【原题】预测资产负债表调整下的货币政策立场,堪萨斯城联邦储备银行研究论文,2017年5月10日

【0. 原文摘要】

美联储的资产持有情况会影响包括利率在内的宏观金融状况。这样,通过资产负债表进行的货币政策调整就可以在一定程度上代替联邦基金目标利率的变化。具体来说,在未来两年,美联储的资产负债表缩减6750亿美元,大致等效于将联邦基金利率上调25个基点。

The Federal Reserve’s balance sheet holdings can affect broad financial conditions, including interest rates. In this way, monetary policy accommodation provided through the balance sheet may, to a modest extent, substitute for changes in the target federal funds rate. Specifically, we find a $675 billion reduction in the Fed’s balance sheet over a two-year horizon is about equivalent to a 25 basis point hike in the funds rate.

【1. FOMC开始讨论缩表问题】

全球金融危机期间和之后,资产购买计划使美联储资产负债表上长期资产的规模和份额大幅增加。当联邦基金利率受其有效下限限制时,这些购买计划主要提供了额外的货币宽松。自那之后,联邦基金利率重新上升,联邦公开市场委员会(FOMC)也开始讨论缩表问题。但问题是,缩表与加息是否会对经济产生同样的影响。

During and after the global financial crisis, asset purchase programs substantially increased the size and share of longer-term assets on the Federal Reserve’s balance sheet. These purchases were largely used to provide additional accommodation when the federal funds rate was constrained by its effective lower bound. The funds rate has since increased, and the FOMC has discussed reducing the size of its balance sheet. One question, however, is whether decreasing the balance sheet has the same effect on the economy as increasing the target federal funds rate.

【2. 缩表影响r *,即实际自然利率】

想要量化资产负债表政策和联邦基金利率变化的可替代性,一种方法是采用一种框架,允许资产负债表政策影响自然利率(通常被称为r *)。自然利率为货币政策制定者评估政策立场提供了基准,例如,如果实际基金利率低于自然利率r *,即为货币宽松,货币政策是为了缓解金融状况并支持经济增长而提供了适度宽松。FOMC可以通过改变资产负债表,在一定程度调节金融市场情况,进而影响自然利率r*,即其可以通过缩表来代替加息。

One approach to quantifying the so-called substitutability of balance sheet policy and changes in the funds rate is to use a framework that allows balance sheet policy to affect the natural real federal funds rate, frequently referred to as r*. The natural rate provides a baseline that monetary policy makers often use to assess the stance of monetary policy. If the real funds rate is below r*, for example, then monetary policy is providing accommodation that tends to ease financial conditions and support economic growth. To the extent the FOMC can shape financial market conditions through changes in its balance sheet—and, in turn, r*—it could trade reductions in the balance sheet for increases in the target federal funds rate.

【3. 模型显示加息与缩表存在替代性】

为了探索这一点,Hakkio和Smith构造了一个模型,其利用期限溢价将美联储资产负债表与自然利率r *联系在一起。期限溢价指的是,投资者在更长时间内借款所需的额外补偿。当美联储购买长期的国库券或机构抵押支持证券时,资产负债表扩张;有证据表明,这些购买将通过减少期限溢价来降低长端利率。长端利率的降低又通常会导致抵押贷款和汽车贷款利率下降。在Hakkio和Smith的模型中,联储购债导致自然利率r *抬升。这是因为资产负债表提供的额外宽松,减少了联邦基金利率需要宽松的幅度。换句话说,Hakkio和Smith模型预测了联邦基金利率与资产负债表政策之间具有一定的可替代性。

To explore this, Hakkio and Smith specify a model that links the Fed’s balance sheet to r* through the term premium. The term premium is the additional compensation investors require to lend money at longer horizons. When the Fed buys longer-term Treasury or agency mortgage-backed securities, the balance sheet expands; evidence indicates these purchases lower longer-term interest rates by lowering the term premium. Reductions in longerterm interest rates, in turn, often result in lower interest rates on mortgages and auto loans. In the Hakkio and Smith model, these lower rates raise r*, as the additional accommodation from the balance sheet reduces the accommodation needed from the funds rate. In other words, the Hakkio and Smith model predicts some substitutability between the funds rate and the balance sheet.

