上证是反映大众对于中国经济真实情绪的一个“迷之”指标。经济增速,PMI和工业增加值等官方统计数据继续显示经济增长在温和放缓。然而令人费解的是,舆论引导却已全力以赴,隐隐地渗透出一种紧迫感。本周末,银保监会在对如何更好地指导和规范信贷增长以支持实体经济发展提出意见的同时,无意地透露了7月新增人民币贷款1.45万亿元,以确保为在建项目和基建支出提供足够的资金。这其实是在抢跑央行,提前公布了官方新增贷款数据。这确实是一种“我们不一样不一样”的数据发布途径。市场交易员仿佛又闻到了空气中的那股熟悉的放水的味道。

这是我们20180812的报告

《

向政策再借一命

》

的英文原版《A Lifeline for the Market》。感谢阅读。

---------------------------

The Shanghai Composite is an uncanny indicator of the prevailing sentiment towards the Chinese economy. Official statistics, such as GDP growth, PMI and value added of industries, continues to suggest moderate slowdown of the economy. But the propaganda is already at its full force, conveying a sense of urgency - it is baffling. Over the weekend, the China Banking and Insurance Regulatory Commission (CBIRC) revealed that new loans grew by RMB1.45 trillion in July to ensure sufficient funding for projects under construction and infrastructure spending, while commenting on how best to direct and regulate credit growth to support the economy. It is indeed an unusual way to release the official new loan figure – ahead of the central bank’s official release. Liquidity is in the air.

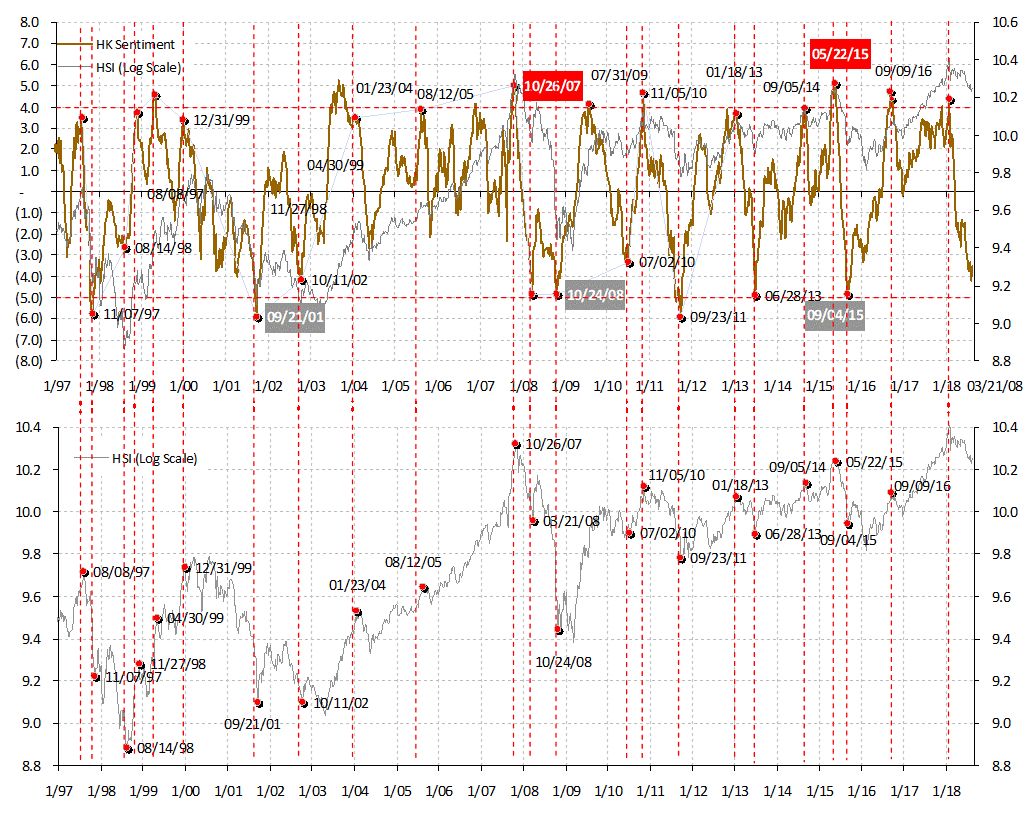

In our last report “

Rebound vs. Bottom

”, we suggested that any subtle policy shift in a technically-oversold market should initiate a short-term rebound (20180723). Last weekend, our proprietary market sentiment model plunged to its historical low levels that tend to suggest a technical reprieve in the near term (

Figure 1

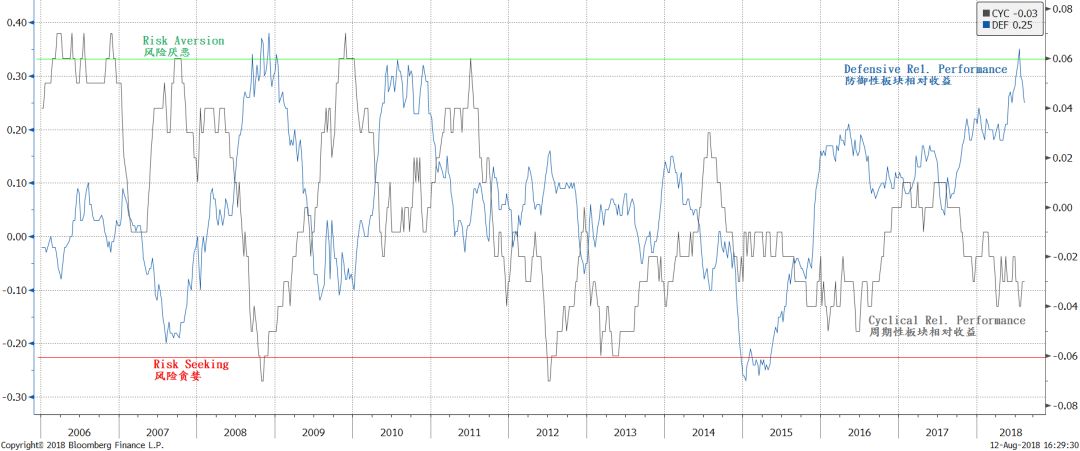

). Meanwhile, the strong relative performance of defensive sectors has also been approaching its extreme, while cyclical sectors continue to underperform. Such market developments also hint at significant market risk aversion (

Figure 2

).

Figure 1: Market sentiment is depressed, auguring well for a short-term technical reprieve

Figure 2: Defensive relative performance also suggests risk aversion

In our 2H18 outlook report “

Rough Sailing

”, we wrote about a likely recovery in infrastructure spending in the second half, as well as easing of monetary conditions to support bank lending (20180521). At the time of writing our second-half outlook, we believed that the plunge of infrastructure spending in the first half was not sustainable, and infrastructure spending should be once again deployed to support economic growth. Further, as loan demand recovered in the second half, some smaller banks with low reserves would find it challenging to expand lending. As such, more RRR cuts, as well as further yuan weakness, were likely (

Figure 3

). Already, we have seen one 50bp RRR cut in late June – one month after our report. And the yuan has weakened substantially.

Figure 3: Further RRR cut likely; the yuan has a well-defined trading

range,

and is set to depreciate further