版权所有,转

载请注明出处,

否则本公司将有权

采取维权措施追究其侵权责任

前言:

编者按:

中美第一阶段贸易协议于北京时间2020年1月16日在美国白宫签署。

芝华数据CEO黄劲文1月18日发表了这篇评论,当天即获得了美国贸易代表办公室首席谈判代表格雷格多德大使的好评。

多德大使是美国农业部副部长,在中美贸易谈判中是美方农产品谈判的最高负责人。

Jim W. Huang, CFA (

[email protected]

)

CEO, China-America Commodity DataAnalytics, Inc.

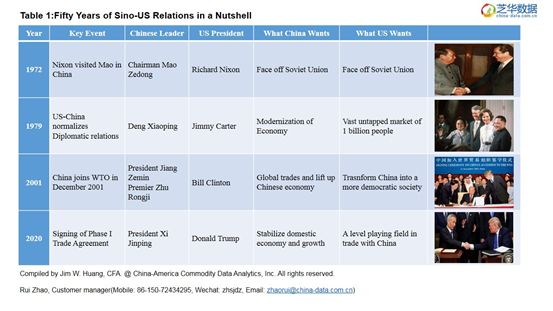

[January 18, 2020, Shanghai] On Wesdnesday,January 15, President Donald J. Trump and Vice Premiere Liu He signed thehistoric Economic and Trade Agreement between the United States of America andthe People’s Republic of China at the White House.

While this is offically calledthe “Phase I” Trade Agreement, I consider it amounting to

“Phase IV”

of US-China relations in the past 50 years sincePresident Richard Nixon took the ice-breaking trip to Beijing and met withChairman Mao Zedong in February 1972.

Let’s take a quick review of whathappened since then.

-

Phase

I

:

Establishment

of US-China strategic collaberation. Key event:Nixon-Mao summit in February 1972. Key Motive: Geopolitical. Facing the commonenemy Soviet Union. Trade was not a main concern back then.

-

Phase

II

:

Implementation

of normal diplomatic relations and full cooperation.Key events: Deng Xiaoping met with Jimmy Carter in US in 1979 and normalizeddiplomatic relations between US and China. Key Motives: China needed the help ofWest to modernize its economy. The West was drawn to a vast untapped market of1 billion people.

-

Phase

III

:

Take-off

of China’s economy boon with the support of the US. Keyevent: China joined WTO in December 2001. Key motive: Bill Clinton believedthat incorporating China into world trade would help transform it into ademocracy.

-

Phase

IV

:

Reset

the US-China trade relations on new terms based on levelplaying field, after two years of escalating trade war.

.

The Trade Agreement is a gamechanger. It not only calls off the damaging trade war, more importantly, itsets the tone of a potentially long lasting win-win relations where bothcountries could benefit based on mutually acceptable rules and conducts.

What does the Trade Agreementacccomplish? First of all, it resets the US-China relations where each sideviews the other as an equal partner. This is the most important foundation of afair trade, where rights and obligations have to be reciprocal. As the world’ssecond largest economic power, China no longer enjoys special concessions fromthe West as an emerging market. Generally,it may result in short-term pain, butChinese enterpreneurs will welcome the opportunity to compete by merit, nowthat private companies may gain fair market access to industries when state-runenterprises currently dominate.

Secondly, it establishes the commonground and a set of rules essential to grow commerce across borders, includingprotections of intellectual property, technology transfer and trade secretes,accepting international standards which will streamline processes andsignificantly reduce uncertainty. Presently, industry rule-making in China isnot necessarily consistent with commonly acceptable international practice.This was a major concern for US firms.

Thirdly, it sets up an enforceablemechnism, including evalution framework, communication channel, and dispute resolutionprocedures. Past agreements, including those leading up to China’s acceptance tothe WTO, lacked enforcebility and did not receive their intented goals.

Fourthly, it opens up China’svast but mostly closed financial market to US companies, including fundmanagement, securities and futures brokerage, banking, insurance, electronicpayment, and credit rating agency.

Finally, it sets specific Chineseannual import targets in 2020 and 2021 over 2017 levels at $200 billion, underChapter 6 of the Agreement, Expanding Trade. These include Manufactured Goods($77.7 billions two-year total), Agriculture ($32.0 billion), Energy (52.4billion), and Services (37.9 billion).

By and large, expert opinionsacross both coasts of the Pacific Oceans narrowly define the Phase I deal as “ChinaBuys US Farm Products”. It turns out that Agriculture is the smallest of thefour categories and accounts for only 16% of the $200 billion total.

So, what are the best potential opportunitiesfor US companies and investors, now that you are granted unprecedented accessto a market 2/3 of the size of US economy and five times its population?

Without any hesitation, I pointto China’s banking and financial services industry. Trade Agreement calls forgranting licenses to US financial institutions in China’s banking, securitiesand futures brokerage, fund management, insurance, eletronic payment, andcredit rating sectors. Not only could US financial institutions provide betterinvestment products to China’s 1 billion investors, they could also create moreinstruments at home for investors wanting exposures in China. The potential isso large and the market is so vastly underserved, this deserves detaileddiscusssion in a later writing.

US farmers and agribusiness firmswill have the biggest opportunities to increase export and participate inChina’s agriculture sector. The African Swire Fever in China last year createdpork supply shortage of over 10 million metric tons. The 300% pork price hikemade Mr. Qin Yinglian, owner of Muyuan Holding (002714), a Henan-province basedhog producer, the wealthest person in China with an estimated net worth of US$16.4billion. Meanwhile, many US pork producers couldn’t make ends meet as Chinaimposed punitive tariff of 60% on US pork.

However, before hopping on thebandwagon, I strongly advise our clients, both US firms and Chinese firms, to workclosely with your trade associations and government agencies to implement thenew and transparent trading rules as quickly as possible. Without thefoundation of fair trade being rebuilt, it’s unlikely the trade targets wouldhold, or the benefits of expanding trade would materialize.