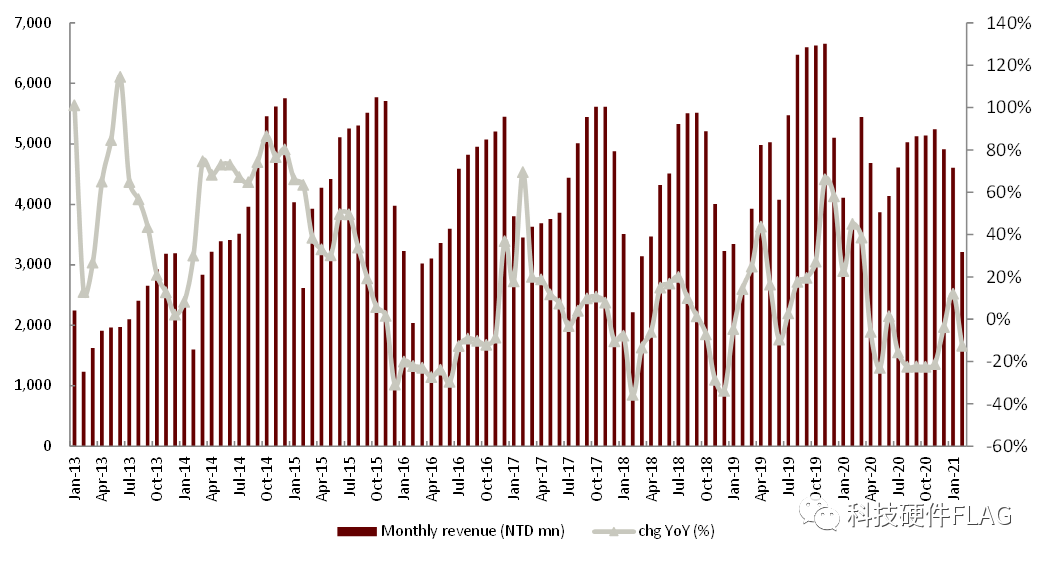

Sunny recorded 35% YoY growth in its handset lens shipment in January–February, still outperforming Largan’s 0.5% YoY sales growth in the same period. We expect upgrades in 2021 to partially offset intense competition in middle- to low-end handset lens products.

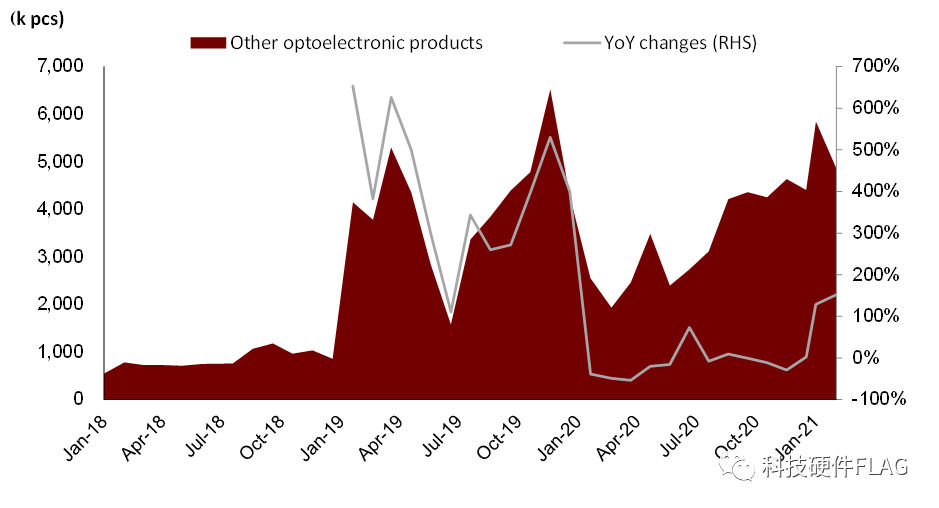

Other optoelectronic products driven by ToF and VR.

The shipment of other optoelectronic products increased 139% YoY in January–February. We believe AR and VR technology will see substantial improvement in 2021 and may become mainstream trends in the mid-to-long term.