【4. 但r *的估计取决于模型】

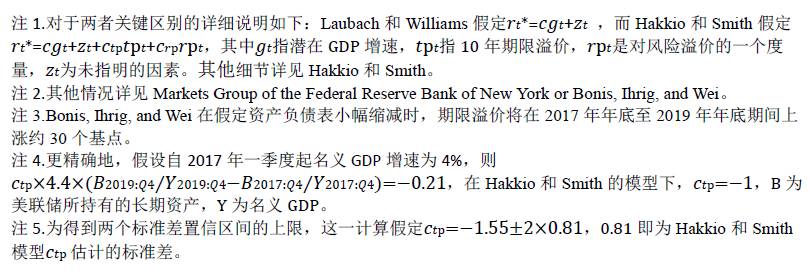

然而,对r *的估计是模型依赖的,对于期限溢价的度量也是如此。经济模型不同,在一定程度上r *的估计也会不同。例如,图1显示了Hakkio和Smith的估计,以及经常被引用的Laubach和Williams的r *估计值。(注1) 后者虽允许一系列的因素来影响r *,但其中并未明确包含期限溢价。近年来因为使期限溢价下降的资产负债表政策,Hakkio和Smith对r *的测量方法比Laubach和Williams的方法更广而被人采纳。

However, r* estimates are model dependent, as are measures of the term premium. To the extent economic models differ, so will measures of r*. As an example, Chart 1 shows estimates from Hakkio and Smith alongside a commonly cited measure of r* from Laubach and Williams. (note1)This latter measure allows a broad array of factors to affect r* but does not explicitly incorporate the term premium. As a result, the Hakkio and Smith measure of r* rises by more than the Laubach and Williams measure in recent years, largely due to balance sheet policies that reduced the term premium.

【5. 缩表通过抬升期限溢价影响长端利率;长端利率上行时,虽然基准利率未动,货币政策趋紧了】

可以预测,缩减资产负债表扭转了扩表的一些影响。缩表抬升了期限溢价,从而提高了长期利率。Gagnon等人估计,资产负债表缩减1%的GDP,对目前来说即约缩表1900亿美元,将抬升期限溢价约4.4个基点。因此,缩表通过提升期限溢价,将会降低以Hakkio和Smith方法对于自然利率r *的估计。具体来说,期限溢价提高1个基点,自然利率r *将降低1-1.5个基点。直观上,较低的r *反映了更高的期限溢价,也反映了此时尽管基准利率没有变化,货币政策并没那么宽松。

Presumably, reducing the balance sheet reverses some of the effects of expanding the balance sheet. Therefore, balance sheet reductions should raise the term premium and thereby raise long-term rates. Gagnon and others estimate that a decrease in the Fed’s balance sheet of 1 percent of gross domestic product, which would currently be about $190 billion, raises the term premium by about 4.4 basis points. Thus, by raising the term premium, reductions in the balance sheet would be expected to lower the Hakkio and Smith measure of r*. In terms of the magnitude, Hakkio and Smith estimate a 1 basis point increase in the term premium decreases r* by about 1 to 1.5 basis points. Intuitively, a lower r* reflects a higher term premium, as it captures that monetary policy is less accommodative even when the funds rate is unchanged.

【6. 如果两年内缩表6750亿美元,将抬升期限溢价25个基点,继而降低自然利率r * 25个基点,相当于加息一次】

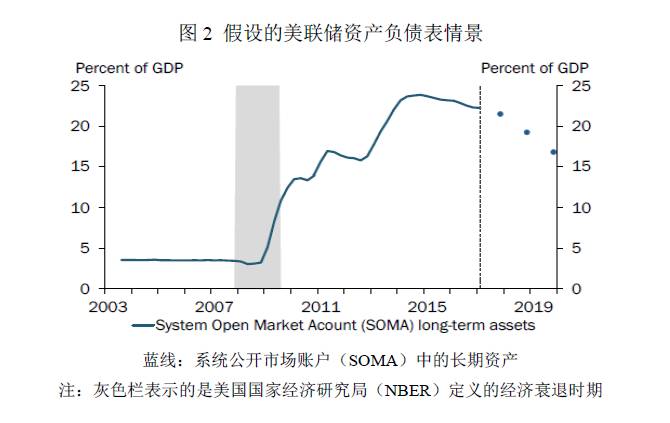

由于美联储正在考虑资产负债表可能的缩减规模,估计r *可以量化缩表将会带来多少货币环境的紧缩。尽管不确定,图2显示了未来几年资产负债表一种可能的情况。(注2) 在这种情况下,资产负债表到2019年缩减了6750亿美元。由于缩表,期限溢价则可能会上涨。图3显示了由美联储持有的长期资产(根据Gagnon等人的估计)带来的期限溢价的变动,它显示出随着资产减少期限溢价将如何抬升。上述情况表明,仅在资产负债表调整的情况下,到2019年底,期限溢价可能会上涨约25个基点。(注3) 根据Hakkio和Smith模型,期限溢价上升带来自然利率r *下降的幅度大致相同,即约为25个基点。因此资产负债表缩减6750亿美元,大致相当于将联邦基金利率上调25个基点。 (注4)

