Summary -

Shanghai surged to new high, after staying below 3300 for more than eight months (“

Outlook 2017: High-Wire Act

”, 20161213). But China’s short-term growth rate cycle has peaked, and long-term cycle is declining - as indicated by our three-year property inventory investment cycle. Already, July’s economic data show that growth momentum has begun to wane. Contrary to consensus, the breakout had little to do with the revival in the old and cyclical part of the economy, but was driven by strong earnings in large caps – a structural opportunity we have been advocating. Indeed, large caps tend to outperform in an environment of moderating growth. As growth momentum is moderating rather than collapsing, the environment conducive for gains in large caps should persist, leading major stock indices to new highs. Continue to focus on earnings and size. (“

An Idiot’s Guide to China’s Nifty-Fifty Run

”, 20170609). And on financials, internet and tech, consumer and large cap industry leaders.

The obsession with cyclical strength stemming from an upstream resuscitation can be precarious. The surge in commodity prices is already pressuring the profitability of the mid and down-stream companies.

Mathematically

, such unrelenting strength in the upstream cyclical sectors means cyclicals could

in theory

seize all profits in the economy eventually, creating significant misallocation of resources, ultimately making the economy an entire cyclical being – a far cry from the objective of our structural reform.

The easing effect from a weak dollar is under appreciated. But most dollar bears have been buried. In a bubble, unrestrained price surge away from fundamentals is on its own self-destructive. It will also invite regulatory intervention. As the economy continues to expand, the commodity bear market rally has not exhausted. But traders’ skill will continue to be tested. Borrowing from thousands of years of Chinese ancient philosophy, we have updated our theory and models regarding China’s growth rate cycle in this note.

这是今天的报告《

中国经济周期权威指南 之二 - 新高

》的英文版,感谢阅读。

---------------

“Though this be madness, yet there is method in ’t.” – Hamlet, Shakespeare

For the Chinese, time is cyclic. It is a recurrence, a tapestry of monsoons, seasons and the rise and fall of dynasties. It is one of the reasons why the Chinese is prone to economic cycle theories. Since ancient times, the Chinese classics such as

the I-Ching, the Records of the Grand Historian and the Discourses on Salt and Iron

all had discussed cycles in the ancient agrarian economy. As commodity prices are surging back after its plunge between March and June, pundits are once again invoking economic cycle theories to point to the beginning of a “new economic cycle” – but many discussions are rich in theory and scant in data.

Regrettably, indicators from the old, more cyclical part of the economy are being applied as evidence for the “new cycle”. The term “cycle” suggests regularity, implying that economic variables fluctuate around a long-term trend with well-defined length and amplitude. In practice, it is easy to confuse interim swings with secular trends. But bullish momentum in commodity prices can be contagious. In March, we wrote the first part of “

A Definitive Guide to China’s Economic Cycle

”. We demonstrated the peaking of China’s three-year property inventory investment cycle - with comprehensive data. In this note, borrowing from ancient Chinese philosophy, we will discuss various Chinese cycles in further details.

The Growth Rate Cycle

The significance of any cyclical models is to identify turning points. The timing of the cycle’s peak and trough will mean profit or loss for traders. It would be futile to trade with hindsight. For forecasting purpose, our discussion will focus on the growth

rate

cycle – as opposed to the growth cycle that is commonly discussed. While a growth cycle consists of contraction and expansion of activity levels, a growth

rate

cycle measures the rate of change in economic growth, and is more adept at forecasting inflection points. The growth

rate

cycle can turn down, even if the level of economic activities is still expanding. Indeed, we have been applying the concept of growth

rate

cycle across almost all quantitative models in our writings.

Unbeknownst to many economists, the world underwent unsynchronized recessions in the 1990’s. It happened, because countries such as Germany and Japan seemed to have undergone an uninterrupted period of post-war economic growth on the surface. For these countries, the word “recession” indeed means a sustained period of below trend growth rate. Japanese growth was actually around 3% during the lost decade. China has also experienced uninterrupted growth since its “Reform and Open” in 1978. As such, the concept of growth rate cycle is more applicable when analyzing China.