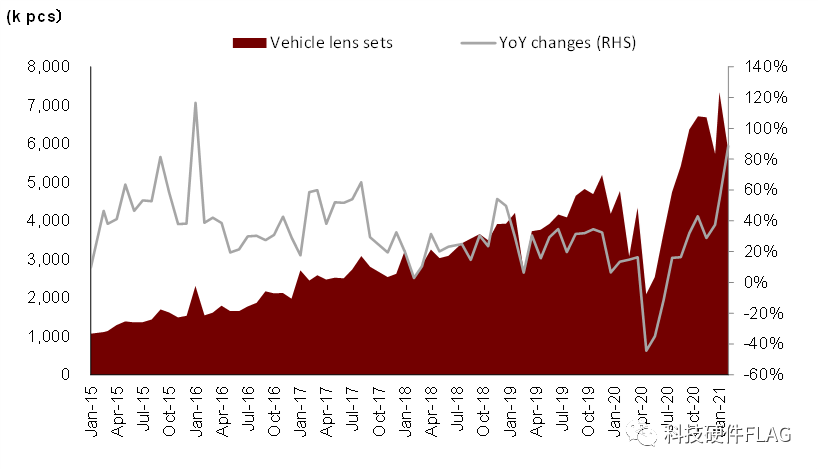

Vehicle lens recorded strong growth.

In January–February, vehicle lens shipment recorded 67% YoY growth. We believe this segment will benefit from penetration of advanced driver-assistance systems (ADAS) in the long term.

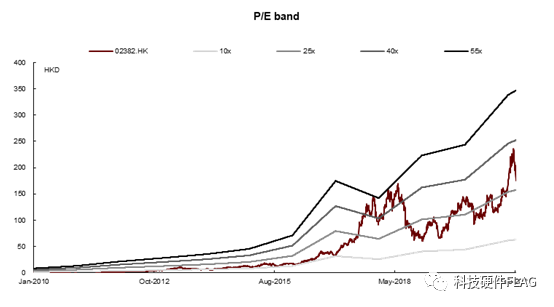

Valuation and recommendation

Sunny is trading at 28.0x and 24.7x 2021e and 2022e P/E. We maintain our earnings forecasts and OUTPERFORM rating. We maintain our target price of HK$225, representing 35.4x and 31.2x 2021e and 2022e P/E and 26.3% upside.

Risks

COVID-19 impact; China-US trade friction.

Figure 1: Sunny – Monthly handset lens setshipments

Source: Company announcement, CICC Research

Figure 2: Sunny – Monthly shipment of other optoelectronic shipments

Source: Company announcement, CICC Research

Figure 3: Sunny – Monthly shipment of vehicle lens sets

Source: Company announcement, CICC Research

Figure 4: Sunny – Monthly shipment of handset camera modules

Source: Company announcement, CICC Research

Figure 5: Sunny – Monthly shipment

Source: Company announcement, CICC Research

Figure 6: Chinese mainland – Monthly smartphone shipments

Source: CAICT, CICC Research

Figure 7: Largan – Monthly sales trends

Source: Company announcement, CICC Research

Figure 8: P/E band

Source: Wind Info, Bloomberg, CICC Research

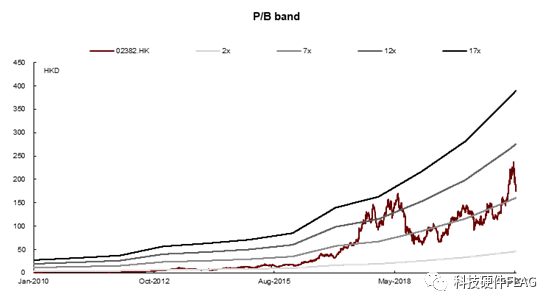

Figure 9: P/B band

Source: Wind Info, Bloomberg, CICC Research

本文

摘自:

2021

年

3

月

8

日已经发布的

《

舜宇光学科技(

02382.HK

)

2

月数据点评:市场份额稳步提升,重申跑赢行业评级

》

陈旭东

SAC

执证编号

:S0080519120006

SFC CE Ref:BPH392

胡誉镜

SAC

执证编号

:

S0080517100004

SFC CE Ref:BMN486

彭 虎

SAC

执证编号

:S0080521020001