As the Fed contemplates possible reductions in its balance sheet, estimates of r* can quantify how much accommodation these reductions would remove. Though uncertain, Chart 2 illustrates one possible scenario for the balance sheet over the coming years.(note2) In this scenario, the balance sheet declines by $675 billion through 2019. As it declines, the term premium is likely to rise. Chart 3 illustrates movements in the term premium due to the Fed’s longer-term asset holdings (based on the estimates of Gagnon and others), then shows projections of how the term premium will rise as holdings decline. This exercise suggests that due to balance sheet adjustments alone, the term premium could rise by about 25 basis points through the end of 2019.(note3) According to the Hakkio and Smith model, this rise in the term premium would reduce r* by a similar magnitude—that is, by about 25 basis points. These changes are roughly equivalent to raising the funds rate by 25 basis points.(note4)

【7. 然而期限溢价对r *的影响不易估计】

然而,期限溢价对r *的影响的估计是非常不确定的。在Hakkio和Smith模型95%的置信区间表明,期限溢价对r *的影响可能高达75个基点(假定期限溢价对r *有较强的影响)或低至0(假定期限溢价对r *有很少或没有影响)。 (注5)

However, estimates of the term premium’s effects on r* are highly uncertain. The 95 percent confidence bands around the estimate from Hakkio and Smith suggest the effect on r* could be as high as 75 basis points (assuming the term premium exerts a stronger influence on r*) or as low as 0 (assuming the term premium has little or no effect on r*).(note5)

【8. 按照联储预期的加息节奏和上文所述的缩表路径,至2019年货币政策立场依然偏向宽松】

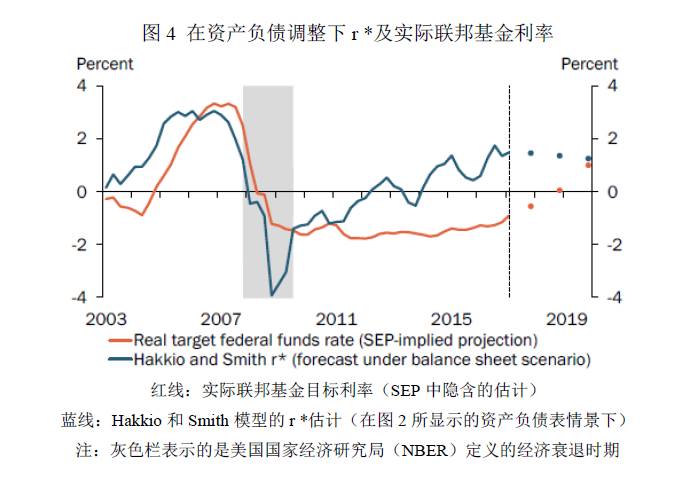

除了资产负债表的变化外,FOMC成员在经济预测摘要(SEP)中也预测了基金利率的变化。图4显示了按照SEP预测的实际联邦基金利率,与按照图2缩表路径下的自然利率r *,在未来是如何变化的。在整个预测期间,实际基准利率将上涨近2个百分点,r *将微降约25个基点。根据这一估计,货币政策目前是宽松的,在逐步调整资产负债表的情况下,未来几年可能仍然如此。到2019年,货币政策预计仍不会变为中立。但是,Hakkio和Smith对r *的估计值远高于Laubach和Williams的估计。当实际联邦基金利率达到中立时,将不仅取决于美联储资产负债表的规模和利率的变化路径,还将取决于自然利率的基本衡量标准。

In addition to changes in the balance sheet, FOMC participants project changes to the funds rate in their Summary of Economic Projections (SEP). Chart 4 shows how SEP-implied adjustments to the real federal funds rate would evolve relative to r* under the balance sheet adjustment scenario in Chart 2. The chart shows r* declining modestly by about 25 basis points over the forecast horizon, as the real funds rate rises by almost 2 percentage points. Under this estimate of r*, monetary policy is currently accommodative and is likely to remain so for the next few years under a scenario of gradual balance sheet adjustment. Monetary policy isn’t expected to become neutral until 2019. However, the Hakkio and Smith estimate of r* is considerably higher than the Laubach and Williams estimate. When the actual federal funds rate reaches neutral depends not only on the size of the Fed’s balance sheet and the path of the funds rate but also on the underlying measure of the natural rate.

(感谢实习生李子卓对本文的贡献)

参考文献

1.Bonis, Brian, Jane Ihrig, and Min Wei. 2017. “The Effect of the Federal Reserve’s Securities Holdings on Longer-term Interest Rates.” Board of Governors of the Federal Reserve System, FEDS Notes, April 20.