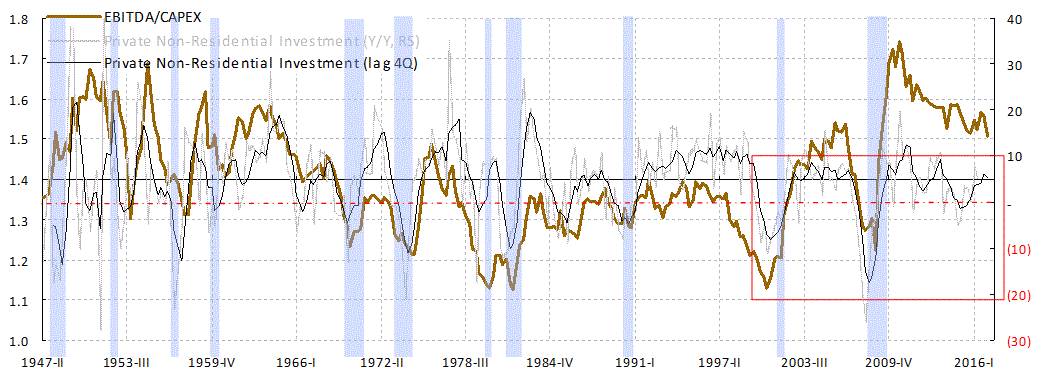

The US Investment Cycle

Recently, a client approached us with a chart of US investment growth rate since 2000. The chart showed that the US investment growth rate troughed in 2002, 2009 and again in 2016, with a gap of seven years between each growth bottom (

Focus Chart 1,

top panel, red rectangle highlight

). As the gap of seven years roughly coincides with the length of a typical Juglar Cycle of around six years, my client asked whether the current upswing in investment growth constitutes the beginning of a new cycle.

Focus Chart 1: US RoI leads GDP/investment growth, and explains the volatility in cyclical sectors well.

We believe a cycle means sustained and simultaneous upward or downward movements across key economic variables. The trend has to be pronounced, pervasive and persistent. Wesley Mitchell, an Economic Cycle guru, outlined the classic definition of business cycles as “

fluctuation in aggregate economic activities

”. A cycle must “

consist of simultaneous expansion in many economic activities followed by similarly general recessions, (must be) recurrent … and not divisible into shorter cycles of similar magnitude and character

”.

Once we extend the chart backward beyond 2000, the quasi-Juglar cycle starts to fade into the more frequent fluctuations in the US investment growth since 1947 (i.e. not recurrent). Our data show that the inception of a new investment cycle tends to begin with a substantially more negative growth rate (i.e. the cycle observed since 2000 is divisible into shorter cycles of similar magnitude and character). In short, the chart does not fit the classic definition of cycles. Indeed, the previous two bottoms of investment growth are concurrent with the US recession in 2002 and 2009. A new cycle will likely initiate with investment growth rate once again falls to its recession level.

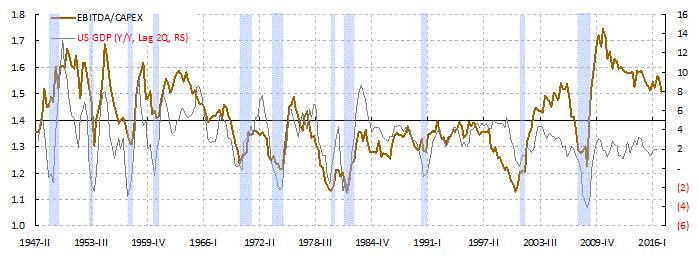

Instead, we calculate the history of US Return on Investment (RoI) by comparing the aggregated EBITDA and Capex of US firms since 1947. We show that this measure consistently leads the US private non-residential investment by two to four quarters, and the US GDP growth by two quarters (

Focus Chart 1

, top and mid panels

). The reason is intuitive – when investment generates good return, it attracts more investment. And vice versa.