2.Gagnon, Joseph, Matthew Raskin, Julie Remache, and Brian Sack. 2011. “The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases.” International Journal of Central Banking, vol. 7, no. 1, pp. 3–43.

3.Hakkio, Craig S., and A. Lee Smith. 2016. “Bond Premiums and the Natural Rate of Interest.” Federal Reserve Bank of Kansas City, Economic Review, vol.102, no. 1, pp. 5–39.

4.Laubach, Thomas, and John C. Williams. 2003. “Measuring the Natural Rate of Interest.” The Review of Economics and Statistics, vol. 85, no. 4, pp. 1063–1070.

5.Markets Group of the Federal Reserve Bank of New York. 2017. “Domestic Open Market Operations During 2016,” April.

免责申明

本报告仅供华泰证券股份有限公司(以下简称“本公司”)客户使用。本公司不因接收人收到本报告而视其为客户。

本报告基于本公司认为可靠的、已公开的信息编制,但本公司对该等信息的准确性及完整性不作任何保证。本报告所载的意见、评估及预测仅反映报告发布当日的观点和判断。在不同时期,本公司可能会发出与本报告所载意见、评估及预测不一致的研究报告。同时,本报告所指的证券或投资标的的价格、价值及投资收入可能会波动。本公司不保证本报告所含信息保持在最新状态。本公司对本报告所含信息可在不发出通知的情形下做出修改,投资者应当自行关注相应的更新或修改。

本公司力求报告内容客观、公正,但本报告所载的观点、结论和建议仅供参考,不构成所述证券的买卖出价或征价。该等观点、建议并未考虑到个别投资者的具体投资目的、财务状况以及特定需求,在任何时候均不构成对客户私人投资建议。投资者应当充分考虑自身特定状况,并完整理解和使用本报告内容,不应视本报告为做出投资决策的唯一因素。对依据或者使用本报告所造成的一切后果,本公司及作者均不承担任何法律责任。任何形式的分享证券投资收益或者分担证券投资损失的书面或口头承诺均为无效。

本公司及作者在自身所知情的范围内,与本报告所指的证券或投资标的不存在法律禁止的利害关系。在法律许可的情况下,本公司及其所属关联机构可能会持有报告中提到的公司所发行的证券头寸并进行交易,也可能为之提供或者争取提供投资银行、财务顾问或者金融产品等相关服务。本公司的资产管理部门、自营部门以及其他投资业务部门可能独立做出与本报告中的意见或建议不一致的投资决策。

本报告版权仅为本公司所有。未经本公司书面许可,任何机构或个人不得以翻版、复制、发表、引用或再次分发他人等任何形式侵犯本公司版权。如征得本公司同意进行引用、刊发的,需在允许的范围内使用,并注明出处为“华泰证券研究所”,且不得对本报告进行任何有悖原意的引用、删节和修改。本公司保留追究相关责任的权力。所有本报告中使用的商标、服务标记及标记均为本公司的商标、服务标记及标记。

本公司具有中国证监会核准的“证券投资咨询”业务资格,经营许可证编号为:Z23032000。

全资子公司华泰金融控股(香港)有限公司具有香港证监会核准的“就证券提供意见”业务资格,经营许可证编号为:AOK809

©版权所有2017年华泰证券股份有限公司

近期视角

华泰宏观研究团队简介

团队首席李超在央行工作期间一直从事重大金融改革相关工作,加入市场后对宏观经济和金融政策把握准确,为投资者做好投资提供重要判断。团队成员均为毕业于海内外名校博士、硕士,同时具备部委工作经验和外汇、大宗商品交易经验,研究特色是理论与实战的结合,擅长政策判断和宏观经济对大类资产配置的影响分析。

本研究报告已由华泰证券研究所正式对外发布,本公众号旨在沟通研究信息,交流研究经验,任何完整的研究观点应以正式发布的报告为准。在任何情况下,本公众号中的信息或所表述的意见均不构成对客户私人投资建议。对依据或者使用本公众号内容所造成的一切后果,华泰证券及作者均不承担任何法律责任。本公众号版权仅为华泰证券公司所有,未经公司书面许可,任何机构或个人不得以翻版、复制、发表、引用或再次分发他人等任何形式侵犯本公众号发布的所有内容的版权。本公司具有中国证监会核准的“证券投资咨询”业务资格,经营许可证编号为:Z23032000。

欢迎阅读华泰宏观研究微信平台。您可以通过“hthgyj”,或者点击右上角“华泰宏观研究”关注我们。谢谢支持!

![]()

微信扫一扫

关注该公众号