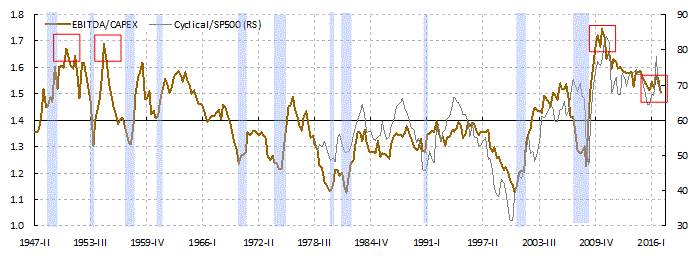

The US investment return has been declining since 2012. It explains why US firms deploy its capital to buy back stocks, instead of reinvesting in Capex. It also explains the volatility and the bear market in commodities since 2012 (

Focus Chart 1

,

lower panel

). Indeed, this persistent decline in US RoI was the basis of our call for a severe commodity bear market back in 2013 (“

Black Horse and Black Swan

”, 20131207). Subsequently, oil plunged from USD100+ to USD28, iron from USD 140 to USD40 and rebar steel from RMB 3,600 to RMB1,800, before their recovery in late 2015.

The Twelve-Year Cycle

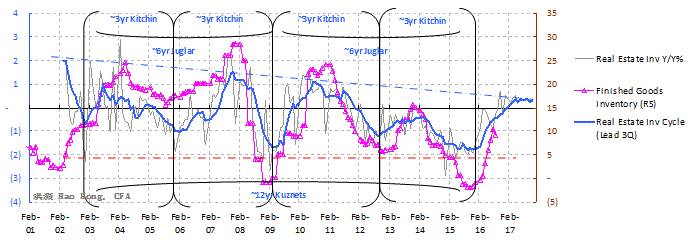

Another client approached us, with a chart showing that the growth rate of China’s industrial finished goods inventory bottomed in 2016 and started to rise. The low points of the growth rate are consistent with the levels seen in 3Q2009 and 4Q2002 – previous cyclical bottoms. Visually, the bottom in 2016 appears to be a significant low (

Focus Chart 2

, top panel

). Thus, my client posited that the momentum of inventory restocking will likely continue.

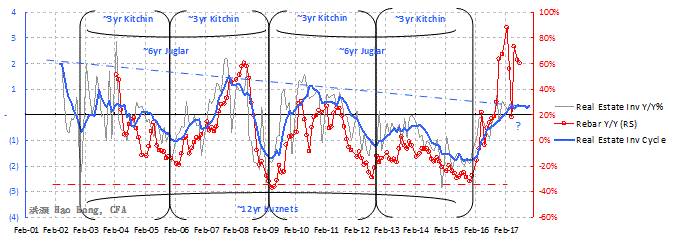

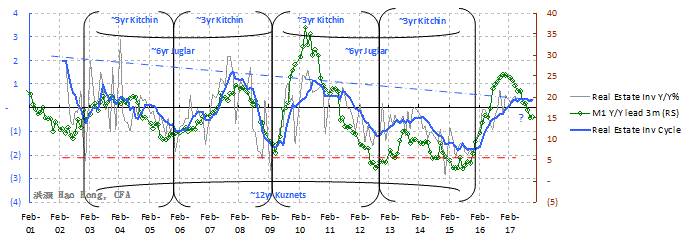

Focus Chart 2: The 3-year property inventory cycle lags M1, coincides with rebar price and leads finished goods inventory.

In the first part of “

A Definitive Guide to China’s Economic Cycle

”, we discussed China’s three-year property inventory investment cycle with supporting data and charts. Our quantitative model shows that the growth rate of China’s property investment, once filtered out the noises from higher-frequency observations, demonstrates a persistent three-year cycle. This cycle is similar in length as the three-year Kitchin Inventory Cycle. Two inventory cycles make a six-year Juglar Investment Cycle. And two Juglar Cycle equates one twelve-year Kuznets Building Cycle. We then applied this 3-year Kitchin Inventory Cycle to explain the cycles in China’s other key economic variables, such as money supply, stock market, rebar steel, inflation and bond yield.

We note that the three-year property inventory cycle is peaking, or has peaked in 2Q. Already, July’s economic data have begun to disappoint. The property inventory cycle leads the cycle of industrial finished goods by around six months (

Focus Chart 2

, top panel

). The cycle in China’s capacity utilization demonstrates a similar lead time, too (

Focus Chart 3

). Importantly, M1 narrow money supply growth and stock prices in turn lead the property inventory cycle by more than three months (

Focus Chart 2

, bottom panel

).While restocking activities could extend a little further, it is already in the price (

Focus Chart 4

). And the momentum of restocking will wane soon, if history is a guide.

Focus Chart 3: Capacity utilization leads finished goods inventory by more than 6 months.